How much does the state pay for child care

Child Care Subsidy Provider Payment Information

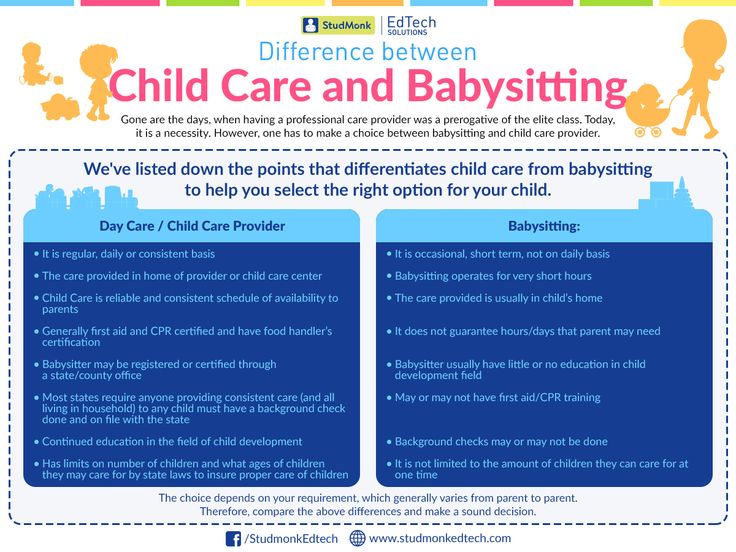

Child care providers must be contracted or registered with the Department of Elementary and Secondary Education (DESE) in order to receive payment for child care provided to child care subsidy eligible families.

- How much will the state pay?

-

The state rate for child care services is called the "maximum base rate." This rate applies to all non-foster children (children in the legal custody of the Children’s Division) participating in the child care subsidy program. As a child care provider, the amount you charge for your child care services is your decision. This amount is called your "rate." If your rate is higher than the maximum base rate, the child's family is responsible for paying the difference directly to you. This difference is called the co-pay.

The maximum base rate you are paid is based on all of the following factors:

- County you reside in or facility location (rates vary depending on if you live in an urban or rural part of the state)

- Type of child care facility (family home, group home, center, etc.

)

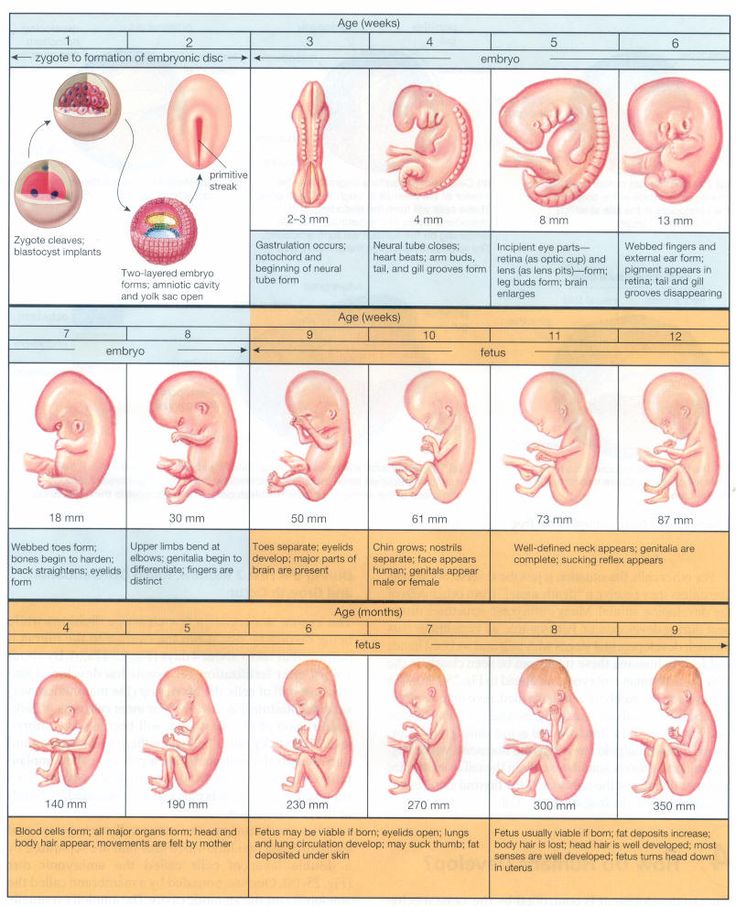

- Age of the child

- Infant (newborn to 2 years)

- Preschool (2 years to 5 years)

- School age (5 years and over)

- Number of hours you care for the child

- Full day (5 to 12 hours per day)

- Half day (3 to 4 hours and 59 minutes per day)

- Part day (30 minutes to 2 hours and 59 minutes per day)

- What time during the week you provide care

- Daytime (Monday through Friday from 6 a.m. to 7 p.m.)

- Evening (Monday through Friday from 7:01 p.m. to 5:59 a.m.)

- Weekend (6 a.m. Saturday to 7 p.m. Sunday)

- What is an Authorization Letter?

