How much child maintenance do i pay

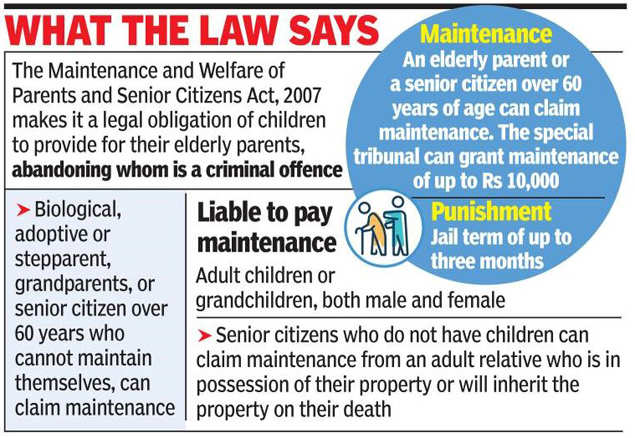

How the Child Maintenance Service works out child maintenance: How child maintenance is worked out

Skip to contents of guide

The Child Maintenance Service usually follows 6 steps to work out the weekly amount of child maintenance.

The child maintenance calculator shows you what the government is likely to work out for you.

Step 1 - working out income

The Child Maintenance Service will find out the paying parent’s yearly gross income from information supplied by HM Revenue and Customs (HMRC).

They’ll also check if the paying parent is getting benefits (tax credits, student grants and loans do not count as income).

The ‘paying parent’ does not have main day-to-day care of the child. The ‘receiving parent’ has main day-to-day care of the child.

Step 2 - looking at things that affect income

The Child Maintenance Service will check for things that could change the gross income amount (for example, pension payments or other children they support).

You can also ask for extra income, assets or expenses to be taken into account.

They’ll convert the yearly gross income into a weekly figure.

Step 3 - child maintenance rates

One of 5 rates will be applied, based on the gross weekly income of the paying parent.

| Gross weekly income | Rate | Weekly amount |

|---|---|---|

| Unknown or not provided | Default | £38 for 1 child, £51 for 2 children, £64 for 3 or more children |

| Below £7 | Nil | £0 |

| £7 to £100, or if the paying parent gets benefits | Flat | £7 |

| £100.01 to £199.99 | Reduced | Calculated using a formula |

| £200 to £3,000 | Basic | Calculated using a formula |

If the paying parent’s gross weekly income is more than £3,000, the receiving parent can apply to the courts for extra child maintenance.

Step 4 - other children

The Child Maintenance Service will take into account the number of children the paying parent has to pay child maintenance for. This includes any other children living with them and any arrangements that have been made directly for other children.

Step 5 - weekly amount of child maintenance

Using information from the first 4 steps, the Child Maintenance Service decides the weekly child maintenance amount.

Step 6 - shared care

This is when a paying parent’s child stays overnight with them.

In these cases, the Child Maintenance Service makes a deduction to the weekly child maintenance amount based on the average number of ‘shared care’ nights a week.

View a printable version of the whole guide

How much child maintenance should I pay?

If you and your ex-partner have children, you’re both expected to continue to pay towards their costs after you separate. And often that means one parent will pay the other. You can agree this between you or, if you can’t agree, ask the Child Maintenance Service to calculate the amount.

You can agree this between you or, if you can’t agree, ask the Child Maintenance Service to calculate the amount.

What’s in this guide

- Arranging child maintenance yourselves

- How much are you expected to pay?

- When does child maintenance stop?

- How your income affects how much you pay

- How the number of children affects how much you pay

- How shared care affects child maintenance

- Paying for children from another relationship

Arranging child maintenance yourselves

If you and the other parent are arranging child maintenance between you, you’re free to decide the amount one parent pays the other. This is referred to as a family-based arrangement.

This is referred to as a family-based arrangement.

While the Child Maintenance Service doesn’t need to be involved if you do this, it’s a good idea to check the amount you agree against what they would assess it to be.

It’s important to think about what you’d like to include in this payment and how you’d like to pay:

- Do you want to pay a fixed regular amount or will you vary it to help with extra expenses throughout the year?

- Do you want to cover the cost of things like school uniform, activities or holidays?

- Do you want to pay a percentage of your earnings? If your earnings fluctuate, this might be helpful to you but it would mean the amount of child support is less predictable.

Back to top

How much are you expected to pay?

If you can’t agree how much child maintenance one parent should pay the other, you can ask the Child Maintenance Service to calculate it for you.

They’ll take into account:

- how many children you have

- the paying parent’s income

- how much time children spend with the paying parent

- whether the paying parent is paying child maintenance for other children.

Back to top

When does child maintenance stop?

