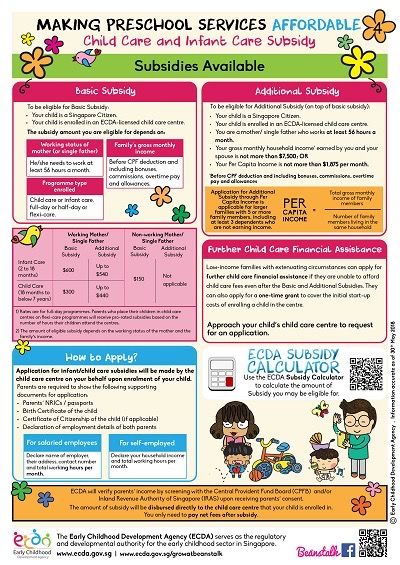

How much child care rebate calculator

In Home Care CCS Calculator

This In Home Care Child Care Subsidy (CCS) Calculator is developed for Australian parents to estimate their possible Child Care Subsidy payment amount for In Home Care (IHC). For Centre Based Day Care, Family Day Care or Outside School Hours Care please use the Child Care Subsidy Calculator.

This Calculator is based on the publicly available guidelines and publications about Child Care Subsidy that can be found in the Child Care Subsidy Guide by the Department of Education and Training, Australian Government. The Child Care Subsidy rates that take effect on 11 July 2022 for Financial Year 2023 (FY23) are being used. However, the results from this calculator are only indicative and informative.

From 2 July 2018, a new In Home Care (IHC) service type will be available under the Australian Government's new child care package. The new arrangements provide flexible early childhood education and care for families who can demonstrate that the other types of approved child care are not suitable or available and where:

- parents or carers are working non-standard or variable hours;

- families are geographically isolated from other types of approved child care, particularly in rural or remote locations;

- the family is experiencing challenging or complex situations and their needs cannot be met by other approved child care services.

To access IHC, families must be eligible for CCS. Given the unique family aspect of IHC, a family's CCS entitlement for IHC will be based on a family hourly rate cap but not an hourly rate cap per child. The Child Care Subsidy for In Home Care will be based on a family hourly rate cap of $34.64 per hour.

Families receiving IHC may also be eligible for Additional Child Care Subsidy (ACCS). The ACCS provides assistance in the following circumstances:

- ACCS (Child Wellbeing) for families (including foster carers) who require practical help to support their child's safety and wellbeing;

- ACCS (Grandparent) for grandparent primary carers on income support;

- ACCS (Temporary Financial Hardship) for families experiencing temporary financial hardship.

Families eligible for ACCS (Child Wellbeing), ACCS (Grandparent) or ACCS (Temporary Financial Hardship) will receive a subsidy equal to the actual fee charged, up to 120 per cent of the CCS family hourly rate cap. Those families will not be subject to the activity test, and will be entitled to up to 100 hours of care per child, per fortnight.

Those families will not be subject to the activity test, and will be entitled to up to 100 hours of care per child, per fortnight.

ACCS (Transition to Work) is available for parents transitioning to work from income support. Eligible families will receive a subsidy of 95 per cent of the actual fee charged or up to 95 percent of the CCS family hourly rate cap, whichever is lower. Hours of subsidised care will be determined by the Child Care Subsidy Activity Test.

Please Note: 5 per cent (5%) of your weekly Child Care Subsidy entitlement will be withheld unitl the end-of-year reconciliation if you are NOT eligible for ACCS. The five per cent mandatory withholding of your entitlement will not apply to ACCS payments and neither will the annual cap.

Help: Click on the "" icon to show explanation of each field. PLEASE NOTE: We are NOT affiliated with Centrelink! If you have any questions regarding your Child Care Subsidy Assessment, please phone Centrelink on 136 150 (8am – 8pm, Monday to Friday).

Privacy: Neither the details entered nor the final results are stored in any system so you may want to print it and have a copy of the results.

Child Care Subsidy Calculator FAQs

Based on the feedback from the users, we hereby provide a list of FAQs to help our users to understand the CCS calculator better.

If you cannot find an answer to your question, please feel free to share your question with us and we will get back to you within 24 hours.

Can I use this CCS calculator if I DON'T meet the Activity Test Requirements?