-

You will receive an Authorization Letter from Department of Elementary and Secondary Education (DESE) for each child who is eligible for child care subsidy that identifies the following:

- Name of the child

- Beginning and ending dates the child is authorized for child care subsidy

- Portion of day (full, half, or part) the child is eligible

- Number of days in the month the child can receive child care subsidy

- Sliding fee the parent must pay to you

The state will not pay for more hours or days of care than stated in the Authorization Letter.

If there are any questions about a child's authorization, have the parent contact Childhood Finance.

If there are any questions about a child's authorization, have the parent contact Childhood Finance. - When will I be paid?

-

You will receive payment approximately 10 to 15 days from the time invoices are entered into the payment system by DESE. Payments made by direct deposit will be received sooner.

If you would like to register to receive payments through direct deposit, please download and complete the Vendor Direct Deposit application and submit it with a voided check or an official letter from your financial institution.

For assistance, please contact the Childhood Finance.

- Accreditation

-

Accreditation is a way child care providers are recognized for meeting high standards of quality. There are seven accrediting organizations that are recognized by DESE.

If you are accredited by one of these organizations, are in good standing with DESE, and are serving a child eligible for Child Care Subsidy you are eligible to receive the accreditation rate differential.

To receive the accreditation rate differential, you must submit your accreditation certificate to the Child Care Subsidy Agreement Unit via:

Email: [email protected]

Fax: 573-526-2926Office of Childhood, Child Care Subsidy

PO Box 480

Jefferson City, MO 65102 - How should I address payment issues?

-

If you have an issue with a payment or lack of payment, you will need to submit a Child Care Provider Payment Resolution Request form. You must submit the request within 60 calendar days of the service month with attendance records and the reason a review is being requested. If applicable, submit the attendance form with your Payment Resolution Request.

- Subsidy Rate Enhancement

-

- Accreditation is a 20% rate differential awarded to providers who are accredited by one of the seven DESE recognized accrediting agencies.

- Apply here: Accreditation Rate Differential Agreement

- Disproportionate Share program is a 30% rate differential awarded only to providers who are Accredited and it’s been verified that 50% or more the children enrolled for care are state-subsidized.

The provider is eligible if they are a licensed or licensed exempt child care provider who is:

The provider is eligible if they are a licensed or licensed exempt child care provider who is:

- Contracted or registered with the Office of Childhood Child Care Subsidy Agreement Unit.

- Providing care to a disproportionate share (50 percent) of children receiving child care subsidy.

- Accredited or working towards accreditation with one of the DESE recognized accrediting organizations.

- Apply here: Accreditation/Disproportionate Share Enhancement Agreement

- If all requirements are met the provider will receive the DS2 rate differential for one year unless provider becomes ineligible.

Note: Providers who are accredited receiving the 20% enhanced rate and who serve a disproportionate share of subsidy eligible children (50% or more) receiving the 30% enhanced rate may continue receiving the enhancements while caring for 50% or more subsidy eligible children and maintaining their accreditation.

Providers who are accredited receiving the 20% enhanced rate who no longer serve 50% or more subsidy eligible children will lose the 30% enhanced rate for serving a disproportionate share of subsidy children but may continue receiving the 20% accreditation enhancement for maintaining their accreditation.

- Accreditation is a 20% rate differential awarded to providers who are accredited by one of the seven DESE recognized accrediting agencies.

Working Connections Child Care | Washington State Department of Children, Youth, and Families

