How long to receive child tax benefit

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Child Tax Credit Payment Schedule for 2021

(Image credit: Getty Images)

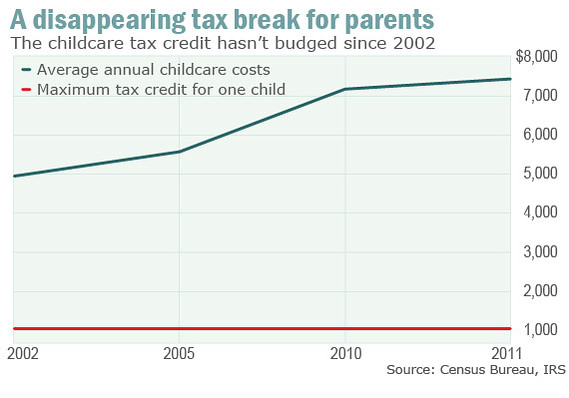

Monthly child tax credit payments were a godsend for many parents who struggled financially in 2021. Families that received their initial payment in July got up to $300-per-child each month (monthly payments could have been higher for parents who started receiving payments later). That kind of extra cash meant the difference between poverty and financial stability for some American families.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. Dates for earlier payments are shown in the schedule below. As it stands right now, the payments won't continue into 2022. However, President Biden and many members of Congress want to extend them beyond this year. So, there's a chance the IRS will still be sending monthly payments next year, too.

However, President Biden and many members of Congress want to extend them beyond this year. So, there's a chance the IRS will still be sending monthly payments next year, too.

Schedule of 2021 Monthly Child Tax Credit Payments

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of Kiplinger’s expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of Kiplinger’s expert advice - straight to your e-mail.

Swipe to scroll horizontally

| PAYMENT | DATE |

| 1st Payment | July 15, 2021 |

| 2nd Payment | August 13, 2021 |

| 3rd Payment | September 15, 2021 |

| 4th Payment | October 15, 2021 |

| 5th Payment | November 15, 2021 |

| 6th Payment | December 15, 2021 |

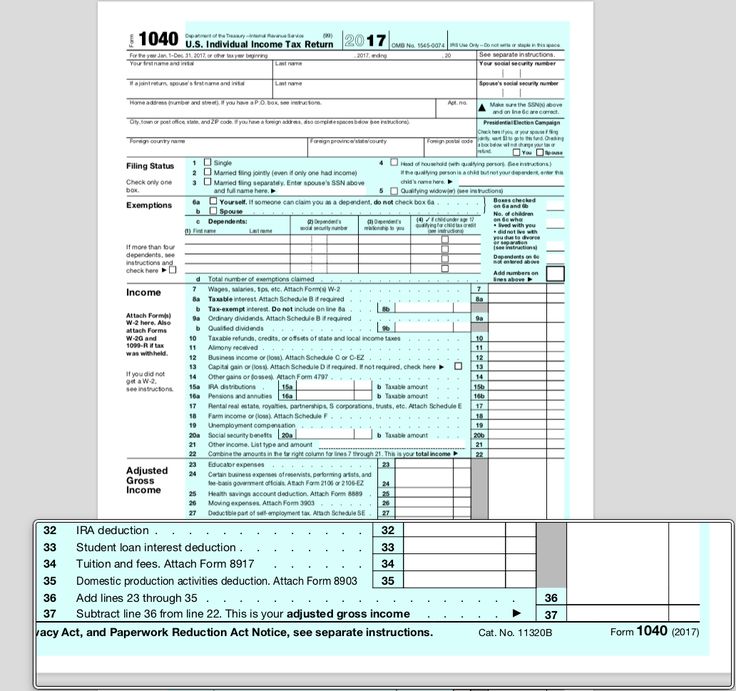

How Much Were the Child Tax Credit Payments Each Month?

The monthly payments were simply an advance of the child tax credit you would otherwise claim on your 2021 tax return, which must be filed by April 18, 2022. In most cases, if you received all six payments this year (i.e., from July to December), the combined total of all your payments equaled 50% of the credit you're expected to qualify for on your 2021 return. You'll claim the other half when your file your tax return next year. (Note that the monthly child tax credit payment amounts didn't include the $500 credit available for older children, elderly parents, and other dependents.)

