How is child support calculated for military

Calculating Child Support When the Paying Parent Is in the Military

Family support rules may be different when the paying spouse is in the military.

By Shae Irving, J.D.

If the parent who must pay child support is in the military, it can be challenging to calculate the proper amount. This article can help you find your way.

Where to Start

To calculate a reasonable amount of child support, start with your state's child support guidelines. If you and the other parent can't agree on the support amount and a court hasn't yet weighed in, you can consult military guidelines. Each branch of the military has its own guidelines for appropriate interim family support when the state hasn't yet established a support order. Generally, however, the amounts are less than what state guidelines provide.

Be aware that it can be difficult to find information about the military's child support guidelines. If you need to establish interim support, check with your state's child support enforcement agency or seek help from a military Legal Assistance Office. (You can use the online legal services locator to find an office near you.)

Calculating a Service Member's Income

Because military paychecks are unlike any other paychecks, it can be a real challenge to determine what a service member's actual pay is. This is unfortunate given that a parent's income is always the basis for calculating child support. To get started with your state's child support guidelines, you'll need to know the service member's income as well as the amount of any payments the service member is making for the children's health insurance or for work-related day care.

Start with the service member's base salary. There's also a housing allowance, calculated using location, family commitments, and the service member's pay grade. There are also pay differentials for hazardous assignments and other variations in responsibilities. It's possible that the service member is receiving "in-kind" compensation in the form of housing, meals, and other nonmonetary compensation.

In trying to determine the other parent's income, don't use a tax return, because some of the income that service members receive is tax-free, and you'll be working with an amount that's too low. Instead, use the Leave and Earnings Statement (LES), which is similar to a pay stub but more comprehensive. The LES will show you the service member parent's basic pay and housing and other allowances, as well as information about how many dependents the service member is claiming and how much accrued leave is available.

The IRS doesn't tax military housing and food allowances, but most states' child support guidelines include all income, whether it's taxable or not. In recent years, with many more service members on active duty, state courts have begun to weigh in on this issue. They appear to universally agree that even though allowances and in-kind compensation are nontaxable, they should be counted as income for purposes of calculating support. In-kind compensation can include onbase housing -- so if a service member lives on the base, the value of the housing can also be included.

As always when you're dealing with the U.S. military, you may not have an easy time getting access to the information you need. In fact, you may be required to submit a Freedom of Information Act request if your spouse won't cooperate and provide the LES. You'll probably need an attorney's help for this, but you also could seek assistance from a child support enforcement agency. (Links to the child support enforcement agencies for every state are available at the National Child Support Enforcement Association website.)

Excerpted from Nolo's Essential Guide to Child Custody & Support, by Emily Doskow.

Talk to a Lawyer

Need a lawyer? Start here.

Military Divorce - Special Considerations for Calculating Child Support

The general method for calculating child support is similar in every state. You begin with each parent's gross income and subtract legitimate deductions including state and federal taxes, Social Security and Medicare contributions to determine net income.

Each state has a table of support guidelines based on that state's cost of living and other relevant factors. Locating the combined net income amount in the support guidelines will show the total child support obligation owed by both parents.

The total support obligation is then split based on each parent's share of net income. If a parent earns 60% of total net income, that parent will be responsible for payment of 60% of the total support obligation.

In many states, courts can deviate from the basic support obligation and order payment of higher or lower amounts based on numerous factors. These include extremely low or high parental income, support obligations owed to other children, and special needs of a child.

When civilian parents are employed, calculating support is often a relatively straightforward procedure. However, when a spouse is serving in the military, determining the proper income amount to use for support purposes can present challenges.

