How much is child survivor benefits

If You Are The Survivor

If You Are The Survivor

Just as you plan for your family's protection if you die, you should consider the Social Security benefits that may be available if you are the survivor — that is, the spouse, child, or parent of a worker who dies. That person must have worked long enough under Social Security to qualify for benefits.

How Your Spouse Earns Social Security Survivors Benefits

A worker can earn up to four credits each year. In 2022, for example, your spouse can earn one credit for each $1,510 of wages or self-employment income. When your spouse has earned $6,040 they have earned their four credits for the year.

The number of credits needed to provide benefits for survivors depends on the worker's age when they die. No one needs more than 40 credits (10 years of work) to be eligible for any Social Security benefit. But, the younger a person is, the fewer credits they must have for family members to receive survivors benefits.

Some survivors can get benefits if the worker has credit for one and one-half years of work (six credits) in the three years just before their death. Each person’s situation is different and you need to talk to one of our claims representatives about your choices.

When A Family Member Dies

We should be notified as soon as possible when a person dies. However, you cannot report a death or apply for survivors benefits online.

In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report.

If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to one of our representatives between 8:00 am – 7:00 pm. Monday through Friday. You can also contact your local Social Security office.

Do we pay death benefits?

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if they were living with the deceased. If living apart, they were receiving certain Social Security benefits on the deceased’s record.

If living apart, they were receiving certain Social Security benefits on the deceased’s record.

If there is no surviving spouse, the payment is made to a child who is eligible for benefits on the deceased’s record in the month of death.

What happens if the deceased received monthly benefits?

If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months.

For example, if the person died in July, you must return the benefits paid in August. How you return the benefits depends on how the deceased received benefits:

- For funds received by direct deposit, contact the bank or other financial institution. Request that any funds received for the month of death or later be returned to us.

- Benefits received by check must be returned to us as soon as possible. Do not cash any checks received for the month in which the person dies or later.

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

- A widow or widower age 60 or older (age 50 or older if they have a disability).

- A surviving divorced spouse, under certain circumstances.

- A widow or widower at any age who is caring for the deceased’s child who is under age 16 or has a disability and receiving child’s benefits.

- An unmarried child of the deceased who is one of the following:

- Younger than age 18 (or up to age 19 if they are a full-time student in an elementary or secondary school).

- Age 18 or older with a disability that began before age 22.

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

- A stepchild, grandchild, step grandchild, or adopted child.

- Parents, age 62 or older, who were dependent on the deceased for at least half of their support.

Eligible family members may be able to receive survivors benefits for the month that the beneficiary died.

Widow Or Widower

If you are the widow or widower of a person who worked long enough under Social Security, you can:

- Receive reduced benefits as early as age 60.

- Begin receiving benefits as early as age 50 if you have a disability and the disability started before or within 7 years of the worker's death.

- Receive survivors benefits at any age, if you have not remarried and you take care of the deceased worker's child who is under age 16 or has a disability and receives child’s benefits.

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62.

If a widow or widower who is caring for the worker's children receives Social Security benefits, they're still eligible if their disability starts before those payments end or within seven years after they end.

If you remarry after you reach age 60 (age 50 if you have a disability), your remarriage will not affect your eligibility for survivors benefits.

- A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact us at 1-800-772-1213 to request an appointment. If you are deaf or hard of hearing, call our TTY number at 1-800-325-0778.

- If you wish to apply for disability benefits as a survivor, you can speed up the disability application process if you complete an Adult Disability Report and have it available at the time of your appointment.

- We use the same definition of disability for widows and widowers as we do for workers.

A few other situations:

- If you already receive benefits as a spouse, your benefit will automatically convert to survivors benefits after we receive the report of death.

- If you are also eligible for retirement benefits, but haven't applied yet, you have an additional option. You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later.

- For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

If you became entitled to retirement benefits less than 12 months ago, you may be able to withdraw your retirement application and apply for survivors benefits only. If you do that, you can reapply for the retirement benefits later when they will be higher.

Surviving Divorced Spouse

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more.

Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

If you remarry after you reach age 60 (age 50 if you have a disability), the remarriage will not affect your eligibility for survivors benefits.

If you are caring for a child under age 16 or who has a disability and the child get benefits on the record of your former spouse, you would not have to meet the length-of-marriage rule. The child must be your former spouse's natural or legally adopted child.

If you qualify because you have the worker's child in your care, your benefit will affect the amount of the benefits of others on the worker's record.

