How does child care tax credit work canada

Ontario Child Care Tax Credit

Overview

The Ontario Child Care Tax Credit (known as Ontario Childcare Access and Relief from Expenses (CARE) Tax Credit) puts more money in the pockets of families and provides the flexibility they need to choose the child care options that work best for them.

- Eligible families can claim up to 75% of their eligible child care expenses, including services provided by child care centres, homes and camps.

- As announced in the 2021 Ontario Budget, the government will provide an automatic top‑up of 20 per cent of the credit entitlement for the 2021 taxation year.

You can claim this tax credit when you file your personal income tax return.

How much you can receive

Families can receive up to:

- $6,000 per child under the age of seven (plus a top‑up of up to $1,200 for 2021)

- $3,750 per child between the ages of seven and 16 (plus a top‑up of up to $750 for 2021)

- $8,250 per child with a severe disability (plus a top‑up of up to $1,650 for 2021)

The Ontario Child Care Tax Credit is calculated as a percentage of your Child Care Expense Deduction. The Child Care Expense Deduction provides provincial and federal income tax relief toward eligible child care expenses.

The top‑up is calculated as an additional 20 per cent to the credit entitlement.

Eligibility

The Ontario Child Care Tax Credit supports families with incomes up to $150,000, particularly those with low and moderate incomes. Learn how the credit is calculated.

To claim the Ontario Child Care Tax Credit, you must:

- be eligible to claim the Child Care Expense Deduction

- have a family income less than or equal to $150,000

- be an Ontario resident at the end of the tax year

Learn how to claim the tax credit.

Eligible expenses

Child care expenses that are eligible for the Child Care Expense Deduction will also be eligible for the Ontario Child Care Tax Credit.

Eligible expenses include:

- caregivers providing child care services

- day nursery schools and child care centres

- boarding schools, overnight sports schools or camps where lodging is involved

- educational institutions (for the part of fees that relate to child care only)

- day camps and sports schools where the primary goal of the camp is to care for children

Ineligible expenses include:

- medical or hospital care, clothing or transportation costs

- fees related to education costs at an educational institution (such as tuition)

- fees for leisure or recreational activities (such as tennis lessons)

- child care services provided by the eligible child's parent or a person under 18 years of age who is connected by a blood relationship (such as a sibling)