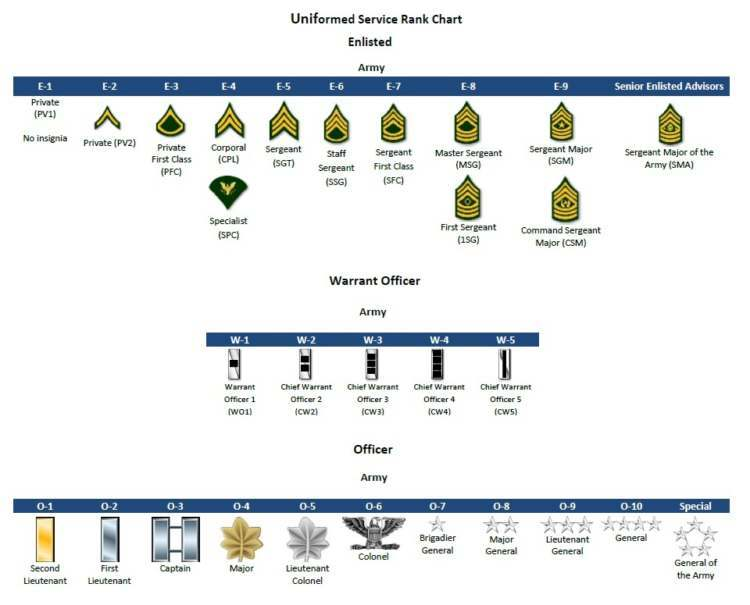

Military paystubs look very different and contain information you don't see on civilian paystubs. It is critical to use the service member's Leave and Earnings Statement (LES), the military's version of a paystub. In addition to base pay, the statement will show the service member's rank, years of service, allowances received, the number of dependents being claimed and the amount of leave time available.

It is critical to use the service member's Leave and Earnings Statement (LES), the military's version of a paystub. In addition to base pay, the statement will show the service member's rank, years of service, allowances received, the number of dependents being claimed and the amount of leave time available.

In addition to the base pay amount, the LES will show any incentive or special pay the service member has received. For example, this may include a higher pay level for hazardous duty, aviation career incentive pay and special pay awarded to medical and dental officers.

Housing and Meal Allowances in a Military Divorce

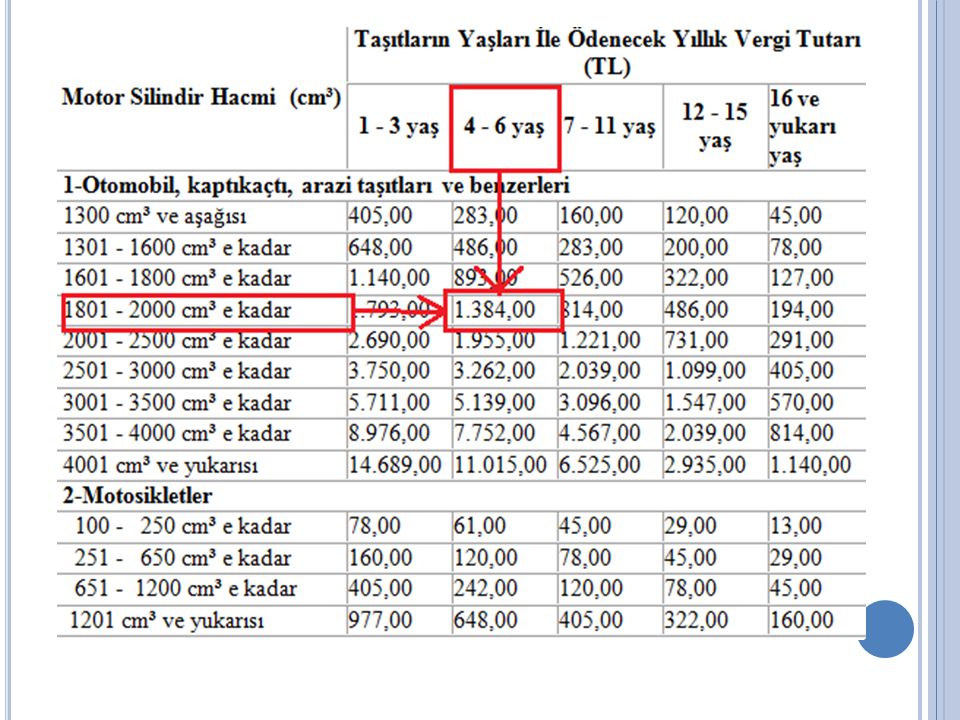

When determining the income amount to be used for support calculations, non-taxable benefits including housing and meal allowances must be considered. The basic allowance for subsistence (BAS) is a specific amount paid to service members for their personal food expenses. For 2021, the BAS is $266.18/mo. for officers and $386.50/mo. for enlisted personnel.

for officers and $386.50/mo. for enlisted personnel.

