How much do i get on taxes for a child

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Assistant Assigning Editor | Taxes, small business, retirement and estate planning

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for over 15 years, and was a senior writer and spokesperson at NerdWallet before becoming an assigning editor. Previously, she was a researcher and reporter for leading personal finance journalist and author Jean Chatzky, a role that included developing financial education programs, interviewing subject matter experts and helping to produce television and radio segments. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. She is based in Charlottesville, Virginia.

She is based in Charlottesville, Virginia.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

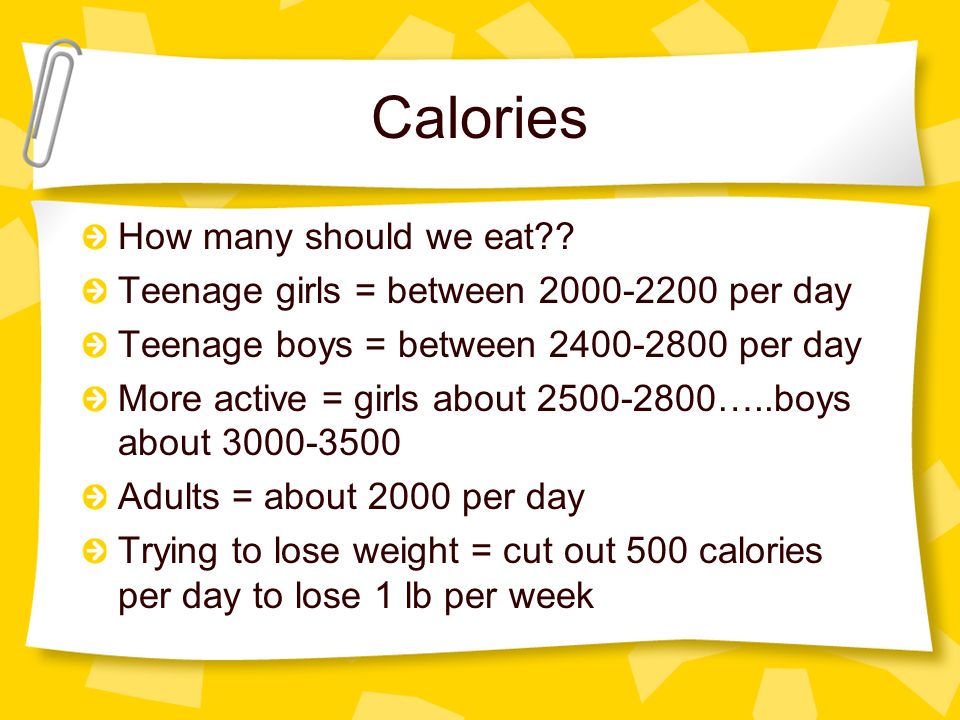

For tax returns filed in 2023, the child tax credit is worth up to $2,000 per qualifying dependent under the age of 17.

The credit is partially refundable. Some taxpayers may be eligible for a refund of up to $1,500.

The credit amount decreases if your modified adjusted gross income exceeds $400,000 (married filing jointly) or $200,000 (all other filers).

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

$1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

Internal Revenue Service

. Child Tax Credit.

View all sources

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Child tax credit vs. child and dependent care credit

Though similar sounding, the child tax credit and the child and dependent care credit are not the same thing. The child tax credit is a tax incentive for people with children, while the CDCC is another tax credit for working parents or caretakers designed to help offset expenses such as day camp or after-school care. Both credits have different rules and qualifications.

The child tax credit is a tax incentive for people with children, while the CDCC is another tax credit for working parents or caretakers designed to help offset expenses such as day camp or after-school care. Both credits have different rules and qualifications.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents. " Check the IRS website for more information.

" Check the IRS website for more information.

Tax Planning Made Easy

Take the stress out of tax season. Find the smartest way to do your taxes with Harness Tax.

Visit Harness Tax

How to calculate the 2022 child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable tax credit; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

When to expect your CTC refund

The IRS cannot release an additional child tax credit refund before mid-February. Per the agency, early filers who selected direct deposit as their refund method, e-filed, and submitted an error-free return could have seen refunds hit their accounts around Feb. 28, 2003. If you want to check on the status of your return, you can use the agency's "Where's My Refund" tool.

Internal Revenue Service

. When to Expect Your Refund if You Claimed the Earned Income Tax Credit or Additional Child Tax Credit.

View all sources

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

Visit your state's department of taxation website for more details.

History of the CTC

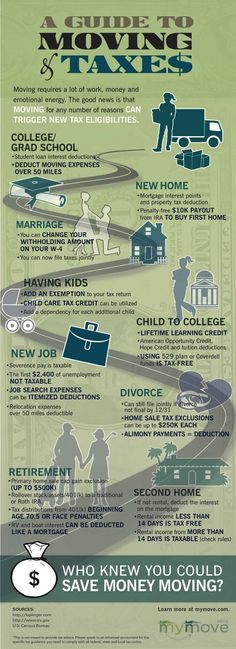

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. The child and dependent care credit covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll also need to make sure your child has a Social Security number by the due date of your 2022 return (including extensions).