How to claim

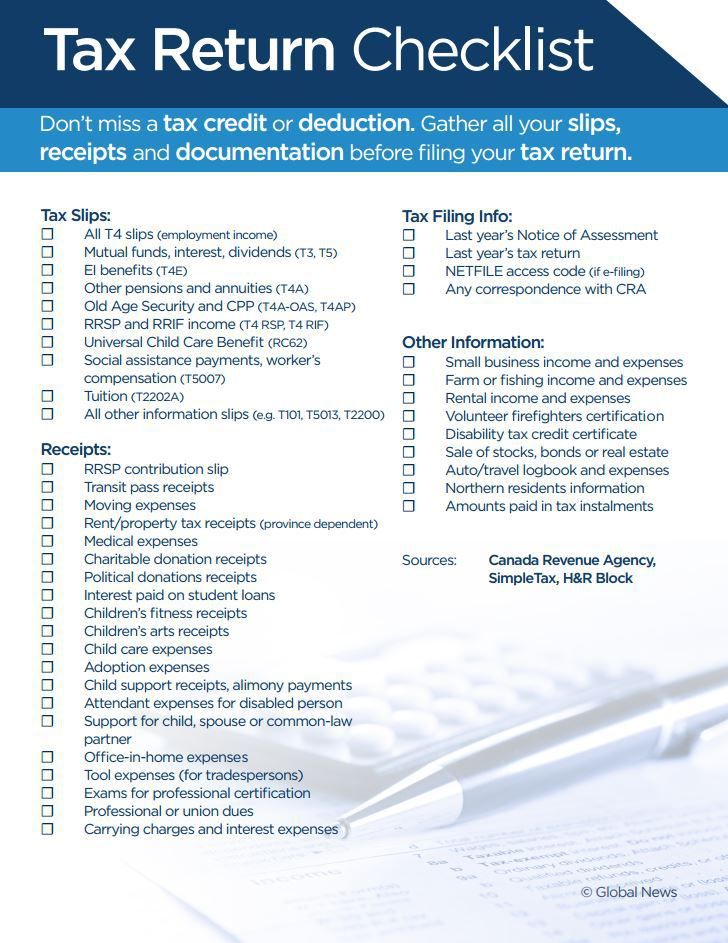

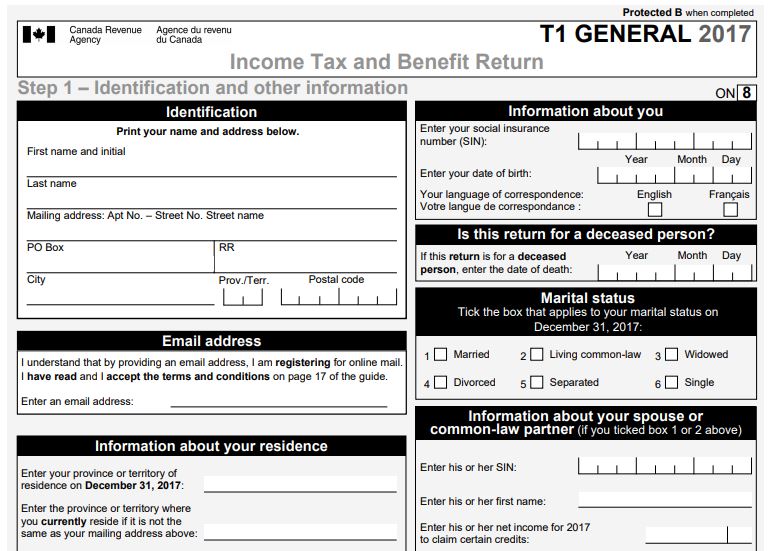

To claim the Ontario Child Care Tax Credit, file your tax return and submit a completed Schedule ON479-A, Ontario Childcare Access and Relief from Expenses (CARE) Tax Credit.

You must keep the receipts for child care expenses incurred throughout the year.

How the tax credit is calculated

The amount you could receive is calculated using your Child Care Expense Deduction, multiplied by the Ontario Child Care Tax Credit rate that is based on your family income (that is, the incomes of family members used in determining your Child Care Expense Deduction).

| Family income | Rate calculation |

|---|---|

| Up to $20,000 | 75% |

| Greater than $20,000 and up to $40,000 | 75% minus 2 percentage points for each $2,500 (or part of) above $20,000 |

| Greater than $40,000 and up to $60,000 | 59% minus 2 percentage points for each $5,000 (or part of) above $40,000 |

| Greater than $60,000 and up to $150,000 | 51% minus 2 percentage points for each $3,600 (or part of) above $60,000 |

| Greater than $150,000 | 0% |

For example, if your income is $10,000, your Ontario Child Care Tax Credit rate will be 75%. If your income is $45,500, your rate will be 55%.

If your income is $45,500, your rate will be 55%.

For the 2021 taxation year, your credit will automatically be topped up by 20 per cent.

Contact the Canada Revenue Agency

If you have questions about the Ontario Child Care Tax Credit, please contact Canada Revenue Agency's:

- Tax services offices and tax centres

- Individual tax enquiries line at 1-800-959-8281

More information is also available on the Canada Revenue Agency website.

Claiming Child Care Expenses In Canada

TurboTax Canada

September 28, 2020 | 3 Min Read

Childcare expenses can be claimed for the purposes of earning a living or going to school, this will, in turn, reduce your income, therefore the amount of taxes you must pay will be lowered.