The basic allowance for housing (BAH) varies depending on pay grade, location and whether the service member has dependents. The BAH "with dependents" amount remains the same whether the dependent is a spouse, a child or a spouse and children. BAH amounts are based on housing rental costs in the area where the service member is stationed. Housing allowances are usually not provided if a service member lives on base or in other government-provided housing.

In an expensive housing market like Seattle, an officer with an O-1E pay grade would receive a monthly BAH of $2679 without dependents and $3258 with dependents. This is a substantial amount of income that should not be overlooked when calculating support. The website of the Defense Travel Management Office for the U.S. Department of Defense includes a useful BAH calculator.

The Internal Revenue Service classifies food and housing allowances as untaxable income. However, for calculating child support, most states require all income to be disclosed regardless of whether it is taxable. This also applies to non-monetary compensation such as on-base housing.

This also applies to non-monetary compensation such as on-base housing.

BAS and BAH are cash benefits, and the amounts should be included in financial affidavits required by courts and in calculations for child support. If a service member receives free housing by living on base, the value of that housing may not be included in gross income as defined by state law. However, the potential value of that housing might still be considered by a court to justify an upward deviation from the basic support obligation.

Special and Incentive Pay in a Military Divorce

Special and incentive (S&I) pay are typically used to improve recruiting or to retain persons with critical skills and important occupational specialties. Currently, there are more than 60 S&I pays authorized by law.

Some examples include Hardship Pay of up to $150 a month for service members living outside the continental United States in areas where the qualityof life conditions are substantially below U. S standards. Imminent Danger Pay of up to $225 a month may be paid to service members deployed to foreign areas where they are subject to the threat of physical harm or imminent danger resulting from insurrection, civil war, terrorism, or wartime conditions.

S standards. Imminent Danger Pay of up to $225 a month may be paid to service members deployed to foreign areas where they are subject to the threat of physical harm or imminent danger resulting from insurrection, civil war, terrorism, or wartime conditions.

Assignment Incentive Military Pay of up to $3,000 a month is paid to service members for unusual assignment circumstances. Service members with certain skills who served 12 months in Iraq and Afghanistan and volunteered to agree to extend their tours received assignment incentive military pay of $300-$900 per month depending on the length of the extension. If service is in a war zone, this pay is not taxable.

Payment of annual bonuses to service members can be substantial and must also be considered as part of gross income. For example officers of the Air Force Medical Service Corps may get an annual bonus of up to $75,000 simply by agreeing to remain on active duty for not less than one year.

Courts often require both spouses to provide relevant financial documents to each other and the court when child support is being considered. At a minimum, the non-military spouse should request the other spouse's most recent tax return, 12 months of earning statements and any documentation showing receipt of bonuses and payments not reflected by those statements for the past year.

At a minimum, the non-military spouse should request the other spouse's most recent tax return, 12 months of earning statements and any documentation showing receipt of bonuses and payments not reflected by those statements for the past year.

Income should never be determined by relying exclusively on the service member's income tax return. A substantial amount of military income, such as BAS and BAH payments, may be untaxable and not reported to the IRS, but that income would be relevant for child support calculations.

Calculating a fair and proper amount of child support is among the most important tasks when going through a divorce. Particularly when children are involved, consultation with a family law attorney is well-advised. When a spouse is a service member, choosing an attorney with experience handling military divorces should help ensure that important financial details are fully disclosed and reviewed. If you have any questions concerning a military divorce and child support, call the Law Offices of Peter Van Aulen at 201-845-7400 for a free initial consultation.

How to get alimony from a mobilized person, October 2022 | v1.ru

All news2023 is a chariot: what will be the year of the Black Rabbit? We consider our personal forecast together with a numerologist

They will not ask for consent: the paratrooper was instructed to introduce domestic IT technologies in Volgograd and the region

Artur Smolyaninov*, who admitted that he would have fought on the side of Ukraine, was declared a foreign agent

Coffee grounds, a ring on a thread and chocolate eggs: we talk about interesting fortune-telling for Christmas time

The State Duma did not agree on sending unserved storekeepers over 30 years old for military training

Volgograd officials moved the final minibus of Rodnikovaya Dolina

Fashion returns: the main haircut of 2023 - it will suit any appearance and almost does not require styling

