How much does raising a child cost in canada

Average Cost of Raising a Child in Canada [Breakdown]

In 2019, there were 372,038 Canadian babies born to families across the nation. As of 2021, there were 359,533 little ones brought into this world.

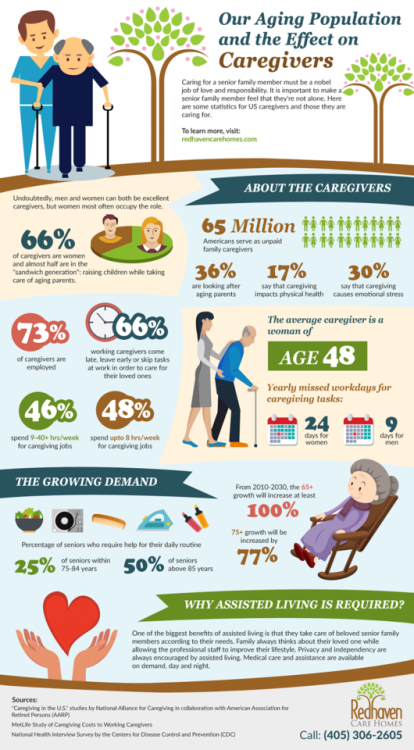

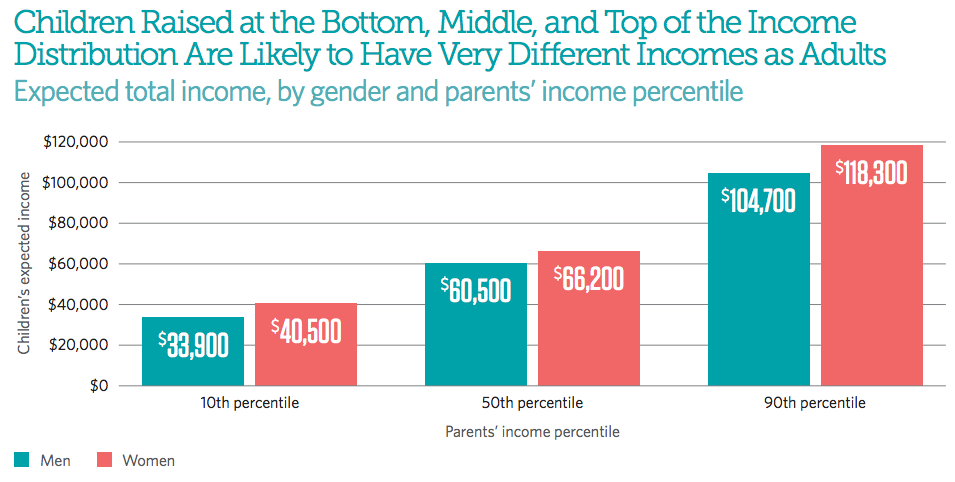

If you're thinking about having a baby yourself, you have to consider, "how much does it cost to raise a child?" and how that cost will impact your family's financial situation. The cost of raising a child has changed over the years. About 20% of Canadian children come from impoverished families, making this much more difficult. A report in February of 2021 found that approximately 3.7 million Canadians are living below the poverty line, which is 10.1% of the population.

What is the cost of raising a child in Canada specifically? Is there a way to know how to save money while raising a child?

Learn more about the cost to raise a child in this country and whether or not it is something you can truly afford.

Jump To:

- The Cost of Food for Raising a Child

- Clothing Costs for Raising a Child

- Daycare Costs

- Transportation Costs of Raising a Child in Canada

- School Associated Costs

- Summer Camp

- Saving for University

- Other Expenses for Raising a Child

The Cost of Food for Raising a Child

The cost of food is one of the biggest costs that you may not spend that much time considering, but it's important that you do. Families that want to focus on healthy eating may have to pay a little bit more.

While food costs are increasing in Canada, the income levels for many families are remaining the same. In a recent 2022 publication by Canada's Food Price Report, a Canadian family of four is expected to pay an extra whopping $966 for food this year. If you're adding another mouth to feed to your family, especially if the child may have allergies or special dietary needs, you have to consider the cost of food for years to come.

Many women breastfeed obviously, but for those who cannot, formula is the only option for providing your little one with the liquid nutrients needed to grow and sustain. While formula has come a long way, it's also very pricey. The average yearly cost would be anywhere from $900-$3000/year.

Clothing Costs for Raising a Child

Many parents love to shower their new baby or child with cute clothing, but the cost of this adds up really quickly. Many parents spend as much as $76 per month in the baby's first year, but of course, this is affected by income levels.

As your child gets older, they may require special clothing for sports or other activities that they are involved in.

Babies grow relatively fast, so you will have to replace clothing often for the child as they grow well into their teen years.

Luckily, there are better options than buying new clothing every time your child outgrows something. One of those options, Once Upon a Child, makes it easy to sell clothing your child doesn't use anymore and buy clothing that another child doesn't use anymore - a win-win situation.

Diapers

With diapers, the numbers you need tend to decrease the older your child gets. But that doesn't change the massive amounts you'll need, especially in the first two years.

On average, parents will change 60 diapers in the first ten days of a child's life, which means the largest box you can find, usually containing 144 diapers, won't last an entire month. The cost of a box this size usually runs around $40. This means that you will be spending upwards of $500 per year on diapers alone.

This means that you will be spending upwards of $500 per year on diapers alone.