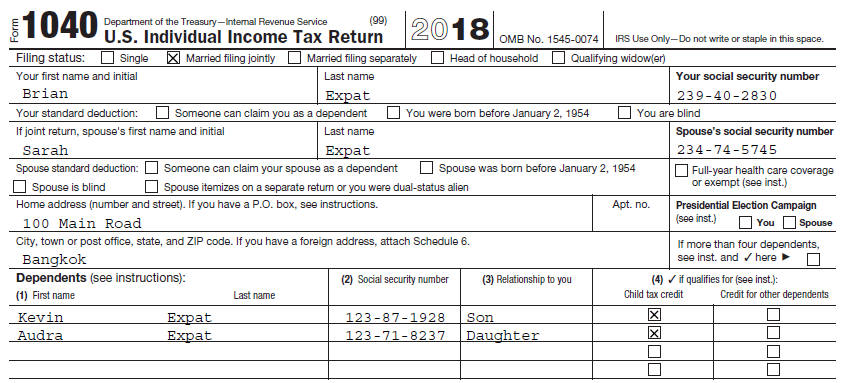

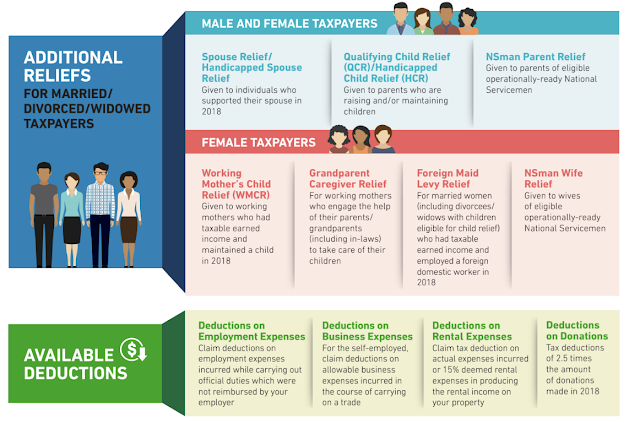

Each child for whom you claim expenses on your tax forms must meet the Canada Revenue Agency’s eligibility requirements:

An eligible child is one of the following:

- your or your spouse’s or common-law partner’s child

- a child who was dependent on you or your spouse or common-law partner, and whose net income was less than the Basic Personal Amount (roughly $12,000)

- The child must have been under 16 years of age at some time in the year.

However, the age limit does not apply if the child had an impairment in physical or mental function and was dependent on you or your spouse or common-law partner.

However, the age limit does not apply if the child had an impairment in physical or mental function and was dependent on you or your spouse or common-law partner.

How Much of Your Child Care Expenses Can You Claim?

- Canadian taxpayers can claim up to $8,000 per child for children under the age of 7 years at the end of the year.

- $5,000 per child for children aged 7 to 16 years.

- For disabled, dependent children of any age who qualify for the disability tax credit, the amount to claim for that child is $11,000.

- You can claim $5,000 for a disabled child over the age of 16 who does not qualify for the disability tax credit but was still dependent on you and required care.

- For a boarding school or overnight camp, you may only claim up to $200 per week for a child under the age of 7 years, $275 per week for an eligible disabled child, or $125 per week for a child aged 7 to 16 years.

The CRA Form T778 – Child Care Expenses Deduction lists these rates, as well as further explanations about claiming childcare expenses.

What Child Care Expenses Can You Claim?

- You can claim child care costs paid to day nursery schools and daycare centers, caregivers such as nannies, overnight boarding schools and camps that provide lodging, day camps and day sports schools.

- To be eligible, the primary purpose of the day camp or day sports school must be to provide child care.

- In Canada, if you pay an individual person such as a nanny or babysitter, you must provide their social insurance number. Note that the CRA requires proof of expenses in the form of receipts and that you may be selected for a review or audited.

“Parents should take precautions when choosing a daycare or child care provider. One of these is to make sure ahead of time that proper receipts will be issued. Child care providers are required to issue receipts showing either their business number or social insurance number. Ask for a receipt each month,” advises Robert Stone, a personal tax professional and founder of Mr. Taxes.ca. “It is better to ask ahead of time than to try to get receipts at the end of the year.”

Taxes.ca. “It is better to ask ahead of time than to try to get receipts at the end of the year.”

Child Care Expenses You Cannot Claim

Child care expenses which are not eligible for the childcare expense deduction include:

- Medical or hospital care expenses, clothing costs, and transportation costs are all ineligible.

- For example: If you pay for a shuttle bus to transport your child to and from a daycare center, these costs are not an eligible child care expense.

- Child care provided by the child’s father or mother, your spouse or common-law partner also is not eligible.

- Payments made to relatives under the age of 18 years — such as your older children, or a niece or nephew — cannot be claimed.

- If you are claiming fees paid to an educational institution, such as a boarding school or sports program, the cost of tuition is not deductible, but the lodging portion is.

- Fees for swim lessons, Girl Scouts or other recreational programs are not eligible.

- If your employer reimbursed any portion of your child care expenses, that portion cannot be claimed.

These rules apply to Canadian citizens and residents, including immigrants to Canada. Canadian taxpayers who live and pay for child care outside of Canada also may claim child care expenses, subject to certain conditions. Again, obtain and keep receipts for all eligible expenses.

“The CRA routinely conducts audits at random, and if you were audited in the previous year, you may be flagged for a follow-up audit,” says Stone.

Claiming all your dependant credits is easy with TurboTax – Canada’s #1 tax preparation software.

However, if you feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, there’s a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

References & Resources- Canada Revenue Agency: Questions and Answers About Child Care Expenses

- Canada Revenue Agency: Income Tax Folio S1-F3-C1, Child Care Expense Deduction

Get your maximum refund guaranteed

Canada Child Benefit

Canadian Child Benefit Features

A unique program created with the assistance of the

Canadian Federal Government,

and the Provincial and Territory Governments.