Sometimes they return : we are looking where tripods will appear again in Volgograd and the region

The authorities of Volgograd gave another contract to the company participating in the development of 300 million for the repair of the Alley of Heroes

“The military commissariat acts with impunity”: a mother sued the military and saved her son who was illegally mobilized

“Sinara-Development” in Volgograd commissioned a high-comfort house

“Great grief and ordeal”: ex-deputy head of the regional agricultural committee died in Volgograd

A mobilized master of a weaving factory from the Volgograd region died in Ukraine

The disease is extremely dangerous for children: an outbreak of a deadly infection in Volgograd for the first time in three years

In Volgograd, two breaks engulfed residential buildings and a court in an ice ring

“They were also asked to close the door”: in Volgograd, the Criminal Code explained the lack of water and heat in an apartment building

three children

Thanks for the morning fitness: Volgograd residents stormed buses from the airport

Old New Year, skating rinks, theaters and humor: where to go on weekends in Volgograd

“Victory will be ours”: members of the special operation demanded to rename Volgograd to Stalingrad

Hiding under a hood: in Volgograd, a sentence was passed on a shooter who was urinating in the middle of an intersection

Important medicines were missing from pharmacies. We tell you what drugs are difficult to find and what are the reasons

We tell you what drugs are difficult to find and what are the reasons

“They opened the way for infection”: Volgograd officials were accused of murderous pruning of trees

The first victim in a bus accident was discharged from a hospital in the Volgograd region

Back to the past! Paper five-rouble notes returned to Russian stores0003

“All questions to the Criminal Code”: the windows of Volgograd residents were covered with a layer of frost due to lack of heating

“Deep people” have nothing to worry about. What will happen to the Russian economy in 2023? 5 stories

"They will protect the Christmas tree": residents of Volgograd and the region are promised unusual work for a salary from the budget

A man has been suing the tax office for two years for overpayment nine years ago. And got my money back with 9 percent0003

A teenager found dead in his own bathroom near Volgograd

“The mayor’s office set me up!”: Volgograd residents were massively late for work due to uncleaned roads

More than 12,000 families in Volgograd settled in comfortable houses from DARS Development shrinkflation. What is it and what trick do sellers use?

What is it and what trick do sellers use?

"Kraken", "griffin" or Chinese "noname" - who wins: experts - about new strains of covid and their symptoms

"A subscription to extreme sports as a gift from the authorities": two districts of Volgograd were left without electricity useful”: what is happening with the currency and what to expect from it in the new year0003

Photo: Artem Lenz / NGS24.RU

Share

After the announcement of partial mobilization in Russia, the problem of non-payment of alimony became more acute. Now the military has the right to apply to the bailiffs with a statement on the suspension of enforcement proceedings, respectively, for the duration of the service, all transfers can be paused. But even if such a statement is not written, it is now difficult for women to get money from the places of service of ex-husbands. 74.RU discusses different situations with a lawyer. nine0089

nine0089

Photo: Elena Latypova / NGS55.RU

Share

The source of income has changed for those mobilized and simply sent to serve under a contract, and for those to whom they pay alimony, this has become a problem. Irina, a resident of Tyumen, shared her story. Her ex-husband, a pensioner from the Ministry of Internal Affairs, signed a contract with the Ministry of Defense on June 30.

— I received alimony from my pension, and now I received a notification that he was reinstated in the service. The Ministry of Internal Affairs now does not pay me alimony, and I also do not receive anything from the income that he now receives in the service, ”says Irina. - She came to the bailiff, she said: "I don't know what to do with you." I went to the military registration and enlistment office, they say that they don’t send any documents anywhere, this is not their duty. In Yelan, where he was sent for training, they gave him the number of the unified settlement center of the Ministry of Defense of the Russian Federation, they say: “We will accrue [alimony] only if the original documents are sent to us by mail. ” And no one gives me the original documents as an ordinary citizen. It turns out that I have been fighting for a month and I can’t get anything - a vicious circle, you don’t know which doors to knock on. nine0089

” And no one gives me the original documents as an ordinary citizen. It turns out that I have been fighting for a month and I can’t get anything - a vicious circle, you don’t know which doors to knock on. nine0089

According to Irina Zaitseva, Senior Associate at Filatov & Partners Law Firm, the procedure for collecting alimony from those mobilized remained the same as before the announcement of partial mobilization, in accordance with the Family Code of the Russian Federation. If the debtor is in the service, there are several options for transferring alimony. When this is done voluntarily, the soldier can send money himself, but with this option there may be some difficulties, for example, there may be no connection and the ability to connect to a mobile bank. The second option is to issue transfers through the employer. nine0089

- In this case, the debtor refers the writ of execution to the employer, and all payments are made through a single settlement center of the Ministry of Defense, - explains the specialist.