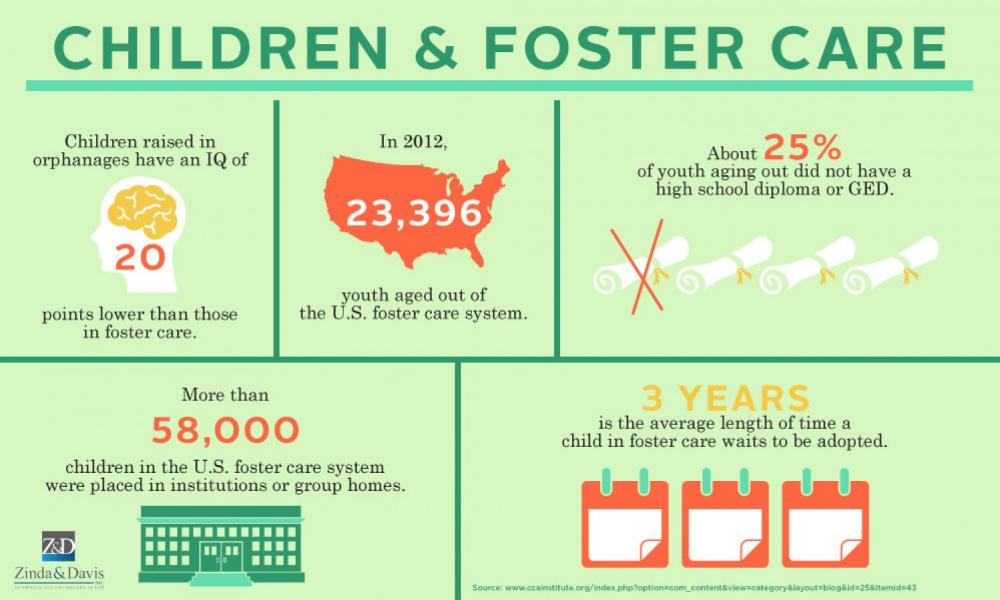

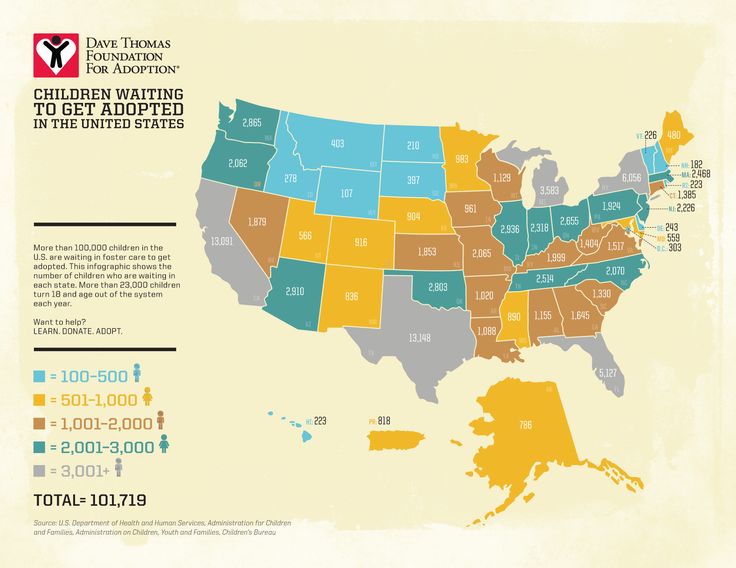

Working Connections Child Care (WCCC) helps eligible families pay for child care. When a family qualifies for child care subsidy benefits and chooses an eligible provider, the state pays a portion of the cost of child care. Parents may be responsible for a copayment to their provider each month.

- Copay Calculation Table - Effective beginning April 1, 2022

- Child Care Subsidy Regional Map for Licensed Family Homes and Centers

Families experiencing homelessness may be approved for up to 12 months to help resolve issues surrounding homelessness.

Basic Eligibility Requirements for Child Care Subsidy Benefits

- The child must be a U.S. citizen, legal resident, or otherwise eligible for federal benefits

- The family with whom the child resides must live in Washington state

- The family's income must be at or below 60% of the State Median Income (SMI) at application or 65% of SMI when reapplying

- The family must have resources under $1 million

- Child Care Subsidy helps pay for child care while the parent, or parents in a two-parent household, participate in an approved activity. Approved activities include:

- Employment or self-employed in legal, income-generating, taxable activities

- Education activities include:

- High school or high school equivalency programs for parents ages 21 and younger

- Attending community, technical, or tribal college full-time and seeking an associate or vocational degree

- Attending community, technical, or tribal colleges part-time and seeking an associate or vocational degree AND working 20 hours per week

- Activities approved under the parents WorkFirst or BFET plan

Income Eligibility

The maximum household income increases from 200% of the U. S. federal poverty level (FPL) to 60% of the State Median Income (SMI). The maximum monthly income limit by household size is listed below:

S. federal poverty level (FPL) to 60% of the State Median Income (SMI). The maximum monthly income limit by household size is listed below:

| Family Size | $0 Copay | $65 Copay | $90 Copay | $115 Copay | $215 Copay |

|---|---|---|---|---|---|

| 1 | $0 to $928 | $929 to $1,671 | $1,672 to $2,320 | $2,321 to $2,784 | $2,785 to $3,016 |

| 2 | $0 to $1,214 | $1,215 to $2,185 | $2,186 to $3,034 | $3,035 to $3,641 | $3,642 to $3,944 |

| 3 | $0 to $1,499 | $1,500 to $2,699 | $2,700 to $3,748 | $3,749 to $4,498 | $4,499 to $4,872 |

| 4 | $0 to $1,785 | $1,786 to $3,213 | $3,214 to $4,462 | $4,463 to $5,354 | $5,355 to $5,800 |

| 5 | $0 to $2,070 | $2,071 to $3,727 | $3,728 to $5,176 | $5,177 to $6,211 | $6,212 to $6,729 |

| 6 | $0 to $2,356 | $2,357 to $4,241 | $4,242 to $5,890 | $5,891 to $7,068 | $7,069 to $7,657 |

| 7 | $0 to $2,409 | $2,410 to $4,337 | $4,338 to $6,024 | $6,025 to $7,228 | $7,229 to $7831 |

| 8 | $0 to $2,463 | $2,464 to $4,433 | $4,434 to $6,157 | $6,158 to $7,389 | $7,390 to $8,005 |

| 9 | $0 to $2,517 | $2,517 to $4,530 | $4,531 to $6,291 | $6,292 to $7,550 | $7,551 to $8,179 |

