How is child support arrears calculated

Child Support Arrears

If you are owed child support, it is essential to understand the tools you have at your disposal to resolve any issues. Here, the experienced attorneys at Rodier Family Law explain what child support arrears are and how you can collect on missed payments.

Child Support Arrears

Many non-custodial parents, or parents without primary custody, are mandated by the court to provide financially for their child. When these parents fail to make the mandated payments, and child support becomes past due, it is termed “Child Support Arrears.”

Because many single parents and their children depend on support payments, a series of policies and enforcement laws have been put in place to ensure that custodial parents are able to receive the full amount they have been awarded by the court.

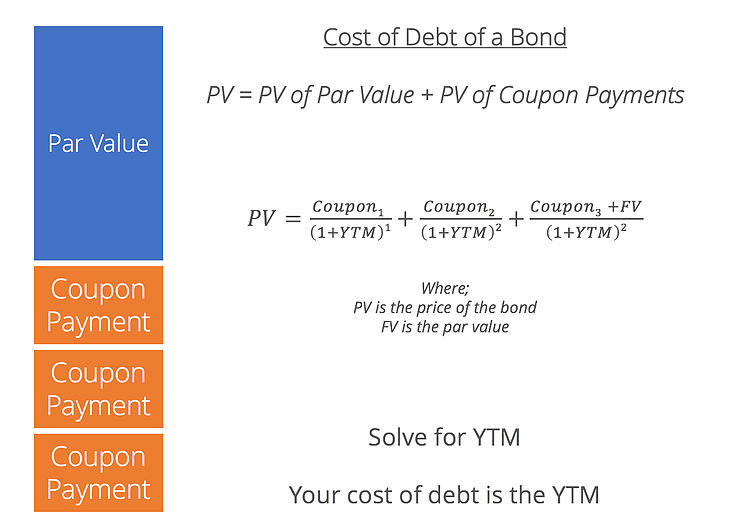

Calculation of The Child Support Arrears

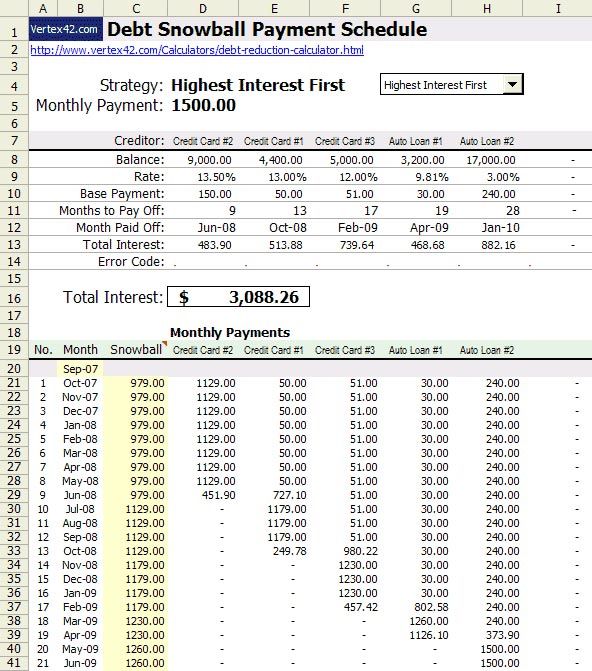

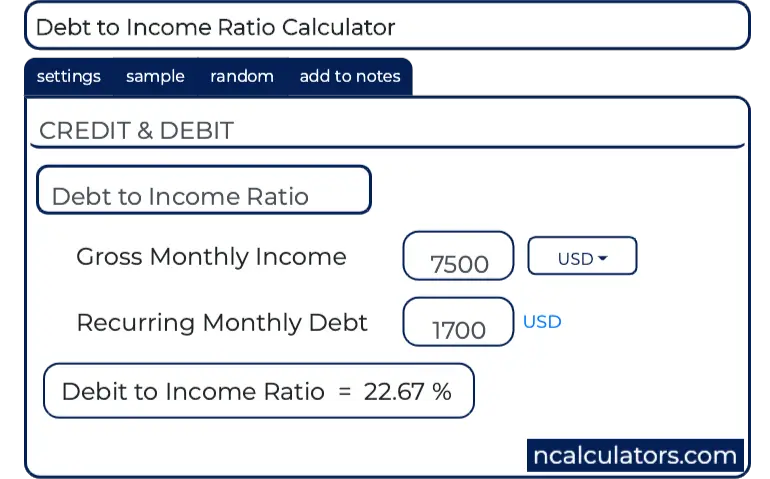

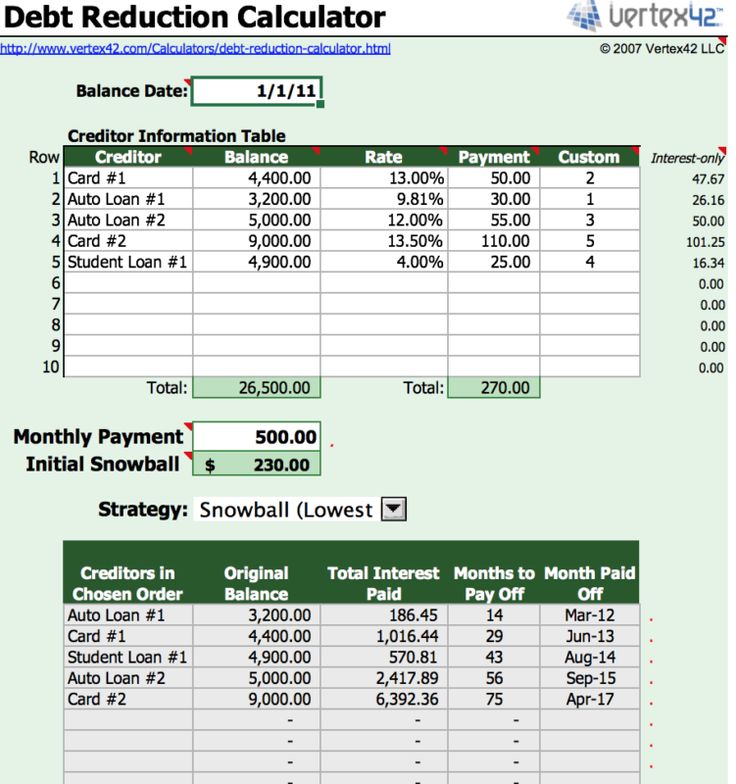

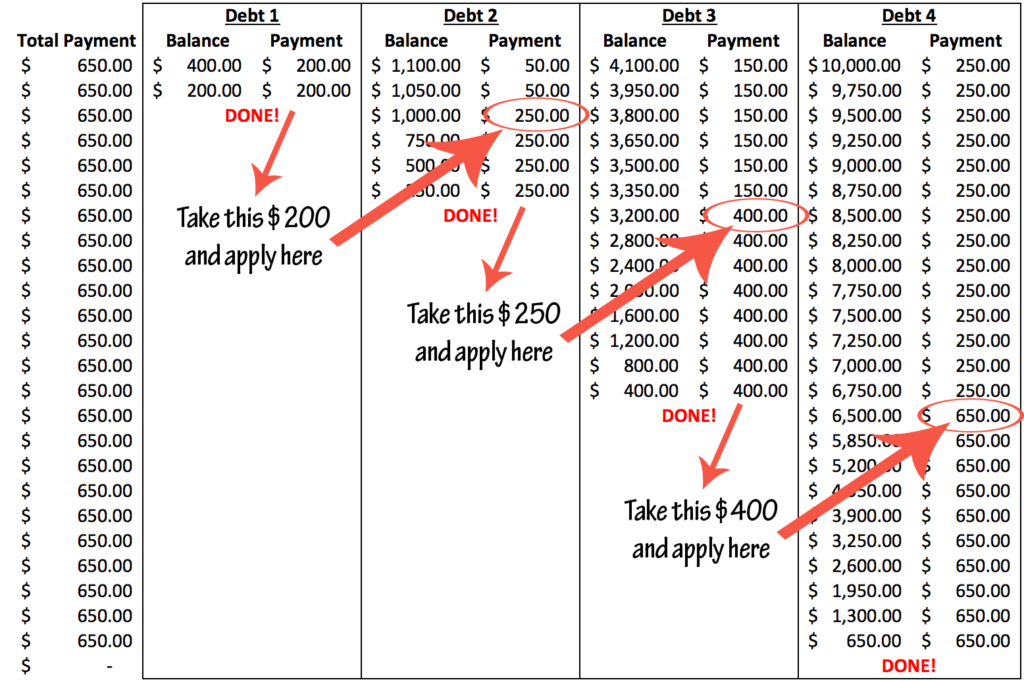

Arrears are simply calculated by determining the amount that a delinquent parent has already paid and the amount that they still owe for past months.

If your child support amount has changed since the payments became past due, the amount will be calculated using the value of the support on the month or months that is past due. For example, if two payments of $800 for the months of April and May are overdue, but the presiding judge decreased the monthly support payment to $700.00 in June, then the delinquent parent will be required to pay $1,600.00 for April and May plus the $700 for June, making the grand total $2,300 of child support arrears.

Collecting Child Support Arrears

