How long can you collect back child support

What is the Statute of Limitations on Child Support in Texas?

Texas parents have a general duty to provide financial support for their children.

If child support is not paid on time, custodial parents have a number of different enforcement tools at their disposal.

What happens if you don’t pay child support in Texas?

As explained by the Office of the Attorney General of Texas, the failure to pay child support could potentially lead to the interception of an income tax return, wage garnishment, or even a bank levy.

However, parents do not always have an unlimited amount of time to make a claim to recover overdue child support. A parent will lose their right to bring a legal claim if action is not taken before the statute of limitations expires.

Here, our experienced Waco, TX child custody attorneys explain the most important things that you need to know about the Texas child support arrears statute of limitations.

Texas Child Support Statute of Limitations

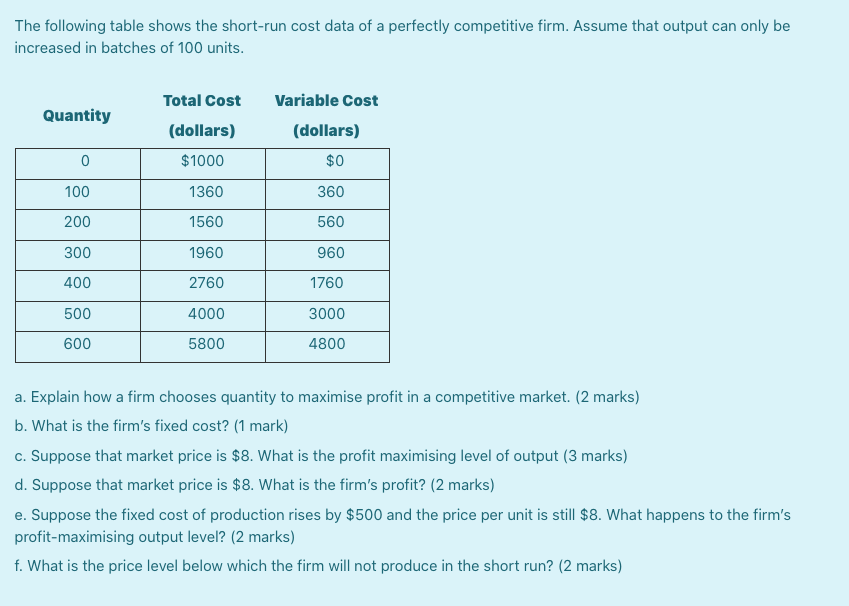

What is the Statute of Limitations With an Existing Court Order?If there is already a court order in place, then parents in Texas have considerable — but not unlimited — time to file for back child support.

Under Texas law, the statute of limitations for seeking back child support when a court order is already in place is ten years from the child’s 18th birthday. If a claim isn’t filed by the deadline, then any recovery for back child support in Texas may be denied.

What is the Statute of Limitations Without an Existing Court Order?If there isn’t an existing child support order in place, that does not mean that a non-custodial parent can simply avoid making payments. Child support is still owed, even without an official court order to mandate it.

However, in this circumstance, parents have far less time to seek financial relief for unpaid, overdue child support. Under Texas law (Texas Family Code – FAM § 154.131), the custodial parent has four years after the date of the child’s 18th birthday to file a claim. This is a far more strict back child support Texas statute of limitations.

Under Texas law (Texas Family Code – FAM § 154.131), the custodial parent has four years after the date of the child’s 18th birthday to file a claim. This is a far more strict back child support Texas statute of limitations.

Notably, this type of case is known as a retroactive child support claim — since financial recovery is being sought without any existing court order. With retroactive child support, Texas courts presume that the total amount of child support that will be awarded will not exceed the amount that would have been due over the previous four years had a child support order been in place.

This is a rebuttable presumption. If evidence can be presented that the non-custodial parent intentionally sought to avoid paying child support, a Texas court may allow retroactive child support in an amount beyond the general four-year limit.

Contact Our Waco, TX Child Support Lawyer Today

At the Law Office of Simer and Tetens, our Texas family attorneys have extensive experience handling the full range of child support cases.

If you have any questions about back child support in Texas, we are here to help. To set up a free, no obligation initial consultation, please do not hesitate to contact us today.

With an office in Waco, we also serve communities in McLennan County and throughout Central Texas.

Collecting Back Child Support After the Child Turns 18

By Christopher Coble, Esq. on September 15, 2016 | Last updated on March 21, 2019

Just because your ex missed a child support payment doesn't mean the obligation goes away. Like any financial obligation, the amount you're owed will accumulate and your ex will still be responsible for making back child support payments. But for how long? Child support generally runs until a child turns 18, but if your ex missed payments during that time, can you still collect back child support after that?

Here's what you need to know.

Emancipation and Arrears

Those who are late making child support payments are said to be "in arrears. " As noted above, this debt does not go away, even after the child turns 18. So even though the child has reached the age a majority, the payments that should have been made before he or she turned 18 are still enforceable after that.

" As noted above, this debt does not go away, even after the child turns 18. So even though the child has reached the age a majority, the payments that should have been made before he or she turned 18 are still enforceable after that.