Minor Or Child with a disability

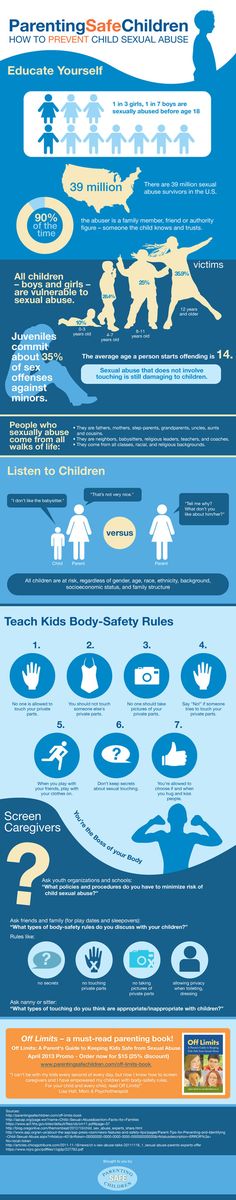

If you are the unmarried child under age 18 of a worker who dies, you can be eligible to receive Social Security survivors benefits. You can also be eligible, if you are up to age 19 and attending elementary or secondary school full time.

And you can get benefits at any age if you have a qualifying disability that began before age 22 and remains the same.

Besides the worker's natural children, their stepchildren, grandchildren, step grandchildren, or adopted children may receive benefits under certain circumstances.

For Your Parents

If you are the dependent parent, who is at least age 62, of a worker who dies, you may be eligible to receive Social Security survivors benefits.

You must have been receiving at least half of your support from your working child. Also, you must not be eligible to receive a retirement benefit that is higher than the benefit we could pay on your child’s record. Generally, you must not have married after your deceased adult child’s death. However, there are some exceptions.

Besides being the natural parent, you could also be the stepparent, or the adoptive parent if you became the deceased worker’s parent before he or she was age 16.

Survivors Benefit Amount

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

The more they paid into Social Security, the higher your benefits would be.

These are examples of the benefits that survivors may receive:

- Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount.

- Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount.

- Widow or widower with a disability aged 50 through 59 — 71½%.

- Widow or widower, any age, caring for a child under age 16 — 75%.

- A child under age 18 (age 19 if still in elementary or secondary school) or who has a disability — 75%.

- Dependent parent(s) of the deceased worker, age 62 or older receive:

- One surviving parent — 82½%.

- Two surviving parents — 75% to each parent.

Percentages for a surviving divorced spouse would be the same as above.

There may also be a special lump-sum death benefit.

Maximum Family Amount

There's a limit to the amount that family members can receive each month. The limit varies, but it is generally equal to between 150% and 180% of the basic benefit rate.

If the sum of the benefits payable to family members is greater than this limit, the benefits will be reduced proportionately. Any benefits paid to a surviving divorced spouse based on disability or age won't count toward this maximum amount.

Other Things You Need To Know

There are limits on how much survivors may earn while they receive benefits.

Benefits for a widow, widower, or surviving divorced spouse may be affected by several additional factors:

- If you remarry before age 60 (age 50 if you have a disability), you cannot receive benefits as a surviving spouse while you are married.

- If you remarry after age 60 (age 50 if you have a disability), you will continue to qualify for benefits on your deceased spouse's Social Security record.

- If you receive benefits as a widow, widower, or surviving divorced spouse, you can switch to your own retirement benefit as early as age 62. This assumes you are eligible for retirement benefits and your retirement rate is higher than your rate as a widow, widower, or surviving divorced spouse.

- In many cases, a widow or widower can begin receiving one benefit at a reduced rate and allow the other benefit amount to increase.

- If you will also receive a pension based on work not covered by Social Security, such as government or foreign work, your Social Security benefits as a survivor may be affected.

However, if your current spouse is a Social Security beneficiary, you may want to apply for spouse's benefits on their record. If that amount is more than your widow's or widower's benefit, you will receive a combination of benefits that equals the higher amount.