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Read more

Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

POPULAR ON NERDWALLET

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Child and Dependent Care Credit: Definition, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

If you’ve paid expenses for day care, preschool or another form of caregiving, there’s a tax break you may want to know about.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

Edited by Pamela de la Fuente

Pamela de la Fuente

Assigning Editor | Retirement, Investing, Underrepresented communities

Pamela de la Fuente is an assigning editor on NerdWallet's investing and taxes team. She has been a writer and editor for more than 20 years. Her team covers retirement, stocks, funds and other general investing topics.

She has been a writer and editor for more than 20 years. Her team covers retirement, stocks, funds and other general investing topics.

Pamela joined NerdWallet after working at companies including Hallmark Cards, Sprint and The Kansas City Star.

She is a thought leader in content diversity, equity and inclusion, and finds ways to make every piece of content conversational and accessible to all. In her role at Hallmark, after working as a senior editor on the Mahogany card line, Pamela was promoted to editorial director, and tasked with making the company's flagship card lineup more inclusive for more consumers.

She is a two-time winner of the Kansas City Association of Black Journalists' President's Award for her editing and page design work. Pamela is a firm believer in financial education and closing the generational wealth gap. She is also a founding co-chair of NerdWallet's Nerds of Color employee resource group.

She got into journalism to tell the kind of stories that change the world, in big and small ways. In her work at NerdWallet, she aims to do just that.

In her work at NerdWallet, she aims to do just that.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

It's easy to confuse the child and dependent care tax credit with its popular cousin, the child tax credit. However, the child and dependent care tax break is distinctive in that it is designed to help people who work or are looking for work with expenses related to care.

Here's a breakdown of how the credit works, who qualifies and how to claim it.

What is the child and dependent care tax credit?

The child and dependent care credit, or CDCC, is a tax credit for parents or caregivers to help cover the cost of qualified care expenses, such as day care, for a child under 13, a spouse or parent unable to care for themselves or another dependent.

If you plan to claim the credit on your tax return, you must have earned income throughout the year and paid for the care expenses so that you could either work or seek employment.

The CDCC is most beneficial for those who anticipate owing taxes when they file because the credit is nonrefundable. This means that any taxes owed will be decreased by the credit amount, but taxpayers will not receive any overage in the form of a refund.

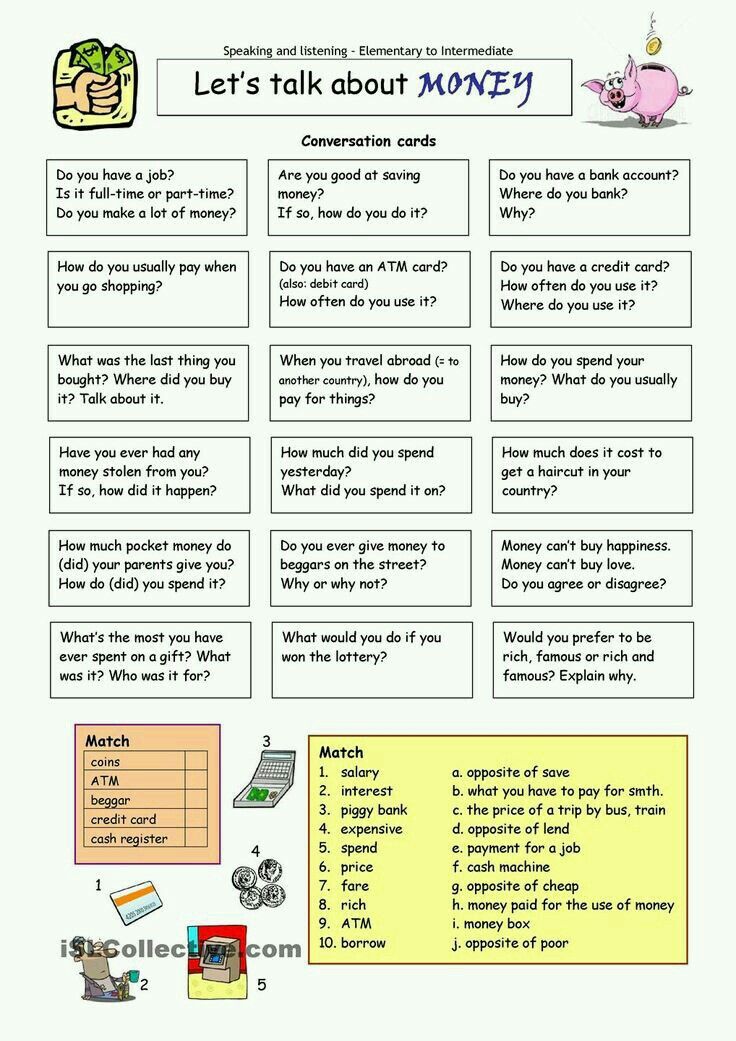

How much is the child and dependent care credit worth?