| 10 | $0 to $2,570 | $2,571 to $4,626 | $4,627 to $6,425 | $6,426 to $7,710 | $7,711 to $8,353 |

| 11 | $0 to $2,624 | $2,625 to $4,722 | $4,723 to $6,559 | $6,560 to $7,871 | $7,872 to $8,527 |

| 12 | $0 to $2,677 | $2,678 to $4,819 | $4,820 to $6,693 | $6,694 to $8,031 | $8,032 to $8,701 |

| 13 | $0 to $2,731 | $2,732 to $4,915 | $4,916 to $6,827 | $6,828 to $8,192 | $8,193 to $8,875 |

| 14 | $0 to $2,784 | $2,785 to $5,012 | $5,013 to $6,961 | $6,962 to $8,353 | $8,354 to $9,049 |

| 15 | $0 to $2,838 | $2,839 to $5,108 | $5,109 to $7,094 | $7,095 to $8,513 | $8,514 to $9,223 |

| 16 | $0 to $2,891 | $2,892 to $5,204 | $5,205 to $7,228 | $7,229 to $8,674 | $8,675 to $9,397 |

| 17 | $0 to $2,945 | $2,946 to $5,301 | $5,302 to $7,362 | $7,363 to $8,835 | $8,836 to $9,571 |

| 18 | $0 to $2,998 | $2,999 to $5,397 | $5,398 to $7,496 | $7,497 to $8,995 | $8,996 to $9,745 |

| 19 | $0 to $3,052 | $3,053 to $5,493 | $5,494 to $7,630 | $7,631 to $9,156 | $9,157 to $9,919 |

| 20 | $0 to $3,106 | $3,107 to $5,590 | $5,591 to $7,764 | $7,765 to $9,316 | $9,317 to $10,093 |

Use the chart above to determine if your family may be eligible for WCCC and to determine your approximate copayment. (Example: If your household consists of yourself, your spouse, and two children, your household size is four. If your income is $4,100, your copayment would be $90 per month.)

(Example: If your household consists of yourself, your spouse, and two children, your household size is four. If your income is $4,100, your copayment would be $90 per month.)

Application Process

The parent must complete the WCCC application and verification process.

- Families can apply by contacting the Child Care Subsidy Contact Center at 1-844-626-8687 or online at www.WashingtonConnection.org.

- DCYF gathers and reviews information to determine a family's eligibility.

- Families will need to provide DCYF with the name and phone number of the child care provider. You do not have to have a provider before applying for child care subsidy.

View the instructions on creating an online account with Washington Connection.

Child Care Subsidy Program - You May Qualify

Read the printable flyer (available in English, Spanish, and Somali)

Verification Process

DCYF will need to verify the following information, as applicable. Some verification may be obtained using existing DCYF or state systems, or DCYF may request verification from families. All statements must contain a name, address, phone number, date, and signature.

Some verification may be obtained using existing DCYF or state systems, or DCYF may request verification from families. All statements must contain a name, address, phone number, date, and signature.

| What may need to be verified? (if applicable) | What may be provided? Verification may include: |

|---|---|

| Residency or citizenship of children | DCYF uses internal systems. If information is not available within these systems, the family will need to provide a social security card, birth certificate, U.S. passport, or immigration documents. |

| Homelessness | DCYF compares the family's living situation with family records. When conflicting information is presented, DCYF will obtain verification from a reliable source. The reliable source must be aware of family's living situation and must be willing to attest under penalty of perjury. |

| Custody | Court order, signed statement from the parent(s), or a statement from a third party if unable to obtain verification from the parent(s). |

| Single parent status | Consumers may provide the declaration form (DCYF form 27-164) or a statement indicating the name and address of the other parent for each of the children OR attest under penalty of perjury that they are a single parent, the whereabouts of the other parent is unknown or that providing this information would cause fear of harm. |

| Household composition (everyone living in the household) | Completed landlord statement (DCYF form 16-238), current lease agreement, or signed statement from the homeowner. |

| Earned income | DCYF will attempt to verify using available systems. If information is not available electronically, DCYF may use wage stubs, payroll history, or an employer statement that the family lists the actual gross income and month it is received, including any tips, bonuses, or commissions. |

| Self-employment | Federal or state tax return, tax transcripts including all forms for the most current reporting year. If you use a state tax return and you use a state tax return and claim all business expenses, verification of expenses will be necessary. Verification would include a profit and loss with receipts or bank statements to support the amounts claimed. |

| Other income (social security income, supplemental security income, unemployment benefits, or any other income received by someone in your family) | DCYF will attempt to verify using available systems. If information is not available electronically, DCYF may use award letters or notifications from corresponding agencies to verify monthly amounts. |

| Child support | DCYF will attempt to verify using available systems. If information is not available electronically, DCYF may use a signed and dated statement from the non-custodial parent, including the amount and frequency of support, including a signature, date, and phone number where the non-custodial parent can be reached. If support is ordered through another state, a statement verifying the amount and frequency of support, including a signature, date, and phone number if not printed from the state child support office. When court-ordered, the consumer pays child support and shows in internal systems, verification of the court-ordered will be required, including verification of the actual amounts paid. |

| Schooling and education | Copy of school registration and a written statement from a school employee verifying enrollment and the program. |

| Work-Study Participation | Statement from the college or case manager, including total hours awarded. |

| BFET participation | DCYF will use internal systems to verify current enrollment in an approved activity and the amount of time participating in this activity. |

| WorkFirst activity participants | DCYF will use internal systems to verify current enrollment in an approved activity and the amount of time participating in this activity. |