In most cases, if you received all six payments this year (i.e., from July to December), the combined total of all your payments equaled 50% of the credit you're expected to qualify for on your 2021 return. You'll claim the other half when your file your tax return next year. (Note that the monthly child tax credit payment amounts didn't include the $500 credit available for older children, elderly parents, and other dependents.)

For 2021 only, the child tax credit amount was increased from $2,000 for each child age 16 or younger to $3,600 per child for kids who are 5 years old or younger and $3,000 per child for kids 6 to 17 years of age. If you received your first payment in July, that means the maximum monthly payment for each child under age 6 was $300 and $250 for each child age 6 to 17. Note that families with higher incomes didn't receive that much or were denied the credit altogether, but most eligible parents will see a considerable bump in their child tax credit for the 2021 tax year. (Use our 2021 Child Tax Credit Calculator to see how much you should have received each month if your first payment arrived in July.)

(Use our 2021 Child Tax Credit Calculator to see how much you should have received each month if your first payment arrived in July.)

Families who got their first monthly payment after July still received 50% of their total credit for the year. As a result, the total payment was spread over less than six months, making each monthly payment larger. For example, the maximum monthly payment for a family that received its first payment in November was $900-per-child for kids under age 6 and $750-per-child for kids ages 6 through 17. If you received your first payment in December, you got up to $1,800 for each child age 5 and under, and $1,500 for each kid age 6 to 17.

Are Child Tax Credit Payments Taxable?

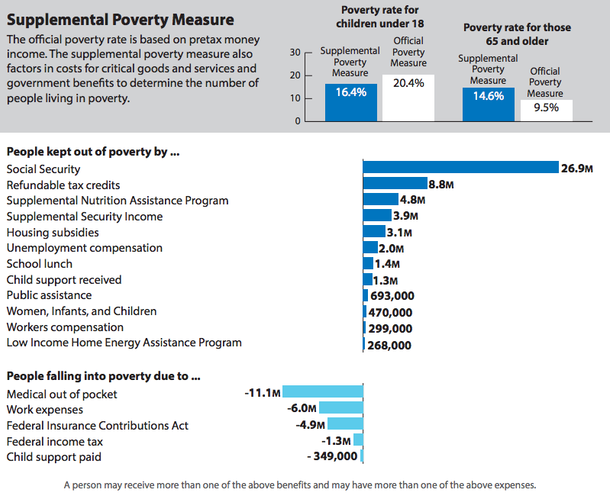

If you received monthly child tax credit payments in 2021, the IRS isn't going to tax that money when you file your tax return next year. The payments were simply an advance of the child tax credit that you will claim on your 2021 return – they aren't "taxable income. " (Since they're not income, the payments also won't affect your eligibility for SNAP, WIC, or other federal benefits.)

" (Since they're not income, the payments also won't affect your eligibility for SNAP, WIC, or other federal benefits.)

The monthly payments still can affect next year's tax bill or tax refund, though. Since they represent advance payments of the child tax credit, they'll be subtracted from the credit amount you're allowed to claim on your 2021 return. That will make your 2021 child tax credit smaller, which means either your tax bill will be higher or your tax refund will be smaller.

Will I Have to Pay Back Any of My Child Tax Credit Payments?

Some people will have to pay back all or a portion of the monthly child tax credit payments they received. Generally, the amount of each payment was based on your 2020 or 2019 tax return (whichever one was filed most recently). However, the total amount of your child tax credit will be based on information found on your 2021 return. As a result, if your circumstances changed in 2021, you may have gotten more this year in monthly payments than the credit you're entitled to claim on your 2021 return. This could happen, for example, if you earned more money in 2021 or you no longer can claim a child as a dependent this year (e.g., because of alternating custody under a divorce decree). Depending on your income, you may be required to pay back the overpayment, or at least some of it. For more on the payback requirements, see Warning: You May Have to Pay Back Your Monthly Child Tax Credit Payments.

This could happen, for example, if you earned more money in 2021 or you no longer can claim a child as a dependent this year (e.g., because of alternating custody under a divorce decree). Depending on your income, you may be required to pay back the overpayment, or at least some of it. For more on the payback requirements, see Warning: You May Have to Pay Back Your Monthly Child Tax Credit Payments.

Will There Be Child Tax Credit Payments in 2022?