National Childhood Insurance Program.

Canada Child Tax Benefit.

Canadians often refer to their social security system as the “social security system”. Assistance programs are designed for all sectors of society, especially for minors, the unemployed and the elderly. Child allowance introduced from January 1993 years old It is paid to low- and middle-income families with children under the age of 18. The amount of the benefit depends on the total annual income of the family, as follows:

In Canada, the minimum tax-free family income is $20,435 Canadian dollars per year and qualifies for National Child Benefit (NCB) assistance from the state.

Families with annual incomes below $20,435 are eligible for government assistance of:

1) $266.67 per month ($3,200 per year) for first child;

2) $247.92 per month ($2.975 per year) for second child;

3) $248.33 per month ($2,980 per year) for the third and each child up to the 7th in the family.

Families with annual incomes between $20,435 and $36,378 and more than 3 children receive an allowance for the 3rd and each subsequent child (up to the 7th).

Families with more than 4 children raise the minimum annual income cap to $36,378.

Families with one and two children with annual incomes between $36,378 and $99,128 are also eligible for indexed child support.

Larger families are eligible for indexed child support even if the income is $99,128.

Do you know the law, rules, procedures and policies of immigration?

How does the National Child Benefit (NCB) system work?

The NCB program is a combination of 2 elements: a monthly federal allowance for each child in low-income families and additional provincial benefits and payments (health insurance, transportation benefits, social benefits and numerous budgetary grants for sports sections for children and etc.).

Achievement of the Welfare Social Benefit level, the so-called “Welfare Wall”.

The National Childhood Insurance system is closely linked to the taxation system, if the family income exceeds the allowable tax-free minimum, then this affects the amount of the child allowance issued and may threaten with the deprivation of some social benefits, such as compulsory health insurance, benefits for receiving free dental services, free medicines, etc. Thus, it turns out that families in which parents work in low-paid jobs may be lower or at the same material level as families receiving Welfare. To avoid this phenomenon, the Canadian government split the payment between NCB and Welfare. Now only working parents will have child benefits.

Federal Government Supplements to the National Childhood Insurance Program.

According to these additions, the Federal Government has the right to revise the amount of the monthly allowance for children in the direction of indexation, i.e. increase taking into account economic changes in the country. The increase in the amount of the allowance for children has been observed since 1998 .

In 2003-2004, 82% of Canadian families with children received an NCB. The amount of additional funds allocated to the Childhood Insurance Scheme increased by $3.4 billion Canadian dollars.

The National Childhood Insurance Program is administered by the Canada Revenue Agency (CRA). NCB applications must be filed each year in July to be eligible for Child Benefit for the next 12 months.

For more information, visit: http://www.nationalchildbenefit.ca/index.html

Immigrant Benefits in Canada

Canada is very loyal to immigrants. All those who legally enter the country become full members of Canadian society. Therefore, finding themselves in a difficult life situation, immigrants can count on the help of the state and the regional government.

The Government of Canada is doing everything possible to ensure that the people of the country do not fall below the poverty line. Whether it is job loss, illness, the birth of a child or the death of a loved one - a resident of the country can count on the comprehensive support of social services.

Immigrant benefits in Canada: Welfare

Welfare - benefits are provided to those , who want, but are temporarily unable to find a job (for example, you need to pass qualifying exams to get a job).

Any person legally residing in the country and whose income is below the subsistence level can receive benefits.

Many newly arrived immigrants go through the walfare process. It takes several days and consists of an interview and the provision of documents (purchase receipts, customs declaration, etc.). The applicant must show:

- how much money was brought into the country

- what this amount was spent on

- explain the reasons why employment is currently not possible.

At the same time, a person who is “below the poverty line” can own one car, one piece of real estate and insignificant savings.

If all the information provided is correct, a benefit is paid, the amount of which depends on the province and personal circumstances.

Unemployment benefit

Taxable unemployment benefit is subject to a number of conditions, namely:

- people lost their jobs through no fault of their own (eg downsizing). In the event that an employee is dismissed for unsuitability or violation of labor discipline, the allowance is denied.

- is temporarily unable to work for health reasons.

- before losing his job, he worked from 420 to 700 hours.

- the employer made contributions to the appropriate fund.

Documents for cash payment can be processed online.

Benefits start to be paid 28 days after application is submitted. The maximum payment period is 52 weeks. If the benefit is paid due to temporary incapacity for work, then the period of payments is no more than 15 weeks.