Daycare Costs

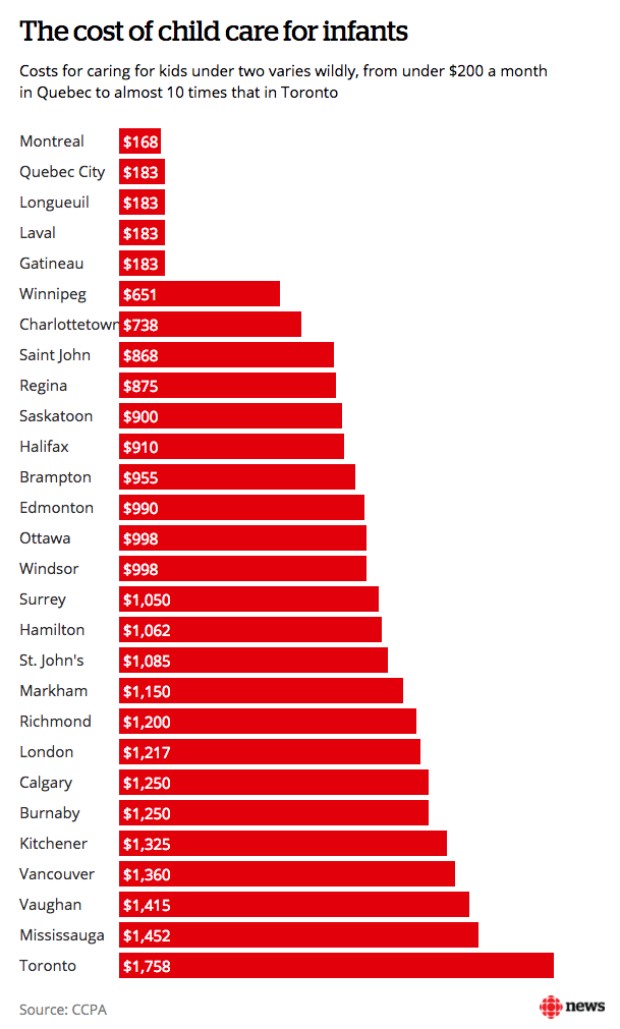

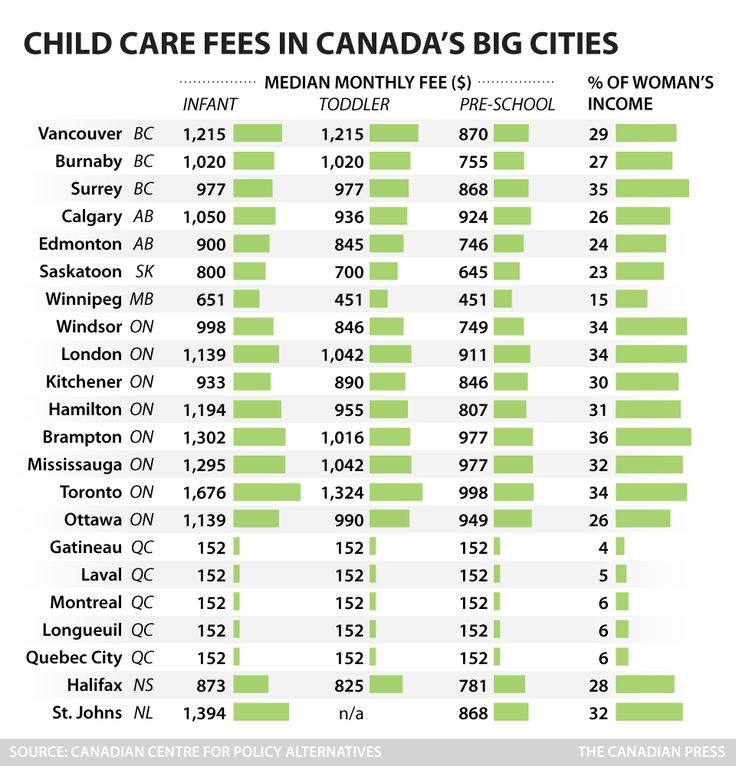

Prices will vary based on whether you go for a full-day daycare centre or if you choose a family or home-based childcare centre. For the purposes of average costs here, we will focus on the cost of full-day daycare centres in each province.

The price also varies based on the age of the child. For instance, infant and toddler costs are typically higher than preschool costs because these younger children require more attention and care. For this reason, we will provide a range of prices in Canadian dollars that cover these ages.

The average range of full-day daycare prices per province are as follows:

- Ontario: $662 - $1,934

- Alberta: $830 - $1,350

- Manitoba: $451 - $651

- British Columbia: $800 - $1,283

- Newfoundland/Labrador: $660 - $995

- Yukon: $850 - $900

- Nunavut: $1,213 - $1,411

- Prince Edward Island: $586 - $738

- Saskatchewan: $615 - $1,000

- New Brunswick: $664 - $868

- Nova Scotia: $847 - $960

- Quebec: $179

- Northwest Territories: $760 - $1,150

Parents in Quebec are at the highest rate of daycare use with 58% of parents using these services.

The cost of daycare is different in major cities because these businesses usually have to pay more to operate in those cities, but they also know that income levels are typically higher for parents in these urban areas. Each province has their own Child Daycare Subsidy programs which are available to parents to assist in off setting the cost of daycare. This is solely based on income however, and government tax assessments are required to determine eligibility.

Transportation Costs of Raising a Child in Canada

There will be costs associated with transporting your child, such as to school, to activities, or to friends' homes. If you're using your vehicle, you can likely anticipate how much the additional cost may be based on what your current fuel efficiency is like.

If you're planning to have your child rely on public transportation, the costs are different.

Bus Pass

A monthly bus pass in Canada costs near $100 in many provinces, but the costs do vary based on your location. The TTC for example which runs in Toronto is expected to increase yet again $122.50 in 2022.

The TTC for example which runs in Toronto is expected to increase yet again $122.50 in 2022.

If you're planning to ride the bus with your child, that's an additional cost to cover. It's important to know local laws surrounding this topic as well.

In Canada, three provinces (New Brunswick, Quebec, and Ontario) have age requirements for when children can be left alone. This includes being alone to ride the bus.

School Bus Fees

Some locations require a school bus fee for yellow buses that will take your child directly to and from school. Not all provinces have these fees.

For instance, in Calgary, Alberta, the fee for school buses has just increased to $465 or $800 for families.

Get the Coverage You Want at the Best Rates

A great way to ensure your child's financial stability is by having a Life Insurance Policy.

Get Quotes Now

School Associated Costs

No matter where you live, there will be costs associated with schooling. Since your child is in school for many years, the costs will change as they get older.

Since your child is in school for many years, the costs will change as they get older.

Laptops and Tablets

Some schools will provide these devices to your child for use, while others may require families to purchase them on their own.

The best budget laptops range from $200 to $800.

Purchase these items at secondhand locations, like Craigslist, eBay, Kijiji, or a local electronics store. The cost for a used laptop can vary greatly based on the company that made it or the year it was made.

Supplies

Children typically need more school supplies when they are younger, including pencils, scissors, glue, crayons, and tissues. Expect to pay near or more than $650 for younger children's school supplies.

As they get older, they may need books, backpacks, or electronics to keep up with their requirements, but these vary from school to school.

If you're unsure about whether you can afford these supplies, consider shopping at dollar stores. You will often be able to find what you need at a much lower cost.

Online Memberships

One of the parental expenses in Canada that is often forgotten is online memberships for students. These memberships provide additional opportunities and skills to children, but they come at a fee depending on the membership you choose.

An example of this is ABC Mouse. This service costs $79.99 per year.

Another option is Learn With Homer. This online early learning membership is usually priced at $119.88.

School Trips

While the school may cover some of the costs of school trips, if they don't have the full cost in their budget, your family may be asked to pay for your child's participation.

These fees will vary depending on several factors, including the average socioeconomic situation for families in your area, the type of trip it is, and more. Without additional payment, however, your child may be left out of the fun.

Some examples of school trips include:

- Museums

- Nature areas

- Aquariums

- Amusement parks

- Educational tours

While the school may cover some of the cost, the average cost for a child's ticket to a museum, like the Canadian Museum of History, is $11 for children 8-12 years old.

Summer Camp

This is not a necessity for families, but it can be a great way for your child to get exposure to different experiences and learn new skills or hobbies. It's also a wonderful chance for socialization and making friends.

There are options for a summer camp that are either far away from home or local, regardless of where you live in Canada.

Local options may be less expensive because they require less travel, but the fees to attend could still be higher. Farther away options, such as those in northern or southern Canada, could face the opposite problem.

Kawkawa Camp, as an example, costs $455 for youth camps and junior teen camps.

Saving for University

Another one of the big Canadian parental costs is saving up for university. While not all children will attend university, many Canadian parents want to save for this expense because it is a large expense, and not preparing beforehand can cause a lot of stress.

A Canadian citizen that wants to attend university as an undergraduate in Canada will expect to pay about $6,463 per year. At the time this article was updated in March of 2022, that cost has raised to an average of $6,693 for undergraduate programs. Now fast forward to the year 2035, and parents can expect to pay a staggering $17,200 per year for their kids to attend university.

At the time this article was updated in March of 2022, that cost has raised to an average of $6,693 for undergraduate programs. Now fast forward to the year 2035, and parents can expect to pay a staggering $17,200 per year for their kids to attend university.