In addition to increasing the credit amount and authoring monthly advance payments, Congress made other changes to the 2021 child tax credit, too. For example, the age for an eligible child was raised to 17, the credit is fully refundable, and the $2,500 earnings floor was removed. An additional layer of phase-outs was also introduced to prevent wealthier families from claiming a larger credit.

Right now, these enhancements only apply to the 2021 tax year. But, as mentioned earlier, President Biden and other lawmakers are trying to extend most of them beyond this year. Whether that happens remains to be seen, but if the Build Back Better Act is passed, the credit enhancements will apply in 2022 as well (with some changes). That would also mean monthly child tax credit payments would continue next year.

Whether that happens remains to be seen, but if the Build Back Better Act is passed, the credit enhancements will apply in 2022 as well (with some changes). That would also mean monthly child tax credit payments would continue next year.

We'll continue to cover any further child tax credit developments, but in the meantime you can get up-to-speed on all the changes for this year's credit at Child Tax Credit 2021: How Much Will I Get? When Will Monthly Payments Arrive? And Other FAQs.

Rocky is a Senior Tax Editor for Kiplinger with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, he worked for Wolters Kluwer Tax & Accounting and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky has a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

Rocky has a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

How to get a certificate of non-receipt of a tax deduction

05.05.2021

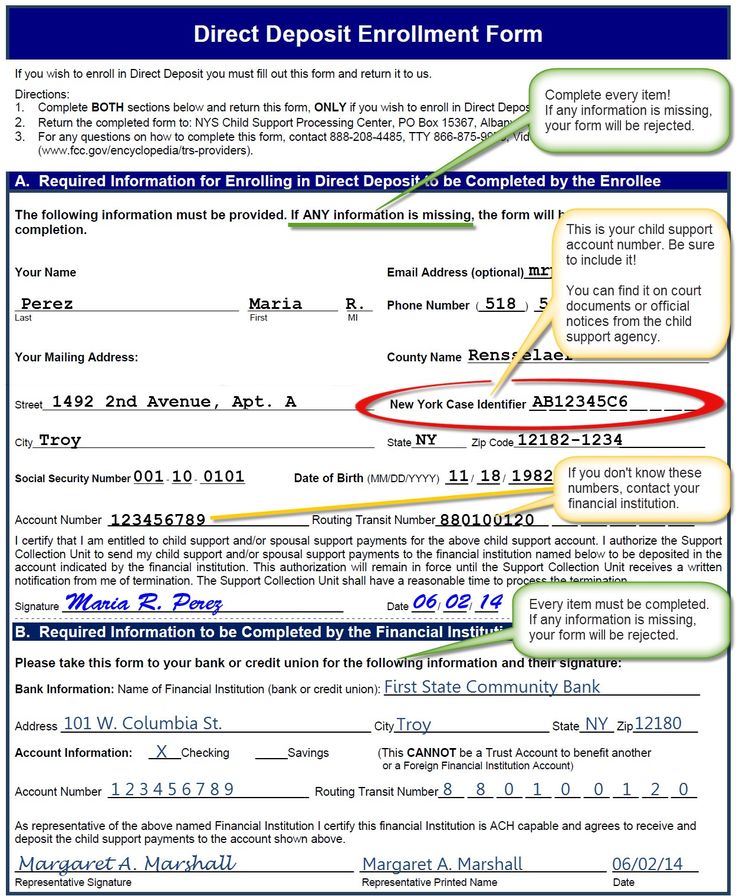

Such a certificate is needed if for some reason you terminated the insurance contract ahead of schedule and did not receive a tax deduction from the state. If you have a debt, a certificate will help you clear it.

Why debt arises

If you did not receive a tax deduction, you do not need to pay the debt.

nine0002 The appearance of debt is a standard security measure on the part of the state, so that those who receive the deduction immediately return it.A certificate of non-receipt of a tax deduction can be obtained from the tax office in person or online.

Step 1

Get a certificate from the tax office

Step 2

Send information to us

How to get a tax certificate online

You can get help online in a few minutes. You must have an account on nalog.ru or on State Services. nine0003

You must have an account on nalog.ru or on State Services. nine0003

- Log in to your personal tax office

- Go to the section "Life situations"

- Select the relevant certificate

- Fill in all fields of the application

Go to nalog.ru and log in to your personal account: using your login and password, using an electronic signature, or through your account on the State Services.

Next, find "All life situations" and click on "Request help and other documents."