The child and dependent care credit is worth 20% to 35% of up to $3,000 (for one qualifying dependent) or $6,000 (for two or more qualifying dependents). This means that for the 2022 tax year, the maximum child and dependent care credit is $1,050 for one dependent or $2,100 for two or more dependents.

How much of the credit you're eligible for depends on your adjusted gross income, which determines the percentage of qualifying expenses you can deduct

Here's a glance at how it breaks down by percent and income level. Note that there is no income restriction on the CDCC — if you make more than $43,000, you may still qualify to claim up to 20% of expenses.

Note that there is no income restriction on the CDCC — if you make more than $43,000, you may still qualify to claim up to 20% of expenses.

Percent of permitted expenses by AGI

Adjusted gross income | Percentage of expenses* |

|---|---|

$0 to $14,999. | |

$15,000 to $16,999. | |

$17,000 to $18,999. | |

$19,000 to $20,999. | |

$21,000 to $22,999. | |

$23,000 to $24,999. | |

$25,000 to $26,999. | |

$27,000 to $28,999. | |

$29,000 to $30,999. | |

$31,000 to $32,999. | |

$33,000 to $34,999. | |

$35,000 to $36,999. | |

$37,000 to $38,999. | |

$39.000 to $40,999. | |

$41,000 to $42,999. | |

$43,000 and over. | |

*For one dependent, the maximum amount of qualified expenses is $3,000. For two or more dependents, the maximum amount is $6,000. | |

Who is a qualifying dependent for the child and dependent care credit?

Generally, to qualify for the credit, the person for whom you're paying care expenses must be claimed on your taxes as a dependent and be either:

A child under the age of 13.

A spouse who is mentally or physically unable to care for themselves and has lived with you for more than half of the year.

A person who is mentally or physically unable to care for themselves, who has lived with you for more than half the year and whom you can claim on your return as a dependent (a parent, for example).

You may also be able to claim someone who meets all the previous requirements, but you could not claim as a dependent because:

They made $4,400 or more of gross income.

They filed a joint return.

You or your spouse (if filing jointly) could be claimed as a dependent on someone else's return.

There are special rules for children who turn 13 during the tax year, newborns and people who are separated or divorced. See IRS Publication 503 for more information.

What care expenses qualify toward the child and dependent care credit?

Before claiming the credit, you must ensure the care expenses you paid throughout the year qualify or are approved by the IRS.

What qualifies:

Nursery school.

Preschool or equivalent care programs for children below kindergarten.

Pre- and after-school care.

A care provider who watches your dependent outside your home (e.g., a neighbor).

Transportation that a care provider takes with your qualifying dependent (e.g.

, bus, subway, taxi).

, bus, subway, taxi). Dependent care center.

Day camp.

Fees, certain deposits and application fees paid to care providers or care services.

What doesn't qualify:

Child support payments.

Expenses to attend kindergarten and above grades.

Summer school.

Tutoring.

Sleepaway camp.

Food, lodging, clothing, education or entertainment (unless these costs are small, incidental and part of a care service program).

Also, if your employer contributes to your care expenses, you have a dependent care flexible spending account or if you take advantage of an employer-sponsored care facility, you may need to subtract the amount contributed for those benefits from your total qualifying expenses. To see a complete list of qualifying expenses and applicable rules and stipulations, see IRS Publication 503.

Internal Revenue Service

. Publication 503 (2022), Child and Dependent Care Expenses.

Accessed Feb 8, 2023.

View all sources

Who counts as a qualified care provider?

The IRS is very particular about how it defines "care provider" to claim the CDCC. Not just anyone qualifies. For example, paying certain family members, such as your spouse, to take care of your dependent is not permissible. There are also additional rules for people who are considered household employees.

Other people who may be ineligible to provide paid care include:

The parent of the child/dependent (if your qualifying person is your child and under age 13).

Another dependent you or your spouse can claim on your tax return.

Your child under the age of 19.

When you claim the credit, the IRS will also ask you to list information about the care provider, including their name, address and taxpayer identification number. If you hire an individual as a care provider, their TIN is their Social Security number; for businesses, it's the employee identification number or EIN.

Additional child and dependent care credit requirements

IRS Publication 503 has the full scoop, but here are some other significant details to keep in mind:

Generally, to claim the credit as a married couple, you must file married filing jointly. However, the primary custodial parent may claim the credit if the couple is legally separated, not living together or divorced. In addition, if there is joint custody and the qualifying dependent is with each party for an equal number of nights throughout the year, the party with the higher income can claim the credit.