In most states, the collection of child support payments is automatically completed through wage withholding. But, if a payment is missed, custodial parents have a legal right to seek the financial assistance granted to them. Moreover, they have a right to assistance from law enforcement officials or governmental agencies in seeking full payment.

As such, each state has institutes an agency to help collect unpaid support. Here in Maryland, The Maryland Child Support Enforcement Administration (CSEA) plays an essential role in ensuring that all children receive the support necessary to thrive. This administration works both with custodial parents to aid in the collection of arrear payments as well as with non-custodial parent to create a plan to overcome any payment challenges they may face.

Here in Maryland, The Maryland Child Support Enforcement Administration (CSEA) plays an essential role in ensuring that all children receive the support necessary to thrive. This administration works both with custodial parents to aid in the collection of arrear payments as well as with non-custodial parent to create a plan to overcome any payment challenges they may face.

When timely payment is not made, the CSEA has the authority to use the following enforcement tools to collect and distribute past-due child support:

- Wage Withholding. Many child support arrangements have a preemptive plan in place which requires the employer to automatically garnish the non-custodial parent’s wages after one missed payment. This is the most common way that past-due child support payments are collected.

- Federal and State Income Tax Refund Offset. CESA has the authority to intercept both state and federal tax refunds when support is not paid.

In these scenarios, the delinquent parent will receive a notice and can challenge the decision.

In these scenarios, the delinquent parent will receive a notice and can challenge the decision. - Lottery Winnings. If over $150 is owed, the CSEA can intercept any lottery winnings earned by the delinquent parent.

- Passport Denial. Delinquent parents can have their passport application, or current passport, denied or suspended if they owe $2,500 or more in support.

- Suspension of Driver’s License. If child support payments are over 60 days past due, the driver’s license of the delinquent parent may be suspended until payment is made and the MVA is contacted.

- Revocation of Professional Licensing. If child support payments are over 120 days past due, any professional licenses of the delinquent parent may be revoked until payment is made in full or full payments are made for at least four consecutive months.

- Consumer Credit Bureau. When the arrears balance is equal to, or greater than, 60 days of combined support (meaning the monthly amount plus any arrears payments) the CSEA is required to report past-due payments to a credit reporting agency.

- New Employer Notice. Maryland has a central registry where all new hires are reported. If a new hire has past due support payments, a wage withholding order is sent to the new employer when they are registered.

- Financial Institution Data Match (FIDM). Maryland has the ability to garnish financial assets of those owing support payments through the FIDM database match.

- Liens. States can issue a lien on personal property or assets.

- Unemployment Insurance. CSEA is authorized to collect payment through unemployment insurance.

- Workers Compensation Commission (WCC). Any workers compensation payment can be intercepted to cover past-due payments.