Finding Child Care

There are different provider options parents may choose to fit the needs of their family. Parents may choose from:

- Licensed or certified child care centers

- Licensed or certified family child care homes

- Unlicensed care, typically referred to as family, friend, or neighbor (FFN) child care

Licensed child care providers follow minimum licensing requirements set by Washington State to ensure children are in safe, healthy, and nurturing places.

Learn more about licensed child care

If you are not sure where to find licensed child care providers, your local Child Care Aware Washington agency can help. Call 1-800-446-1114 for help.

You have a choice in finding quality early care and learning settings in Washington State.

- You Have a Choice! A Guide to Finding Quality Child Care

- For more information, go to the Find Child Care / Early Learning page

- Child Care Check is a search tool for you to get information about individual child care providers and early learning programs in Washington

Some families prefer to have a family, friend, or neighbor care for their child or provide care in the child's home. When you choose a child care provider who is exempt from licensing, you have extra responsibilities.

When you choose a child care provider who is exempt from licensing, you have extra responsibilities.

The provider you must be:

- 18 years of age or older

- A citizen or a legal resident of the United States

- Pass the DCYF background check. If care is provided in the provider's home, then anyone older than 16 who lives in the home must also pass a background check

- Physically and mentally healthy enough to meet all the needs of the child in care

- Someone other than the child's biological parent, step-parent, adoptive parent, legal guardian, in-loco parentis, or spouse of any of these individuals

- Meet the health and safety requirements in WAC 110-16-0025, 110-16-0030, and 110-16-0035 if not related to the child

For more information go to the Family, Friends and Neighbor provider page

Note: In-home providers who are relatives and are paid child care subsidies to care for children receiving WCCC benefits, may not receive those benefits for their children during the hours in which they provide subsidized child care.

Additional Support

Parents of children with special needs may qualify for higher rates to help pay for additional supports needed. Further information is provided below.

- Special needs eligibility, application and rate information

- Special Needs Child Care Rate Request

Questions?

Families or parents with questions about their copayment may call the DCYF Child Care Contact Center at 1-844-626-8687.

Child care providers with questions about a family's copay may contact the DCYF Provider Help Line by emailing [email protected] or calling 1-800-394-4571.

Article 17.2. Deadlines for assigning state benefits to citizens with children \ ConsultantPlus

The amounts of benefits established by this law have been changed due to indexation. See Help Information for indexed benefit amounts.

Article 17.2. Deadlines for assigning state benefits to citizens with children

(as amended by Federal Law No. 207-FZ of 05.12.2006)

207-FZ of 05.12.2006)

(see the text in the previous edition)

