How do i buy stocks for my child

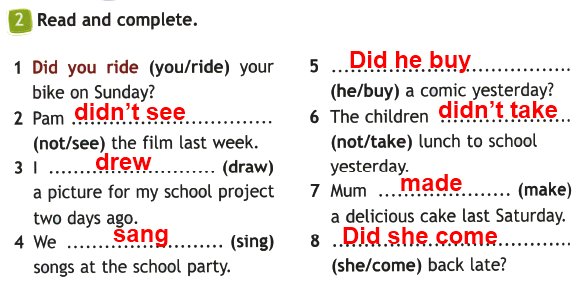

How to Buy Stock for a Child (And Why it’s a Smart Money Move)

One of the best ways to set children up for financial success is to introduce and teach important money lessons from an early age. This may mean helping them manage a bank account, explaining the wonders of compound interest, or teaching them about family budgeting.

But while the majority of parents do talk to their kids about money, a much smaller percentage introduce the idea of investing money in the stock market. When you consider how valuable the growth of an investment portfolio could be over a child’s lifetime, though, it’s easy to see why investing with your child might be a great decision.

Let’s talk about the different ways you can invest on a minor’s behalf, where to start, and exactly how to buy stock for a child when you’re ready.

In this article

- How to buy stock for a child: 5 options

- How to choose a stock for your child

- FAQs about buying stock for a child

- The bottom line

How to buy stock for a child: 5 options

There are a few options to choose from if you are looking to buy stock for a child, whether he or she is your own child or a grandchild, sibling, niece/nephew, etc. Here are five investment routes to consider.

1. Give the gift of stock

On the day of my 11th birthday, a single share of Amazon stock had a price tag of just over $4.

Though I do remember that birthday very well, I don’t remember what my parents or grandparents bought me that year; it probably amounted to somewhere in the $40 price range. Just imagine if, rather than buying me the latest trendy toy or a new pair of shoes, my grandma had opted to give me 10 shares of Amazon instead.

Today, that 11th birthday gift would be worth nearly $376,200.

Unfortunately, I don’t have a bunch of well-aged Amazon stocks lying around. It’s easy to see, though, how gifting the children in your life with a share of stock can be potentially lucrative. This gift can also garner their own interest in investing and help establish their investment portfolio for the future.

Companies like Stockpile allow you to give stock gift cards in any amount from $1 to $2,000. You can choose from a wide range of individual stock options — such as Apple, Disney, Facebook, and more — either by purchasing a physical gift card or by simply printing out a gift certificate from your home computer.

You can choose from a wide range of individual stock options — such as Apple, Disney, Facebook, and more — either by purchasing a physical gift card or by simply printing out a gift certificate from your home computer.

You (or another adult) can then set up a custodial account on Stockpile, at which time the recipient can redeem their Stockpile gift for full or fractional shares and begin trading. Minor children can track their stock’s progress over time and even make their own (approved) stock purchases for additional shares.

Once they come of age, the account ownership switches over to the now-adult child and hopefully they will have a nice investment portfolio upon which to build.

2. Open a custodial brokerage account

Whether you’re interested in purchasing specific company stocks or diversifying your child’s investments, opening a custodial brokerage account is an easy place to start.

Custodial accounts are also referred to as UTMA/UGMA accounts, which stands for Uniform Transfer to Minors Act and Uniform Gifts to Minors Act. These accounts act as an irrevocable trust for minors, allowing them to own assets (such as stocks or shares of a mutual fund or exchange-traded funds) that are managed by a parent or guardian until the child reaches a certain age.

These accounts act as an irrevocable trust for minors, allowing them to own assets (such as stocks or shares of a mutual fund or exchange-traded funds) that are managed by a parent or guardian until the child reaches a certain age.

Platforms like Stash and Acorns make it easy to establish and fund custodial brokerage accounts to begin investing for a child. With Stash, 1 for instance, you can purchase whole or fractional shares of stocks or opt for ETFs (exchange-traded funds), 2 starting with as little as $1. 3 You’ll need the Stash+ plan in order to manage custodial accounts, which runs $9 per month. 4

Acorns Early allows you to open custodial accounts for kids in just minutes, which are invested in aggressive ETF-based portfolios. Acorns offers automatic recurring investments with the opportunity for bonus investments, and Acorns Family plans are only $5 per month.