What are the options that you have? How can you possibly afford to save this much with the cost of everything else?

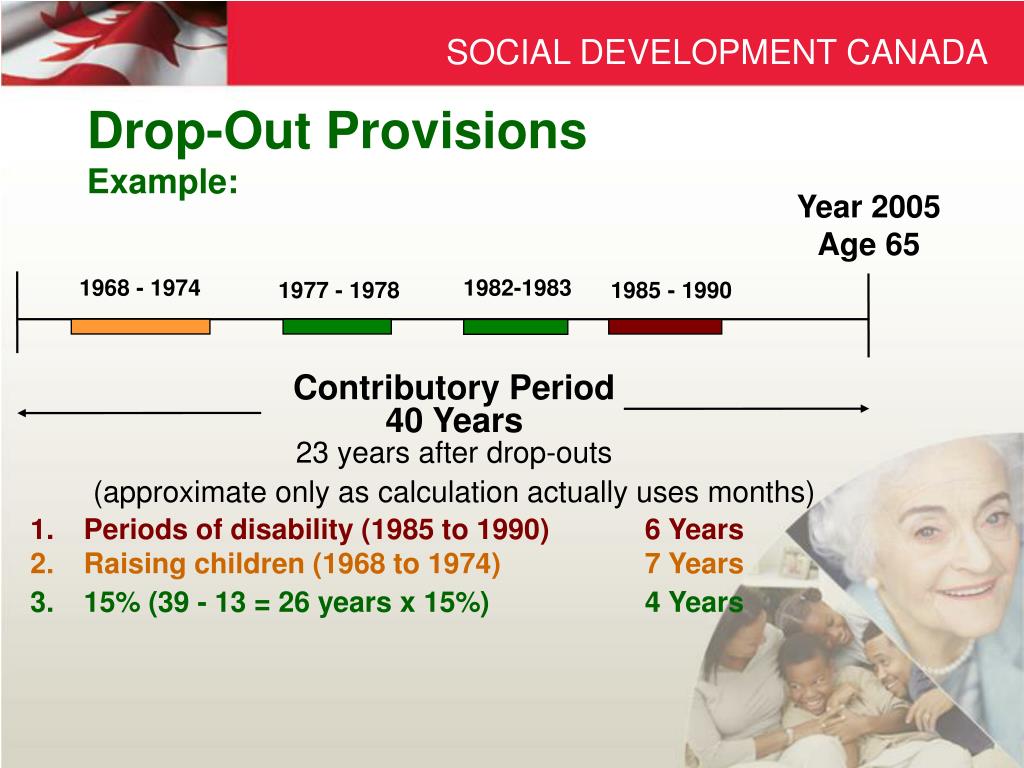

Some parents will choose to open a Registered Education Savings Plan (RESP) for this purpose, which is a specific savings account for a child's education following high school.

Get the Coverage You Want at the Best Rates

Our Online Life Insurance Quoter is fast, free and secure.

Take me there

Other Expenses for Raising a Child

While the obvious costs we have already discussed are clear, there are others that parents to be often overlook.

Birthday Parties

How much do you think the average first birthday party costs for a child? The answer is anywhere from less than $50 to over $500.

Of course, not all parents will spend the same amount on these parties every year, but it's a cost that many parents don't often consider. $500, even once a year, is a lot of money for many families. More to that your child is likely to be invited to a few birthday parties a year so factor in an additional $100-$200 in gifts for other children.

Extracurricular Activities

If your child grows up to be involved in activities, like dance, baseball, or hockey, these will cost some money. You may have to pay for your child to be able to participate at all, but you'll also have to cover fees for travel to tournaments, costumes or gear, and more.

The average family will spend around $1,160 on hobbies and extracurricular activities. At the time of review, this number is unchanged for now.

Babysitting Fees

The average rate for a babysitter in Canada is about $14.54 per hour. It has gone up slightly in recent years. More to that, as of January 1, 2022 the rate of minimum wage increased $15. 00 per hour so that's the recommended starting wage for any babysitter.

00 per hour so that's the recommended starting wage for any babysitter.

As a new parent, you'll likely need some time away from the baby from time to time, and hiring a babysitter may be something you do more often than you think. This cost can add up.

Know the Cost of Raising a Child in Canada

Overall, it's clear that the cost of raising a child in Canada can be pretty high for most families.

When this article was written, children cost about $13,365.63. This means that the average cost of raising a child per month is about $1,113.80. In 2022, average cost ranges between $10,000-$15,000 a year.

If you want to have a child, you need to be prepared financially. What is the best way to do this?

At Insurdinary, we have many financial planning and personal finance resources available to you. Check out our blog to learn more!

Join the Insurdinary newsletter

Get offers, promotions, tips, and advice from all Financial and Insurance institutions once a week.

By subscribing, you agree to our privacy policy. You can unsubscribe at any time.

The Cost of Raising a Child in Canada

**This post may contain affiliate links. I may be compensated if you use them.

When my daughter was born, I knew the costs would add up quickly. Heck, even before she was born, I spent a fair amount to get things ready. It should be no surprise that the cost of raising a child in Canada is expensive! Most estimates for the cost of raising a child in Canada are in the $10,000 – $15,000 a year range until the age of 18 in Canada.

While that number certainly felt accurate while my daughter was in daycare, now that she’s in school, I find I’m not spending that much. The important thing to understand is that you don’t need to spend a set amount on your children to be good parents. If you can provide them with a safe and loving home, you’re doing great.

The idea behind this post is to give you an average cost of what you’ll spend as a new parent. It’s worth noting that the province and territory in which you reside will affect your overall costs. Admittedly, a lot of these points are slanted towards new parents. I’ve also included a few government programs that will give you income and grants for being a parent. Consider the following when thinking about the cost of raising a child in Canada.

It’s worth noting that the province and territory in which you reside will affect your overall costs. Admittedly, a lot of these points are slanted towards new parents. I’ve also included a few government programs that will give you income and grants for being a parent. Consider the following when thinking about the cost of raising a child in Canada.

Maternity leave in Canada covers up to 15 weeks. You can take this paid leave during your pregnancy or after you give birth. After your maternity benefits run out, you can take standard parental leave up to an additional 40 weeks or 69 weeks for extended parental leave. During this time your employer must save your position and if you’re lucky they’ll offer some kind of top up, but if not, maternity employment insurance will help you get by. Employment insurance is meant to replace 55% of your weekly earnings up to a maximum of $573 a week.

Those taking extended leave only get an income replacement of 33% up to a maximum of $343 a week. You’ll hit the cap if your salary is $51,300 or more. To make matters worse, the income is taxable. Note that parents in Canada can now take up to 18 months of maternity leave, the payouts just get spread out over that period.

You’ll hit the cap if your salary is $51,300 or more. To make matters worse, the income is taxable. Note that parents in Canada can now take up to 18 months of maternity leave, the payouts just get spread out over that period.

Most couples choose to take the leave one after the other but you could take it at the same time if you wanted. Whoever has the better top-up benefits should take more time off, but try telling that to the woman who just carried and delivered a baby.

Start-up costsNew parents typically spend a lot when their first child arrives. The cost of a child will vary by family, but some expenses to factor in include:

- Car seat

- Crib

- Formula

- Stroller

- High chair

- Childcare expenses

- Diapers

Even when your kids get out of daycare and diapers, there will still be many expenses that come out. You’ll have to pay for things such as school supplies, extracurricular activities, summer camps, braces, personal care, uninsured healthcare, and more.