A Special Lump-Sum Death Payment

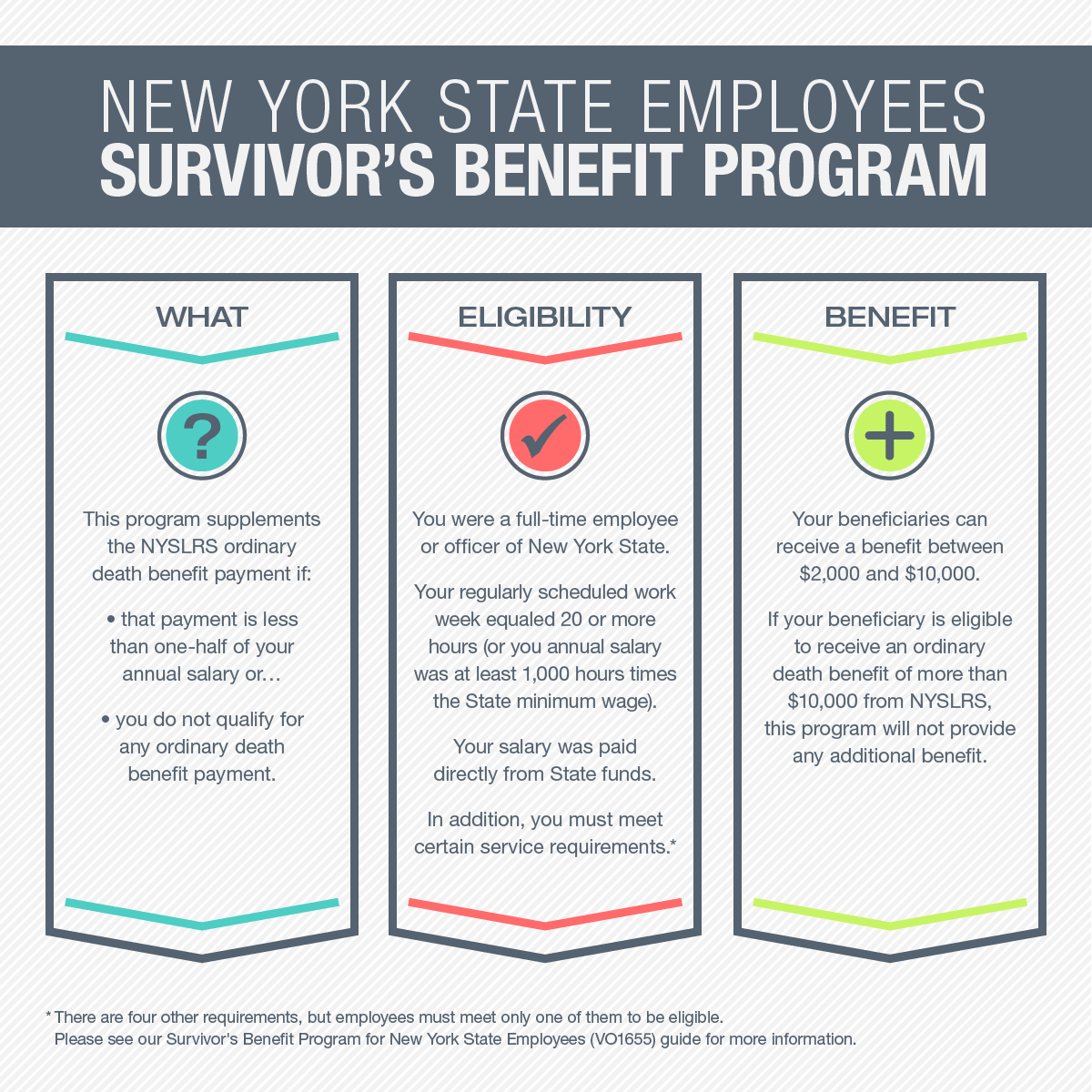

A surviving spouse or child may receive a special lump-sum death payment of $255 if they meet certain requirements.

Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, they met one of the following:

- Were already receiving benefits on the worker's record.

- Became eligible for benefits upon the worker's death.

If there's no eligible surviving spouse, the lump-sum can be paid to the worker's child (or children) if, during the month the worker died, the child met one of the following:

- Was already receiving benefits on the worker's record.

- Became eligible for benefits upon the worker's death.

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death.

For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 (TTY 1-800-325-0778).

