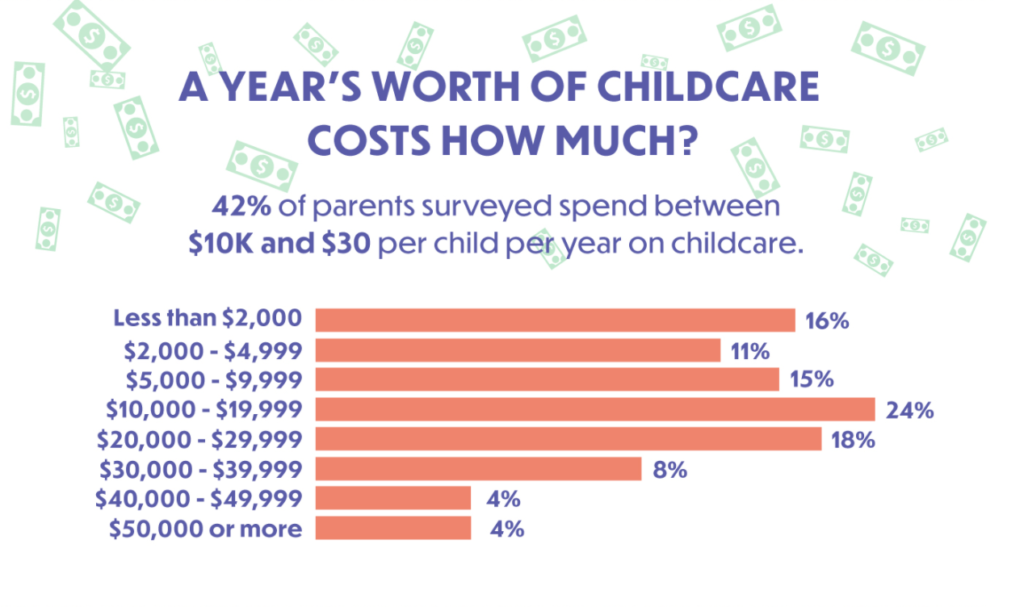

How much does child care assistance pay

Child Care Works Program

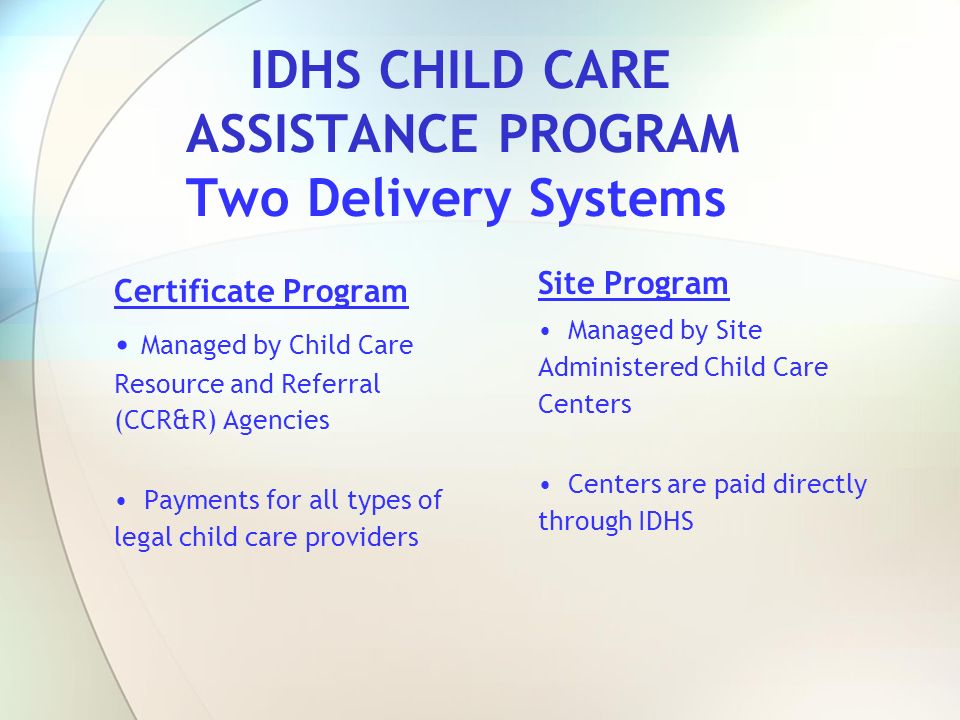

The subsidized child care program helps low-income families pay their child care fees. The state and federal governments fund this program, which is managed by the Early Learning Resource Center (ELRC) office located in your county.

If you meet the guidelines:

- The ELRC will pay a part of your child care cost. This is called a subsidy payment.

- You will pay a part of the cost. This is called the family co-pay.

- The subsidy payment and the family co-pay go directly to the child care program.