The cost of raising children is expensive, but it’s not like you need to accept the price tag of everything you see. Many things can be bought second-hand, which helps reduce the cost of raising kids. Trust me, newborns will not care if their clothes are new or gently used.

Also, if you keep your kids’ stuff in good condition, you can resell them later. That will reduce your total cost overall.

Life insuranceOnce you have dependents, life insurance for Canadians is an absolute must. Our children depend on our income to get by so have a policy in place that will leave them with enough money to get by until they become self-dependent adults.

If you’re young and healthy, term life insurance is affordable at roughly $30-40 a month. Generally speaking, the amount you want to get enough to cover the costs of your funeral, the balance of your mortgage, and the cost of a post-secondary education. Getting life insurance these days is easy as you can do it all online via companies such as PolicyMe. You’ll still get access to licensed advisors, there’s just no need to meet face-to-face since they walk you through the policies.

You’ll still get access to licensed advisors, there’s just no need to meet face-to-face since they walk you through the policies.

Since I’m being all morbid, don’t forget to get your will done. Many people still prefer to go to a lawyer to get their wills done, but they can charge a fair amount. DIY wills kits aren’t bad, but I think there’s a better solution now in Willful. With Willful, you can create a legally binding will online. You only pay for it once and you get unlimited updates for free. Willful makes creating a will quick, easy, and inexpensive. Click my Willful affiliate link and use promo code MONEYWEHAVE15 to get $15 off your will.

Registered Education Savings PlanSetting up an RESP isn’t mandatory, but I would consider it a cost of raising a child in Canada. You can get $500 free every year through the Canadian Education Savings Grant. The grant gives you a 20% match on the first $2,500 you save every year until your child turns 17 with a lifetime maximum benefit of $7,200 per child. Contributions aren’t tax-deductible but any gains would be taxable under your child when withdrawn. Since your child typically won’t have much income at that time, the gains are usually tax-free.

Contributions aren’t tax-deductible but any gains would be taxable under your child when withdrawn. Since your child typically won’t have much income at that time, the gains are usually tax-free.

Lower-income families could potentially get a higher match and they can access up to $2,000 to help kick-start their child’s RESP through the Canada Learning Bond. The money is completely free; no fees and no additional contributions are required.

If the idea of setting up an RESP and investing is freaking you out, consider using a robo advisor such as Justwealth. Robo advisors have low fees and automate their investment strategy. All you really need to do is set up an account and then choose the year when your child will graduate from high school. The robo advisor will then invest and balance your RESP with that target date in mind. When you sign up for Justwealth through my referral link, you’ll get a $50 bonus.

Daycare costsWhere you live will determine your daycare costs. Licensed daycare in major cities can cost up to $2,000 a month. Unlicensed home care is a cheaper solution and is worth checking out. Regardless of which route you decide on, there are limited spots so put your child’s name on a waiting list as soon as they are born (if not earlier).

Licensed daycare in major cities can cost up to $2,000 a month. Unlicensed home care is a cheaper solution and is worth checking out. Regardless of which route you decide on, there are limited spots so put your child’s name on a waiting list as soon as they are born (if not earlier).

With the cost of child care so high, it might even make sense for one parent to stay home for an extended period. MoneySense has a great article on how to find and pay for child care. My wife and I personally checked out close to a dozen daycares before we settled on one that made the most sense for us. We were fortunate that our first choice had availability when we needed it.

Note that with the federal $10-a-day daycare deal in place, the cost of daycare will drop significantly over the next few years. Some provinces such as Quebec already have lower child care costs in place.

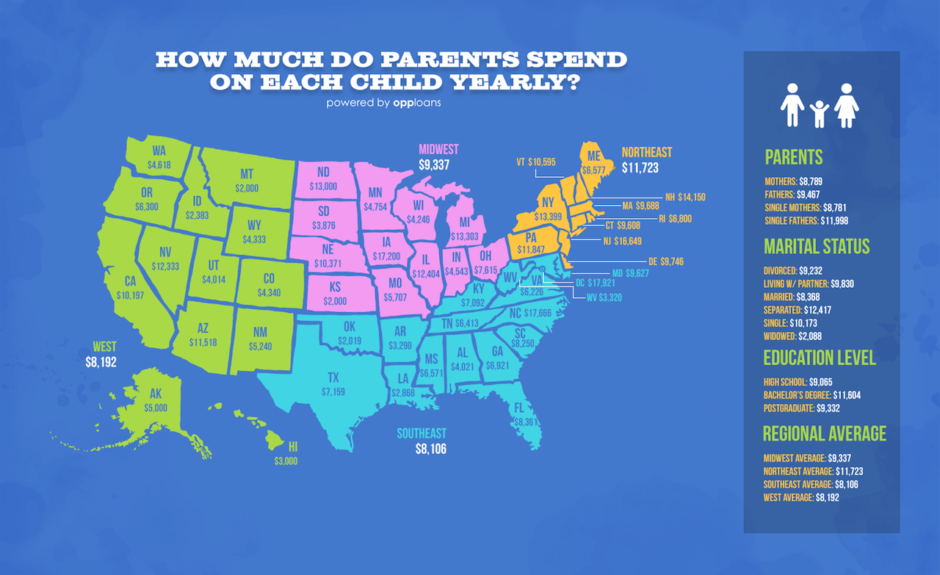

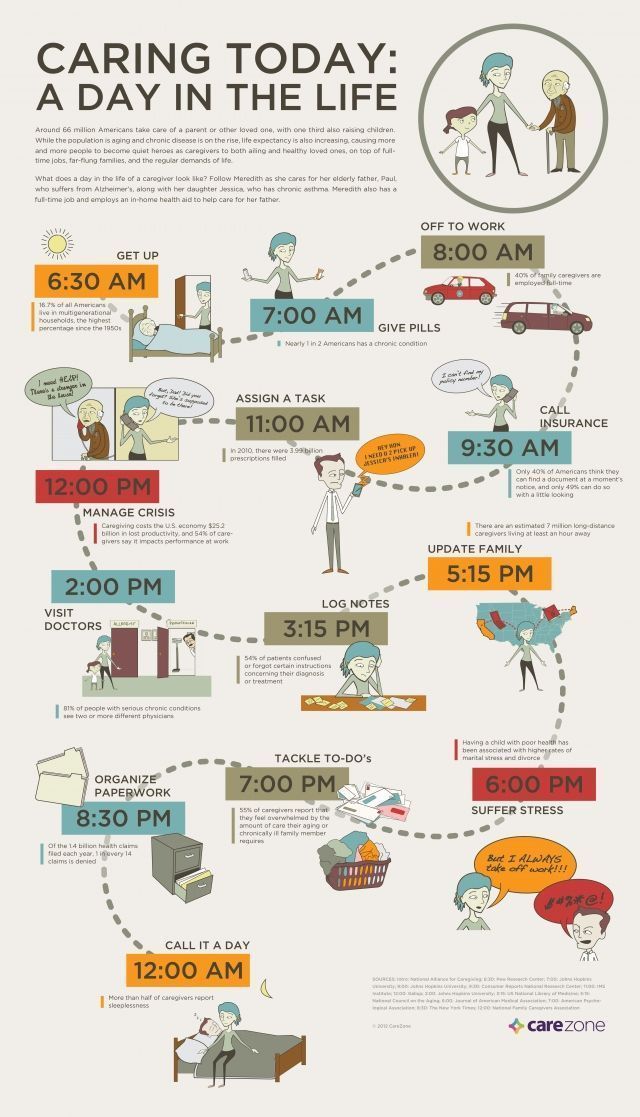

Canadian Child BenefitThe cost of raising a child in Canada is offset by the Canadian Child Benefit which provides up to $6,639 per year ($553. 25 per month) for each eligible child under the age of six, and up to $5,602 per year ($466.83 per month) for each eligible child aged 6 to 17. This benefit was created with lower income families in mind. If you’re in a household that earns a middle-income or higher income, there’s a possibility that you won’t qualify for the Canadian Child Benefit. Some people find that to be unfair as they may still have to pay for childcare and other expenses, but I don’t mind the current system. Use the child and family benefits calculator to see what you’re entitled to.