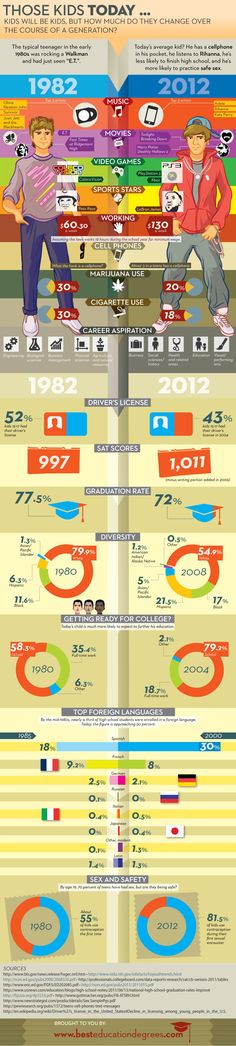

The Average American Gets This Much in Survivor Benefits From Social Security. How Do You Compare?

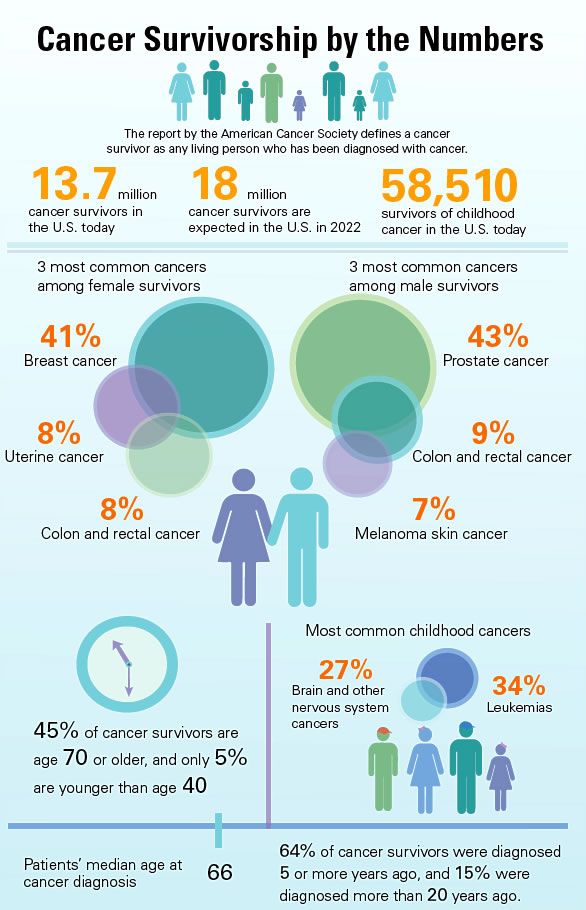

Social Security is a huge program, with almost 59 million Americans getting more than $70 billion in monthly benefits from the Social Security Administration. Almost three-quarters of these benefits go directly to retired workers, but the Social Security program also provides key assistance to retirees' loved ones after they pass away. Specifically, more than 6.1 million Americans receive survivor benefits from Social Security, with nearly all of them being surviving spouses or children of deceased workers.

In total, recipients of survivor benefits get about $6.68 billion in monthly Social Security payments. That represents an average of $1,088 per month for every surviving family member getting Social Security benefits. Yet when you look more closely at the numbers, you'll find that many survivors have to live on even smaller benefits, while others take greater advantage of how Social Security works to boost their payments.

Yet when you look more closely at the numbers, you'll find that many survivors have to live on even smaller benefits, while others take greater advantage of how Social Security works to boost their payments.

To show you where you stand compared to others in your situation, let's turn to the SSA itself to find out how much the average American gets in survivor benefits from Social Security. Even if you're not in a situation in which you're collecting survivor benefits now, what you learn could help you take steps to make sure you'll get as much as possible if you find yourself in that position in the future.

Image source: Getty Images.

What the typical survivor gets

After your death, your spouse can receive survivor benefits from Social Security under several different provisions. The most common occurs when your spouse is at or near retirement age, with surviving spouses being entitled to claim benefits as early as age 60. As you'll see below, those benefits are substantial, with the typical nondisabled surviving spouse receiving $1,253 in monthly payments.

By contrast, average benefits for surviving family members who haven't yet reached retirement age tend to be smaller. Spouses under 60 who care for children under age 16 are also entitled to Social Security benefits, but they tend to be smaller, with the average coming in at $924 per month. Disabled spouses can claim survivor benefits as early as age 50, but they average even less at just $712 monthly.

Children also tend to receive relatively small amounts in survivor benefits. Children under age 18 can receive survivor benefits, as can those who are 18 or 19 and still in high school as well as children of any age who became disabled before reaching age 22. On average, eligible children get about $816 in monthly Social Security benefits.