NOTE: If your child care subsidy does not pay the full amount that your child care program charges, the provider may ask you to pay the difference between the subsidy payment and their private charges.

Guidelines

You must submit an application to the ELRC to see if you meet the guidelines for the subsidized child care program.

The following are the basic guidelines:

- You must live in Pennsylvania

- Have a child or children who need child care while you work or attend an education program

- Meet income guidelines for your family size

- Work 20 or more hours a week - or-

- Work 10 hours and go to school or train for 10 hours a week

- Have a promise of a job that will start within 30 days of your application for subsidized child care

- Teen parents must attend an education program

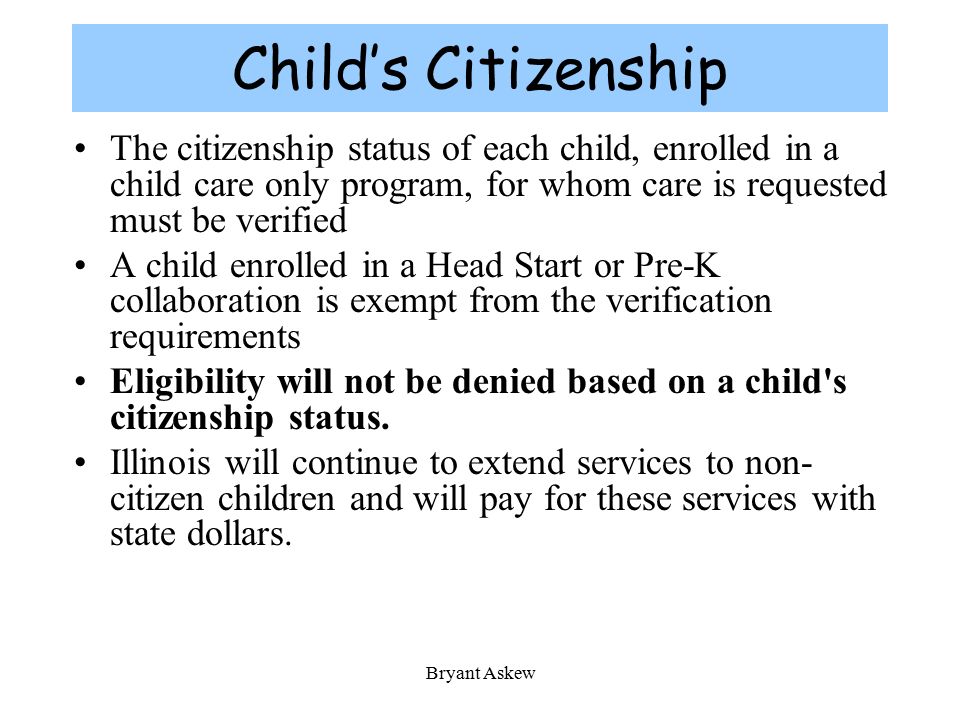

- The child who needs care must be a citizen of the United States or an alien lawfully admitted for permanent residency

- Have proof of identification for each parent or caretaker in the home.