- Civil Contempt. Child support is a legal obligation, so those who a judge deems able to pay the obligation but choosing not to are subject to legal penalties or, in many cases, even incarceration.

If you are owed child support arrears and are unsure of the tools available to you, contact the experienced attorneys at Rodier Family Law online or by phone at 410. 803.1839 for assistance with collecting the child support you are owed.

803.1839 for assistance with collecting the child support you are owed.

What are Child Support Arrears? | Overdue Child Support

Learn what happens when parents don't pay child support, how to get help collecting unpaid support from your child's other parent, and what you can do if you owe child support arrears but can't pay.

All parents are legally responsible for supporting their children, with or without a court order. But once a court has ordered one parent to pay a certain amount of child support, failing to keep up with those payments could lead to serious and financial legal consequences. The other parent can get help from the state to collect the money. And if those steps don't work, authorities have ways to punish deadbeat parents until they pay what they owe.

What Are Child Support Arrears?

"Child support arrears" is just a fancy name for unpaid or past-due child support. When a parent gets behind with court-ordered child support—or stops paying completely—the unpaid amounts add up (or "accrue") and become child support arrears (sometimes called "arrearages"). Because support arrears don't accrue until there's an actual child support order in place, any parent who wants to collect past-due support needs to have an official order that establishes who must pay and how much. When parents get divorced, the divorce judgment should include an order like this. When married parents are separated, one of them may ask the court for a temporary child support order until the divorce is final. If the parents were never married, the one with the child (almost always the mother) will also need to legally establish parentage (traditionally paternity) along with a child support order.

Because support arrears don't accrue until there's an actual child support order in place, any parent who wants to collect past-due support needs to have an official order that establishes who must pay and how much. When parents get divorced, the divorce judgment should include an order like this. When married parents are separated, one of them may ask the court for a temporary child support order until the divorce is final. If the parents were never married, the one with the child (almost always the mother) will also need to legally establish parentage (traditionally paternity) along with a child support order.

Parents may have an agreement about child support, but most state laws require that a judge approve and include the agreement in a court order before it can be enforced. If you don't yet have a child-support order, you might be able to get help with that from your state's child support agency (more on that below).

What's the Difference Between Child Support Arrears and Retroactive Child Support?

Sometimes, judges will order retroactive child support—requiring a parent to pay support for a period of time before the court order was in place. (But most states have limits on how far back a retroactive support order may go.)

(But most states have limits on how far back a retroactive support order may go.)

The typical situations when judges order retroactive child support include:

- An unmarried mother wasn't able to establish the legal paternity of her child at first.

- It took a long time for a parent's request for child support to work its way through the court system.

- A judge increases the amount of child support that was in a previous order and makes the higher amount take effect on an earlier date.

If you've been ordered to pay retroactive child support (often under a payment schedule), it won't be considered child support arrears until you get behind on the payments.

How to Collect Child Support Arrears

If your child's other parent owes you past-due child support, you should be able to get help from the child support agency in your state. (You can find links and phone numbers for state and tribal agencies here, along with information on applying for assistance. )

)

The specific procedures and rules vary from state to state, but your state or local child support agency can provide a range of services, such as:

- finding the other parent, if you don't know where they are

- establishing parentage when that's necessary

- helping you get a child-support order if you don't already have one, and

- taking steps to enforce the order and collect past-due support.

Depending on the rules in your state and the circumstances in your case, the child support agencies have many ways to collect past due child support, including:

- having an amount withheld (or "garnished") from the other parent's wages or from other kinds of income, like workers' compensation benefits, some disability benefits, and settlements from lawsuits or insurance companies

- reporting the arrears to federal and state tax authorities, who will then take (or "intercept") all or part of the other parent's tax refunds; and

- freezing bank accounts or seizing other property.

Child support agencies also have other legal tools meant to make life difficult for deadbeat parents who owe a certain amount of past-due support, such as revoking or suspending their driver's license or other business or professional licenses.