Why benefits differ

One of the biggest reasons why these average benefits are different is that the rules that determine how much each person gets in survivor benefits differ among various family members. For instance, here are some of the most common classes of survivors and how much they receive as a percentage of the deceased worker's primary insurance amount:

- Spouses who reach full retirement age before claiming can get 100% of the worker's benefit.

- Spouses who claim between 60 and full retirement age get between 71.5% and 99% of the worker's benefit.

- Disabled spouses who claim between 50 and 59 get 71.5% of the worker's benefit.

- Spouses caring for children under 16 get 75%, as do eligible children.

As you can see, it therefore makes sense that children and disabled spouses would get considerably less than spouses who reach full retirement age, as the percentage amount that the SSA applies to the deceased worker's benefit is smaller.

Image source: Getty Images.

Giving your surviving loved ones more from Social Security

Yet the other determining factor in how much family members get in survivor benefits is what decision the worker makes in choosing when to take Social Security. If the worker claimed benefits early, that reduces not only the worker's own benefit amount but also the amount on which the SSA calculates survivor benefits. That will leave your surviving spouse and any eligible children potentially receiving less in benefits for as long as they're allowed to receive them.

Unfortunately, most people end up costing their survivors some of their benefits. When you look at trends on the age at which men claim Social Security over the past 50 years, you'll see that men don't wait nearly as long to collect benefits as they used to. Now, only about 20% of all men wait until full retirement age or beyond. Nearly half claim at the earliest possible age of 62. That decision has the impact of reducing survivor benefits for their loved ones by 25%.

By contrast, those who wait until past full retirement age can actually enhance their survivor benefits, but only about 6% actually do so. And while men demographically are more likely to be the first to die, the claiming trends among women are quite similar.

If you want to make sure your loved ones won't end up on the short end of the stick after your death, be sure to think twice about when to start taking Social Security benefits. Even if you don't end up maximizing your own benefits with your decision, the extra amount that your loved ones get in survivor benefits could make a vital difference in their financial survival after you're gone.

Dan Caplinger has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

90,000 PFR will extend survivor's pensions for people over 18 until September 1 - RBCwww.adv.rbc.ru

www.adv.rbc.ru

www.adv.rbc.ru

Hide banners

What is your location ?

YesSelect other

Categories

Euro exchange rate as of November 1

EUR CB: 61. 12 (-0.01) Investments, 31 Oct, 16:03

12 (-0.01) Investments, 31 Oct, 16:03

Dollar exchange rate on November 1

USD Central Bank: 61.62 (+0.09) Investments, 31 Oct, 16:03

Turkey considers Sweden's actions against the Kurds insufficient Politics, 12:52

The British FTSE 100 rose to a five-week high Investments, 12:50

How to prepare your car for the cold season: seven useful life hacks RBC and Nokian Tires, 12:50

www.adv.rbc.ru

www.adv.rbc.ru

Carlyle demanded $700 million from insurance companies for aircraft remaining in Russia Business, 12:42

Modern house in a historic area: what are the advantages of such a property RBC and Amaranth, 12:37

Military operation in Ukraine. The main thing Politics, 12:37

The main thing Politics, 12:37

Tinkoff Bank shares fell 2% after the words of the founder about the brand recall Investments, 12:32

Explaining what the news means

RBC Evening Newsletter

Subscribe

In the resource: how to find a balance between burnout and employee efficiency Pro, 12:32

Oleg Tinkov initiates brand recall from Tinkoff Bank Finance, 12:27

Chinese hockey player named KHL Forward of the Month for the first time Sport, 12:20

"Economic Truth" learned about the departure of Vitrenko from the post of head of "Naftogaz" Business, 12:18

Klishas urged to avoid excessive regulation of social networks Technology and media, 12:14

Exchange, return and force majeure: what services for business trips can do RBC and Smartway, 12:14

PSB will issue a business credit card immediately with the opening of a current account Press release, 12:13

www. adv.rbc.ru

adv.rbc.ru

www.adv.rbc.ru

www.adv.rbc.ru

Photo: Aleksey Sukhorukov / RIA Novosti

The Russian Pension Fund will automatically extend the payment of survivor's insurance pensions to teenagers aged 18 and over who have graduated from school or college until September 1. Such a law will come into force on June 1, the document is published on the portal of legal information.

According to the law, family members of the deceased breadwinner are now recognized as disabled not only until they reach 18 years of age. If a Russian has graduated from secondary or basic general education programs and has reached the age of 18, he will receive a pension until September 1 of the year in which he graduated. The provision also applies to those citizens who studied abroad.