25 per month) for each eligible child under the age of six, and up to $5,602 per year ($466.83 per month) for each eligible child aged 6 to 17. This benefit was created with lower income families in mind. If you’re in a household that earns a middle-income or higher income, there’s a possibility that you won’t qualify for the Canadian Child Benefit. Some people find that to be unfair as they may still have to pay for childcare and other expenses, but I don’t mind the current system. Use the child and family benefits calculator to see what you’re entitled to.

Having a baby is a serious decision and one that should be made with our finances in mind. Most parents will divert all their savings towards their children, but it’s foolish to ignore your own retirement savings in the process. While trying to budget the average annual cost of having children is nice, the reality is that the real costs will always be unknown.

Money for children in Canada - Immigrant today

Greetings from Canada! My name is Alex Pavlenko.

Today I want to talk about how much money you can get if you live in Canada and if you have children. And these are really very impressive amounts: thousands, maybe even $ 10,000 - 15,000 (Canadian dollars) per year. And it all depends on what your income is and how many children you have. The best thing is that you do not have to pay taxes on this amount.

Canada is very, very, very helpful in getting new immigrants on their feet. Let's say you just moved to the country, you don't have a job yet, or you're on minimum wage. And if you have two children, then an extra $1,000 a month obviously won't hurt. But at the same time, there are some problems that you may encounter sooner or later.

First, if you don't ask for help, you won't get it. For example, our family, we have three children. When we came to Canada, we did not know that any money was being paid for children, and we did nothing to get it. Only a few months after we lived in Canada, we went to one of the organizations that helps to fill out forms for free (that is, this is another plus for Canada, that there are a huge number of organizations that help to find a job and fill out all kinds of questionnaires, forms and so on), and they helped us fill out such a questionnaire, and we immediately received either $6,000 or $9000 starting on the 1st of the day we arrived in Canada, meaning you won't lose all that money even if you don't fill out the form right away, but you just need to know about it. And by the way, here is a link to a document where I will describe in more detail what forms to fill out and how much money generally relies on children, depending on your income and on their number.

And by the way, here is a link to a document where I will describe in more detail what forms to fill out and how much money generally relies on children, depending on your income and on their number.

Suppose you live in Canada for a year, two, three, everything is fine with you, your children are growing up, your salaries are increasing, and you, of course, receive money for children (they, however, fall when your salaries increase) . And one fine day you may receive a letter (we received such a letter), and it says that, they say, guys, please prove that your children really lived in Canada, that we pay you money for a reason.

It seems that there are some bad people who took advantage of these child benefits, received money for children and at the same time were not physically in Canada. And you need to prove this physical presence. We, sticking out our tongues, ran around schools, hospitals, clinics, circles and everywhere we asked: “Please give us papers that we really studied at this school last year, that we attend swimming, karate, music lessons” .

We also need documents stating that we rented a house, and such and such documents do not fit, but a certain format is needed. We have been running for a week and collecting these papers everywhere. It's not very comfortable. And it may be that (by the way, there really were such stories, I heard from several people) when people come to Canada, they live in an apartment for some time, and then they move. And they forget to indicate the change of address, that is, somewhere in the databases of Canada, for example, your old address is listed, you continue to receive money for assistance for children in your bank account, you receive a letter, but it comes to the old address. And you do not know that you need to confirm such documents. If you do not confirm them within, in my opinion, 45 days, then you are blacklisted, you need to return all the money in general.

I have a friend who, in my opinion, was asked for either $15,000 or $25,000. If, of course, you do not return this money, then everything will be very, very bad for you. And again, you will have to prove why you did not change your address, that you did not receive this letter, that is, this is a very difficult procedure. Therefore, you should know that it is necessary to collect all the papers about where you paid for children, where you lived, and report the change of address in time so that these letters arrive at the place where you now live.

And again, you will have to prove why you did not change your address, that you did not receive this letter, that is, this is a very difficult procedure. Therefore, you should know that it is necessary to collect all the papers about where you paid for children, where you lived, and report the change of address in time so that these letters arrive at the place where you now live.

Let's probably less blah blah blah, I'll show you with a real example how much money you can get for children in Canada. And also in the description of the video there will be a link to a document that describes in more detail the amount of child support depending on your income and the number of children. Download it!

I went to the official Canadian website, where you can estimate the amount of assistance for children. Of course, this amount depends on the number of children, their age and your income. Let's go step by step.

First of all, you need to agree to the terms of the site (I accept).

Next, you need to specify the year when you handed over taxes. If it's 2018 now, then naturally you're celebrating 2017. Next.

Here you need to indicate that, for example, you live in Canada (I live in Canada), well, as if you live in Canada. And choose the province in which you live (Province/Territory of residence). Let's say I live in the province of Quebec. And here you need to indicate your marital status (Marital status). I now mark that I am married (Married), and press the next step.

And here is the first main question, which greatly affects the amount of money, is “How many children do you have?” (How many children do you have?). I have three, I indicate the corresponding figure - 3.

The next step is to enter the name and date of birth of the first child. The name is optional, and the date of birth (Date of birth), for example, January 1, 2005 (01/01/2005). It has no disability (Qualified disabled dependant - No), that is, here I leave everything unchanged. And I say add another child (Add this child).

And I say add another child (Add this child).

The next child. For example, I was born on January 1, 2007. I indicate the correct years for my children, but the numbers are a little wrong. I also add this child.

And already the third child. For example, he was born on January 1, 2015. By the way, our third son will be 3 years old in May. We add.

That's it, you added three children. If anything, then it will be possible to correct these dates. And move on.

Enter your net income here. If you have just moved to Canada, then indicate, probably, exactly the amount that you received in 2017 in your country. I don't think there will be much income there. Let's say $10,000, relatively speaking, Canadian dollars. And by the way, the number that you indicate in this report will need to be remembered and then indicate the same amount of income in the tax return for the next year, when you will receive a scholarship, and so on, that is, all amounts must match. And the size of the wife's income (Your spouse's net income), let's say zero (0). For example, it didn't work.

And the size of the wife's income (Your spouse's net income), let's say zero (0). For example, it didn't work.

Next step: "Do you want to answer any additional questions?" (Would you like to answer some additional questions?..) - No, leave me alone. I say "next".

Look, if you follow such conditions that there are three children (I indicated there that it turns out to be 13, 11 and 3 years old), then with an income of $ 10,000 in your country or in Canada, you will receive almost $ 18,500 for children in year. Imagine this huge amount! Maybe for those Canadians who have been living there for a long time, this is not much, but it seems to me that for new immigrants it will be very, very good support. Note again that $18,500 per year. If, for example, your income is higher, then you can always correct this questionnaire and see what changes.