Enforcing Child Support Arrears in Court

If none of the child-support agency's collection efforts work, you may need to ask a judge to enforce your child support order by issuing a judgment for child support arrears. The child support agency will often help with this step. If you have a lawyer, the attorney may represent you in the court proceedings (in coordination with the agency, if that agency has been involved in collection efforts).

In most cases, if you win the enforcement action in court, you'll be entitled to collect payment of your attorney's fees and costs from the deadbeat parent, along with the child support arrearages and any interest due under state law. In extreme situations, such as where a parent refuses to pay the judgment without justification, that parent might be charged with contempt of court, which can result in fine or even jail time.

What If the Deadbeat Parent Is in Another State or Country?

Child support agencies (and courts) may enforce child-support orders across state lines, in coordination with the parallel agencies and/or courts in the other state. Most of the collection efforts will be the same across the United States.

In fact, federal law provides another possible tool for going after deadbeat parents who live in a different state than their child—or who've crossed state lines in order to avoid paying support. It's a federal crime for a parent to deliberately refuse to pay court-ordered support for a child in another state for more than a year (or when the arrears total more than $5,000). In addition to paying a fine and/or spending time in federal prison, a guilty parent will have to pay the full amount of arrearages as restitution.

There are fewer enforcement options available when deadbeat parents are in another country. However, the U.S. State Department could revoke their passports or, in some cases, even arrest them when they try to reenter the United States.

What Should You Do If You Can't Pay Child Support or Are Behind on Payments?

If you're behind on the child support payments you owe, it might be a good idea to reach out to your child's other parent, as long as you have a decent working relationship. The two of you might be able come to an agreement on a payment schedule to catch up with the arrearages. If you aren't sure how much you owe in past-due support, the local child support agency can figure that out for you.

However, you should know that you can't automatically get out your obligation to pay child support just because you've lost a job or other earnings, have been hit with unexpected medical bills, or even have filed for bankruptcy. If you're not able to pay the amount of court-ordered child support because your circumstances have changed, you'll need to request a modification of the support order.

How Can You Request a Change in the Amount of Child Support?

Parents who owe child support can generally turn to the local child support agency for help with seeking a support modification. Generally, this requires filing a petition or motion in court, but your state might have slightly different procedures. For instance, Ohio's child support enforcement agency may conduct an administrative review of modification requests in some cases.

Generally, this requires filing a petition or motion in court, but your state might have slightly different procedures. For instance, Ohio's child support enforcement agency may conduct an administrative review of modification requests in some cases.

In all states, parents who want to change the amount of court-ordered child support must demonstrate that they have experienced a substantial change in their circumstances since the order was issued. (This requirement also applies when the parents who receive child support want to have the payments increased.) Judges will also consider whether the change was part of a deliberate attempt to avoid paying support. For instance, judges may reduce support when the paying parents were laid off, but not when parents voluntarily quit work to avoid paying child support.

Can Child Support Arrearages Be Wiped Out?

Even if a judge lowered the amount of your current child support obligation, in most cases the change will apply only from when you filed the modification request. You will still be legally responsible for paying any child support arrears. And because arrearages are the unpaid amounts of past support, you still have to pay them off even after you child has turned 18. If you want to contest the amount of arrearages that the agency or court says you owe, you will need to provide evidence (such as bank statements and pay stubs showing withheld support) to back up your claims.

You will still be legally responsible for paying any child support arrears. And because arrearages are the unpaid amounts of past support, you still have to pay them off even after you child has turned 18. If you want to contest the amount of arrearages that the agency or court says you owe, you will need to provide evidence (such as bank statements and pay stubs showing withheld support) to back up your claims.