Funds held in a custodial investment account can generally be utilized for the child’s own expenses without penalty. This may include educational costs as well as things like music lessons, sports training, or even clothes and school supplies.

This may include educational costs as well as things like music lessons, sports training, or even clothes and school supplies.

*It’s important to note that custodial accounts are considered an asset belonging to the child. Depending on the value of the account, this could impact financial aid decisions for college down the line.

Stash Benefits

- Get $10 to make your first investment

- Invest in stocks, bonds, and ETFs

- Fractional shares available

- Start investing with just $1

Visit Stash

3. Opt for a Roth IRA

If your child is older and has earned income — either from their first job, a side hustle such as a paper route, or helping you with tasks at your own business — they might qualify for a custodial IRA. There are two IRA options to choose from but for children, a Roth typically makes the most sense.

There are two IRA options to choose from but for children, a Roth typically makes the most sense.

Traditional IRAs are funded with pre-tax dollars but are taxable upon withdrawal in retirement, whereas Roth IRAs are funded with taxed dollars and can be withdrawn in retirement tax-free. As long as your child is in a lower income bracket today than you expect them to be when they reach retirement age (which is the case for most kids), a Roth is probably the smarter choice.

IRAs are custodial, meaning that a parent or guardian manages the account until the child comes of age, which is age 18 or 19 in most states. You can contribute up to $6,000 a year into this account (for 2021) or the amount the child actually earned over the year, whichever is lower.

The child can choose to withdraw from those funds at retirement. They can also withdraw contributions without penalty before age 59½ as long as the account has been open for five years and the money is used for qualified educational expenses or for buying a new home for the first time.

4. Consider dividend reinvestment plans (DRIPs)

A dividend reinvestment plan, or DRIP, is another great option for slowly building a child’s wealth over the long term.

DRIPs involve shares that are typically purchased directly from the company, rather than through a brokerage. Any dividends that are paid out are automatically reinvested into more shares, helping your child build not only their overall value but also the number of shares they own, without requiring a lot of hands-on effort.

DRIPs can be purchased on a custodial (UGMA/UTMA) basis, with ownership transferred to the child when they come of age.

5. Open a 529 plan

If your primary goal is investing for a child’s future educational expenses, a 529 plan is a long-trusted route to consider.

These tax-advantaged, college savings accounts allow parents, grandparents, other relatives, and even friends to contribute and invest toward a child’s K-12 and college education expenses. The funds will grow tax-free over time and can then be withdrawn to pay for things like tuition, books, and lab fees.

The funds will grow tax-free over time and can then be withdrawn to pay for things like tuition, books, and lab fees.

Each 529 plan, or qualified education plan has its own fees, rules, and tax benefits. There are two types of 529 plans available (prepaid tuition plans and education savings plans), and every state plus the District of Columbia offers at least one. While each state typically offers 529 plan options, you do not need to choose the plans offered by your home state. It’s best to compare fees and investment options across plans to decide which plan makes sense for your family.

It’s important to note that some plans are designed for children who will attend a school within that same state. Additionally, the funds held in a 529 account are counted as a parental asset on the FAFSA.

How to choose a stock for your child

Picking the right investment vehicle (and stocks) for your child depends on a number of personal factors. The best choice may be different from one parent to the next. Here are our recommendations for how to choose a stock for your child.

The best choice may be different from one parent to the next. Here are our recommendations for how to choose a stock for your child.

Consider your goals

Are you hoping to foster an interest in investing? Do you want to begin building wealth for your child’s future? Or do you hope to fund an education savings vehicle that will grow over time?

Maybe the answer is all three.

Take some time to decide why you want to invest for your child in the first place, and what you primarily hope to gain from the experience. That will help you choose the best investment method.

Look at your budget

Your budget may guide you down one investment path over another. If you’re hoping to invest $10,000 a year for your child, for instance, a Roth IRA (alone) probably isn’t the best choice due to its $6,000 annual contribution limit for 2021. And if you’re only wanting to invest a few dollars a month, the monthly cost of a brokerage account may not be worthwhile.