After September 1, bereaved survivors will still be eligible for benefits if they certify university or college enrollment. Provided that they are not officially employed, citizens will receive such payments until graduation, but no longer than upon reaching the age of 23.

www.adv.rbc.ru

In addition, from June 1, working pensioners who quit their jobs in February 2022 will be able to receive a pension with an indexation of 8.6%, follows from the PFR explanation. They will also be paid the cash difference between the old and new pensions for the previous three months. If a pensioner gets a job again after some time, the amount of his insurance pension will not decrease.

www.adv.rbc.ru

On April 11, Russian President Vladimir Putin instructed the government to develop a program for additional increase or indexation of pensions, salaries of employees of state and municipal institutions, as well as social benefits. Later, his assistant Maxim Oreshkin said that indexation would take place in the near future

On May 9, Labor Minister Anton Kotyakov announced the preparation of proposals for additional indexation of pensions, minimum wages and social benefits. He did not give details, but indicated that the initiative would reduce poverty.

Research Store Analytics by topic "Education"

How to apply for a survivor's pension, who is entitled to such a pension? - Lawyer in Samara and Moscow

HomeQuestions and answers How to apply for a survivor's pension, who is entitled to such a pension?

How to apply for a survivor's pension, who is entitled to such a pension?

A prerequisite for the provision of this assistance is the financial support of the deceased members of their family, unable to work for various reasons. Minors are eligible for this assistance. The concept of "children" includes not only the relatives of the deceased, but also his younger sisters, brothers, grandchildren, who at the time of calculating the pension are minors, do not work and cannot independently support themselves. Children under the age of 23, if they are studying and cannot work independently. The natural children of the deceased are over 23 years old, if they are not able to earn money due to their health, which is confirmed by the presence of a disability. As for this category of citizens, it is necessary to take into account the fact that a person’s disability must be established before he reaches adulthood. As for the siblings and grandchildren of the breadwinner who are disabled and unable to support themselves, the latter are only entitled to survivor benefits if they are not supported by someone else and are orphans. Husband (wife) of the deceased, father (mother), adult brother (sister) who care for the young children of the deceased. In this case, only one of the family members who cares for children under the age of 14 receives a survivor's pension. If there are several children, then these payments are paid to the youngest until the age of 14. In this case, only those citizens who care for young children and do not have a personal source of income can apply for a pension.

Children under the age of 23, if they are studying and cannot work independently. The natural children of the deceased are over 23 years old, if they are not able to earn money due to their health, which is confirmed by the presence of a disability. As for this category of citizens, it is necessary to take into account the fact that a person’s disability must be established before he reaches adulthood. As for the siblings and grandchildren of the breadwinner who are disabled and unable to support themselves, the latter are only entitled to survivor benefits if they are not supported by someone else and are orphans. Husband (wife) of the deceased, father (mother), adult brother (sister) who care for the young children of the deceased. In this case, only one of the family members who cares for children under the age of 14 receives a survivor's pension. If there are several children, then these payments are paid to the youngest until the age of 14. In this case, only those citizens who care for young children and do not have a personal source of income can apply for a pension. The right to assistance after the death of the breadwinner is for relatives who have retired or received a disability and do not have other relatives who are required to support them by law . Adoptive parents and adopted children have the same status as natural children and parents. If an orphaned child who is already receiving state assistance after the death of his relatives is adopted, then his right to receive payments does not disappear. A survivor's pension is also provided for a non-native father or mother (stepfather or stepmother) who has been dependent on the deceased for the past five years or more.

The right to assistance after the death of the breadwinner is for relatives who have retired or received a disability and do not have other relatives who are required to support them by law . Adoptive parents and adopted children have the same status as natural children and parents. If an orphaned child who is already receiving state assistance after the death of his relatives is adopted, then his right to receive payments does not disappear. A survivor's pension is also provided for a non-native father or mother (stepfather or stepmother) who has been dependent on the deceased for the past five years or more.

Yours faithfully, lawyer Anatoly Antonov.

Still have questions for the lawyer?

Ask them right now here, or call +7 (846) 212-99-71 (24/7), or come to our office for a consultation (by appointment)!

Relevance date: 02/22/2016

To make an appointment for a consultation, call the round-the-clock number +7 (846) 212-99-71 or leave a request below

Leave your feedback about our work here!

Search the site

Antonov & Partners law office - high-quality legal assistance throughout Russia.