You must have earned income throughout the year to qualify.

Any money earned from pensions, foreign earned income, Social Security benefits, workers' comp, unemployment, investment income from interest or dividends or child support does not count. Publication 503 has more details.

Any money earned from pensions, foreign earned income, Social Security benefits, workers' comp, unemployment, investment income from interest or dividends or child support does not count. Publication 503 has more details.If you are married filing jointly, and your spouse is a student (enrolled full-time for at least five months of the year), they will be treated as having earned income for the time they are enrolled. Volunteer work does not qualify.

Special rules for calculating the credit apply if you worked for part of the year or part-time.

How to claim the child and dependent tax credit

The child and dependent care credit can be claimed on tax returns filed in 2023 using qualifying expenses from 2022. You'll need to attach two forms to the standard 1040: Form 2441 and Schedule 3.

IRS Form 2441 has a worksheet that can help you determine the exact credit amount you're eligible for. You'll then enter the result on line 2 of Schedule 3. Don't worry if this sounds like a lot of paperwork to keep track of. The good news is that most good tax preparation software can automatically calculate and file the credit on your behalf.

Don't worry if this sounds like a lot of paperwork to keep track of. The good news is that most good tax preparation software can automatically calculate and file the credit on your behalf.

🤓Nerdy Tip

Generally, you can only claim expenses you incurred during the tax year, but if you need to claim expenses from 2021 that you paid for in 2022, you may be able to increase the amount of your credit. Use Worksheet A of Form 2441 to calculate your credit amount and note the amount on line 9b of Form 2441.

When claiming the credit, you must include your qualifying dependent's Social Security number, individual taxpayer identification number or adoption identification number.

Bottom line: Is it worth claiming the child and dependent care tax credit?

It depends on your situation. The CDCC is nonrefundable, so it can make a difference if you anticipate a tax bill. However, if you foresee a refund, the credit provides no benefit.

It may be worthwhile to consider other options in addition to the child and dependent tax credit. For example, employer-sponsored dependent care flexible spending accounts allow you to divert pre-tax money from your salary to an account for qualified care expenses. For the 2023 tax year, you can contribute up to $5,000.

For example, employer-sponsored dependent care flexible spending accounts allow you to divert pre-tax money from your salary to an account for qualified care expenses. For the 2023 tax year, you can contribute up to $5,000.

Since the contributions are tax-advantaged, you'll lower your taxable income by the corresponding amount you contribute, which can mean more tax savings than taking the CDCC credit alone. Just be mindful that if you take advantage of the dependent care FSA and the CDCC, you can't "double-dip," or claim the same expenses for both benefits.

About the author: Sabrina Parys is a content management specialist at NerdWallet. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Methodology for accounting for the annual tax return

▪ 8 stycznia 2020 r. ▪ Zaktualizowano: 12 stycznia 2023. ▪ Autor: Redakcja PITax.pl

▪ Zaktualizowano: 12 stycznia 2023. ▪ Autor: Redakcja PITax.pl

Spis treści

- Annual tax return accounting method

- What is the tax amount?

- Tax calculation method

- What benefits can be deducted from the annual tax?

- When and how to pay tax?

- When and how to get a tax refund?

Accounting methodology for annual tax return

There are three ways to calculate PIT-37 or PIT-36:

-

Just for yourself (individually),

-

For yourself and your spouse (together with your spouse),

-

As a single parent.

Spouses can calculate accounts together if:

-

Were married during the entire previous year (since January 1),

-

During the entire previous year, there was a property community between them,

-

None of the spouses managed the department covered by a one-time, unified tax or tax card.

-

A citizen of Ukraine has a Polish tax residence.

The co-settlement option also applies to income tax settlement with a deceased spouse, i.e. when we were married before the start of the tax year and our spouse died during the tax year, or we remained married during the tax year and our spouse died after a tax year before filing a tax return. In this situation, we can also present a joint settlement.

| Attention! If one of the spouses is from Ukraine and does not have a Polish tax residence, then there is no possibility of a joint settlement, in which case two separate tax returns must be filed. |

For example, like a family with one parent, a taxpayer who is raising children who are:

They receive a social pension or care allowance, regardless of the children's income.

They are under 25 and still studying or studying and in the reporting year they did not receive an income (taxable under the tax scale or taxed at 19%) higher than PLN 3089 (this income does not include pensions).

A citizen of Ukraine who has a Polish tax residence can pay as a single parent, even if the child is in Ukraine or was born before the taxpayer acquired Polish tax residence.

Paying taxes together with a spouse or as a parent is more beneficial than an individual settlement because then the tax is calculated on a smaller amount.

What is the tax amount?