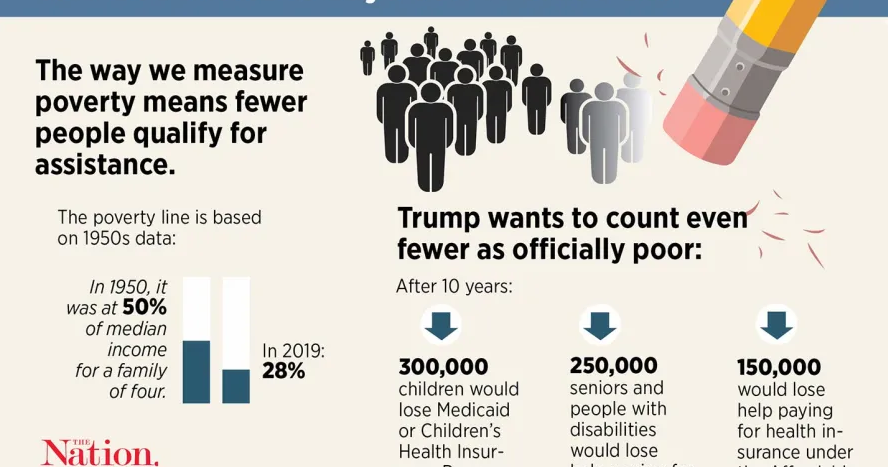

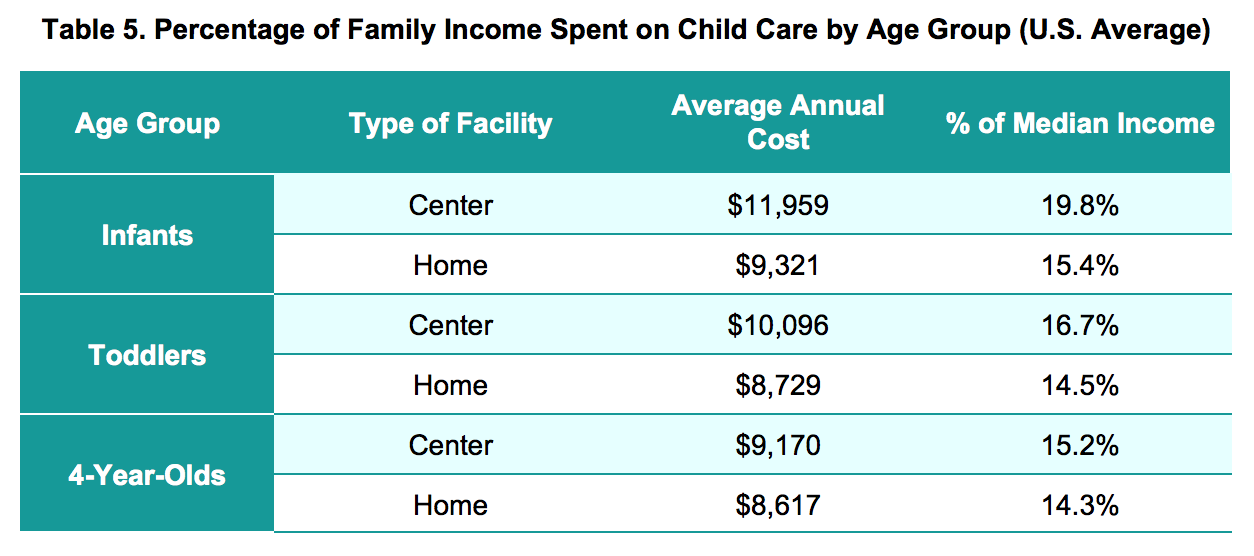

Income Guidelines

The annual income for a family to be eligible to receive a subsidy is 200 percent or less of the Federal Poverty Income Guidelines:

| Family Size | Maximum Yearly Family Income (May 2022) |

| 2 | $36,620 |

| 3 | $46,060 |

| 4 | $55,500 |

| 5 | $64,940 |

| 6 | $74,380 |

| 7 | $83,820 |

| 8 | $93,260 |

(Note: The above information provides only general guidelines. Other conditions may apply. Please contact your county Early Learning Resource Center to apply for assistance.)

Additional Guidelines

- Each adult family member must work at least 20 hours a week or work at least 10 hours a week and participate in an approved training program at least 10 hours a week.

- The hours that a child may receive subsidized child care must coincide with hours of work, education, or training.

- Children are eligible for care from birth until the day prior to the date of the child's 13th birthday. Children with disabilities may be eligible through age 18.

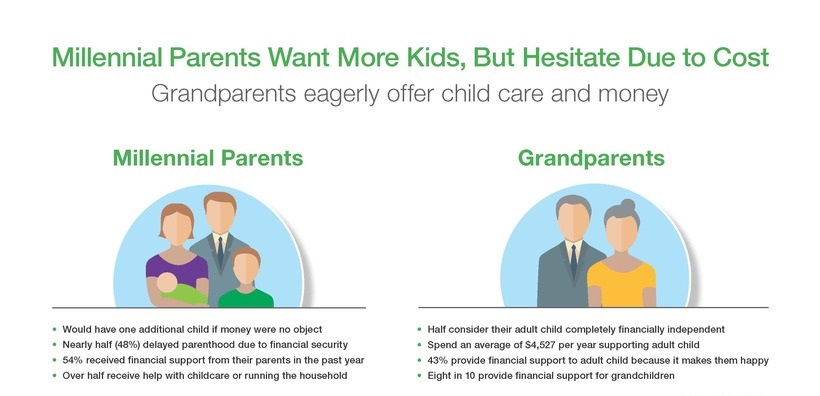

- The parent is responsible to help pay for child care. This is called a co-payment. The co-payment may be as little as $5.00 per week and varies according to your income and the number of people in your family.

- The parent may choose the provider of his or her choice. The parent may choose a child care center, a small family day care home, a group day care home or even a relative to care for his or her child.

- The parent who is receiving a subsidy must choose an eligible child care provider. Relative providers must complete an Agreement with the ELRC, must comply with the participation requirements listed in the Agreement and must complete CareCheck in order to be eligible to participate in the Subsidized Child Care Program.

CareCheck is the Department of Human Services' program that requires background clearances (see below).

CareCheck is the Department of Human Services' program that requires background clearances (see below). - If funding is not available at the time that a low-income, working parent applies for subsidized child care, the child may be placed on a waiting list.