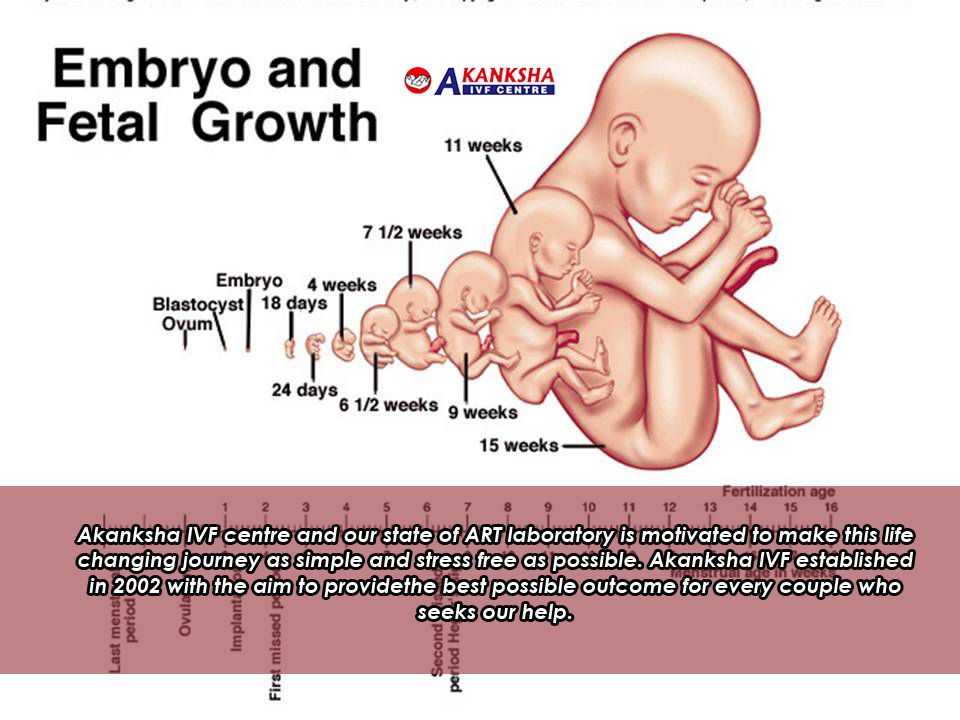

Maternity allowance, one-time allowance for the birth of a child, monthly child care allowance, as well as a one-time allowance for the transfer of a child to be raised in a family, are assigned if the application was followed no later than six months, respectively, from the date of the end of the maternity leave, from the date of the birth of the child, from the day the child reaches the age of one and a half years , from the day the court decision on adoption comes into force, or from the day the guardianship and guardianship authority makes a decision to establish guardianship (guardianship), or from the date of the conclusion of an agreement on the transfer of a child for upbringing to a foster family, and a one-time allowance to the pregnant wife of a serviceman undergoing military service by conscription, and a monthly allowance for the child of a soldier undergoing about military service by conscription - no later than six months from the date of completion of military service by military conscription.

(as amended by Federal Laws No. 233-FZ of 25.10.2007, No. 129-FZ of 07.06.2013, No. 151-FZ of 26.05.2021)

(see the text in the previous version)

child care allowance is paid for the entire period during which the person caring for the child was entitled to the said allowance, in the amount provided for by the legislation of the Russian Federation for the relevant period.

The day of applying for a one-time allowance when a child is placed in a family is considered the day of acceptance (registration) by the body authorized to assign and pay a lump-sum allowance when a child is placed in a family, applications for the appointment of a lump-sum allowance when a child is placed in a family with all necessary documents.

(Part three was introduced by Federal Law No. 27-FZ of 07.03.2011)

indicated on the postmark of the federal postal organization at the place of sending this application.

(Part four was introduced by Federal Law No. 27-FZ of 07.03.2011)

27-FZ of 07.03.2011)

If not all the necessary documents are attached to the said application, the body authorized to assign and pay a lump-sum allowance when a child is transferred to a family, gives to the person who applied for a one-time allowance when transferring a child to a family, a written explanation of what documents should be submitted additionally. If such documents are submitted no later than six months from the date of receipt of the relevant explanation, the day of applying for a one-time allowance when transferring a child to a family is considered the day of receipt (registration) of an application for the appointment of a lump-sum allowance when transferring a child to a family or the date indicated on the postmark of the federal postal organization at the place of sending this application.

(Part five was introduced by Federal Law No. 27-FZ of 07.03.2011)

Article 13. Procedure for the appointment and payment of insurance coverage \ ConsultantPlus

Article 13. Procedure for the appointment and payment of insurance coverage

Procedure for the appointment and payment of insurance coverage

(as amended by the Federal Law of 04/30/2021 N 126-FZ (as amended on 05/26/2021))

(see the text in the previous edition)

Federal law, when the payment of benefits for temporary disability is carried out at the expense of the insured), for pregnancy and childbirth, a lump sum allowance for the birth of a child, a monthly allowance for child care are carried out by the insurer.

agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art) at the time of the occurrence of the insured event was occupied by several policyholders and in the two previous calendar years was occupied by the same of insurers, benefits for temporary disability, for pregnancy and childbirth are assigned and paid to him by the insurer for each of the insurers with whom the insured person is employed at the time of the insured event, and the monthly allowance for child care for one of the insurers, for the cat The majority of the insured person is employed at the time of the occurrence of the insured event, at the choice of the insured person and is calculated based on the average earnings determined in accordance with Article 14 of this Federal Law for the time of work (service, other activities) with the insured for which the benefit is assigned and paid.

(as amended by Federal Law No. 237-FZ of July 14, 2022)

(see the text in the previous edition)

are the performance of works and (or) the provision of services, an agreement of an author's order or an author of works receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art) at the time of the insured event is employed by several insurers, and in the previous two calendar years it was employed by other insurers (another insured), temporary disability benefits, pregnancy and childbirth benefits, monthly allowance for child care are assigned and paid to him insurer under one of Art. insured person, with whom the insured person is employed at the time of the occurrence of the insured event, at the choice of the insured person.

(as amended by Federal Law No. 237-FZ of July 14, 2022)

(see the text in the previous edition)

are the performance of works and (or) the provision of services, an agreement of an author's order or an author of works receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art) at the time of the occurrence of the insured event was employed by several insurers, and in the two previous calendar years it was employed by both these and other insurers (another insured), benefits for temporary disability, for pregnancy and childbirth are assigned and paid to him by the insurer or in accordance with part 2 of this th article for each of the policyholders with whom the insured person is employed at the time of the insured event, based on the average earnings for the time of work (service, other activities) with the policyholder for which the benefit is assigned and paid, or in accordance with part 3 of this article for to one of the policyholders with whom the insured person is employed at the time of the occurrence of the insured event, at the choice of the insured person.