No! Please DO NOT use this Child Care Subsidy calculator if you DON'T meet the Child Care Subsidy Activity Test Requirements.

Do you have an Excel version of this CCS calculator?

Yes! You can download the free CCS calculator in Excel from this link.

Is this CCS calculator secure?

Yes! Your information is protected with our SSL certificate.

Do you have a CCS calculator for In Home Care?

Yes! You can use the online In Home Care Child Care Subsidy Calculator.

Can you provide some examples of how the CCS is calculated?

Let's have a look at the following examples.

Example 1:

Family A with a combined family income of $66,000 and meets the activity test so entitled to a subsidy of 85% up to 50 hours per week. The long day care centre charges Family A $110 per day for a 10-hour long day care session for their below school age child.

Example 1 Calculation:

Step 1 Work out hourly fee = $110 / 10 = $11.00

Step 2 Work out the hourly subsidy based on the hourly fee = $11.00 x 85% = $9.35

Step 3 Work out the hourly subsidy based on the hourly fee cap = $12.74 x 85% = $10.83

Step 4 Compare the results from Step 2 and Step 3 and use the less one as the actual hourly subsidy = $9.35

Step 5 Work out the weekly subsidy = $9.35 x 10 x 5 = $467.5

Step 6 Work out the weekly out-of-pocket cost = $110 x 5 - $467. 5 = $82.5

5 = $82.5

Example 2:

Family B with a combined family income of $66,000 and meets the activity test so entitled to a subsidy of 85% up to 50 hours per week. The long day care centre charges Family B $150 per day for a 10-hour long day care session for their below school age child.

Example 2 Calculation:

Step 1 Work out hourly fee = $150 / 10 = $15.00

Step 2 Work out the hourly subsidy based on the hourly fee = $15.00 x 85% = $12.75

Step 3 Work out the hourly subsidy based on the hourly fee cap = $12.74 x 85% = $10.83

Step 4 Compare the results from Step 2 and Step 3 and use the less one as the actual hourly subsidy = $10.83

Step 5 Work out the weekly subsidy = $10.83 x 10 x 5 = $541.45

Step 6 Work out the weekly out-of-pocket cost = $150 x 5 - $541.45 = $208.55

Example 3:

Family C with a combined family income of $66,000 and meets the activity test so entitled to a subsidy of 85% up to 50 hours per week. The family day care charges Family C $110 per day for a 10-hour long day care session for their below school age child.

The family day care charges Family C $110 per day for a 10-hour long day care session for their below school age child.

Example 3 Calculation:

Step 1 Work out hourly fee = $110 / 10 = $11.00

Step 2 Work out the hourly subsidy based on the hourly fee = $11.00 x 85% = $9.35

Step 3 Work out the hourly subsidy based on the hourly fee cap = $11.80 x 85% = $10.03

Step 4 Compare the results from Step 2 and Step 3 and use the less one as the actual hourly subsidy = $9.35

Step 5 Work out the weekly subsidy = $9.35 x 10 x 5 = $467.50

Step 6 Work out the weekly out-of-pocket cost = $110 x 5 - $467.50 = $82.50

Example 4:

Family D with a combined family income of $185,000 and meets the activity test so entitled to a subsidy of 50% up to 50 hours per week. The long day care centre charges Family D $150 per day for a 10-hour long day care session for their below school age child.

Example 4 Calculation:

Step 1 Work out hourly fee = $150 / 10 = $15.00

Step 2 Work out the hourly subsidy based on the hourly fee = $15 x 50% = $7.50

Step 3 Work out the hourly subsidy based on the hourly fee cap = $12.74 x 50% = $6.37

Step 4 Compare the results from Step 2 and Step 3 and use the less one as the actual hourly subsidy = $6.37

Step 5 Work out the weekly subsidy = $6.37 x 10 x 5 = $318.50

Step 6 Work out the weekly out-of-pocket cost = $150 x 5 - $318.50 = $431.50

Example 5:

Family F with a combined family income of $200,000 and meets the activity test so entitled to a subsidy of 50% up to 50 hours per week. The long day care centre charges Family F $118 per day for a 10-hour long day care session for their below school age child. The child is enrolled for 50 weeks' care.