Consider the cost of the best brokerage accounts, initial investment requirements, the typical returns, and what you are able to contribute to the account before making your decision. In some cases, you may also choose to diversify your child’s investments.

Pick stocks that interest your child

If you are going the individual stock route — rather than investing in ETFs or other tax-advantaged accounts — you could have an opportunity to really pique your child’s interest.

You can choose to invest in companies that your child is into, such as Disney, Apple, Nike, Hasbro, Mattel, and the like. Many platforms will allow your older children to sign in and track their investments, as well as make their own stock-buying decisions (with your approval). All of this can help develop an interest, education, and appreciation for investing that could follow your child well into adulthood.

FAQs about buying stock for a child

Can you gift stock to a child?

Yes, you can absolutely gift shares of stock to your child(ren), as well as children who are not your own. This can be done by gifting shares that you already own (just make sure to research the tax implications of this beforehand), purchasing stocks for a child, or contributing to investment funds on their behalf.

This can be done by gifting shares that you already own (just make sure to research the tax implications of this beforehand), purchasing stocks for a child, or contributing to investment funds on their behalf.

Gifts of up to $15,000 per year per child (for 2021) are not subject to gift taxes.

Do you need to pay taxes on gifted stock?

You can give stocks or other investment funds to a child without needing to pay taxes on the gift, as long as the total amount given annually does not exceed $15,000 (for 2021). This means that you can contribute up to $15,000 a year to each child in your life without any gift tax penalty, though that total amount may be subject to change based on IRS regulations.

What's the best way to buy stock for a child?

The best stock for a child is the one that could potentially grow healthily over a long period of time and, ideally, pique their interest in investing. The biggest benefit that child investors have is time in the market; they might be able to afford to have a portfolio that is a bit more aggressive and, in turn, has the opportunity for greater growth. Keep in mind, though, that all investments are subject to the risk of loss.

Keep in mind, though, that all investments are subject to the risk of loss.

If your goal is to teach your children about investing and get them involved in the process, you may want to let them choose specific stocks that interest them. Consider buying fractional shares of companies like Disney or Apple, for instance, and letting them track performance.

Time is the most valuable aspect when it comes to buying stock for your child.

They will be building their portfolio for many, many decades, and their investments have plenty of time to grow. Of course, like any other investment, those investments will also be subject to losses, depending on asset and stock market performance. Don’t necessarily try to time the market when it comes to your child’s investments, and don’t treat their portfolio the same way you’d treat your own. Remember, their time horizon for investing will likely be longer than yours.

Consider being slightly more aggressive with their investments, have fun with the experience, and be sure to teach your child about investing along the way. Doing so will plant seeds of financial wisdom that will last for life.

Doing so will plant seeds of financial wisdom that will last for life.

Stash Benefits

- Get $10 to make your first investment

- Invest in stocks, bonds, and ETFs

- Fractional shares available

- Start investing with just $1

Visit Stash

Author Details

Stephanie Colestock Stephanie Colestock is a credit card expert, travel rewards aficionado, and writer who enjoys teaching people how to be financially independent and confident about their money choices.

If it has to do with credit, credit cards, or traveling the world on points, you'll find Stephanie writing about it. She also enjoys teaching people how to reach financial independence, regardless of obstacles in their path (such as the crippling student loan debt she once held). Stephanie graduated from Baylor University, and is currently working toward her CFP certification. Her work can be seen on sites such as Forbes, Dough Roller, and Johnny Jet, among many others.

Stephanie graduated from Baylor University, and is currently working toward her CFP certification. Her work can be seen on sites such as Forbes, Dough Roller, and Johnny Jet, among many others.

More posts from Stephanie Colestock >

Investing for Kids: How to Open a Brokerage Account for Your Child

You’re our first priority.

Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Investing is for kids, too — and it's never too early to start. You can open a custodial brokerage account for your children and help them select investments.

Written by Arielle O'Shea

Reviewed by

Raquel Tennant

At NerdWallet, we have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start.