You can also apply for benefits and renew benefits by using COMPASS, the online resource for cash assistance, Supplemental Nutrition Assistance Program (SNAP), child care, health care coverage, home heating assistance (LIHEAP), school meals, SelectPlan for Women and long-term living services.

Information on child care facilities

You may contact your local Early Learning Resource Center for resource and referral services. Your ELRC can assist you in finding a facility that meets your needs. You can also find a listing of regulated child care providers through the Online Child Care Provider Search. To request information regarding a facility's certification or registration history, current certification status, and verified complaint history you may contact the Regional Child Development Office or review a facility's history online.

Making a complaint/reporting a facility operating illegally without a department license

Contact the appropriate Department of Human Services' Regional Child Development Office. Each regional child day care office is assigned responsibility for certain counties in Pennsylvania. Regional office staff investigates complaints about child care centers, group child care homes, and family child care homes that do not follow the regulatory requirements for operating a facility. You may also register an Online Complaint.

Ensuring your child's Safety

The most important way to be certain that your child is safe and well cared for is to become a partner with your child care provider. Here is a checklist that will provide you with ideas about what to look for at the provider location you choose.

For more information, call the Child Care Works helpline at (877) 472-5437 or find the appropriate ELRC for your county. Click to view the Subsidized Child Day Care Eligibility Regulations.

CareCheck: is the term for required child abuse and State Police background clearances for relatives who care for children whose parents participate in the subsidized child care program.

Relatives who care for three or fewer children, not including their own children, are not required to have a state license but can receive subsidized child care funding. Relatives who participate as providers for the subsidized child care are required to complete CareCheck. CareCheck is the Department of Human Services program that requires State Police criminal history and child abuse background clearances for all relative providers. In addition to CareCheck, relatives must obtain Federal criminal history clearances. The relative provider must pay the cost of the Federal criminal history clearance, which is $23.00. Relatives must complete CareCheck and Federal criminal history clearances in order to be eligible to be paid through the Subsidized Child Care Program. Relatives are defined as grandparents, great-grandparents, aunts, uncles, and siblings. All relative providers must be 18 years of age or older and live in a residence separate from the residence of the child for whom they will provide care.

Relatives are defined as grandparents, great-grandparents, aunts, uncles, and siblings. All relative providers must be 18 years of age or older and live in a residence separate from the residence of the child for whom they will provide care.

To find out more about background clearances, call the Child Care Works helpline at (877) 4-PA-KIDS (1-877-472-5437).