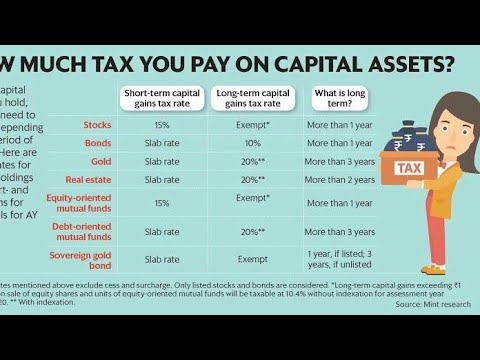

There are three types of taxation. Tax rates depend on the type of income.

-

Taxation under the tax scale 17.75%, 32%, on general terms - income from work, orders, pensions, economic activity, unregistered activity, from abroad, minor children and others (PIT-36, PIT- 37).

The following tax scale applies to the calculations for 2019 (income tax was submitted in 2020):

| Tax Calculation | Tax | |

| tax deductible | ||

| over PLN 85 528 | PLN 15 282 + 32%* (the basis for calculating the tax is PLN 85,528). | |

The amount of tax reduction in PIT calculations for 2019 is:

1) 1 420 PLN - for the tax base not exceeding 8 000 PLN,

2) for the calculation of tax and PL00 8) over PLN 13,000: PLN 1,420 minus the amount calculated according to the formula: PLN 871.70 × (tax base - PLN 8,000) ÷ PLN 5,000.

3) for tax calculation above PLN 13 000 and not more than PLN 85 528 – PLN 548.30 calculated according to the formula: PLN 548.30 × (tax calculation basis – PLN 85 528) ÷ PLN 41 472

5) for a tax base exceeding PLN 127,000 – tax reduction without amount.

| Persons under the age of 26 whose earnings under an employment contract and commission did not exceed PLN 35,636.67 in 2019 are exempt from paying tax. |

Tax calculation method

1. Turnover – tax-deductible expenses = income.

2. Income - social security contributions - deductions from income = taxable amount.

3. Calculate the tax specified in the field above on the tax base.

4. Taxable amount - health insurance premiums - tax credits = tax debt (tax liability).

If the tax due is higher than the advance payments received by the employer, we have tax to pay, and if it is higher, we have an overpayment of tax and the office is required to return the excess amount.

C) Flat tax rate 19% - income from business activities, sale of real estate, cryptocurrencies, securities (PIT-36L, PIT-38, PIT-39)

For the above sources of income, the tax is 19% of income.

In this case, deductible taxes include all income-related expenses. There are no statutory amounts here. It is important that expenses are related to income. For example, such expenses include:

-

For the sale of real estate - expenses that increase the value of real estate incurred during its possession (for example, expenses for finishing the premises, inheritance and gift taxes paid, expenses for press advertising, commissions for agencies, etc.

)

) -

For capital income, cryptocurrencies are, for example, expenses for the purchase of securities sold, brokerage commissions, etc.).

-

For business - purchase of goods, office expenses, accounting services.

-

Detailed instructions for completing Forms PIT-36, 36L, 38, 39 can be found on the website; https://pomoc. pitax. pl/

C) Flat-rate taxation - for business transactions for which this method of taxation was chosen at the time of establishment or during the conduct of business (PIT-28).

The amount of tax depends on the type of business. Their amount is specified in the Law on Flat Income Tax on Certain Income Received by Individuals. The amount of tax is from 2 to 20% of the income received. The tax base is income. For a flat rate, the tax is not taxable.

What benefits can be deducted from the annual tax?

Benefits reduce the tax paid or increase the tax refund. Therefore, it is worth including them in your annual tax return. We distinguish between tax deductions and income. The right to deduct benefits on your annual tax return is not determined by citizenship.

Therefore, it is worth including them in your annual tax return. We distinguish between tax deductions and income. The right to deduct benefits on your annual tax return is not determined by citizenship.

Benefits deducted from income in 2020 (income tax for 2019) include:

-

Donations

-

in public interests,

-

for religious purposes,

-

for benefactor church care,

-

For blood donation purposes, i.e. blood or plasma donation.

-

Educational and professional training purposes

| Donations must be made by organizations located in the countries of the European Union or the European Economic Area. Therefore, a donation made to an institution located in Ukraine cannot be deducted. |

-

Rehabilitation assistance – expenses incurred by or for the rehabilitation of a disabled person to facilitate the day-to-day functioning of that person.

-

Internet allowance - for people who settled this benefit for the first time or settled it a year ago.

-

Individual Retirement Account Benefit (IKZE) - payments to an individual retirement account to save funds for retirement,

-

Refund of unjustifiably collected benefits that previously increased taxable income, such as the return of ZUS.

-

Development assistance - expenditures incurred on research and development in development.

-

Interest rate cuts - for people who started qualifying apartment investments during benefit years, housing costs incurred during the benefit period may be deducted.

Tax incentives also include:

-

Child benefits – a family benefit for parents raising children.

| Important! A parent who earns income in Poland has the right to deduct family allowance even if he is not a Polish citizen. |

-

Housing allowance – deduction of expenses for systematic savings in a savings account based on an agreement entered into before 2002.