Investing for kids

One of the biggest keys to successful investing is a long time horizon for your money to grow — and kids have a lot of time on their side. If they're willing to let their money remain invested for several years, they're likely to see a nice return on their initial investment. Seeing their money grow can encourage them to be good savers and investors as adults.

If they're willing to let their money remain invested for several years, they're likely to see a nice return on their initial investment. Seeing their money grow can encourage them to be good savers and investors as adults.

Here are some things to consider about investing for kids, including which investments are best and how to select and set up your child’s first brokerage account. Brokerage accounts for children are often referred to as custodial accounts. They're labeled as UGMA/UTMA accounts depending on the type of account restrictions.

Decide on an account type

To get your kids started investing, you should first decide which investment account is best for them. That decision largely hinges on whether they have earned income.

If your child doesn't have taxable income or wages: Under the Uniform Gift to Minors Act or Uniform Transfer to Minors Act (UGMA/UTMA)

Social Security Administration

.

SI 01120.205 Uniform Transfers to Minors Act.

SI 01120.205 Uniform Transfers to Minors Act.Accessed Apr 11, 2022.

View all sources

, you can open up custodial brokerage accounts for your kids. Although the account will initially be in your name, your child will automatically take full control of it once they reach age 18 or 21, depending on state laws. (Learn more about UTMA and UGMA accounts).

If your child has taxable income or wages: If your children are older and have earned income from a part-time job, such as babysitting, raking leaves, or something similar, you can help them open a custodial IRA. A Roth IRA in particular is ideal for children: The contributions your child makes to the account will grow tax-free. Those contributions can be pulled out at any time, and the investment growth portion can be used for retirement, or tapped for special purposes such as a first-home purchase or higher education expenses. (Here's a full run-down on Roth IRAs for kids.

)

)

Brokerages are also creating new account types geared specifically for teens. Fidelity, for example, offers a Youth Account, which lets teens aged 13 to 17 control the account, but lets parents monitor its activity, trades and transactions, complete with alerts. This is a new type of youth investment account separate from the custodial accounts outlined above.

Advertisement

NerdWallet rating NerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. | NerdWallet rating NerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. | NerdWallet rating NerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. |

Learn More | Learn More | Learn More |

Fees$0 per trade for online U.S. stocks and ETFs | Fees$0.005 per share; as low as $0.0005 with volume discounts | Fees$0 per trade |

Account minimum$0 | Account minimum$0 | Account minimum$0 |

Choose the right broker

No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker that offers custodial accounts. The best investment accounts for kids charge no account fees, and have no minimum initial deposit. This gives your kids the chance to start investing with a small amount of money.

The best investment accounts for kids charge no account fees, and have no minimum initial deposit. This gives your kids the chance to start investing with a small amount of money.

Consider, too, the costs associated with the investments your child plans to choose. For example, for kids who want to practice trading stocks, you should ensure the broker charges low or no trade commissions. If your kids just want their money to grow in a hands-off way, consider looking for brokers with a large selection of low-cost index funds.

If you’re looking for a brokerage account to teach your kids about investing, know that many brokers offer educational content, including online investing tutorials and even practice trading accounts.

Open the account

You can open a custodial account — both a standard brokerage account and a Roth IRA — for your child in under 15 minutes or so. At most brokers, the entire process is completed online.

To speed things up, make sure you have the necessary information ready. The broker will likely ask for both your and your child's Social Security number, as well as dates of birth and contact information. You'll probably have to supply your employment information, and you should be ready to link another bank or brokerage account so you can transfer money to fund the new account.

The broker will likely ask for both your and your child's Social Security number, as well as dates of birth and contact information. You'll probably have to supply your employment information, and you should be ready to link another bank or brokerage account so you can transfer money to fund the new account.

Help your kid decide what to invest in

Once the custodial account is open and funded, the real fun begins: Investing the money.

Within their brokerage account, your kids will be able to invest in individual stocks, as well as mutual funds, index funds and exchange-traded funds.

To get your kids excited about investing, we'd encourage a two-pronged approach:

1. Help them pick one or two individual stocks. Focus on household names they're familiar with — owning even one share of a brand kids recognize will get them excited about investing.