Keep in mind that state laws can vary a little on this issue. For example, some states cut off child support at 18, some at 19, and others at 21. (And some dismiss child support obligations if the child has been "emancipated.") Also, some states and courts may modify child support obligations after the child turns 18, since the custodial parent no longer needs to support the child. Even with these differences, however, the rule is that child support payments must continue until the arrears balance is paid in full, regardless of the child's age.

Enforcement Actions

States and the federal government are pretty serious when it comes to enforcing child support orders. Enforcement officials can withhold or revoke driver's licenses or passports, garnish wages, seize tax refunds, place liens on property, or even sentence a delinquent parent to jail time. These enforcement measures can continue after the child turns 18, and most states do not allow child support obligations to be discharged in bankruptcy.

These enforcement measures can continue after the child turns 18, and most states do not allow child support obligations to be discharged in bankruptcy.

One thing to keep in mind is that some states may have statutes of limitation on collection of back child support, so may only have a limited time to collect after your child turns 18 or you may have to go back to court and renew the child support order.

Child support collection can be complicated, both legally and emotionally. If you have questions regarding child support obligations or are having trouble collecting back child support, you should contact an experienced family law attorney in your area.

Related Resources:

- Need help with child support? Get a free review of your case now. (Consumer Injury - Family)

- Child Support Enforcement Options (FindLaw's Learn About the Law)

- How Long Can I Collect Past-Due Child Support? (FindLaw's Law and Daily Life)

- Dad Pays Back Child Support, Gets 6 Mos.

in Jail (FindLaw's Law and Daily Life)

in Jail (FindLaw's Law and Daily Life)

You Don’t Have To Solve This on Your Own – Get a Lawyer’s Help

Meeting with a lawyer can help you understand your options and how to best protect your rights. Visit our attorney directory to find a lawyer near you who can help.

Content For You

Civil Rights

Block on Trump's Asylum Ban Upheld by Supreme Court

Criminal

Judges Can Release Secret Grand Jury Records

Civil Rights

Politicians Can't Block Voters on Facebook, Court Rules

Recovery of alimony for the past period \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Recovery of alimony for the past period

A selection of the most important documents upon request Collection of alimony for the past period (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more ...

Judicial practice : Alimony for the last period

Register and get a binding access to the Minor Access to system ConsultantPlus free of charge for 2 days

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 113 "Determination of alimony debt" of the RF IC

(R.B. Kasenov) The court refused to satisfy the claims of the plaintiff - the recoverer of alimony for a minor child in enforcement proceedings to recognize as illegal the inaction of the bailiff, expressed in the refusal to calculate the debt on alimony; on the obligation of the bailiff-performer to calculate the debt. At the same time, the court recognized the conclusions of the trial court that the provisions of paragraph 2 of Art. 113 of the Family Code of the Russian Federation are of a general nature in relation to paragraph 1, since the fault of the alimony non-payer is presumed, therefore it is necessary to calculate the debt for the entire period from the moment the alimony is collected. As the court pointed out, as a general rule, the recovery of alimony for the past period is carried out within the three-year period preceding the presentation of the writ of execution for recovery. Alimony for the past period may be recovered within a three-year period from the date of applying to the court, if the court establishes that prior to applying to the court, measures were taken to obtain funds for maintenance, but the alimony was not received due to the evasion of the person obliged to pay alimony from their payment . In the case under consideration, there is no evidence in the case file confirming that the debtor evaded the payment of alimony. These circumstances indicate that there are no grounds for recognizing as illegal the inaction of the bailiff in terms of calculating the debt.

113 of the Family Code of the Russian Federation are of a general nature in relation to paragraph 1, since the fault of the alimony non-payer is presumed, therefore it is necessary to calculate the debt for the entire period from the moment the alimony is collected. As the court pointed out, as a general rule, the recovery of alimony for the past period is carried out within the three-year period preceding the presentation of the writ of execution for recovery. Alimony for the past period may be recovered within a three-year period from the date of applying to the court, if the court establishes that prior to applying to the court, measures were taken to obtain funds for maintenance, but the alimony was not received due to the evasion of the person obliged to pay alimony from their payment . In the case under consideration, there is no evidence in the case file confirming that the debtor evaded the payment of alimony. These circumstances indicate that there are no grounds for recognizing as illegal the inaction of the bailiff in terms of calculating the debt.

Register and get the trial access to the consultantPlus system free 2 days 2 days

Open the document in your consultantPlus system:

Selection of court decisions for 2020: Article 107 "The deadlines for applying for alimony" of the IC of the Russian Federation

(p .B. Kasenov) The court partially satisfied the claims of the plaintiff to the defendant for the recovery of alimony for the maintenance of a minor child. At the same time, the court indicated that, in accordance with Part 2 of Art. 107 of the Family Code of the Russian Federation, alimony is awarded from the moment of applying to the court. Alimony for the past period may be recovered within a three-year period from the date of applying to the court, if the court establishes that prior to applying to the court, measures were taken to obtain funds for maintenance, but the alimony was not received due to the evasion of the person obliged to pay alimony from their payment . In this case, the court refused to satisfy the plaintiff's claims for the recovery of alimony from the defendants for the maintenance of the child for the period from the moment of divorce until the moment of filing a claim with the court, based on the fact that reliable evidence indicating that the plaintiff had taken measures before going to court to receive funds from the defendant for the maintenance of the child, but the alimony was not received due to his unlawful evasion, was not presented.