-

Benefit for foreigners - assistance to people who worked abroad and paid taxes there.

When and how to pay tax?

The tax arising from the annual tax return (line "To be paid") must be paid by the end of April (before the end of February in the case of PIT-28). You do not need to pay tax at the same time as filing/sending your PIT to the tax office. PIT can be sent, for example, in March, and the tax is paid no later than 30.04.

The tax can be paid in cash (at the office cash desk, by bank transfer) or in non-cash form, for example, from a bank account via the Internet.

The tax must be paid using a micro tax account. Its number can be found on the government website podatki.gov.pl or obtained from any tax office by indicating the NIP or PESEL number.

If a foreigner is still waiting for a decision on granting PESEL, he can pay value added tax from the tax micro-account of the tax office in accordance with the list of tax bank account numbers of the National Tax Administration (effective from January 1, 2020). There you will also find detailed explanations on which account to pay individual taxes.

In this case, indicate the number of the document when sending, for example, passport, identity card.

When and how can I get a tax refund?

Offices have 45 days to refund tax (the amounts received from the "Overpayment" or "Total refund amount" line) - if the PIT was submitted online or 3 months if the PIT was submitted in paper form - from the date of receipt of the tax return. This takes into account the day when the tax office receives the PIT, and not the day it is sent.

This takes into account the day when the tax office receives the PIT, and not the day it is sent.

If the overpayment was due to a correction of the declaration, the office has 2 months to refund the tax in case of a paper correction and 45 days for an electronic correction.

Tax refunds can be received either at the address listed on the PIT or to a bank account. A refund to a bank account is more profitable, since in the case of a tax refund by mail, its amount is reduced by postage.

Latvian State Portal

- Home

- Life events

- Finances and taxes

- Work, taxes and tax book

Life events

02.11.2020.

One of the most significant situations in life is the beginning of a new employment relationship.

The first employment relationship can be started from the age of 13. There are special regulations for the employment of minors. However, it is important for an employee of any age to know how to use government-provided e-solutions and services for a successful employment relationship.

However, it is important for an employee of any age to know how to use government-provided e-solutions and services for a successful employment relationship.

For information about the conditions and services that are essential before starting work and were in an employment relationship, we suggest that you familiarize yourself with the sections below.

Rhododendron from estilo do site daApple, que usa um truque com checkBox para, solução 100% in CSS Para mostrar ou recolher um Men. Aqui troque o checkBox Por Divs e Links.

At the beginning of a career, we often face doubts whether a certain field of activity is suitable for us and the work will bring joy, or whether we are strong enough and competitive in this area. Various tests are available at the State Employment Agency (SEA) career opportunities for learning to determine interests, abilities and motivation. Self-help will help you decide which area of professional activity is most suitable for you. Tests will also be a good helper for those who have been working in any area of professional activity for a long time, but want to develop their career in another direction.

Tests will also be a good helper for those who have been working in any area of professional activity for a long time, but want to develop their career in another direction.

If you need help interpreting your career test results , eligibility, education, or job search, use GAS career counseling and other career services. With the help of the GAS in the e-learning module “Preparing a letter of motivation and preparing for a job interview”, you can prepare for a job interview, master the course of life and work (CV) and prepare a letter of motivation. At the end of the training, a knowledge test may be completed.

Job descriptions are also available in electronic form Description of professions in catalog .

Use the Labor Market Forecasting Tool and check out changes in labor demand across occupations and industry groups, regions and the country as a whole. Additionally (by clicking on a profession), information is available on the number of employees and the average remuneration by profession.

Additionally (by clicking on a profession), information is available on the number of employees and the average remuneration by profession.

After finding out the areas of interest and relevant areas of activity, you can familiarize yourself with job offers, as well as create or update your CV on the GAZ corporate portal. The portal is suitable for both employees and employers. This covers all vacancies registered with GAZ and its use is free of charge.

When planning to enter into a new employment relationship , it is important to be sure that the future employer, whether it is an enterprise or another institution, is in good faith and acts in accordance with the laws of the state. With the help of the Business Register (UR) website search engine, it is possible to check basic information about registered registries and find out the business reputation of a potential employer, for example, information on business insolvency proceedings, commercial liens or liquidation.

Detailed information about a legal entity or natural person , including insolvency proceedings of an individual, an insolvency administrator, can be obtained using the e-service “Issue of information from the information website of the register of enterprises".

In the register of insolvency, it is possible to find out the insolvency status by searching for information by the debtor's registration number, first name or last name. those who pay less than the national minimum monthly wage, as a whole, paid taxes in the previous year.

Payroll tax book (ANG) is a section of the State Revenue Service (SRS) electronic declaration system. From June 1, 2014, it is available only in the form of an electronic document and is contained in the SRS.