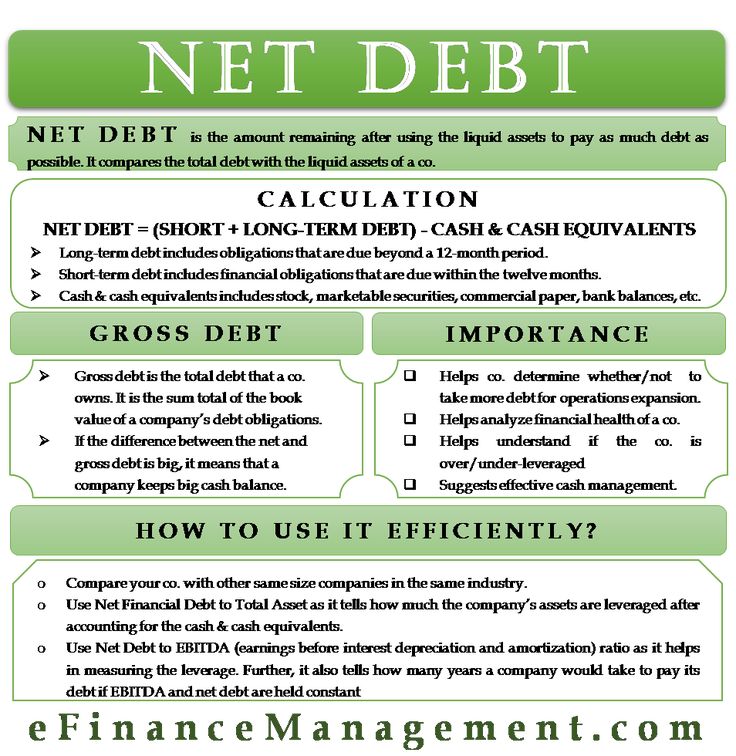

Although you can wipe out many types of debts in bankruptcy, that's not the case with child support debts, including arrearages. However, filing for bankruptcy could help you pay off your past-due child support by getting rid of other debts. It could also make it easier for the other parent to collect the child-support arrears. (Learn more about how Chapter 7 or Chapter 13 bankruptcy affects enforcement of child support.)

In some extreme circumstances, such as a terminal illness or catastrophic accident, a judge may waive or reduce the amount you owe for child support arrearages. In most cases, however a judge won't eliminate child support arrearages but instead might come up with a payment plan to let you pay off the balance over time.

Once you've finishing paying off your child support arrears, you should ask the court or the child support agency to dismiss or close your case.

Calculation of alimony the debtor does not work \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Calculation of alimony the debtor does not work

A selection of the most important documents upon request Calculation of alimony the debtor does not work (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of the spouses

- Alimony in 6-NDFL

- Alimony Alimony in a solid amount of

- Alimony of individual entrepreneur

- more .

..

..

- Employment and employment:

- Alimony from the unemployed

- Vacant position on the staffing of

- A vacant position is

- Payments at the labor exchange

- Guarantees for pregnant women

- More...

Court practice : Calculation of alimony debtor does not work

Register and receive trial access to the consultantPlus system free 2 days 2 days

Open the document in your system consultantPlus:

Selection of court decisions for 2020: Article 441 "Finding an application for applications for an application for an application for an application for an application for an application contesting the decisions of officials of the bailiff service, their actions (inaction)" Code of Civil Procedure of the Russian Federation

(LLC law firm "YURINFORM VM") Guided by Article 441 of the Code of Civil Procedure of the Russian Federation and establishing that alimony was collected from the administrative plaintiff for the maintenance of a minor child until his majority; on the basis of a court order, by a decision of the bailiff-executor, enforcement proceedings were initiated and a decision was made to calculate the debt on alimony, while the calculation of the alimony was made taking into account the partial payment of alimony and based on the fact that during the disputed period the debtor did not work, was not registered with the MCHN, the court justifiably refused to invalidate the ruling on the calculation of alimony arrears, taking into account information about the receipt by the plaintiff of a monthly compensation payment in connection with caring for a disabled disabled person, as well as the lack of information about his work activity and real income, having come to a reasonable conclusion about the legitimacy made by the bailiff-executor of the calculation of debt on alimony based on the average wage in the Russian Federation. nine0015

nine0015

Register and get trial access to the ConsultantPlus system for free for 2 days

Open a document in your ConsultantPlus system:

Selection of court decisions for 2020 in the adoption of the CAC "Court issues" “Meanwhile, in violation of the requirements of Articles 226, 178, 180 of the CAS RF, these arguments of the administrative plaintiff were not checked by the court, they did not receive any legal assessment in the court decision, while they are important for the correct resolution of the present case, since by virtue of Parts 2, 3 of Article 102 of the Federal Law "On Enforcement Proceedings" the amount of alimony arrears is determined in the decision of the bailiff on the calculation and collection of alimony arrears based on the amount of alimony established by a judicial act or agreement on the payment of alimony, taking into account the amount of earnings and other income of the debtor for the relevant period of time and only to the extent In the second case, if the debtor did not work during this period of time or documents on his income were not submitted, the debt is determined based on the size of the average wage in the Russian Federation. nine0015

Articles, Comments, answers to questions : Calculation of alimony debtor does not work

Register and receive trial access to the consultantPlus system free 2 days

Open the Consultant Pluss:

Article the need to change the rules and practice of determining the amount of alimony for minor children

(Shelyutto M.L.)

("Law", 2018, N 6) and calculate child support based on estimated, not actual, income. It would seem that such an approach is similar to the rules on calculating the debt for alimony of a non-working debtor (as well as in the absence of information about the debtor's income) based on the average wage in the Russian Federation (clause 4 of article 113 of the UK, part 3 of article 102 of the Law on enforcement proceedings). However, the expected income is established by the court individually, depending on the personal potential of the debtor (his professional skills, qualifications, type of activity, earnings in previous years, health status, age, the presence of other barriers to employment or full employment, property security) and opportunities to receive income from taking into account these circumstances, as well as the local labor market. This is the amount of income that is reasonable to expect from the debtor in his particular circumstances. nine0015

This is the amount of income that is reasonable to expect from the debtor in his particular circumstances. nine0015

Register and get trial access to the ConsultantPlus system free of charge for 2 days

Open a document in your ConsultantPlus system:

Situation: How to collect child support from a non-working debtor?

("Electronic journal "Azbuka Prava", 2022) If the debtor does not work and has no other income (including if he is registered with the employment service, but does not receive unemployment benefits), alimony established as a share of income the bailiff calculates based on the size of the average wage in the Russian Federation at the time of collection of the debt on alimony, that is, on the day the bailiff issued the decision to calculate the debt. section "Statistics", then in the subsection "Official statistics" - the tab "Labor market, employment and wages" (clause 4 of article 113 of the RF IC; Letter of the Federal Bailiff Service of Russia dated 04. 03.2016 N 00011/16/19313-AP; Guidelines).

03.2016 N 00011/16/19313-AP; Guidelines).

Normative acts : Calculation of alimony debtor does not work

Register and receive trial access to the consultantPlus system free 2 days

Open the document in your system consultantPlis:

FSSP of Russia dated 04.03.2016 N 00011 / 16 / 19313-AP

"On the calculation of alimony arrears based on the average wage in the Russian Federation" In accordance with Part 3 of Article 102 of the Federal Law of 02.10.2007 N 229-FZ "On Enforcement Proceedings" (hereinafter referred to as the Law) and Article 113 of the Family Code of the Russian Federation, if the debtor obliged to pay alimony did not work or did not submit documents confirming his earnings and (or) other income, the alimony debt is determined based on the average salary in the Russian Federation at the time of debt collection.

Alimony arrears from July 1 will be considered in a new way

On average, more than 120 people daily turn to bailiffs with a request to forcibly collect alimony. As a rule, this is due to the fact that the former spouses are in no hurry to pay money for the maintenance of their child, so alimony debt is formed. From July 1, the procedure for its calculation will change. Innovations will affect only those debtors who did not work or did not submit documents confirming their earnings, BelTA writes. nine0126

As a rule, this is due to the fact that the former spouses are in no hurry to pay money for the maintenance of their child, so alimony debt is formed. From July 1, the procedure for its calculation will change. Innovations will affect only those debtors who did not work or did not submit documents confirming their earnings, BelTA writes. nine0126

As Yulian Misyukevich, consultant of the Main Department of Compulsory Enforcement of the Ministry of Justice, explained, changes in the system for calculating alimony arrears are provided for by the Law of the Republic of Belarus "On amendments to laws" dated December 18, 2019. This document also amends the Marriage and Family Code. Starting next month, child support arrears for the period when the debtor did not work will be calculated based on the living wage budget. For one child, the amount of payments will be 50%, for two children - 100%, for three or more children - 150% BPM.