Articles, comments, answers to questions : recovery of alimony for the past period

Register and receive trial access to the ConsultantPlus system free 2 days

Open the ConsultantPlus:

Article: Disputes on the recovery of alimony for minor children (based on the judicial practice of the Moscow City Court)

("Electronic magazine "Advocate Assistant", 2022) As a general rule, alimony is awarded from the moment you apply to the court (clause 2, article 107 of the RF IC). However, the law provides for the possibility of recovering alimony for the past period within a three-year period from the date of applying to the court.For the court to make an appropriate decision, the plaintiff must prove that before applying to the court he took measures to obtain funds for the maintenance of the child, but did not receive them due to the defendant's evasion from their payment (for example, Appellate rulings of the Moscow City Court dated 10. 06.2021 in case N 33-23383/2021, dated 06/24/2021 in case N 33-16479/2021, dated 06/16/2021 in case N 33-19802/2021, dated 04/16/2019 in case N 33-15990/2019).

06.2021 in case N 33-23383/2021, dated 06/24/2021 in case N 33-16479/2021, dated 06/16/2021 in case N 33-19802/2021, dated 04/16/2019 in case N 33-15990/2019).

Normative acts : Collection of alimony for the past period applying to the court, if the court established that prior to applying to the court, measures were taken to obtain funds for maintenance, but the alimony was not received due to the evasion of the person obliged to pay the alimony from paying them.

Decree of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 N 56

"On the application by the courts of the law when considering cases related to the recovery of alimony" The court has the right to satisfy the claim for the recovery of alimony for the past period within a three-year period from the moment of applying to the court, if in during the trial, it will be established that before going to court, measures were taken to obtain alimony, but they were not received due to the evasion of the person obliged to pay alimony from paying them (paragraph two of paragraph 2 of article 107 of the RF IC).

Accelerated proceedings on a payment order for the recovery of maintenance

The court decides in expedited proceedings on a payment order claims for the payment of a certain amount of money , arising from private law relations . Here the parties to the process are the debtor and the applicant.

If the application for expedited proceedings on a payment order complies with the requirements specified in the law, the court delivers to the debtor payment proposal and objection forms (objection form with instructions available here ). The debtor may file an objection against the claim or part of it to the court that made the payment offer within 15 days , calculated from the delivery of the payment offer, in case of delivery of the payment offer abroad - within 30 days. The objection may be submitted on the form attached to the payment proposal or in another form. You don't need to substantiate your objection. Compliance with deadline is extremely important in terms of making a court decision (you should also take into account the time during which the application will be delivered to the court).

Compliance with deadline is extremely important in terms of making a court decision (you should also take into account the time during which the application will be delivered to the court).

If the debtor files a timely objection to the proposal for payment , then the court continues the proceedings in action proceedings (unless the applicant has unequivocally expressed a desire to terminate the proceedings in case of filing an objection - then the proceedings are terminated).

If the debtor did not pay the amount named in the payment proposal and did not submit objections to the payment proposal in a timely manner , then the court takes an order to recover the amount from the debtor . The resolution on debt collection is an executive document, on the basis of which it is possible to initiate enforcement proceedings.

If you have received a payment proposal from the court and agree with the requirements given in it, but wish to pay the debt in installments, then you need to contact the applicant to agree on a payment schedule. If you have agreed on a payment schedule among yourselves, then the debtor and the applicant must submit to the court a written application for payment of the debt in installments . Then the court may, together with the adoption of the resolution on the recovery of money from the debtor , approve payment schedule for the payment of the debt.

If you have agreed on a payment schedule among yourselves, then the debtor and the applicant must submit to the court a written application for payment of the debt in installments . Then the court may, together with the adoption of the resolution on the recovery of money from the debtor , approve payment schedule for the payment of the debt.

The resolution on debt collection is subject to immediate execution, irrespective of the delivery of the resolution on debt collection to the debtor. This means additional costs in enforcement proceedings if the claim is not paid.

The debtor may file an audit complaint against the debt collection order within 15 days (if the debt collection order is delivered abroad, within 30 days), counting from the delivery of the debt collection order to the debtor.

The private complaint of the debtor must be based on one of the following circumstances:

- the payment proposal was delivered to the debtor not under a personal signature and not in time without the fault of the debtor, and therefore the debtor was not able to file an objection in time;

- the debtor was unable to submit an objection to the offer of payment for a good reason beyond his control;

- The prerequisites for accelerated proceedings on a payment order have not been met, or the conditions for accelerated proceedings on a payment order have been violated in another material way, or the claim for the recovery of which an accelerated procedure has been carried out is manifestly unfounded.