Example 5 Calculation:

Step 1 Work out hourly fee = $118 / 10 = $11. 80

80

Step 2 Work out the hourly subsidy based on the hourly fee = $11.80 x 50% = $5.90

Step 3 Work out the hourly subsidy based on the hourly fee cap = $12.74 x 50% = $6.37

Step 4 Compare the results from Step 2 and Step 3 and use the less one as the actual hourly subsidy = $5.90

Step 5 Work out the weekly subsidy = $5.90 x 10 x 5 = $295.00

Step 6 Work out the weekly out-of-pocket cost = $118 x 5 - $295.00 = $295.00

How does this Child Care Subsidy Calculator estimate the Child Care Subsidy Percentage?

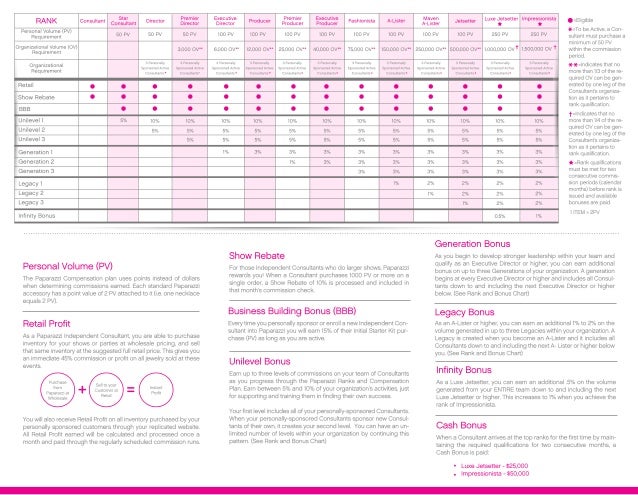

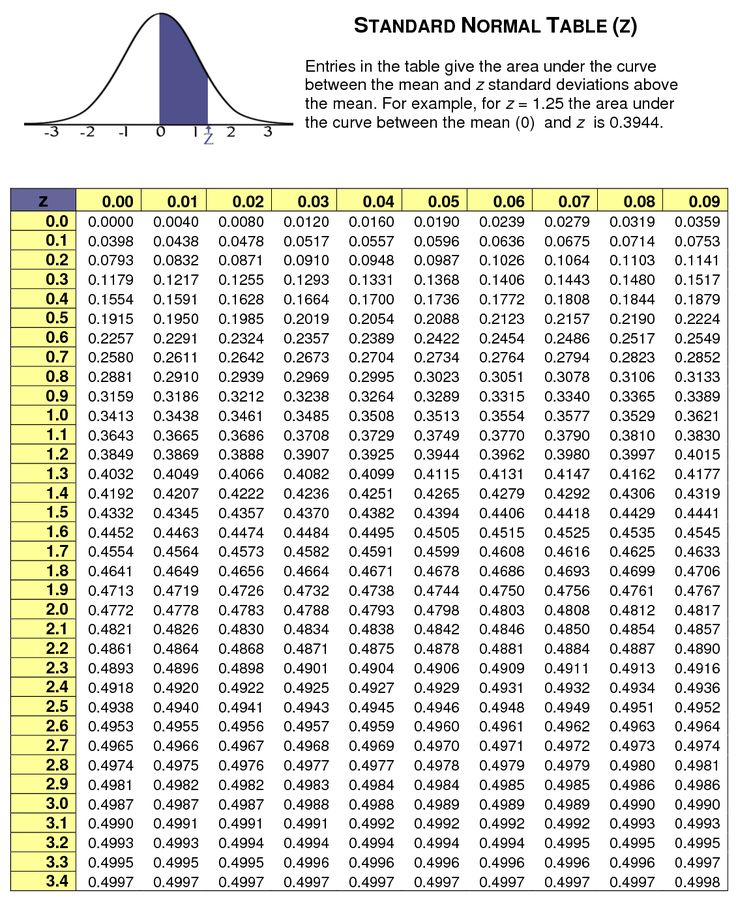

The Child Care Subsidy Calculator estimates your Child Care Subsidy Percentage based on the Child Care Subsidy Percentage & Combined Family Adjusted Taxable Income (ATI) table (as shown below) published by the Australian Government.

