How much child tax credit 2023

Guide to filing your taxes in 2023

Note

For tax year 2022 some tax credits that were expanded in 2021 will return to 2019 levels. This means that affected taxpayers will likely receive a smaller refund compared with the previous tax year. Changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC) and Child and Dependent Care Credit.

- Those who got $3,600 per dependent in 2021 for the CTC will, if eligible, get $2,000 for the 2022 tax year.

- For the EITC, eligible taxpayers with no children who received roughly $1,500 in 2021 will now get a maximum of $530 in 2022.

- The Child and Dependent Care Credit returns to a maximum of $2,100 in 2022 instead of $8,000 in 2021.

If you are one of the estimated 100 million people that are eligible to file your tax return for free you can keep all of your refund money by choosing one of three options.

In person full-service tax preparation

The IRS Volunteer Income Tax Assistance (VITA) , AARP Foundation Tax-Aide, and The Tax Counseling for the Elderly (TCE) programs have operated for over 50 years. All these services use IRS certified tax preparers and meet high IRS quality standards. VITA/TCE and Tax-Aide sites offer free tax help to people who need assistance in preparing their tax returns, including:

- People who generally make $60,000 or less

- Persons with disabilities; and

- Limited English-speaking taxpayers

- 60 years or older

To find a VITA or an AARP Tax Aide site go here .

Remote full-service tax preparation

You can prepare your own return with help from IRS certified volunteers when you need it through MyFreeTaxes if:

- Your income is $73,000 or less.

You can get connected to VITA providers around the country virtually to have your return prepared by signing up through GetYourRefund if:

- Your income is $66,000 or less.

Self-preparation

You can prepare and file your own return through IRS Free File :

- If your income is $73,000 or less, you can access guided return preparation assistance.

- If your income is greater than $73,000 you can access fillable forms to prepare your own return without assistance.

For servicemembers

You can prepare and file your tax return through MilTax if you are:

- Active-duty service members, spouses and dependent children of the eligible service members.

- Members of the National Guard and reserve — regardless of activation status.

- Retired and honorably discharged service members, including Coast Guard veterans, within 365 days of their discharge.

- A family member who is managing the affairs of an eligible service member while the service member is deployed.

- A designated family member of a severely-injured service member who is incapable of handling their own affairs.

- Eligible survivors of active-duty, National Guard and reserve deceased service members regardless of conflict or activation status.

- Some members of the Defense Department civilian expeditionary workforce.