Photo: Ekaterina Tychinina / 74.RU

Share

In cases where alimony has to be collected through the FSSP, the lawyer advises contacting the bailiff and insisting that he find the debtor and establish his new place of work (service).

“A woman herself cannot request data from the military registration and enlistment office, but this can be done by a bailiff, he has broad powers, they can request a lot, get it, you just need to make an effort,” says Irina Zaitseva. - If there is no action on the part of the bailiff, you can write a complaint about inaction to the head of the district department of the FSSP or go to court with an administrative claim and recognize the inaction of the bailiff as illegal. nine0089

The delays that are happening now, the lawyer connects with a large number of bailiffs mobilized and insufficient experience in the current conditions. Maybe things will settle down in the near future.

Photo: Elena Latypova / NGS55.RU

Share

However, those who receive alimony by court order may already face a new problem. Recently, enforcement proceedings against military personnel can be suspended at their request - including alimony. To do this, it is enough for the debtor to fill out an application at the military registration and enlistment office, at the department of the Federal Bailiff Service or through the State Services. Moreover, even close relatives of the debtor can now submit such an application. nine0089

— Suspension of enforcement proceedings against military personnel is of a declarative nature, that is, a citizen, in accordance with Part 2 of Article 40 of the federal law “On Enforcement Proceedings,” has the right to apply for a temporary suspension of enforcement proceedings in connection with military service, — commented in the management of the Federal bailiff service in the Chelyabinsk region. - Enforcement proceedings are suspended until the circumstances that served as the basis for its suspension are eliminated, and until it is resumed, the application of enforcement measures is not allowed. nine0003

- Enforcement proceedings are suspended until the circumstances that served as the basis for its suspension are eliminated, and until it is resumed, the application of enforcement measures is not allowed. nine0003

This message pops up on the website of the Office of the Federal Bailiff Service for the Chelyabinsk Region

Photo: R74.fssp.gov.ru

Share

will write off payments, charge him penalties and fines. But this does not relieve the parent of the obligation to pay alimony - the debt will still accumulate, and after the end of the service, when the enforcement proceedings are resumed, it will have to be paid off. nine0089

In the event of the death of the debtor, the debts will have to be collected from the heirs.

news from the story

Subscribe to important news about the special operation in Ukraine

— If a person dies, enforcement proceedings are terminated due to the death of the debtor, but do not forget that debts are also inherited, — reminds the lawyer. “Even if the claimant has not found an heir, he can file a lawsuit against the estate if he knows that the debtor had an apartment or some other property. The courts accept such claims, search for heirs, and this way you can collect a debt. nine0089

“Even if the claimant has not found an heir, he can file a lawsuit against the estate if he knows that the debtor had an apartment or some other property. The courts accept such claims, search for heirs, and this way you can collect a debt. nine0089

Earlier, the lawyer explained that the obligation to pay alimony is not removed from the parents called up for service on partial mobilization.

Related

-

November 28, 2022, 09:00

“The child just went to work.” A 17-year-old guy was charged taxes for his father, who died 15 years ago -

January 13, 2023, 10:00

A man sued the tax office for two years for an overpayment nine years ago. And he returned his money with interest -

August 18, 2022, 08:00

Is this even legal? After the father's death, the daughter sued for inheritance with his common-law wife for more than a year -

October 14, 2022, 08:00

Summons instead of a trip: is it possible to leave Russia if you were stopped by border guards -

October 06, 2022, 12:00

Print apartment and pick up from work: what the military commissar cannot do

Svetlana Talipova

columnist

AlimonySpecial operationMobilizationPartial mobilization

Did you see a typo? Select a fragment and press Ctrl+Enter

COMMENTS8

Read all comments

What can I do if I log in? November 2, 2022 | 59. ru

ru

1

To whom can a mobilized person be obliged to pay alimony?