Families earning $72,466 or less will receive a subsidy of 85 per cent of the actual fee charged (up to 85 per cent of an hourly fee cap). For family incomes above $72,466, the subsidy tapers down by 1 per cent for each $3000 of family income to 20 per cent when family income reaches $356,756. For families with incomes of $356,756 or more, the subsidy is zero per cent.

For families with incomes of $356,756 or more, the subsidy is zero per cent.

| Combined Family Income | Subsidy per cent of the actual fee charged (up to relevant percentage of the hourly fee cap) |

|---|---|

| Up to $72,466 | 85 per cent |

| More than $72,466 to below $177,466 | Tapering to 50 per cent* |

| $177,466 to below $256,756 | 50 per cent |

| $256,756 to below $346,756 | Tapering to 20 per cent* |

| $346,756 to below $356,756 | 20 per cent |

| $356,756 or more | 0 per cent |

What Child Care Subsidy Hourly Fee Caps are being used in this Child Care Subsidy calculator?

The tables below show the hourly rate caps that are being used in this Child Care Subsidy calculator.

Table 1: CCS Hourly Rate Caps by Care Type

| Service type | Maximum hourly fee cap (children below school age) | Maximum hourly fee cap (school aged children) |

|---|---|---|

| Centre Based Day Care (Long Day Care and Occasional Care) | $12.74 | $11.15 |

| Outside School Hours Care (Before, After, and Vacation care) | $12.74 | $11.15 |

| Family Day Care | $11.80 | |

| In Home Care |

$34. 64 (per family) 64 (per family)

|

|

Table 2: ACCS Hourly Rate Caps by Care Type

| Service type | Maximum hourly fee cap (children below school age) | Maximum hourly fee cap (school aged children) |

|---|---|---|

| Centre Based Day Care (Long Day Care and Occasional Care) | $15.29 | $13.38 |

| Outside School Hours Care (Before, After, and Vacation care) | $15.29 | $13.38 |

| Family Day Care | $14.16 | |

| In Home Care |

$41. 57 (per family) 57 (per family)

|

|

My child is currently in child care. We are approved for 100 hours a fortnight as my husband and I both work full time. I will be on maternity leave soon. Will I still be covered for the same amount of CCS at childcare when on maternity leave as when I am at working full time?

Yes, your 100 hours CCS entitlement will be the same. As a matter of fact maternity leave does NOT affect the hours of subsidised care that individuals are entitled to. The Family Assistance Guide does not explicitly state maternity leave as a recognised activity for CCS activity test. This might leave many parents confused. The fact that maternity leave is a type of parental leave entitlements makes it definitely a recognised activity for CCS activity test.

According to 3.5.2.10 CCS - activity test - general in Family Assistance Guide (Version 1.230 - Released 1 July 2021), paid work (a recognised activity for CCS activity test) includes periods of paid and unpaid leave such as parental leave, annual leave, long service leave, leave for illness or injury, or carer's leave. Individuals on paid or unpaid leave will have their leave recognised for the same number of hours per fortnight as they worked immediately prior to being on leave. For example: If an individual was working 50 hours per fortnight immediately before their leave, they would (continue to) have an activity test result of 100 hours per fortnight while on leave. This means when you apply for CCS, under work/activity you need to put the hours you were doing before you went on maternity leave.

Individuals on paid or unpaid leave will have their leave recognised for the same number of hours per fortnight as they worked immediately prior to being on leave. For example: If an individual was working 50 hours per fortnight immediately before their leave, they would (continue to) have an activity test result of 100 hours per fortnight while on leave. This means when you apply for CCS, under work/activity you need to put the hours you were doing before you went on maternity leave.

On the website of Australian Government Department of Human Services, it clearly states that "We'll count any paid or unpaid parental and maternity leave you take." as recognised activities.

If you cannot find an answer to your child care subsidy question, please feel free to share your CCS question with us and we will get back to you within 24 hours. If you do not hear from us, please come back to this page as we may include your question and the answer here instead of sending you an email.

what benefits are due to parents in the labor, pension and tax areas

Marina Sukhovskaya

lawyer

Author profile

Parents of a child with a disability can receive benefits from the state in the labor, pension and tax spheres.