2. Build the rest of the portfolio with index funds. As your child continues to add money to the investment account, consider skipping additional shares of individual stocks, and instead focus on low-cost index funds or ETFs. These funds bring much-needed diversification to the portfolio, by pooling hundreds of stocks together into one investment. That way, your child can invest in a lot of different companies in one transaction for one price.

These funds bring much-needed diversification to the portfolio, by pooling hundreds of stocks together into one investment. That way, your child can invest in a lot of different companies in one transaction for one price.

To learn more about the investments your child will be able to choose from — and to decide which is most suitable — read our full guide to various types of investments.

Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few weeks and comparing the small fluctuations with the larger long-term changes shown on their quarterly statements. This can spark discussion and inspire kids to become more informed investors.

Investing for teens

If your teen is asking about investing, a custodial account is still going to be your best place to start. The age requirement to open a brokerage account with the most popular investment apps is 18 (and sometimes older, depending on the state. ) So until then, you have the final say in how they invest, and where.

) So until then, you have the final say in how they invest, and where.

However, some of the investment apps that are most popular with younger generations (such as Robinhood and Webull) don’t offer custodial accounts. So you’ll want to do your research alongside your teen, explaining that if they want to start investing before the age of 18, they’ll have to do it through an institution that offers custodial accounts. Once they’re of age, they can decide if they want to continue with the same brokerage service, or open their own. This can also be a time to explain the benefits of opening multiple investment accounts for various purposes.

Frequently asked questions

How old does my child have to be to buy stocks?

To start investing in stocks on their own, your kid will need a brokerage account, and they must be at least 18 years old to open one. They can start earlier than this, but they’ll need a parent or guardian to open a custodial account for them.

What is a custodial account?

A custodial account is a type of investment account that’s managed by a parent or guardian who opens it for a minor before the age of 18 (or 21, depending on the state.) Once the child turns the age of majority, the parent or guardian loses the ability to manage the account.

Can you withdraw money from a custodial account?

If you’re withdrawing money from the custodial account, it must be used for the benefit of the minor — no raiding the account to pay for your own expenses. Also, contributing to the custodial account is a one-way street; you can’t take back any assets held in the custodial account once you’ve given them to the minor. The account and its assets belong to the child in every way, even if you’re the one managing it.

Who pays taxes on a custodial account?

Considering the account belongs to the minor, technically, they’re the minor’s taxes to pay. However, in general, the first $1,100 of unearned income (such as dividends, interest or earnings from the account) is tax-free. After that, the next $1,100 of unearned income is taxed at the child’s rate. Once the minor’s unearned income rises above $2,200, it will be taxed at the parents’ tax rate.

After that, the next $1,100 of unearned income is taxed at the child’s rate. Once the minor’s unearned income rises above $2,200, it will be taxed at the parents’ tax rate.

About the author: Arielle O'Shea is a NerdWallet authority on retirement and investing, with appearances on the "Today" Show, "NBC Nightly News" and other national media. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

How to give shares to another person: four ways

When money in an envelope seems too commonplace, investors can give shares or other financial instruments to another person. We collected all the working ways to give shares and not only them

Photo: Shutterstock

In this article:

- Step-by-step instructions for making shares as a gift

- Give shares to a child

- The cost of registration of shares as a gift

- Share taxes as a gift

- Gift Certificate

- Gift of securities online

- Instead of shares of a unit investment fund as a gift

Donation of shares - gratuitous transfer of ownership in favor of another person. The donation of shares is permitted and regulated by Russian law. Undocumented security paper (share) is not a thing or property in the literal sense, but is included in the category of objects of civil rights, designated as “other property”, therefore it can be freely alienated.

The donation of shares is permitted and regulated by Russian law. Undocumented security paper (share) is not a thing or property in the literal sense, but is included in the category of objects of civil rights, designated as “other property”, therefore it can be freely alienated.

How to legally issue shares as a gift

www.adv.rbc.ru

- The donor and recipient of "gift" shares must have brokerage accounts . They can be opened online, without visiting the office of brokerage companies or banks that provide such services. Accounts can be opened with different brokers. At the same time, securities that are available only to qualified investors can act as a gift between two qualified investors who are clients of the same broker.