Now the debt is determined based on the income of the parent-debtor for the period during which he did not pay. If a person did not work at that time, the amount is calculated based on the amount of wages at the last place of work. In the event that more than three months have passed since the dismissal or there is no relevant information on income, the average salary of employees in the republic is taken into account.

If a person did not work at that time, the amount is calculated based on the amount of wages at the last place of work. In the event that more than three months have passed since the dismissal or there is no relevant information on income, the average salary of employees in the republic is taken into account.

As of July 1, there is also another change regarding child support. It refers to debtors who did not pay money for the maintenance of a child during their stay in the Armed Forces of Belarus, other troops and military formations in military service, performing alternative service. In this case, the debt is determined in the following amounts: per child - 25%, for two children - 33%, for three or more - 50% of the actual income received. However, these features will not apply if the amount of alimony is determined by a marriage contract, an agreement on children, or an agreement on the payment of alimony.

The issue of collecting alimony from debtors who live abroad, in particular in Russia, remains topical. In this regard, the Ministry of Justice has initiated some changes aimed at simplifying this procedure as much as possible. As expected, they will be included in the agreement on the procedure for the mutual execution of court decisions in cases of alimony, concluded in 2015 between Belarus and Russia. nine0015

According to Yulian Misyukevich, at one time this agreement made it possible to significantly simplify the procedure for collecting alimony on the territory of the two countries. At present, judgments in such cases do not need a special recognition procedure. Based on the claimant's application, the documents are sent for execution through the authorized bodies of one country to the authorized bodies of another country. On the Belarusian side, such bodies are the enforcement departments of the main departments of justice of the regional, Minsk city executive committees, on the Russian side - territorial bodies of the Federal Bailiff Service.

“Today, active work is being carried out to develop this agreement. In particular, the Belarusian side came up with the initiative to make changes to it aimed at further simplifying the procedure. income on the territory of another state. While this issue is being worked out. Therefore, it is too early to say that this will definitely work" ," said the headquarters consultant.

In particular, the Belarusian side came up with the initiative to make changes to it aimed at further simplifying the procedure. income on the territory of another state. While this issue is being worked out. Therefore, it is too early to say that this will definitely work" ," said the headquarters consultant.

According to the Ministry of Justice, in 2018, bailiffs received 45,246 enforcement documents for the recovery of alimony, which is 1.8% of all received by the enforcement authorities. In 2019, this figure was 44,533 documents, or 1.9%. This year, about 18,000 documents, or 2.1%, have already been submitted for execution. It turns out that, on average, more than 120 people daily turn to bailiffs with a request to forcibly collect alimony. nine0015

In order for the rights of a minor child not to be infringed, it is important for a bailiff to promptly receive the necessary information about the financial situation of the debtor. The Ministry of Justice has done significant work in this direction, which has increased the efficiency of enforcement agencies. In particular, communication with information resources of state bodies and organizations has been established.

In particular, communication with information resources of state bodies and organizations has been established.

"Already today, the bailiff, by pressing one button, receives real-time information about the financial situation of the debtor, for example, about his place of work, income received, bank accounts, vehicles, real estate. This contributes to the timely adoption of measures to enforce requirements contained in the executive document" , - noted Yulian Misyukevich.

Today, a bailiff can take sufficiently serious measures to induce the debtor to repay the debt. It is not only about putting him on the wanted list and calling him for a conversation. Various restrictions can be applied to a person who evades his duties: seize money on accounts, other property, including vehicles, real estate, restrict certain rights - to travel outside the republic, drive a car, visit gambling establishments, use of communication services, the Internet, etc.