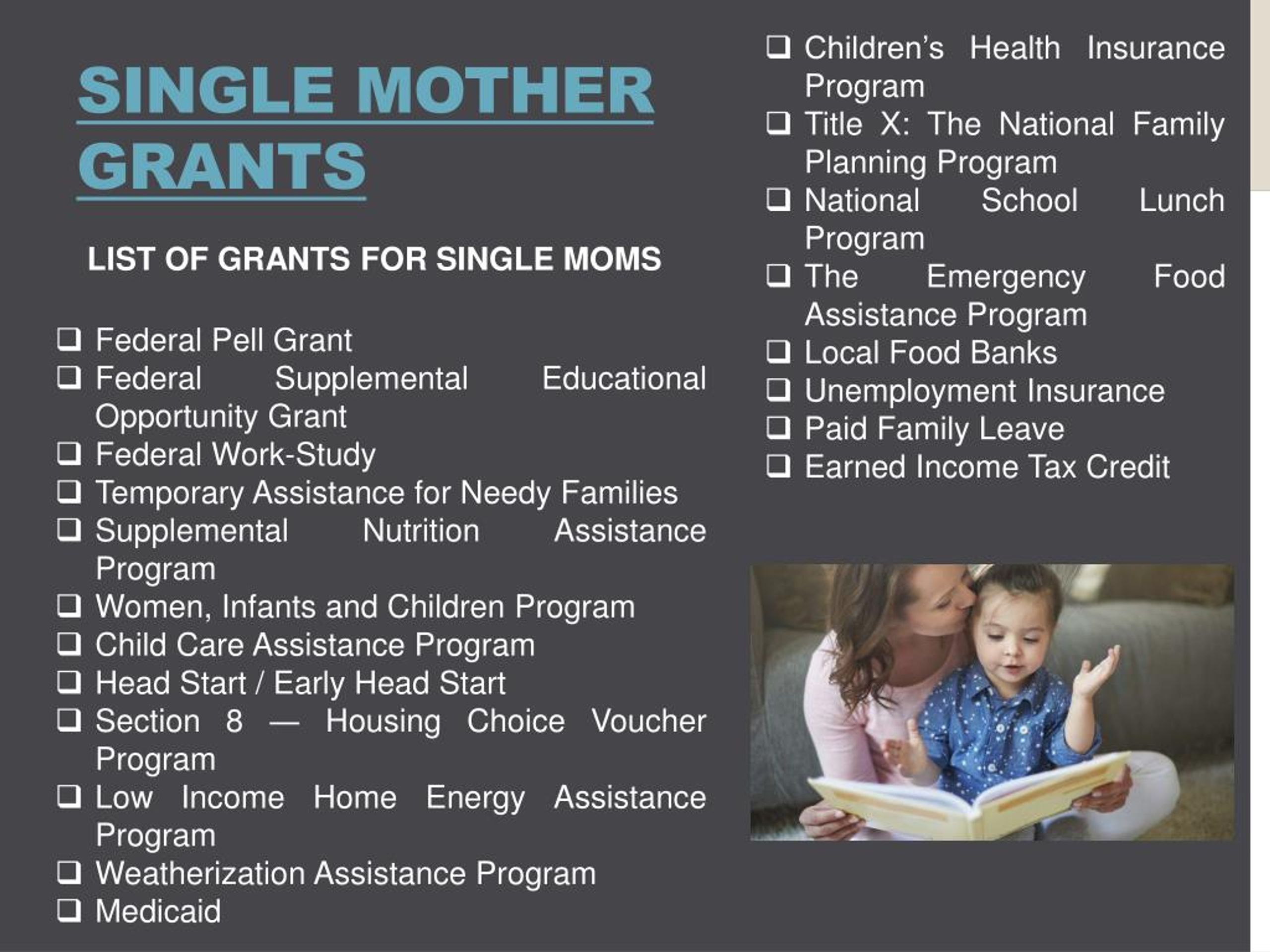

Child Care Payment Assistance

Who is eligible?- Parents applying for the Smart Steps program whose income is below the 85th percentile of State Median Income (which can be found on the Income Eligibility and Parent Co-Pay Fee Table using the 85.0% line that coincides with your household size) who have children six (6) weeks to five (5) years old and who work or go to school, or both, for 30 hours or more a week.

- High school or middle school mothers who stay in school who participate in the Teen Parent program.

- Parents in the Families First program who need child care to complete the work activities in their personal responsibility plan.

- Parents whose Families First case has closed can receive transitional child care assistance for 18 months after their Families First case closes IF each parent works 30 hours or more a week.

- Non-parental guardians in the Families First program who need child care for a related child IF the guardian does 30 or more hours of work, training, or education a week.

How do I apply?

Apply Online through the One DHS Customer Portal by clicking here.

Or complete the application below and then fax it, mail it, or bring it to your local TDHS office.

If you have questions about child care payment assistance, child care staff are located at these TDHS offices to help you.

Application for Child Care Payment Assistance/Smart Steps (HS-3408) - Instructions

Application for Child Care Payment Assistance/Smart Steps (Spanish) (HS-3408sp) - Instructions

Application for Child Care Payment Assistance/Smart Steps (Arabic) (HS-3408a) - Instructions

Application for Child Care Payment Assistance/Smart Steps (Somali) (HS-3408s)- Instructions

**Make sure you submit all required verification documents with your application. The required documents are listed on the first page of the application above**

The required documents are listed on the first page of the application above**

If you are applying for child care payment assistant through Families First, you will not use the above application, but will apply through the Families First link at the top of this page.

Should you have any questions, you may contact the Child Care Customer Service Response team at 1-833-740-1440.

How do I find a child care provider?

Click here to search by county. The providers that accept child care payment assistance are listed as “Yes” under the “Child Care Assistance” column.

If I qualify, what will I have to pay?

The co-pay chart estimates your payment based on your income and the number of children you will have in child care. You will receive an exact amount that you will have to pay if you qualify. It’s important that you pay the amount you owe and don’t miss payments. Your child care provider may terminate your child from their program if you don’t pay the amount you owe.

Your child care provider may terminate your child from their program if you don’t pay the amount you owe.

You can learn more here about how to choose the right child care provider, the types of child care providers in the State, and how the State assesses child care providers. You can also learn about the importance of checkups and developmental screening for children.

You can learn more here about tips for safe sleep for babies.

Also, if you are interested in child care payment assistance, you may also be eligible for one or more of these programs to assist you with your other needs.

Customer Survey

Please take a moment to let us know about your experience applying for child care payment assistance.

Types of family benefits | Sotsiaalkindlustusamet

You are here

Home Children, families Applicants for family benefits Types of family benefits

If a child is born dead or die within 70 days

Parents have the right to birth benefit and parental compensation if the child is born dead or die in within 70 days.

Childbirth allowance

One of the parents is also entitled to childbirth allowance in case of stillbirth from the 22nd week of pregnancy. The allowance is one-time, in the amount of 320 euros. The right to receive childbirth allowance arises on the day the child is born.