(as amended by Federal Law No. 237-FZ of July 14, 2022)

(see the text in the previous edition)

4.1. If the insured person working under a civil law contract, the subject of which is the performance of works and (or) the provision of services, or under an author's order agreement, or who is the author of works, receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works science, literature, art, publishing license agreement, license agreement on granting the right to use a work of science, literature, art, at the time of the insured event, employed under the specified agreements with several insurers, benefits for temporary disability, for pregnancy and childbirth, monthly allowance for care for the child are assigned and paid to him by the insurer for one of the insurers, with whom the insured person is employed under the specified contracts at the time of the insured event, at the choice of the insured person.

(Part 4.1 was introduced by Federal Law No. 237-FZ of July 14, 2022)

4.2. If an insured person working under a civil law contract, the subject of which is the performance of work and (or) the provision of services, or under an author's order contract, or who is the author of works, receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works of science, literature , art, publishing license agreement, license agreement on granting the right to use a work of science, literature, art, at the time of the occurrence of an insured event is employed by another insurant (other insurers) under an employment contract or other activities during which it is subject to compulsory social insurance in case temporary disability and in connection with motherhood, benefits for temporary disability, pregnancy and childbirth are assigned and paid to him by the insurer for the insured, for whom the insured person is employed under an employment contract or other activity during which it is subject to compulsory social insurance in case of temporary disability and in connection with motherhood, or for each such insurant in accordance with parts 2 and 4 of this article and for one of the insurers in accordance with part 4. 1 of this article, and a monthly allowance for child care is assigned and is paid to him by the insurer for one of the insurers, who employed the insured person at the time of the insured event, at the choice of the insured person.

1 of this article, and a monthly allowance for child care is assigned and is paid to him by the insurer for one of the insurers, who employed the insured person at the time of the insured event, at the choice of the insured person.

(Part 4.2 was introduced by Federal Law No. 237-FZ of July 14, 2022)

, during which it was subject to compulsory social insurance in case of temporary disability and in connection with motherhood, the temporary disability benefit is assigned and paid by the insurer for the insured for whom such work or activity was carried out.

6. The basis for the appointment and payment of benefits for temporary disability, pregnancy and childbirth is a certificate of incapacity for work, formed by a medical organization and placed in the information system of the insurer in the form of an electronic document, signed using an enhanced qualified electronic signature by a medical worker and a medical organization, if otherwise not established by this Federal Law. The conditions and procedure for the formation of sick leave certificates in the form of an electronic document are established by the federal executive body responsible for the development and implementation of state policy and legal regulation in the field of healthcare, in agreement with the federal executive body responsible for developing state policy and regulatory legal regulation in the field of social insurance, and the Pension and Social Insurance Fund of the Russian Federation. The procedure for information interaction between the insurer, policyholders, medical organizations and federal state institutions of medical and social expertise for the exchange of information in order to form a sick leave certificate in the form of an electronic document is approved by the Government of the Russian Federation.

The conditions and procedure for the formation of sick leave certificates in the form of an electronic document are established by the federal executive body responsible for the development and implementation of state policy and legal regulation in the field of healthcare, in agreement with the federal executive body responsible for developing state policy and regulatory legal regulation in the field of social insurance, and the Pension and Social Insurance Fund of the Russian Federation. The procedure for information interaction between the insurer, policyholders, medical organizations and federal state institutions of medical and social expertise for the exchange of information in order to form a sick leave certificate in the form of an electronic document is approved by the Government of the Russian Federation.

(as amended by the Federal Law of July 14, 2022 N 237-FZ)

(see the text in the previous edition)

The form of the statement is approved by the insurer.

8. Insurers, no later than three working days from the date of receipt of data on a closed certificate of incapacity for work, formed in the form of an electronic document, transfer to the information system of the insurer, as part of the information for the formation of an electronic certificate of incapacity for work, the information necessary for the appointment and payment of benefits for temporary disability, for pregnancy and childbirth, signed using an enhanced qualified electronic signature, unless otherwise provided by this article.

(as amended by the Federal Law of February 25, 2022 N 18-FZ)

(see the text in the previous edition)

register of civil status records, and information requested by the insurer in accordance with Part 1 of Article 4.2 of this Federal Law.

10. The basis for assigning and paying a monthly child care allowance to the insured persons specified in Part 1 of Article 2 of this Federal Law is the application of the insured person for the appointment of a monthly child care allowance, which is submitted to the policyholder simultaneously with the insured person's application for granting parental leave until the child reaches the age of three years. The application form for the appointment of a monthly allowance for child care is approved by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance. The insured person, who at the time of the occurrence of the insured event is employed by several insurers, when submitting an application to one of the insurers for the appointment of a monthly child care allowance, confirms the choice of the insurant, according to which the insurer will assign and pay a monthly child care allowance.

The application form for the appointment of a monthly allowance for child care is approved by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance. The insured person, who at the time of the occurrence of the insured event is employed by several insurers, when submitting an application to one of the insurers for the appointment of a monthly child care allowance, confirms the choice of the insurant, according to which the insurer will assign and pay a monthly child care allowance.