Various factors are taken into account when calculating the amount of benefits. But usually it is 55% of the average salary, up to $524 per week.

Unemployment benefits can be higher - up to 80% of earnings if:

- the family is classified as low-income, that is, the total annual income of the family is $ 25,921 or less

- has several children

- and receives the Child Tax Benefit.

The benefit amount is reviewed annually.

It must be remembered that the social service can check at any time whether their ward is looking for work or not.

Immigrant benefits in Canada: for employers

Entrepreneurs can also receive unemployment benefits if they are registered with the Canadian Employment Insurance Commission and have made contributions to the Employment Insurance Fund for at least 12 months. In 2016, the maximum annual payment to the Fund was $955.04.

In addition, the following conditions must be met:

- decrease in business income by more than 40% due to: a child was born or adopted, a seriously ill family member requires care, an employee is sick or injured.

- for the previous year, earnings amounted to the minimum amount for entrepreneurs. In 2015, for example, it is $6820.

Entrepreneur can expect to receive $537 per week. This is the maximum amount for 2016.

Child benefits, system of payments and benefits for families with children

Even during pregnancy, a woman can count on assistance from the social services. Expectant mothers and women who have just given birth and are in a difficult life situation receive support from the state in the form of coupons for food and vitamins. Support programs and their content in each province are different.

Expectant mothers and women who have just given birth and are in a difficult life situation receive support from the state in the form of coupons for food and vitamins. Support programs and their content in each province are different.

Maternity benefits

After a child is born and a woman takes maternity leave, she can count on Child Care Benefit, also known as Employment Insurance. You can fill out the form for benefits online and this should be done no later than four weeks after you go on maternity leave.

The amount of the payment depends on the average income. In most cases, this is at least 55% of the average earnings. For example, as of January 1, 2016, the maximum annual benefit payment was $50,800.

Benefit duration varies from 14 weeks to 45 weeks depending on the region.

Types of Child Benefit

Canada Child Benefit is a tax-free monthly payment of $160 for each child under 6 and $60 for each child aged 6 to 17.

Canada Child Tax Benefit is a tax-free monthly benefit for children under 18 years of age. The amount depends on the total family income.

The amount depends on the total family income.

Provincial Benefits depend on local law and are paid until the child reaches 18 years of age. The amount of payments also depends on the total family income.

Child Disability Benefit is approximately $224.58 per month for each child.

To apply for child support immediately upon arrival in Canada, you must have documents on the total family income for the previous year in the country where the immigrants came from.

The amount of the allowance is calculated based on the family's income and the child's age.

Canada Immigrant Benefits: Family Benefits

Compassionate care benefits is a benefit for caring for a family member who is seriously ill. Subject to tax, the percentage of which depends on the total income and the region of residence.

In order to receive this allowance, you must prove to the social service that due to the need to care for the sick, your income has decreased by 40%, you have worked at least 600 hours in the last year, and you must provide all the necessary medical documents.

The maximum benefit period is 26 weeks. In 2016, the weekly payout amounted to $537.

Severely Ill Child Care Allowance

Benefit Conditions: Income reduced by more than 40% due to needing to care for a seriously ill child, worked at least 600 hours in the last 52 weeks, child no 18 years old. The maximum benefit in this situation is $537 per week.

Federal Assistance for Parents of Murdered or Missing Children

This taxable benefit is paid in the amount of $350 for 35 weeks after the incident. The tax is calculated individually, depending on the total income and place of residence.

Pension after the death of a spouse

In the event of the death of a spouse, financial assistance is provided for the funeral, a monthly pension and a one-time payment to the heir of the Pension Fund contributor. The amount of assistance is equal to six times the pension of the deceased, but does not exceed $2,500. This allowance is available to immigrants from the day they officially start working. After all, the employer deducts money for this program. The amount of benefits and payments depends on the age of the spouse and the amount of pension contributions.

This allowance is available to immigrants from the day they officially start working. After all, the employer deducts money for this program. The amount of benefits and payments depends on the age of the spouse and the amount of pension contributions.

Canada Immigrant Benefits: Students

Low Income Student Benefit is $250 per month, depending on the region where the family lives.

Mid-income student benefit is $100 per month.

The amount of average and minimum income that determines whether a student is eligible for these payments is different in each region.

Allowance for full-time students with children under 12 years of age.

The allowance is $200 per month for each child. This amount does not cancel the benefits for a student from a low-income family.

Financial assistance for disabled students.

If a student has the required medical records to qualify for financial aid, the student may receive up to $8,000 per academic year.