Until the age of 18, a disability group is not assigned: there is only a general category "disabled child". It is set for 1 year, 2 years, 5 years, or until the child reaches 14 or 18 years of age.

The category "disabled child" must be distinguished from the category "disabled since childhood" - this is an adult person who received a disability before the age of 18 due to illness or injury.

Clause 7 of the Procedure for Establishing the Causes of Disability - download document

This is what the parents of a child with a disability are entitled to.

Monthly compensation payment

Amount: 10,000 R

Conditions. The payment can be received by one able-bodied parent, adoptive parent or guardian who is not working and caring for a disabled child. If someone else is taking care of him, for example, a grandmother who has not yet retired, the payment will be less - 1200 R.

This money is paid in addition to the child's disability pension.

For families who live in areas where a district coefficient is applied, the payment is increased by this coefficient.

Presidential Decree No. 175 dated February 26, 2013

How to get. Submit an application to the pension fund for a monthly payment. This can be done at the PFR department or through the MFC.

The payment will be assigned from the month in which the parent applied. They will pay for as long as the care of the child lasts. If a parent gets a job or registers with the employment service and receives unemployment benefits, this is also the basis for terminating the payment.

/list/charity-for-children/

From treating rare diseases to fighting bullying in school: 10 funds that help children

Utility discount

Conditions. Families with disabled children can receive a 50% discount on water, electricity, maintenance of common property, and rent for an apartment rented under a social contract. They are also entitled to compensation for the payment of contributions for major repairs - up to 50%.

They are also entitled to compensation for the payment of contributions for major repairs - up to 50%.

These benefits do not depend on whether the parents work or how many children they have.

Art. 17 of the Law on Social Protection of the Disabled

How to get. Each region has its own procedure for applying for and receiving this benefit. For example, in Moscow, you need to contact the MFC.

Increased standard personal income tax deduction for a child

Amount: from 13,400 to 26,800 R

Conditions. All parents, as well as adoptive parents, guardians and trustees are entitled to a child income tax deduction.

sub. 4 p. 1 art. 218 Tax Code of the Russian Federation

For parents of a disabled child under 18 years of age or a student under 24 years of age with the first or second disability group, the child deduction consists of two amounts:

- Basic.

1400 R if the child is the first or second, 3000 R if the child is the third or subsequent.

1400 R if the child is the first or second, 3000 R if the child is the third or subsequent. - Special. 12,000 R for a parent, spouse of a parent, adoptive parent, 6,000 R for a guardian, trustee, foster parent, his spouse.

Both the base and the special amount are doubled for the single parent of a child with a disability.

Please note: 1400 R, 3000 R, 6000 R and 12 000 R is the amount of the deduction, not the amount you will receive. The deduction reduces the taxable base, that is, 13% personal income tax is withheld from a smaller amount.

Here's how it works. For example, a woman has three minor children, while the youngest son is disabled. The amount of the deduction for all children is 17,800 R: 1,400 R for the first and second child, 3,000 and 12,000 R for the third, taking into account disability.

If, under the contract, a woman earns 60,000 R per month, then the deduction will help reduce the taxable base to 42,200 R. This will affect the salary: after withholding taxes, the woman will receive 54,514 R instead of 52,200 R, which she would have received without using the child deduction .

The increased deduction is only for the period for which the child has been diagnosed with a disability. The term is indicated in the certificate issued by the Bureau of Medical and Social Expertise.

Like the regular child deduction, the increased deduction is provided until the parent's income from the beginning of the year exceeds 350,000 RUR.

How to get it. Submit an application for a deduction to the employer along with a copy of the child's disability certificate.

Calculate in advance on our calculator what deduction you are entitled to.

Paid leave at a convenient time

Conditions. One of the parents of a disabled child has the right to take a vacation without regard to the vacation schedule approved by the organization.

The employer is obliged to release such an employee to rest on the dates that he indicated in the vacation application. If the employer does not let go, and the employee still takes it and goes on vacation, then this will not be regarded as absenteeism.

Art. 262.1 TK RF

sign. "d" p. 39Decrees of the Plenum of the Supreme Court of March 17, 2004 No. 2

In order to go on vacation at a convenient time, the parent of a disabled child must work for six months with a specific employer. He can take a vacation before this period only by agreement with the management.