11. Insured persons submit the information necessary for the appointment of a monthly child care allowance to the territorial body of the insurer at the place of their registration no later than three working days from the date of submission by the insured person of an application for the appointment of a monthly allowance for child care, unless otherwise not established by this article.

(as amended by Federal Law No. 18-FZ of February 25, 2022)

18-FZ of February 25, 2022)

(see the text in the previous edition)

11.1. Insurers applying the special tax regime "Automated Simplified Taxation System", no later than one working day from the date of submission by the insured person of an application for the appointment of a monthly child care allowance, send to the insurer in electronic form, including through the personal account of the taxpayer, information about application submitted by the insured person.

(Part 11.1 was introduced by Federal Law No. 18-FZ of February 25, 2022)

when he became aware of the occurrence of such circumstances, sends a notice to the territorial body of the insurer at the place of his registration on the termination of the right of the insured person to receive a monthly child care allowance.

13. Upon employment or during the period of employment, service, other activities, the insured person shall provide the insured person at the place of work (service, other activity) with information about himself necessary for the insurant and the insurer to pay insurance coverage (hereinafter referred to as information about the insured person), the list of which is contained in the form approved by the insurer. Information about the insured person is drawn up on paper or in the form of an electronic document.

Information about the insured person is drawn up on paper or in the form of an electronic document.

14. The insured person is obliged to notify the policyholder in a timely manner of changes in the information specified in paragraph 13 of this article.

15. Information about the insured person received by the policyholder shall be transferred by him to the territorial body of the insurer at the place of his registration no later than three working days from the date of their receipt.

16. Assignment and payment of insurance coverage are carried out by the insurer on the basis of information and documents submitted by the insured, information available to the insurer, as well as information and documents requested by the insurer from state bodies, local governments or subordinate to state bodies or local governments organizations.

using a unified system of interdepartmental electronic interaction are established by the Government of the Russian Federation.

18. The procedure and conditions for the submission by the insured in electronic form of information and documents necessary for the appointment and payment of insurance coverage to insured persons are established by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance. The formats for the submission by the insured in electronic form of the specified information and documents are established by the insurer.

19. In the event that the insurant ceases to operate or if it is impossible to establish its actual location on the day the insured person applies for benefits for temporary disability, pregnancy and childbirth, a one-time allowance for the birth of a child, a monthly allowance for child care, appointment and payment the specified types of insurance coverage (with the exception of temporary disability benefits paid at the expense of the insured in accordance with Clause 1 of Part 2 of Article 3 of this Federal Law) are carried out by the insurer on the basis of information and documents submitted by the insured person, information available to the insurer, and also information and documents requested by the insurer from state bodies, local governments or organizations subordinate to state bodies or local governments.

20. If the information and documents necessary for the appointment and payment of insurance coverage are not provided to the insurer in full, the insurer, within five working days from the date of their receipt, sends the policyholder or, in the case specified in paragraph 19 of this article, the insured person a notice on submission of missing information or documents in the form approved by the insurer. The policyholder or the insured person, upon receipt of the said notice, shall submit to the insurer the missing information and documents within five working days from the date of receipt of the notice.

with motherhood in relation to the deceased on the day of his death or in relation to one of the parents (other legal representative) or other family member of the deceased minor on the day of death of this minor, and in the cases provided for by part 23 of this article, by the insurer.

22. If the insured person was employed by several policyholders at the time of the occurrence of the insured event, the social benefit for burial is assigned and paid by one of the policyholders at the choice of the person who applied for such benefit.

23. If it is not possible for the insured to pay social benefits for burial due to the termination of his activities or insufficient funds in his accounts with credit institutions, or if it is not possible to establish the location of the insured and his property, which may be levied , if there is a court decision that has entered into legal force establishing the fact that such an insurer did not pay benefits to a person entitled to receive it, or if, on the day of the application of a person entitled to receive social benefits for burial, the procedures applied to the insured are carried out in a bankruptcy case, the assignment and payment of social benefits for burial are carried out by the insurer.

funeral matters are carried out by the territorial body of the insurer at the place of registration of the insured in the manner determined by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance.

25. Payment of benefits for temporary disability, for pregnancy and childbirth, a one-time allowance for the birth of a child, a monthly allowance for child care is carried out by the insurer through the organization of the federal postal service, credit or other organization specified in the information about the insured person.

26. Payment for banking services for operations with funds provided for the payment of insurance coverage is not charged.

27. Information on the appointment and payment of insurance coverage is posted by the insurer in the Unified State Social Security Information System in accordance with the Federal Law of July 17, 1999 N 178-FZ "On State Social Assistance".

organization in the form of a document on paper. The specifics of the procedure for assigning and paying insurance coverage to the specified categories of insured persons are established by the federal executive body in charge of developing state policy and legal regulation in the field of social insurance, in agreement with the federal executive bodies in charge of developing and implementing state policy and legal regulation in the established field of activity, other federal state bodies and the Pension and Social Insurance Fund of the Russian Federation.