You’re normally expected to pay child maintenance until your child is 16, or until they’re 20 if they’re in school or college full-time studying for:

- A-levels

- Highers, or

- equivalent.

Child maintenance might stop earlier – for example, if one parent dies or the child no longer qualifies for child benefit.

Back to top

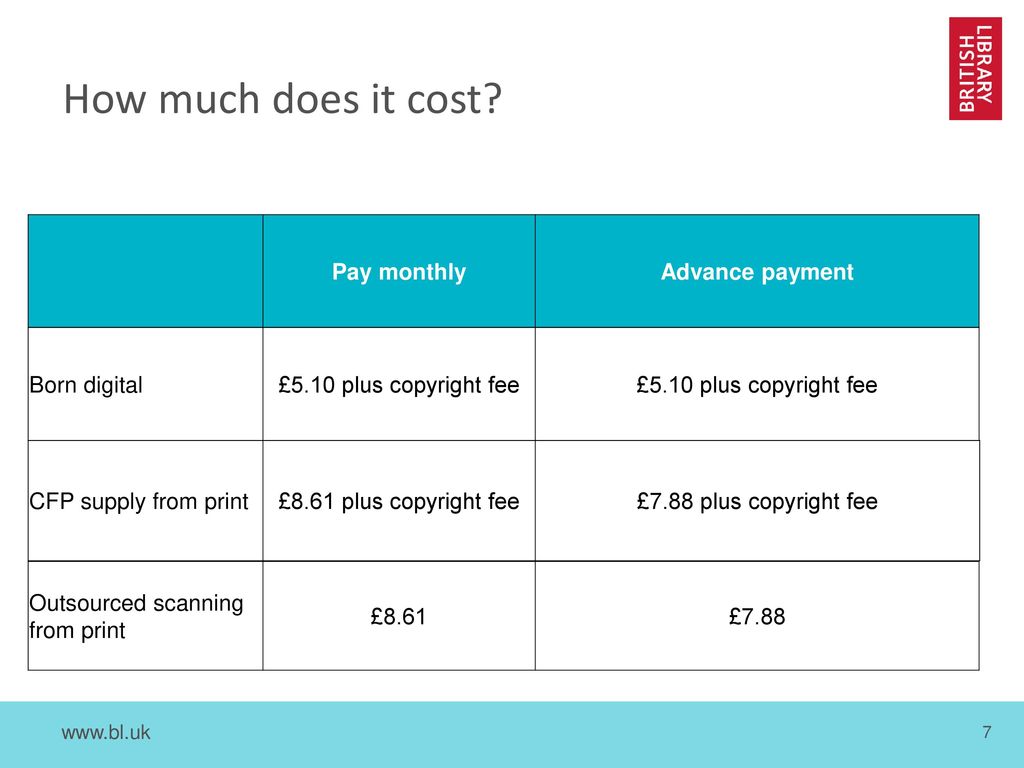

How your income affects how much you pay

There are different child maintenance rates according to the paying parent’s gross weekly income – this means how much you receive before things like tax and National Insurance are taken off.

Child maintenance amounts based on weekly pay

|

Unknown |

Default |

£38 for one child, £51 for two children, £61 for three or more children |

|

Below £7 |

Nil |

You don’t pay any child maintenance |

|

Between £7 and £100 or if you’re on benefits |

Flat |

£7 a week |

|

Between £100. |

Reduced |

Use the child maintenance calculator |

|

Between £200 and £3,000 |

Basic |

Use the child maintenance calculator |

(2021 figures - see GOV.UK for more information. )

)

If your gross weekly income is more than £3,000, you can apply to the court to make a child maintenance ‘top-up’ order.

But before the court will deal with your application, they’ll need to see a Child Maintenance Service calculation showing this.

Back to top

How the number of children affects how much you pay

If you’re paying child maintenance and you’re on the basic rate of child maintenance, the amount you pay will depend on the number of children you’re being asked to pay for.

The figures below assume that your children stay with the parent who receives child maintenance all the time.

On the basic rate, if you’re paying for:

- one child, you’ll pay 12% of your gross weekly income

- two children, you’ll pay 16% of your gross weekly income

- three or more children, you’ll pay 19% of your gross weekly income.

Back to top

How shared care affects child maintenance

Many parents decide to share the care of their children.

If your children spend some time with the paying parent, this will reduce the amount of child maintenance he or she pays.

There are different ‘bands’ which determine how much child maintenance is reduced by.

The amount of child maintenance is reduced for each child who spends time with the paying parent.

If over the year your child is with the paying parent between:

- 52 and 103 nights: child maintenance is reduced by 1/7th for each child

- 104 and 155 nights: child maintenance is reduced by 2/7th for each child

- 156 and 174 nights: child maintenance is reduced by 3/7th for each child

- 175 nights or more nights: child maintenance is reduced by 50%, plus an extra £7 a week reduction for each child.