Parental benefit

If the mother works and is entitled to compensation for temporary disability

From April 1, 2022, a working mother is entitled to maternity leave and parental benefit to the mother for 100 consecutive calendar days starting from the 22nd week of pregnancy if the child is stillborn or dies within 70 calendar days. During this period, the mother is covered by health insurance.

If a mother started exercising her right to mother's parental benefit before the child was stillborn, she is entitled to mother's parental benefit and maternity leave for a total of 100 calendar days. For example, if a mother took maternity leave 70 calendar days before the birth of a child and started exercising her right to parental compensation to the mother after the birth of the child. dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

An exception is also made here for mothers who, by the day of the child's death, have already used the mother's parental benefit in the amount of more than 70 calendar days. In this case, the mother is entitled to the mother's parental benefit additionally within 30 consecutive calendar days from the day following the day of the child's death. This means that no matter how many days the mother managed to use the mother's parental benefit by the day of the child's death, 30 calendar days of parental leave and parental benefit are guaranteed from the day of the child's death.

If the child dies at the time when the mother has managed to start using the already distributed parental benefit, the mother is re-registered as a recipient of the mother's parental benefit.

If the mother is not working

From April 1, 2022, a non-working mother is entitled to receive mother's parental benefit within 30 consecutive calendar days from the day following the day of the child's death, i.e. parental benefit cannot be received distributed by day over a long period of time, but if desired, you must use all 30 days in a row. During this period, the mother is covered by health insurance.

Fathers

From April 1, 2022, the father is entitled to paternity leave and father's parental benefit for 30 consecutive calendar days after the death of the child, regardless of whether the father used the right to paternity leave and father's parental benefit before the estimated date of birth of the child or before the death of the child. Father's parental benefit cannot be received on a daily basis over a long period of time, but if desired, all 30 days in a row must be used. In the case of fathers, there is no difference between granting and paying parental benefit, regardless of whether the father is working or not.

In order to receive family benefits, parents do not need to contact us and apply themselves. The Department of Social Insurance automatically obtains stillbirth information by exchanging data between the health information system and the social protection information system so that it is also possible to proactively offer family benefits to bereaved parents.

Additional parental paternity benefit is a type of benefit paid to fathers to enable them to take a greater part in the upbringing of their children. For working fathers, this is also accompanied by a 30-day leave from the employer.

For how long is compensation paid and for how long should it be scheduled?

You can receive additional parental benefit for a father for a total of 30 days, and not necessarily in a row (that is, the benefit can be received in installments). Supplemental parental benefit to the father can be received both during the period when the mother receives the parental allowance or the birth allowance (30 days before the expected date of birth of the child), and later.

The father is entitled to additional parental benefit until the child reaches the age of 3 or until the father receives regular parental benefit. Paternity leave cannot be separated from the receipt of compensation. If the father wishes to receive regular parental benefit without receiving additional parental benefit but does not notify us of the waiver of paternity leave, the Social Insurance Board will not be able to grant parental benefit until the father confirms his wish to waive paternity leave or use his. To fully waive paternity leave, you must submit an application to us.

Employment during paternity leave

While on paternity leave, the father must take a break from work at all his employers. The period of vacation use is entered in the Employment Register. During paternity leave, the father should not work and receive income! The principle of regular parental benefit does not apply, so the amount of parental benefit is not reduced when a maximum of half of the compensation has been received.

In accordance with the Law on Employment Contracts, an employer may refuse to grant leave if the notice of the desire to receive it is less than 14 days and for a period of less than 7 calendar days. Supplementary parental benefit to the father within the meaning of the Employment Contracts Act is a normal rest period, therefore, being on paternity leave does not adversely affect the calculation of annual leave and these days are considered working days when determining annual leave. Like being on vacation, parental leave does not reduce seniority.

Non-working fathers (including also self-employed persons (FIE) or representatives of the so-called liberal professions (e.g. notaries, bailiffs, sworn translators, auditors, bankrupt bailiffs), as well as persons working on the basis of a contract assignments and work contracts, etc. under the law of obligations, or members of the governing body of a legal entity) also receive additional parental benefit to the father for 30 calendar days. It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

How to apply?

Be sure to talk to your child's mother and, if you have an employment relationship, also to your employer before applying. It must be borne in mind that the employer may refuse to grant a vacation of less than 7 days if you notify him less than 14 days in advance. If the employer agrees, there are no restrictions on our part - you can go on vacation from any day.

The application for additional parental benefit is made through the self-service environment. If you wish to take advantage of the leave until the birth of the child, you must indicate the personal code of the child's mother and the expected date of his birth. After the baby is born, you will find a pre-filled offer in the self-service environment. If you are unable to use the self-service environment, please contact us at [email protected].