In the SRS EDS section “Payroll Tax Book” it is possible to: The payroll tax book ensures the application of the non-taxable minimum and allows you to make entries on the basis of which the employer applies the established tax benefits. Entries about dependents in the payroll tax book must be made by each resident himself. For persons who have not been assigned the payroll tax book , you must connect the SRS EDS, and it must be activated by clicking the “open” button in the “payroll tax book” section, and then “get the payroll tax book ". The payroll tax book must be submitted to the person's main source of income . For example, if a person has two jobs, then the payroll tax book can only be filed in one of them. If the SRS does not have information confirming your right to tax benefits or additional tax benefits , you must submit to the SRS information justifying their application. These documents must be submitted electronically. Electronically with a secure electronic signature, a confirmed document can be sent to the SRS using an e-address or to the official e-mail address of the institution [email protected]. Also, the said documents can also be submitted in paper form at any SRS customer service center, as well as by presenting an identity document to the SRS employee. For individuals who cannot use the EDS SRS, SRS customer service centers provide assistance in opening an electronic fee tax book, as well as in printing out the information contained in it. In order to receive personal income tax benefits , dependent persons must be registered with the State Revenue Service (SRS) when making an entry in their electronic payroll tax book. To add a dependent, connect SRS Electronic Declaration System and open the payroll tax book in your individual profile. In the payroll tax book, in the “dependants” section, click the “add dependent” button. Typically, the system can automatically identify individuals who may be dependents. In this case, you must select the proposed dependent, fill in the necessary details (start date, justification, degree of relationship) and click the “Approve” button. If the dependent is not automatically proposed, it must be identified with the first name, last name and personal code. If you can no longer apply the tax relief for a dependent person , you must inform the SRS within 10 days, indicating the dependent's expiration date in your payroll tax book. If a dependent starts an employment relationship , then the status of dependent is lost. However, for example, if the monthly income received by the student, for example, income from hired labor, does not exceed the established amount of tax relief (in 2021 - 250 euros per month), the benefit for the parent of dependents remains. The exception that parental tax relief is maintained, regardless of income from employment, is if a student under the age of 19 works in a paid job during the summer months from 1 June to 31 August. To remove a person from the dependency record, you can use one of the following methods: As school ends, more and more young people are looking for summer job opportunities. Parents are also starting to think about how to take care of their underage children. You can also ask your municipality about summer job opportunities. Employment of children in permanent jobs is prohibited. For the purposes of the Act, a child is a person under 15 years of age or who, until the age of 18, continues to receive basic education. In exceptional cases, the employment of a child under 13 years of age is provided for in Part 3 of Article 37 of the Labor Law. Employment of a child under 13 years of age is allowed only in exceptional cases, if one of the parents (guardian) has given written consent and received a Permit from the State Labor Inspectorate (VDI) for the child to be employed as a performer in cultural, artistic, sports and promotional events, if such an activity is not harmful to the safety, health, morals and development of the child. Useful information about summer job opportunities can be found on the website of the State Labor Inspectorate (VDI) www.vdi.gov.lv. Information about a safe working environment for young people can be found on the homepage www.stradavesels.lv in the “Materials” section, and job search tips can be found on the homepage www.atkrapies.lv in the “practical advice” section. If a child who is under the age of 19 studying at a general, vocational, higher or special educational institution works in paid work only during the summer months (from June 1 to August 31), the parents retain the tax benefits for the dependent person . For more information about paying taxes, see the State Revenue Service on the website www.vid.gov.lv. But if you want to get advice from the State Labor Inspectorate (VDI) or get VDI action on labor rights or labor protection issues, use the e-service “Applying to the Labor Inspectorate and receiving a response from the Labor Inspectorate” on the Latvija. If an accident occurs at the workplace, it must be reported to VDI. This can be conveniently done using the VDI e-service “Reporting an Accident at Work”. Disability sheets (sickness sheets) are opened, extended and closed electronically. This is done by the patient's family doctor or treating doctor. If a person has entered into an employment relationship and at that time falls ill and is unable to perform work duties, she is entitled to sickness benefit, which is granted on the basis of a sickness certificate issued by a doctor. Socially insured person from the age of 15. From this age, the employer pays mandatory social insurance contributions for the person, on which he also depends or will be entitled to sickness benefit and in what amount it will be assigned. The right to sickness benefit only applies if the mandatory social contributions to health insurance were made for at least 3 months during the last 6 months before the first day of incapacity for work or at least 6 months during the last 24 months. When you recover and are ready to return to work , the doctor will electronically close the sick leave. As soon as the certificate of incapacity for work is concluded , this information is automatically sent to the State Revenue Service (SRS). Your employer in the SRS will see this information the next day after the conclusion of the disability certificate. If a certificate of incapacity for work B has been issued, information about this is also available to the State Social Insurance Agency (VSAA). If the disability certificate was closed, no further action is required. A sick leave certificate is issued for the first 10 calendar days and sickness money for the working days in which it is necessary to work is paid by the employer. If you have received a certificate of incapacity for work B , you can claim sickness benefit from the SSIA within 6 months from the first day of temporary incapacity for work. Information about certificates of incapacity for work, their statuses and numbers is available on the portal Latvija.lv e-service “received certificates of incapacity for work”. If you work at two workplaces , in case of illness, the sick leave will be extended to both workplaces. This means that sickness benefit will be calculated and paid in both jobs. For more information about getting a sick leave, read the life situations “Actions in case of illness” and “Getting a sick leave”. The employer is obliged to pay the statutory taxes for his employees - state compulsory social insurance contributions (part of employer and employee contributions) and personal income tax. The mandatory contribution rate is 34.09%, of which 23.59% is paid by the employer and 10.50% by the employee. The employee is provided with a minimum personal income tax exemption. Its size, as well as the possibility of obtaining tax benefits, affects the number of dependents of the employee. Both part of the employee's mandatory contributions and the amount of personal income tax are calculated from the employee's income and paid to the state budget by the employer. Sometimes an employee may have doubts about whether the employer pays for the taxes they set - mandatory contributions to state social insurance and personal income tax. If you want to check whether your employer pays social insurance contributions for you, use the e-service “Information on social insurance contributions and insurance periods” on the Latvija.lv portal. It is important to know whether social contributions are made for you, because this determines whether or not you will be entitled to social security benefits, including sickness benefit, and how much it will be. To check the amount of personal income tax deducted from your remuneration , you can use the Electronic Declaration System (EDS) of the State Revenue Service (SRS). In the “reports” section, select “information submitted by taxpayers”. As a result, you will receive information on both social contributions and personal income tax withheld. In the SRS, EDS will find information about your periods of employment, wages paid per year, sickness benefits and economic activities, if you are. Remotely and at any time convenient for themselves and at any time convenient for themselves, anyone can get knowledge about taxes, the state and social budget, the activities of the social insurance system in the country in the e-learning module of the State Employment Agency (SEA) “Financial literacy". The training content includes both theoretical explanation and audio and video materials and dialogue simulations, as well as self-testing opportunities. At the end of the training, a knowledge test may be completed. In order for a trainee to officially enter an internship at any enterprise or structure , it is necessary to conclude an internship agreement. The law establishes two types of contracts: The law does not establish an obligation for an enterprise to pay a remuneration to an intern for the implementation of an internship. However, if the trainee agrees in writing with the place of practice, such remuneration to the trainee may be paid. The remuneration paid to the trainee is subject to personal income tax , as well as mandatory contributions to state social insurance must be paid from it. The enterprise must make deductions from the remuneration established for the trainee, paying it to the budget. In certain cases in internship practice, the remuneration received - a scholarship - is not included in taxable income. Scholarships up to 280 EUR per month, which are paid by the place of practice to a trainee who masters the study program in accordance with the procedure established by the Cabinet, in which he organizes and implements studies based on the working environment, are not subject to tax.