Let's say you earned $20,000 instead of $10,000. You remember that the aid was $18,500. Let's see how it changes now. .. It turns out that the amount hasn't changed at all. Marvelous! That is, it does not matter if you receive $10,000 or $20,000, by Canadian standards this is a small income and you can count on such assistance.

.. It turns out that the amount hasn't changed at all. Marvelous! That is, it does not matter if you receive $10,000 or $20,000, by Canadian standards this is a small income and you can count on such assistance.

Let's go further and indicate $50,000 - this is already closer to reality, but still, by Canadian standards, this is not a very good salary. If you watch my videos, then you know that the average income of a Canadian family is over $70,000 a year.

You see, $50,000 seems to be such an impressive amount, but the amount of assistance for children has slightly decreased (to $14,107). Of course, if you have only 1 child, this amount will probably be 3 times less. But nevertheless, these thousands, these hundreds of dollars every month will obviously not interfere.

Let's change the answers to our questionnaire again. Still, if you put your hand on your heart, few immigrants go to the province of Quebec and more go to the province of Ontario, that is, to the city of Toronto or at least Ottawa, so I indicated Ontario here. I click "next".

I click "next".

Here I was already asked to indicate the date of my birth (Your date of birth) and the date of birth of my wife (Your spouse’s date of birth). I entered the wrong years, but this is all as an example, again. I click "next".

Nothing has changed here, that is, the dates of birth of children do not need to be re-entered.

And I state that my income was $20,000.

Further, new questions have already appeared, which were not there when we answered questions about Quebec. The first question is: "How much money do you pay for your rent?" (Rent paid for your principal residence) - Well, I don't know how much the rent is there. In Toronto, I think it's generally expensive. Well, let's say $15,000. Further, you can even write off the cost of electricity (Home energy costs paid ...), that is, it is very cool, there is no such thing in Quebec, I see this for the first time, and so on. Some more questions: “Do you live as a student, that is, in a hostel?” (Do you live in a student residence?) and “Do you live in some Northern Ontario?” (Do you live in Northern Ontario?). I don't know what it is, so I click Next.

I don't know what it is, so I click Next.

Nothing has changed here... Look! I'm actually shocked, well, honestly, I'm shocked! It turns out (if you do not live in Quebec, where, it is believed, the coolest social benefits for families with children) in general, an impressive amount of assistance for children - $ 24,000! How did it happen? I'm going to go talk to my wife right now. Probably, it’s enough for us to live near Montreal already, we should already make our legs and move to Ottawa at least. While I was recording the video, I myself found such interesting information.

In general, I will continue to think about it. On this, perhaps, I will say goodbye to you. Don't forget to like this video, subscribe to the channel and ring the bell. And see you in Canada!

Want to immigrate to Canada but don't know where to start?

👉Take a free artificial intelligence odds assessment that will analyze all available options and tell you if it's worth your time.

How much does it cost to raise a child in Canada?

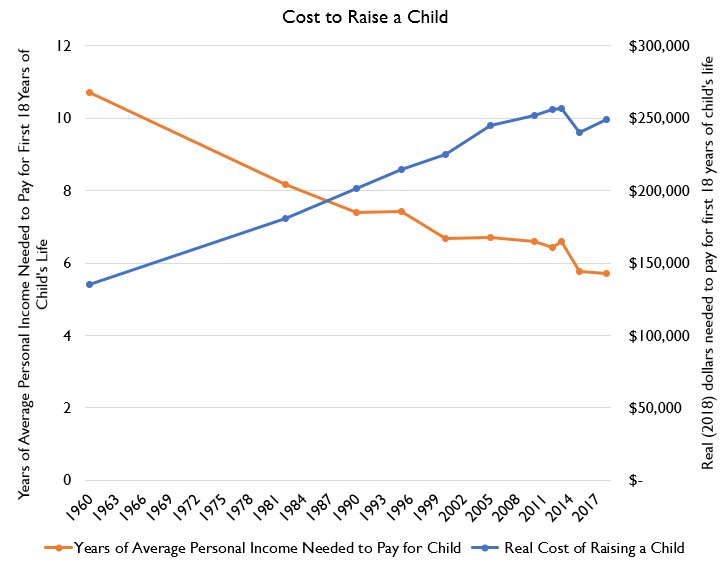

While the USDA has released annual data on how much it costs to raise a child, Canada does not know the exact figure for its country.