If you are registered in the Employment Register as a person with a valid employment relationship, you will need to provide your employer's email address. You should also include the email address of the mother of the child. The self-service system will send them a notice of your leave application and put it on hold for 5 days. You don't need to do anything else.

The employer and the child's mother have 5 working days to tell us if they disagree with your leave application. If your employer or the child's mother does not submit their objections, the system will automatically enter a leave note in the Employment Register after 5 working days.

We will calculate the amount of your compensation and pay it to you at the beginning of the next month (the payout date is the 8th of each month).

How is paternity leave calculated?

Additional parental benefit to the father is calculated according to the same rules as regular parental benefit.

To calculate the benefit, we first subtract the 9 full calendar months prior to the birth of the child (i. e. the average length of pregnancy, whether the child was born on time, premature or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

e. the average length of pregnancy, whether the child was born on time, premature or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

The amount of compensation depends on the amount of social tax paid on the income received. Since the income is calculated based on the social tax paid during the 12 months of the reporting period, the amount based on the reporting period may differ from the exact income received at that time, so it is worth paying attention to the social tax paid during this period. You can read more about how parental benefits are calculated here. You can also use the parental benefit calculator (informative).

The minimum rate of parental benefit is the minimum wage rate of the previous calendar year in effect on 1 January (584 euros in 2022). The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

Example 1: During the period taken as the basis for the calculation, the father earned 1,500 euros per month. He went on paternity leave from January 14, 2021 to February 13, 2021, thus being on paternity leave for 30 consecutive days. Consequently, he was on parental leave for 17 days in January and 13 days in February. In January, the amount of his additional parental benefit amounted to (1500/31×17) 822.58 euros, in February - (1500/28×13) 696.43 euros.

Example 2: During the period taken as the basis for the calculation, the father earned 1200 euros per month. He took one week of paternity leave in January 2021, two weeks in February and the remaining 9 days in March. Thus, the amount of his additional parental benefit amounted to (1200/31×7) 270.97 euros in January, (1200/28×14) 600 euros in February and (1200/31×9) 348. 39 euros in March .

39 euros in March .

Other things to remember:

If several children were born in a family after 1 July 2020 at short intervals, then the right to 30 days of paternity leave and / or additional parental benefit to the father arises in connection with each child. Compensation / leave for each child should be used at different times - leave cannot be received at one time for all children, nor can multiple compensation be received in one period.

Twins are subject to one period, regardless of the number of twins.

If the family wants the father to receive both regular parental allowance and additional parental benefit to the father in succession, the first 30 days are always considered to be the period of additional parental benefit to the father. The father can start receiving regular parental allowance from the day when the child is at least 70 days old and the mother's maternity sheet is closed.

If you are on sick leave, it is recommended that you interrupt your paternity leave by notifying the Social Insurance Board as soon as possible. If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

Starting on September 1, 2019 no longer assigned a child care fee

- due to children who were born on September 1, 2019, , , child care fee is no longer charged for a newborn baby or any other child growing up in the family . The state will gradually link the available funds with the new parental benefit system in the period 2020-2022.

- For all families where a child is born no later than August 31, 2019, we assign and pay a child care fee on the previous basis.

- Also for those who have already been assigned a childcare allowance as of August 31, 2019, we will continue to pay benefits .

We will continue paying the child care allowance until it ends, but no later than August 31, 2024.

At the same time, only one parent in the family is entitled to child care allowance (after the end of receiving parental benefit), if the family grows:

- child under 3 years old – EUR 38.36 per month for each child under 3 years old.

In addition, we pay a lower childcare allowance for children aged 3 to 8 if:

- from 3 to 8 years - 19.18 euros per month also for a child aged 3 to 8 years;

- There are 3 or more children in the family receiving child benefit – EUR 19.18 per month for each child aged 3 to 8 years.

If your child turns 8 in first grade, we will pay child care until the end of first grade, which is August 31st. If the child turns 8 in the second grade, or if the child is not in school, we will pay Child Care Allowance until the end of the month in which the child's birthday is.

Being on parental leave and receiving childcare allowance may be someone else instead of the child's parent. However, there is a rule that the amount of child care allowance paid to such a person cannot exceed 115.08 euros per month in total.

Example . The family has three children: aged 2 years, 3 years and 6 years. For a 2-year-old child, a child care allowance is paid in the amount of 38.36 euros per month. For a 3- and 6-year-old child, child care allowance is paid under the condition that in a family with three or more children, all children under the age of 8 will receive child care allowance. The amount of the child care allowance paid for both a 3-year-old and a 6-year-old child is 19,18 euros per child.

In total, the child care allowance is paid to the family in the amount of 38.36 + 19.18 + 19.18 = 76.72 euros per month.