How to get. Submit an application to the employer with a request to provide annual paid leave. This must be done no later than three days before the start of the vacation in order to receive vacation pay on time.

Four extra holidays per month

Amount: average earnings for four days

Conditions. Additional days off on a monthly basis are due to one of the parents of a disabled child working under an employment contract, including as a part-time worker.

If there are two children with disabilities in a family, then mom or dad are still entitled to only four days a month for both children.

Both parents can also take the day off, but only within the total number of additional days off per month. That is, parents can distribute four days among themselves, for example, two and two or three and one.

Art. 262 of the Labor Code of the Russian Federation

p. 6, 8, 10 of the Rules for granting additional days off

Additional days off are not cumulative, do not accumulate and are not transferred to other months. If the parent for some reason does not use them, then the weekend will simply burn out. There will also be no monetary compensation.

The parent of a disabled child is not required to agree in advance with the employer on specific dates for additional days off. He has the right to rest exactly on the dates indicated in the application. Also, the parent does not have to prove to the employer that he spent the extra weekends solely on caring for the child.

How to get. Submit an application to the employer, attaching to it:

- Certificate of disability of the child.

- Certificate of birth (adoption) of a child or a document on the establishment of guardianship and guardianship over him.

- Documents confirming the child's place of residence. This may be a certificate from the HOA. The address of residence of the child may not coincide with the address of the parent.

- Certificate from the other parent's place of work - either about the number of days off used this month, or that the other parent did not use the day off.

The first three documents can be submitted to the employer only once, but the last certificate must be brought with each application for additional days off. If the other parent is temporarily unemployed, you need to show a copy of the work book.

Additional holiday rules

Right to work part-time

Conditions. Part-time work can be different, at the choice of the parent:

- part-time. For example, 6-hour instead of 8-hour;

- part-time work.

For example, three full days instead of five;

For example, three full days instead of five; - mixed schedule. For example, two days a week for 7 hours and one day a week for 5 hours.

st. 93 of the Labor Code of the Russian Federation

In this case, the salary may decrease: the employer has the right to pay in proportion to the hours worked or depending on the amount of work performed.

How to get. Submit an application to the employer with a request to establish part-time work. After that, an additional agreement to the employment contract must be concluded with the employee.

Only one of the parents has the right to part-time work. Therefore, the employer may request a certificate from the place of work of the second parent stating that he did not use this benefit.

The right to refuse business trips and weekend work

Conditions. An employee who has a child with a disability cannot be sent on a business trip without his consent. Also, he cannot be involved in overtime and night work, as well as to work on weekends and holidays.

Also, he cannot be involved in overtime and night work, as well as to work on weekends and holidays.

The employer is obliged to notify such employee in writing that he has the right to refuse a business trip or work overtime. And if the employee does not object, he must record his consent in writing.

Art. 259 TK RF

How to get. Do not give written consent to go on a business trip or work on a day off.

Reduction protection

Conditions. If layoffs are coming in the company, then a single mother or single parent-breadwinner of a child with a disability will definitely keep her job.

A woman is considered to be a single mother if the child's birth certificate does not contain an entry about the father or this entry is made according to the mother. According to the Supreme Court, this can also include women who raise a child without a father because he has died, or is deprived of parental rights, or has been declared legally incompetent by the court, or is in prison.

It is still not possible to fire a parent if he is the only breadwinner in a family with a disabled child: this means that the other parent does not work anywhere.

Art. 261 of the Labor Code of the Russian Federation

clause 28 of the Decree of the Plenum of the Supreme Court of January 28, 2014 No. 1

Seniority for pension

Conditions. If a parent does not work, but takes care of a child with a disability, then this period is included in the length of service for assigning a pension. But on the condition that before that the parent worked at least for some time.

The coefficient for each year of care is 1.8 pension points.

p. 6, part 1, part 2, art. 12 of the Law of December 28, 2013 No. 400-FZ

How to get. When a parent applies for an old-age pension, the PFR will take into account the years of service when he cared for a disabled child, provided that the parent received a monthly care allowance.