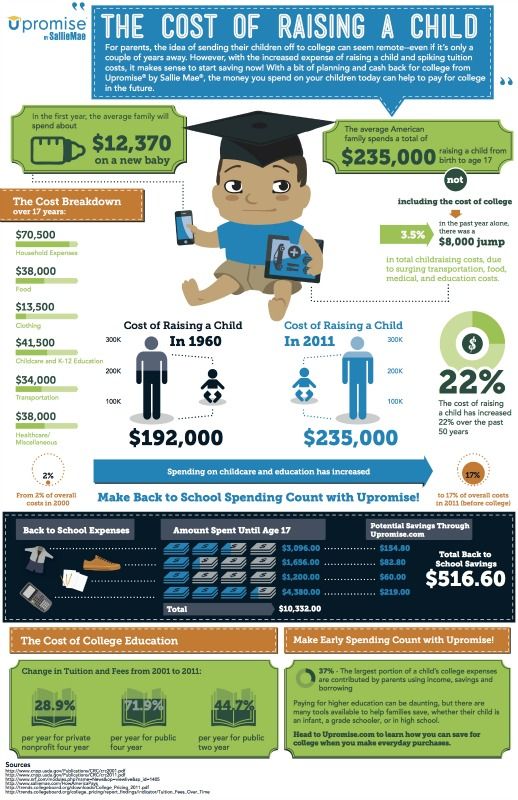

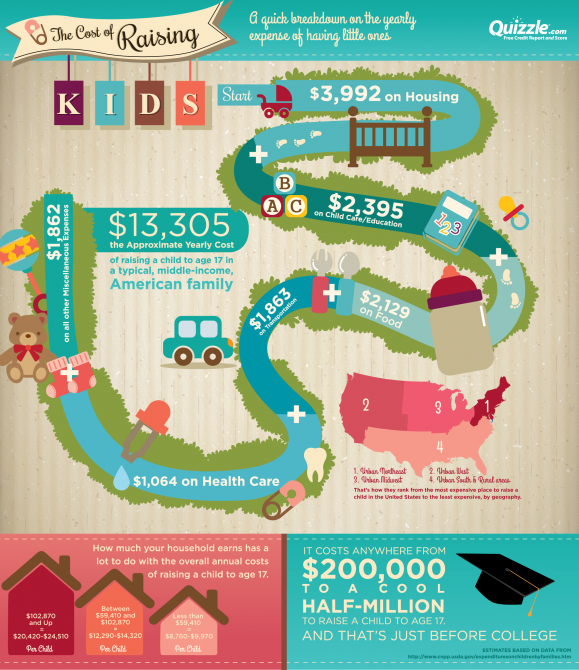

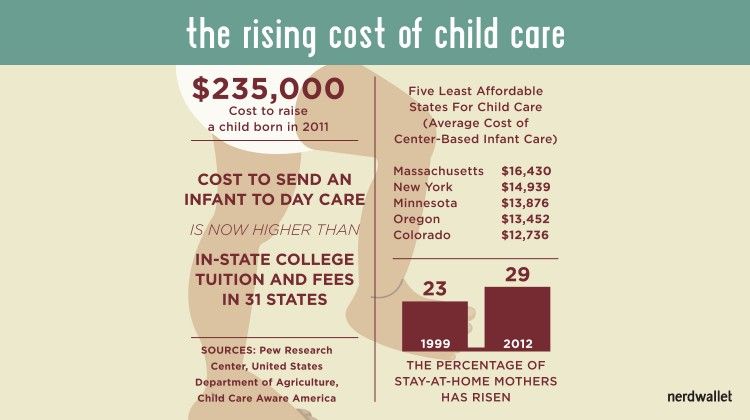

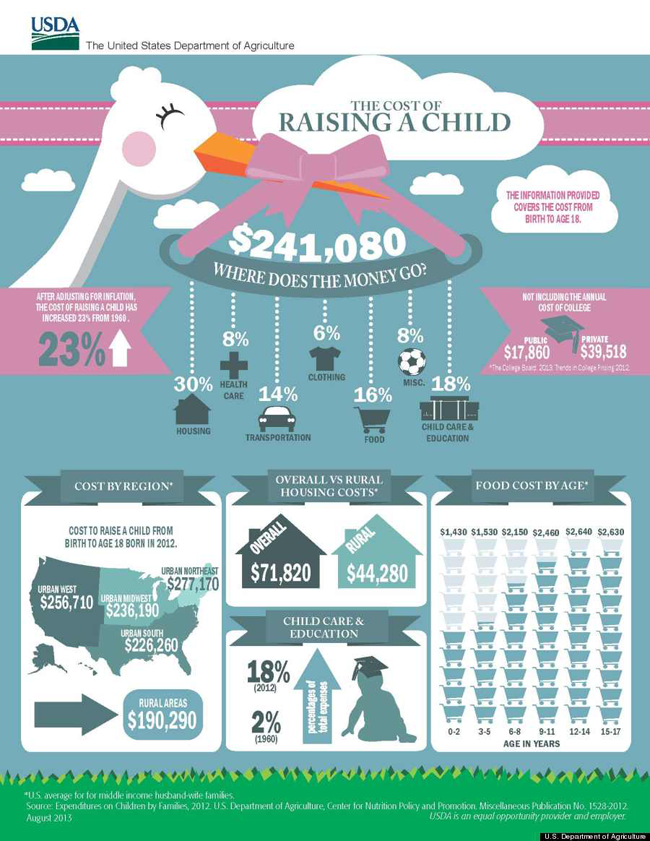

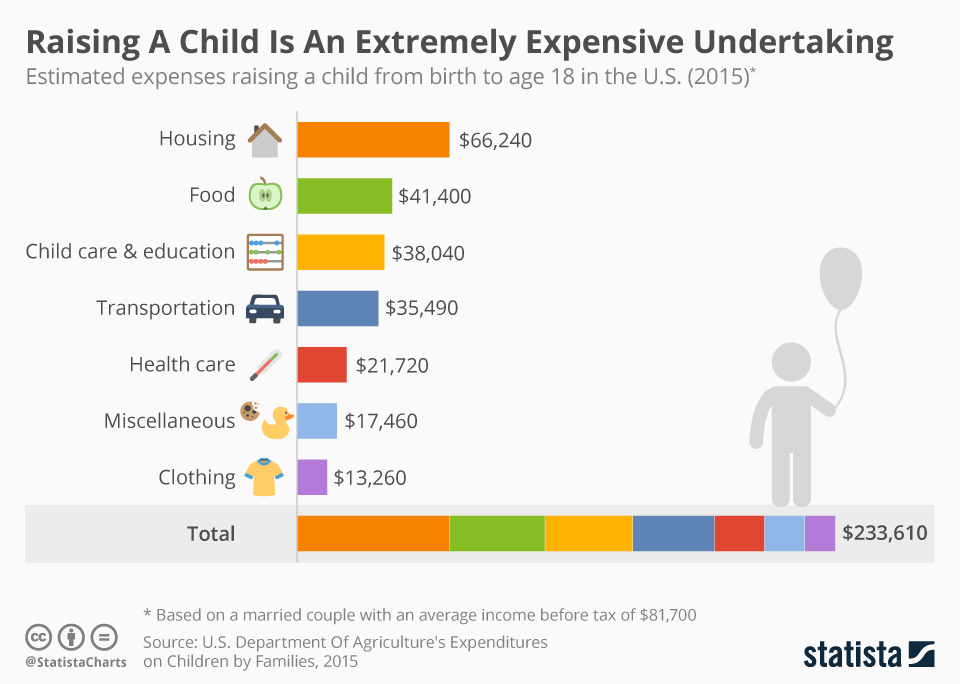

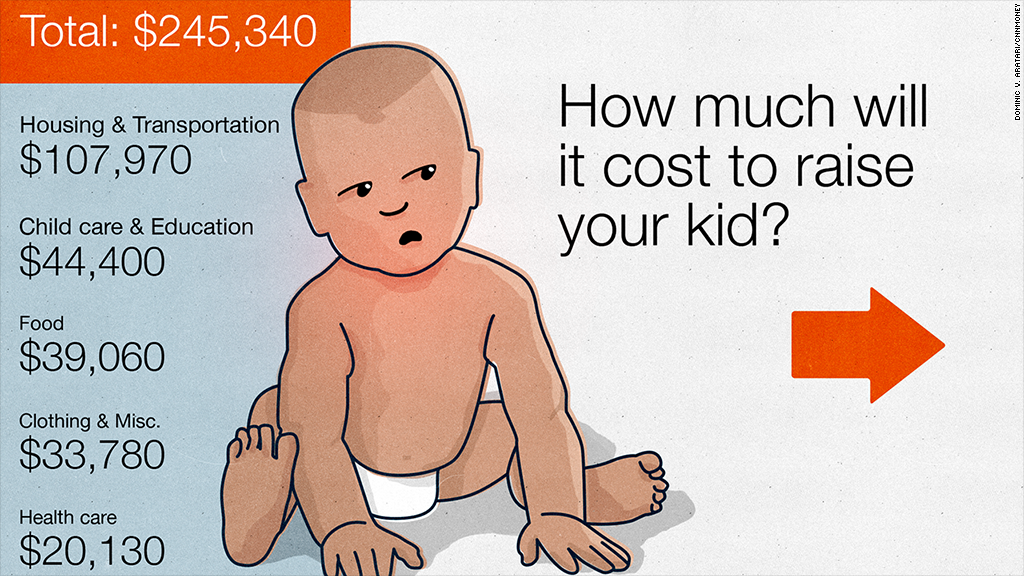

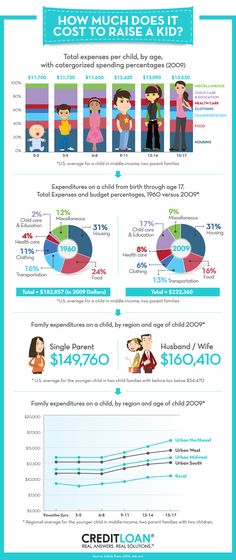

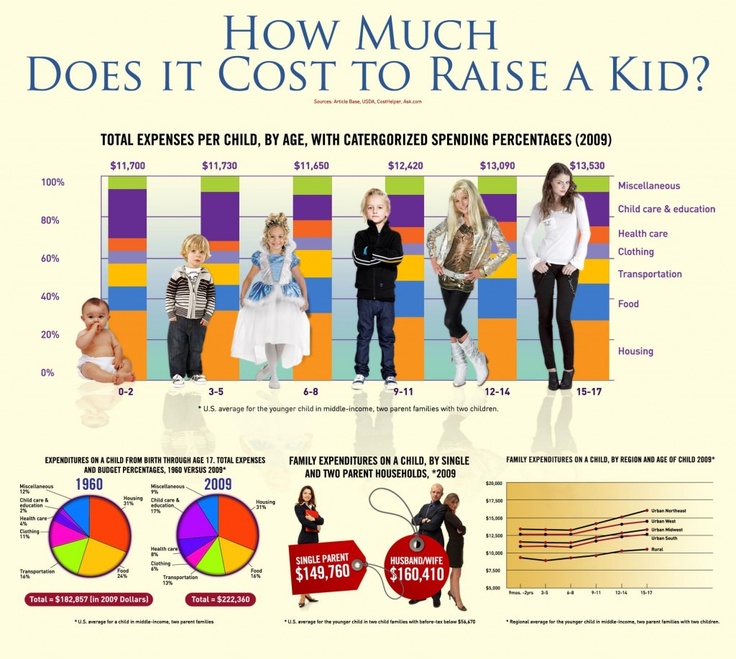

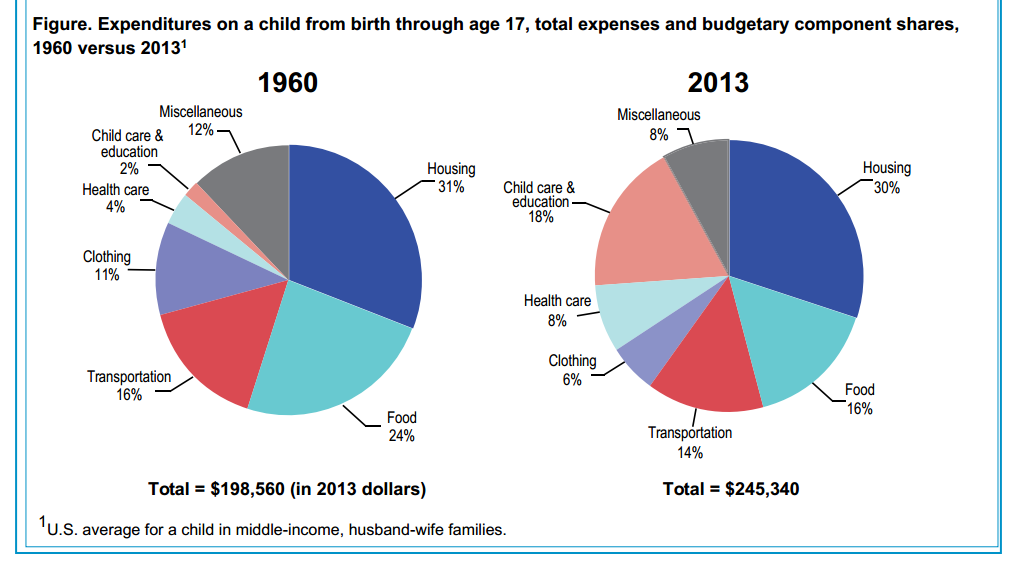

The estimated cost of raising a child in the United States from birth to age 18 is at least $233,610, or $12,300 per year (data based on estimates of housing, transportation, clothing, and other criteria.).

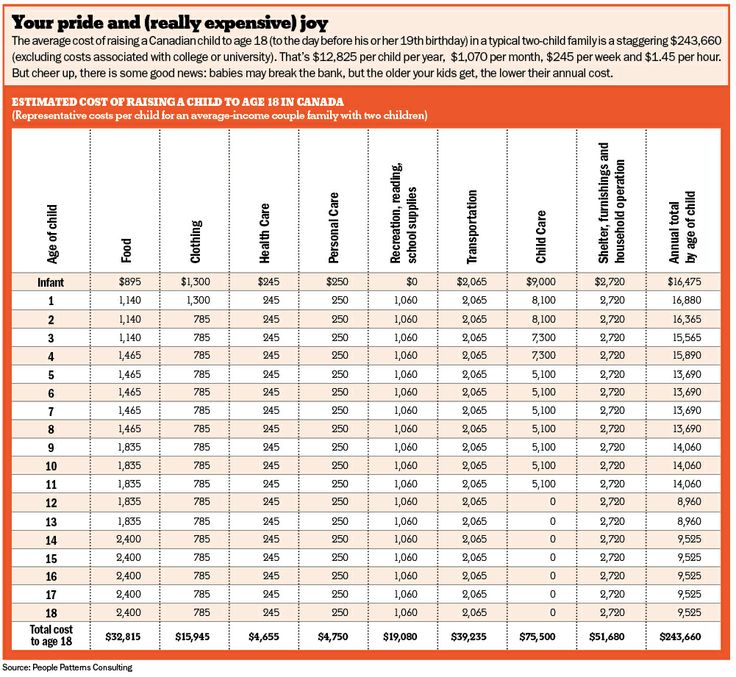

A 2011 article that appeared in the Canadian edition of MoneySense stated that it would cost approximately $12,824 per year to raise a child in Canada, and $243,656 in total until age 18. These figures were then updated in 2015 to reflect inflation. The price for the year rose to $13,366.

“Spending on some basic things like housing and daycare has grown very rapidly over the past 5 years,” says Iglika Ivanova, senior economist and research fellow at the Canadian Center for Policy Alternatives (CCPA) in Vancouver. “Prices for kindergartens have risen two to three times compared to the rate of inflation. ”

”

The Moneysense counts were very different from the counts released by the Fraser Institute in 2013, which received a lot of praise. In that report, by Christopher Sarlo, senior fellow at the Fraser Institute and professor of economics at Nipissing University, the average annual cost of raising a child is between $3,000 and $4,500. But experts criticized and debunked these data.