Click on "Get a certificate confirming the fact of receipt (non-receipt) of a social deduction. nine0003

It is important to fill out the application correctly - a sample of the correct certificate and how its fields should be filled in can be viewed here.

The tax office will send you a certificate in several files. Please send us all the files you receive from the tax office.

How to get a certificate from the tax office

You can get a certificate from the tax office at the place of residence ( it will take about 30 times longer than getting help online ).

There are often errors in certificates - check it after receiving it without leaving the tax office.

Sample certificate can be viewed here.

- Choose the nearest tax office

- Prepare document package

- Apply in person or by Russian Post

- Wait until the help is ready

It is not necessary to apply to the inspection at the permanent registration address. Choose the nearest inspection to you.

Will need to submit:

- A copy of the life insurance contract - can be downloaded in your personal account

- A copy of payment documents confirming the payment of contributions - can be downloaded in your personal account

- A written application for a certificate - the form will be provided at the tax office

A package of documents can be sent by mail. Send them by registered mail with acknowledgment of receipt and a description of the attachment. nine0003

This takes some time. You will be told more about the terms in the tax service. After receiving the certificate, be sure to check it against this sample.

You will be told more about the terms in the tax service. After receiving the certificate, be sure to check it against this sample.

Send us a certificate in your Personal Account or Russian Post

- To send online:

- To send by Russian Post:

Log in to the Renaissance Life Personal Account, go to the Applications and Documents section, click Apply. Select the question "Cancel the insurance contract". Fill in the fields and upload all the files sent to you by the tax office. nine0015 The Tax Service will send you a certificate with several files. Please send us all the files that you receive from the tax office, without them we will not be able to accept the electronic document.

Send a certificate by registered mail with a description of the attachment to the address: Russia, 115114, Moscow, Derbenevskaya embankment, 7, building 22, floor 4, room 13, com. 11 for OOO SK Renaissance Life

The debt will be canceled ~ within a month after we receive the documents. nine0028

nine0028

Is it necessary to apply for a standard deduction annually

Is it necessary to apply for a standard deduction annually - BUKH.1C, website to help an accountantNews for an accountant, accounting, taxation, reporting, FSB, traceability and labeling, 1C: Accounting

- News

- Articles

- FAQ

- Videos

- Forum

06.08.2020

The Ministry of Finance clarified whether an employee, in order to receive a standard tax deduction, must annually submit an application to the employer and submit a certificate from the educational organization where his child is studying.

Letter No. 03-04-05/63596 dated July 21, 2020 reminds that the standard tax deduction is made for each child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, student under the age of 24.

The standard child tax credit requires a written application from the child's parent and proof of eligibility for the child's tax credit.

At the same time, the Tax Code of the Russian Federation does not contain requirements for the annual submission of an application to receive a standard tax deduction for a child.

This means that if the taxpayer's eligibility for the standard child credit has not ended, no re-application is required regardless of the end of the tax period. nine0003

However, if the application states that the employee is only requesting a child tax credit in a particular year, they must submit a new application in order to receive the child tax credit in the following year.

One of the supporting documents for the provision of a standard deduction for each full-time student, graduate student, intern, intern, student, cadet aged 18 to 24 is a certificate from the organization engaged in educational activities, which indicates the period and form of the child's education . nine0003

Accordingly, when deciding on the frequency of submitting a certificate, one should proceed from the fact that the tax deduction is provided for the period of education of the child (children) in an organization engaged in educational activities.

This means that if the certificate indicates the entire period of the child's education, then the annual submission of such a document is also not required.

Topics: standard tax deduction, documentation, personal income tax deduction, employee rights, deduction for training

Category: Documenting , Personal income tax (PIT)

Subscribe to comments

Write a comment

The Federal Tax Service has introduced application forms for offsetting and refunding taxes through a single tax account The Federal Tax Service has introduced a new methodology for organizing EDI with taxpayers Expansion of personal income tax benefits, replacement of inspections with preventive visits and the right to register based on scanned images of the primary: the best news of the week Material benefit in forgiveness of mortgage debt exempted from personal income tax Changes in 1C programs for calculating personal income tax and reporting from 2023 nine0027

Polls

Transition to new tax payment and reporting rules

Are you experiencing difficulties with the transition to new tax payment and reporting rules?

Yes, we have not quite figured out the transition to the EPP and the new reporting.