Skip-the-line service

Disabled children and adults accompanying them must be served out of turn in shops, cafes and restaurants, clinics and hospitals, museums, and other organizations serving the population. In addition, they must be received out of turn by officials of various institutions.

para. 7 paragraph 1 of Presidential Decree No. 1157 of October 2, 1992

Free parking

Conditions. The family car can be parked in special places for people with disabilities that are not allowed to be occupied by other drivers.

The number of places for the disabled in each parking lot is at least 10%.

Part 9 15 of the Law on Social Protection of the Disabled

How to get. Apply to the Federal Register of Disabled Persons - this can be done on the federal or regional portal of public services or at the MFC.

There is no longer an obligation to place a “Disabled” sign on the car, but if you have it stuck, then take your disability documents with you to present them in case of a check.

Deferment from military service

Conditions. Conscripts with a disabled child are entitled to deferment from the army until the child is three years old.

sub. "d" paragraph 1 of Art. 24 of the Law on Conscription and Military Service

How to get. Deferment cannot be issued in absentia. Having received the summons, the man must appear within the terms of the draft - from April 1 to July 15 or from October 1 to December 31 - at the meeting of the draft commission with these documents:

- Certificate of family composition.

- Child's birth certificate.

- Certificate of the child's disability.

Reduced transport and land taxes

Conditions. There are no benefits for car owners at the federal level. Each region decides for itself who and what benefits to provide.

In most regions, one of the parents of a disabled child may not pay transport tax for one car of a certain capacity.

Art. 356 Tax Code of the Russian Federation

For example, in the Kaluga region, the exemption applies to cars up to 250 liters. s., in Moscow - no more than 200 liters. s., in St. Petersburg, Leningrad, Amur, Tambov and Vladimir regions and in Bashkortostan - no more than 150 liters. s., in the Belgorod and Kurgan regions - no more than 100 liters. With. But in the Novgorod region, the power of a car does not matter.

In some regions, parents of disabled children are given a discount on transport tax. For example, in the Krasnoyarsk Territory the discount is 90%.

Many cities have land tax exemptions. The types of benefits are different everywhere: somewhere they are completely exempt from tax, somewhere they give a discount, in other regions they do not take a tax on six acres.

Transport and land tax benefits in each region can be found in a special online service on the tax website.

How to get. Submit an application for tax benefits. The fastest and easiest way to do this is in the taxpayer's office. But you can also refer the application to any MFC or tax office.

The fastest and easiest way to do this is in the taxpayer's office. But you can also refer the application to any MFC or tax office.

/avtolgota/

How parents with many children can apply for a transport tax benefit

Regional payments and benefits

Each region may have its own payments and benefits for parents of a child with a disability.

For example, in Moscow, one of the parents is entitled to monthly compensation: in 2022, this is 13,772 R. It can only be issued in electronic form - on the portal of public services or on the website of the mayor of Moscow.

Also in the capital, parents of disabled children can ride public transport for free and do not have to pay for the kindergarten the child attends.

sign. 1.1.3 Clause 1 of Decree of the Government of Moscow dated April 6, 2021 No. 410-PP

Art. 9, 30 of the Law of Moscow dated November 23, 2005 No. 60 "On social support for families with children in the city of Moscow"

To find out what payments and benefits for parents of children with disabilities are in your region, you can do this:

- go to the regional portal public services in the "Social Security" section;

- come to the pension fund branch at the place of residence and consult a specialist;

- to seek advice from the All-Russian Organization of Parents of Disabled Children.

It is represented in all social networks, and it has regional branches in almost every subject of the Russian Federation.

It is represented in all social networks, and it has regional branches in almost every subject of the Russian Federation.

How to determine the daily calorie intake?

June 4, 2019

The key to an ideal figure is the correct calculation of the required number of calories. The norm for each person depends on many factors that must be taken into account when compiling a diet.

Why count calories?

Almost any food is a fuel, a source of energy for the human body. The calorie content of a product refers to a certain amount of energy that will be obtained when it is consumed. The calorie intake is calculated individually and depends on gender, weight, age, lifestyle and physical activity during the day.