In addition, such a family is paid a child allowance for each child, which is 60 euros for the first and second child, and 100 euros for the third child, for a total of 220 euros per month. Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

The right to receive child care allowance arises after the end of receipt of parental benefit . However, we still recommend that you apply for child care allowance or agree to receive it as soon as you submit your initial application for family benefits. In this way, after the end of the payment of the parental benefit, we will be able to immediately begin the payment of the child care allowance.

However, keep in mind that if one of the parents leaves his job for parental leave, he is also entitled to the childcare allowance. Parental leave can be obtained from the employer.

The state pays social tax for the recipient of the child care allowance, and thus health insurance is provided by the state to the parent to whom we pay the child care allowance! You can read more about health insurance HERE.

Parental benefit and child care allowance are not paid simultaneously to the same family. This means that if we pay parental benefit for one child, during this period we suspend the payment of childcare allowance for all children growing up in the family.

Also, for the time you are already receiving maternity benefit or adoption allowance, we will not pay child care allowance for that child. Child care benefits received for other children are not affected by these benefits.

Childcare allowance

One of the parents, adoptive parents, guardians or grandparents of the child is entitled to receive childcare allowance (grandparents can receive childcare allowance only if he /she meets certain conditions for receiving the allowance, and only if at least one of the child's parents (or adoptive parents) is entitled to allowance for the care of the same child). The allowance is paid until the child reaches the age of one or two years (therefore, when filling out the application, it is necessary to indicate the period for the payment of the allowance, since this choice can no longer be changed later). The allowance for the same child can be assigned to one of the parents, adoptive parents or guardians, so that the parents can receive this allowance alternately.

The allowance for the same child can be assigned to one of the parents, adoptive parents or guardians, so that the parents can receive this allowance alternately.

For example, after the birth of a child, a mother was granted parental leave and also applied for childcare benefits for two years. Six months later, she decided to return to work, and the child's father was granted parental leave. In this case, the mother of the child must apply to Sodra to terminate the child care allowance, and the father must apply for child care allowance (however, the duration of the payment will be determined by the choice of the first parent).

The maximum period of parental leave is three years , but the childcare allowance is no longer paid for the third year. Regardless of this, the employer is obliged to keep the workplace of his employee who is on parental leave. The employer must be informed about the planned parental leave at least 14 days before the end of the maternity leave. A person who is on parental leave continues to accrue the social insurance record.

A person who is on parental leave continues to accrue the social insurance record.

What are the requirements to receive child care allowance?

In order to receive child care allowance, the minimum social insurance period for sickness and maternity (i.e. work experience) must be 12 months in the last 24 months. However, there are some exceptions where the obligation to have the above minimum social insurance record for sickness and maternity does not apply. These exceptions include:

- If you have not acquired the required length of social insurance for sickness and maternity due to the fact that for two years you have worked as a civil servant or military servant and the break after the end of service until the moment of employment does not exceed 3 months;

- In the last two years, were identified as members of the mandatory initial military service in the army or underwent alternative national defense service and the re-service after the change of status does not exceed 3 months;

- You were previously on parental leave, i.

e. your employer granted you parental leave. In this case, the duration of social insurance coverage for sickness and maternity is calculated from the 24-month period until the child turns 2 years old.

e. your employer granted you parental leave. In this case, the duration of social insurance coverage for sickness and maternity is calculated from the 24-month period until the child turns 2 years old.

If you acquired part of the required work experience in another member state of the European Union, the European Economic Area or in Switzerland, you must submit form S041 or E104 to receive child care benefits. In the absence of these forms, you should contact any territorial division of the State Social Insurance Fund "Sodra" and fill out an application for mediation to obtain the above forms and recalculate the maternity social insurance record.

The amount of the childcare allowance depends on the amount of wages:

- When choosing to pay the childcare allowance for one year , the amount of the benefit is 77.58% of the beneficiary's compensable salary;

- When choosing to pay child care allowance for two years: in the first year of child care, the amount of the benefit is 54.

31%, and in the second year of child care, the amount of the allowance is 31.03% of the beneficiary's compensated salary.

31%, and in the second year of child care, the amount of the allowance is 31.03% of the beneficiary's compensated salary.

The amount of the allowance is determined taking into account the average monthly salary in the country, which is published quarterly by the Lithuanian Department of Statistics.

- The minimum monthly allowance for child care is 240 euros (6 BSI). By acquiring the right to receive benefits in the second quarter, the minimum benefit amount is 252 euros.

- Maximum monthly allowance for childcare is 2460.84 euros (the average of the two national salaries that were in effect during the quarter preceding the grant date). If you choose to receive benefits for two years, the maximum amount in the first year is 1,722.71 euros, in the second year - 984.27 euros.

You can find out the benefit amount using the Sodra calculator.

To receive child care allowance, you must apply to the territorial division of the State Social Insurance Fund "Sodra" via the Internet, by mail or in person.