Back to top

Paying for children from another relationship

If the paying parent’s gross weekly income is between £200 and £3,000, and they pay child maintenance for other children, this is taken into account when working out how much they should pay.

The Child Maintenance Service simply reduces the amount of weekly income that it takes into account. For example, if the paying parent is paying for:

- one other child, their weekly income will be reduced by 11%

- two other children, their weekly income will be reduced by 14%

- three or more other children, their weekly income will be reduced by 16%.

Back to top

Was this information useful?

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

How to find out child support debt by last name - check child support debt online

There are several ways to see the amount of child support debt. To do this, you can contact the MFC or come to an appointment with a bailiff. In addition, you can find out the debt by last name via the Internet. To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

State payment

State payment online service offers the easiest and fastest way to find out the amount of alimony debt from yourself or another individual. The service does not require registration. To start checking:

- Go to the State Payments website;

- Enter the last name, first name and patronymic of the debtor, his date of birth and region of residence. Click "Check";

- Next, enter the code from the picture and wait for the verification results.

The service will check the FSSP database and provide information about the amount owed by a particular person.

With the help of "Gosoplata" you can not only find out, but also immediately pay the debt using any bank card.

The service has the following benefits:

- Instant payment of legal, tax and other debts;

- Simple and intuitive interface;

- Convenient mobile application;

- Payment information is automatically transferred to databases;

- All transmitted data is securely encrypted;

- Payment receipt is sent to the payer's e-mail immediately after the payment is made.

FSSP website

To find out the debt for alimony through the official website of the FSSP, you need:

- Go to the site at the link: fssp.gov.ru;

- In the site menu, select the "Service" section, the "Database of Enforcement Proceedings" category;

- Next, you need to fill in all the fields marked with an asterisk (*):

- Territorial bodies;

- Last name, first name;

- Click the "Find" button to start checking. Next, the system will ask you to enter the code from the picture to confirm that the request is made by a person and not a robot.

If several debtors have the same first and last name, you need to enter the middle name and date of birth for a more accurate search.

As a result of the search, you will see a table where all the necessary information will be presented:

- amount of debt and enforcement fee;

- production number;

- court order number;

- territorial subdivision of the FSSP;

- surname and phone numbers of the bailiff.

On the main website of the bailiff service, you can not only find out the debt for alimony, but also pay it. If necessary, you can pay the debt online through the State Services portal or generate a receipt and pay it through any bank.

Public services

To find out the amount of alimony arrears through the Gosuslug portal, you must first register.

Attention! The search for accruals is carried out according to the data from your personal account.

To see if you have a legal debt, log into your personal account and follow these steps:

- Select the "Services" section, then the "Authorities" subsection and the "FSSP of Russia" category;

- Next, open the "Territorial authorities" tab and select the name of the desired department from the list;

- Select the electronic service “Providing information…”;

- Next, select the service "Law Debt";

- Click "Get Service";

You can pay your debt in several ways:

- With any bank card;

- Through Google Pay or Samsung Pay;

- Using an electronic wallet WebMoney, Qiwi, Yandex.

Money;

Money; - From a mobile phone account.

You can also generate a receipt and pay it at the bank or at the post office.

How quickly will an entry in the FSSP database be deleted?

If you have fully or partially paid the child support debt, the entry in the Database will be deleted or changed no earlier than 3-7 working days from the date of payment. This is due to the fact that first the funds go to the account of the bailiff unit, and then to the account of the claimant. It takes at least 3 days to process and transfer funds. If the workload is high, it can take up to 7 days to delete or change an entry.

If you have any additional questions, you can personally contact the territorial division of the FSSP. You can make an appointment for a personal appointment through the official website of the bailiff service - fssp.gov.ru.

Kontselidze Ednary Emzarievich Legal Expert

until what age do they pay, how much percentage of income can they withhold, and what documents are needed to apply for alimony

1.

Who can apply for child support?

Who can apply for child support? Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under 18 years old and has not yet become fully capable by decision of the guardianship or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he is in need and recognized Disabled adults who are entitled to alimony are considered disabled people of I, II, III groups and persons who have reached pre-retirement age (55 years for women and 60 years

- the wife, including the former, is pregnant or less than three years have passed since the birth of a common child. ;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, state of health and other circumstances.

marriage or within five years thereafter, and the spouses have been married for a long time.0011

marriage or within five years thereafter, and the spouses have been married for a long time.0011

Also, child support can be received by:

- disabled parents who need help, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient means for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive maintenance from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept may apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- single housing document and income statements of all family members;

- calculation of the amount you expect to receive as alimony. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

Under exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, unless the child gets married earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated.

01 and £199.99

01 and £199.99