“The problem with the Fraser Institute's report is that important spending categories such as daycare, housing and transportation are simply left out,” says Sid Frenkel, a professor in the Department of Social Work at the University of Manitoba. “As a result, it's not surprising that many parents called these numbers unrealistic. Sarlo says transportation costs weren't taken into account because families make decisions based on their individual lifestyle, but many argue that having kids has a lot to do with the type of car you buy.”

While there are a number of factors that come into play when determining the cost of raising a child, the most basic and costly are housing, food and childcare. And all these factors are constantly growing in price in Canada.

And all these factors are constantly growing in price in Canada.

According to the latest statistics from the Canadian Mortgage and Housing Corporation, the average cost of renting a two-room apartment is $962 per month, although Ivanova notes that prices vary widely. In Toronto, the median rent for a one-bedroom apartment is over $1,100, while in Montreal it is $751.

Despite this, “Last year alone, the median rent for a two-room apartment increased by 4.8 percent in Canada,” she says.

Food prices should also increase in 2017. It is assumed that we are waiting for a rise in prices of 3-5% for food, especially protein, fruits and vegetables will increase in price (according to forecasts by 4-6%). Overall, this will mean that Canadian families will spend $420 more on groceries in 2017.

Kindergarten spending is also staggering. The latest report from Canada's Center for Policy Alternatives found that kindergarten costs have risen nearly 8% since 2014. This is three times more than the inflation rate.