Remembering algebra

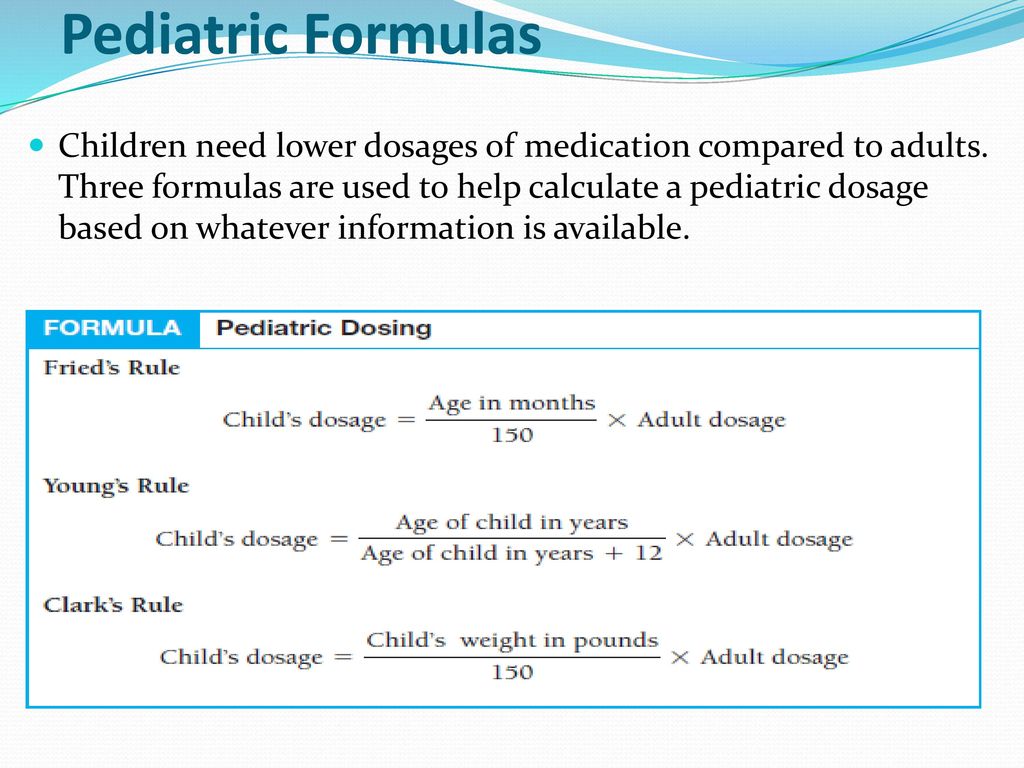

One way to calculate the calorie intake is the Harris-Benedict formula. With its help, you can calculate the basal metabolic rate (BMR), namely the number of calories (energy) necessary for the proper functioning of the body: breathing, gastrointestinal tract, blood circulation, thermoregulation, nervous system, etc.

- Formula for men:

BMR = 88.36 + (13.4 × weight in kg) + (4.8 × height in cm) - (5.7 × age in years).

- Formula for women:

BMR = 447.6 + (9.2 × weight in kg) + (3.1 × height in cm) - (4.3 × age in years).

For example, a 25-year-old man with a weight of 72 kg and a height of 178 cm needs 1765 calories to provide energy to the whole body.

Do not forget about the load

Using this formula, only the basic level of calories is determined. But the needs of the body depend on the physical activity of a person:

- Sedentary lifestyle without stress - BMR multiplied by 1.

2.

2. - Workout 1-3 times a week - BMR times 1.375.

- Classes 3-5 days a week - BMR times 1.55.

- Intensive training 6-7 times a week - BMR times 1.725.

- Athletes who exercise more than once a day – BMR times 1.9.

What's next? Decide on a goal:

- I want to lose weight. Consume fewer calories than the result. It is recommended not to cross the minimum limit of calories per day - for women 1200 kcal, for men 1800 kcal. There are special low-calorie diets, but before using them, it is better to consult a specialist.

- I want to gain weight. On the contrary, eat more calories than the formula worked out. Nutrition for weight gain will also help you choose a specialist.

- My weight is perfect, I want to keep it. The formula indicated the approximate number of calories you need per day - stick to this value.

Remember, the health of the body and a beautiful figure depend not only on the number of calories, but also on the quality, composition, method of preparation, amount of food consumed and lifestyle.