We are used to the fact that alimony is usually paid to their minor children, but this is only a special, albeit common, case. nine0089

“The issue of alimony between family members is regulated in section 5 of the Family Code of the Russian Federation, where obligations are regulated in the relevant chapters,” Magomed Kantaev tells a 59.RU correspondent. - So, except for a minor child, alimony can be paid to disabled needy parents, spouses and former spouses, other family members (brothers and sisters, grandparents, stepsons and stepdaughters, etc.).

Share

2

Should a mobilized person pay alimony?

Even in the case of mobilization, a man will continue to pay alimony, since as a parent he is obliged to support his minor children, says Magomed Kantaev. This obligation is established by Article 80 of the Family Code of the Russian Federation, according to which parents can independently agree on the amount of payments, or they are determined by the court. The same applies to alimony to parents, spouses, former spouses, grandparents, grandchildren, etc. nine0003

The same applies to alimony to parents, spouses, former spouses, grandparents, grandchildren, etc. nine0003

There is an exemption from maintenance obligations. The list of grounds for terminating the payment of alimony is established by Article 120 of the Family Code of the Russian Federation.

So, if alimony was collected in court, then payments stop: when the child becomes an adult or fully capable before the age of 18, if the child was adopted or adopted, if the one who paid the alimony, or the one who was paid, died. Also - already in the case of adults - if the court recognized the restoration of the ability to work or the termination of the need for assistance of the recipient of the alimony, if the disabled ex-spouse in need of assistance entered into a new marriage. If the alimony is paid by agreement, then the obligations under them cease due to the death of one of the parties, as well as "the expiration of this agreement or on the grounds provided for by this agreement. " nine0003

" nine0003

Mobilization is not included in the list of reasons for exemption from payment and is not a basis for this, the lawyer emphasizes.

Share

3

From what income will the mobilized person pay alimony?

Lawyer Magomed Kantaev explains: according to Article 12 of the Federal Law “On the status of military personnel”, servicemen are provided with monetary allowance.

“Consequently, alimony can be deducted from this allowance,” says the lawyer. nine0089

Earlier, the military commissar of the Perm Territory, Alexander Kokovin, told how much the mobilized would be paid for participating in the SVO, and explained in what dates the mobilized should be paid monetary allowances.

Share

4

If a person mobilized in the SVO cannot pay alimony and there is a debt, then what?

Magomed Kantaev says that if a person has a debt on alimony obligations, the court can release him from paying it. nine0003

nine0003

This is regulated by article 114 of the RF IC - it states in which cases a person can be released from paying a debt: in case of mutual agreement of the parties - but not when it comes to paying alimony to minors, or by a court decision, if the one who must pay alimony, for example, was ill or his financial or marital status changed.

As Magomed Kantaev explains, potentially all of the listed criteria can be proved.

- You can prove it, for example, with income certificates, marriage certificates, birth certificates of a child and others, - says the lawyer. - It seems that the criterion as a guideline [if we talk about the financial situation] is the established minimum wage. nine0089

In addition, Magomed Kantaev suggests that participation in the SVO may be a valid reason for paying alimony debt. That is, if a man cannot pay alimony during a special operation and a debt arises during this time, the court can consider this case and release the man from the debt.![]() Upon returning from the CBO, the person will simply continue to pay child support as usual. True, the lawyer notes that so far no one knows how law enforcement practice will develop.

Upon returning from the CBO, the person will simply continue to pay child support as usual. True, the lawyer notes that so far no one knows how law enforcement practice will develop.

Share

5

Can a mobilized person be sued for non-payment of alimony?

- If he is in the SVO, the ex-wife (or person entitled to alimony. - Note ed. .) will be able to sue for alimony, since the man has an obligation to support his minor children (or needy relatives - Note ed .) and monetary allowance is provided for the soldier, - the lawyer explains. nine0089

Share

6

If a person did not pay alimony before mobilization, can they be sued for those debts?

As we wrote above, if a mobilized person cannot pay alimony, as he is on a special operation, then the court can recognize his participation in it as a good reason and release the person from the debt (but not from paying alimony when he finishes serving).