About filing your tax return

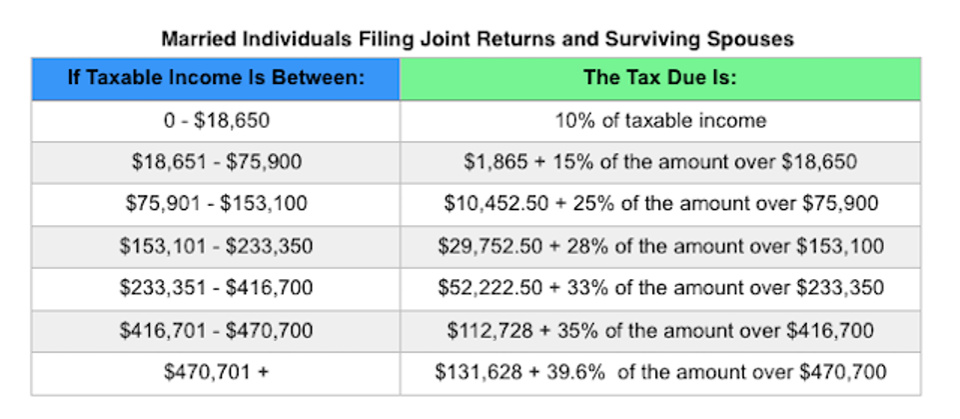

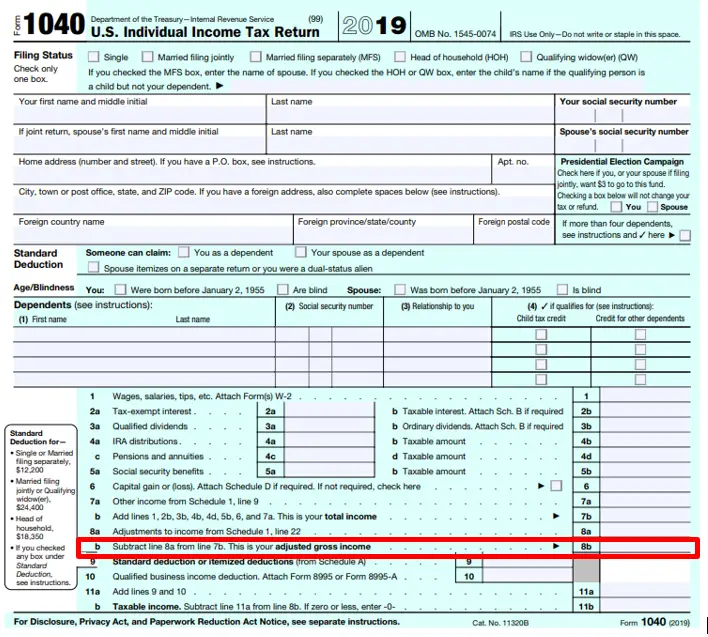

If you have income below the standard deduction threshold for 2022, which is $12,950 for single filers and $25,900 for married couples filing jointly , you may not be required to file a return. However, you may want to file anyway because you may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe, or in many cases, especially for people with low incomes, increase the amount you could receive in a refund. Some key factors to make sure you look out for include:

However, you may want to file anyway because you may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe, or in many cases, especially for people with low incomes, increase the amount you could receive in a refund. Some key factors to make sure you look out for include:

Over-withholding

If you worked during 2022 and had taxes withheld from your paycheck, you may be able to get some or all of that “over-withholding” back in your refund. Make sure you get W2 forms from all your employers and enter that information into the tax form when you fill it out.

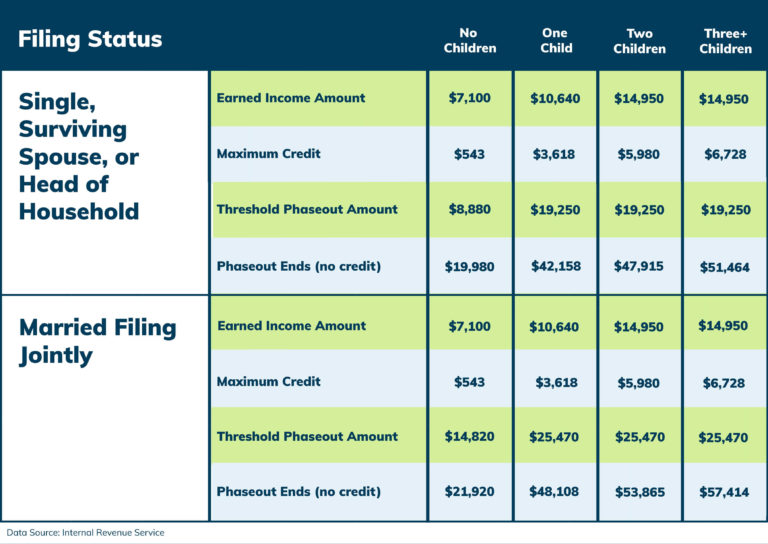

The earned income tax credit

To claim the Earned Income Tax Credit (EITC) , you must

- Have worked and had earned income under $59,187

- Have investment income below $10,000 in the tax year 2022

- Have a valid Social Security number by the due date of your 2022 return (including extensions)

- Be a U.

S. citizen or a resident alien all year

S. citizen or a resident alien all year - Not file Form 2555 (related to foreign earned income )

If you are eligible for this credit, the maximum amount you could receive is:

- $560 if you have no dependent children

- $3,733 if you have one qualifying child

- $6,164 if you have two qualifying children

- $6,935 if you have three or more qualifying children

The child tax credit (CTC)

The CTC is worth a maximum of $2,000 per qualifying child. Up to $1,400 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

Access your tax refund quickly and safely

If you think you may receive a refund, here are some things to think about before you file your return:

- Electronically filing and choosing direct deposit is the fastest way to get your refund.

When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.

When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.- If you already have an account with a bank or credit union, make sure you have your information ready — including the account and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

- You can learn more about choosing the right prepaid card here.

- If you don’t have a bank account or prepaid card, consider opening an account or getting a prepaid card. Many banks and credit unions offer accounts with low (or no) monthly maintenance fees when you have direct deposit or maintain a minimum balance.

These accounts may limit the types of fees you can incur and may also offer free access to in-network automated teller machines (ATMs). You can often open these accounts easily online.

These accounts may limit the types of fees you can incur and may also offer free access to in-network automated teller machines (ATMs). You can often open these accounts easily online.- Learn more about the FDIC’s #GetBanked campaign.

Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals.

The IRS does not initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam. See also: How to know it’s really the IRS calling or knocking on your door.

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6).