Open the SRS EDS section “prepare a document” and select “from the form”. Then, in the "other" document group, open "information in the state revenue service", where you can add the scanned document and fill in the comments box.

Open the SRS EDS section “prepare a document” and select “from the form”. Then, in the "other" document group, open "information in the state revenue service", where you can add the scanned document and fill in the comments box.

The State Employment Agency (SEA), in cooperation with entrepreneurs, local governments and state institutions, offers the opportunity to work in the summer for ages 15 to 20 who are studying and continuing their education in educational institutions of general, special or vocational education in the next academic year. More information about the event is available here.

The State Employment Agency (SEA), in cooperation with entrepreneurs, local governments and state institutions, offers the opportunity to work in the summer for ages 15 to 20 who are studying and continuing their education in educational institutions of general, special or vocational education in the next academic year. More information about the event is available here.  Such an occupation should not interfere with the education of the child. The VDI website provides instructions on how to complete the authorization form.

Such an occupation should not interfere with the education of the child. The VDI website provides instructions on how to complete the authorization form.  lv portal. The application can include a request, complaint, suggestion or question within the scope of the VDI.

lv portal. The application can include a request, complaint, suggestion or question within the scope of the VDI.

To receive benefits for the period specified in the disability certificate, you must submit an application to the SSIA. It can be done:

To receive benefits for the period specified in the disability certificate, you must submit an application to the SSIA. It can be done:

If the trainee is a minor, instead of him the agreement on educational practice is concluded by the parent or legal representative of the trainee;

If the trainee is a minor, instead of him the agreement on educational practice is concluded by the parent or legal representative of the trainee;

In addition, the child is not required to be in Poland. The fact of payment of income in Poland gives the right to the payment of child benefit.

In addition, the child is not required to be in Poland. The fact of payment of income in Poland gives the right to the payment of child benefit.