If they signed up by July:

If they signed up by July: - Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

transfer money from Europe online - international money transfers Koronapay

17. 5 million

5 million

Application users

4.7

Average rating in the AppStore and GooglePlay

50 countries

50 thousand

points of service 9000

People are talking about us

With the KoronaPay application you can

Transfer money at favorable rates

Pay for transfers from a card or from an account 9Ol000

Ask support a question

How to send a transfer

Select a country and enter the amount

Click "Send transfer", select the country in which the recipient is located, the amount and currency of the transfer

Fill in the details of the recipient and sender

Select the method of receiving the transfer if the application offers options. Enter the details of the recipient and sender as in the passport

Enter the details of the recipient and sender as in the passport

Check the data

Pay for the transfer by card or from a bank account

- 1

, amount and currency of the transfer

- 2

Fill in the details of the recipient and sender

Select the method of receiving the transfer if the application offers options. Enter the details of the recipient and sender as in the passport

- 3

Check the details

Pay for the transfer by card or from a bank account

How to receive the transfer

000+ points of issue or credit the transfer to the card.

You can see the address of the points on the map.

You can see the address of the points on the map. To bank cards

The money will be credited to the recipient's card within a few minutes. Visa, Mastercard, Maestro, MIR cards are suitable for enrollment.

KoronaPay application

Garbuz Elena

Very fast and easy transfer.

Redman Alexander

Favorable rate! Super! 👍

Volkov Oleg

The documents were checked very quickly and my first transfer arrived at lightning speed.

Anastasia Zubareva

Translation takes 30 seconds.

Dan Worrell

Very good, I liked it, 10 points, thank you.

Luda Zotova

Very handy application. I use for a long time.

Anastasia Zhukova

It's easy to send money from Europe to Russia.

Petr Mirolyubov

Instant transfer, no problems. I will recommend to my friends.

Garbuz Elena

Very fast and easy transfer.

Redman Alexander

Favorable exchange rate! Super! 👍

About KoronaPay

50,000 service points

Members and partners of the service - banks, postal operators and large retail chains in 50 countries around the world

Online transfers

Transfer money via the Internet to Europe, Russia, Turkey, Georgia, CIS countries. Choose the transfer currency that is convenient for you

Tariffs from 0%

There is no transfer fee if the payment currency differs from the transfer currency. For example, you pay in Polish zlotys, and send the transfer in dollars

Convenient application

More than 17. 5 million users highly rated the KoronaPay application

5 million users highly rated the KoronaPay application

Press about us

Frequently asked questions

How to receive a cash transfer?

Cash transfers are issued at the offices of KoronaPay partners. The recipient must present an identity document and name the number of the transfer.

How to send money?

Go to the send transfer section. Sequentially fill in all the fields of the form. Make sure all information is complete and without errors.

How much can I send?

There are 4 levels of limits: they differ not only in amounts, but also in validity period. Reaching a certain level depends on the type of verification that the sender has passed.

Didn't find what you were looking for?

Fill out the form, we will respond within 24 hours

Transferring money from Europe is easy

Safe

The service uses international data encryption standards

Favorable rates

Phone and online support in the application chat

Fast and affordable

Transfer usually takes a few seconds. Most often, the recipient can collect the money immediately after sending

Most often, the recipient can collect the money immediately after sending

Standard tax deductions in 2023 | Accounting services and maintenance

Let us remind you that according to the Belarusian legislation, 13% of the income received by a citizen (income tax) is transferred to the state budget. Therefore, the higher the wage, the higher the tax must be paid. However, there are government-imposed incentives that can help you reduce your taxable earnings and thus withhold less income tax.

When can income tax benefits be used

Income tax benefits can only be used if the employee has presented all the documents proving the right of a citizen of Belarus to claim these deductions. The list of such documents is enshrined in Article 209 of the Tax Code. In addition, such benefits can be applied at the place of main work. If the deductions are greater than income, then the tax rate is considered equal to zero, and the amount by which the deduction is greater than earnings is not carried over to the next month.

The amount of tax deductions is established annually in the special part of the Tax Code (Article 209). From January 1, 2023, the updated Tax Code of the Republic of Belarus will come into effect.

Changes in the size of standard tax deductions in 2023

Consider what changes are planned to occur in the size of income tax deductions in 2023, and also compare with the figures for 2022 (see table below).

| Who is entitled to the deduction | The size of the deduction (for the month) | |

| 2022 | 200209 | |

| received income for a month in the amount not exceeding the established limit of | . | $156 |

| provided that the amount of taxable income does not exceed | ||

| 817 rubles/month. | 944 rubles/month | |

| Individual entrepreneurs (notaries, lawyers) who do not have a main place of work (service, study) during the reporting (tax) period (part of it) and who have received income not exceeding the established limit | $135 | $156 |

| provided that the amount of taxable income reduced by the amount of professional tax deductions does not exceed | ||

2,452 rubles in the corresponding calendar quarter. | ||