- Draw up a donation agreement (donation) - request a standard template of a donation from a brokerage company or, if the broker does not insist on its template, download it on the Internet.

The contract must specify:

The contract must specify: - date, time, place of detention;

- Full name, date of birth, passport details of both parties;

- name of shares, number, par value, issuer;

- on what basis do the papers belong to the donor;

- presence or absence of encumbrances;

- obligations of the parties;

- procedure for the transfer of ownership;

- grounds for terminating or changing a donation agreement;

- signature of the donee or donor. When donating shares purchased during marriage, the consent of the donor's spouse is required.

- The donor draws up and submits to the depository an instruction to transfer securities , attaching a signed donation agreement. The operation must be done at the office of the bank providing investment services, or at the office of a brokerage company;

- The recipient of the gift draws up and submits to the depository an instruction for crediting securities , attaching a signed donation agreement.

The operation must be done at the office of the bank providing investment services, or at the office of a brokerage company.

The operation must be done at the office of the bank providing investment services, or at the office of a brokerage company.

There will be no surprise

With the above method, making a gift with shares in the form of a surprise, unfortunately, will not work. In accordance with the requirements of the regulator, in order to make a transfer to the account of the donee, the person receiving the gift will need to independently sign a depository order for crediting securities.

Is it possible to give shares to a child

Photo: Shutterstock

brokerage account a child can open from the age of 14, but he can carry out all operations on him only with the written consent of his parents, adoptive parents or guardianship authorities.

A child under the age of 14 can also open a brokerage account, the law does not prohibit this, but in this case, all operations on his behalf are performed by parents (guardians) and each of them, including receiving shares as a gift, will require their permission.

Not all brokerage companies surveyed by RBC Investments work with children and teenagers; many prefer to open accounts only from the age of 18. Therefore, before giving shares, you should find out whether the child (or his representatives) can actually open a brokerage account and accept the gift.

Read also: The Central Bank proposed to allow playing on the stock exchange from the age of 12

How much does it cost to issue shares as a gift

The service of issuing instructions for the transfer of shares (depository transfers) is paid. But there are nuances of who exactly pays for what. The amount of commissions must be clarified with the brokerage company.

For example, in VTB, if the transfer of shares occurs between two VTB clients, then only the donor will pay the depository commission in the amount of ₽250. The donee, who is a client of VTB, does not have to pay anything extra, even if the papers are transferred from another broker.

How to pay taxes on received shares as a gift

Photo: Shutterstock

- Receiving a gift with shares is generally subject to personal income tax at a rate of 13% (15% if the annual income exceeds ₽5 million). If both the donor and the donee are individuals, then the latter will have to independently report on the income received (and “gift” shares are considered income) by filing a 3-NDFL declaration (until April 30 of the next year), calculate and pay personal income tax (until July 15 of the next year ). Tax will be charged on the value of gift shares at the time they were received. If the shares are sold earlier than after three years of ownership, and at a higher price than they were worth at the time of the donation, then tax will also be charged on this difference.

- If the donee retains the shares for three years, while the securities circulate on the Russian market, then he will be able to receive an investment tax deduction (Article 219.

1 of the Tax Code of the Russian Federation) and, in addition to taking into account the expenses of the donor, further reduce the taxable personal income tax income from the sale in the amount of up to ₽9 million. The deduction can be received both on the tax return and by submitting an application to the broker / manager before the end of the calendar year in which the sale took place. And if the "shelf life" of the shares is five years or more, you can get a complete exemption from personal income tax. The beginning of the ownership period in both cases is the date of receipt of the gift (transfer of ownership of shares), the ownership period of the previous owner is not taken into account.

1 of the Tax Code of the Russian Federation) and, in addition to taking into account the expenses of the donor, further reduce the taxable personal income tax income from the sale in the amount of up to ₽9 million. The deduction can be received both on the tax return and by submitting an application to the broker / manager before the end of the calendar year in which the sale took place. And if the "shelf life" of the shares is five years or more, you can get a complete exemption from personal income tax. The beginning of the ownership period in both cases is the date of receipt of the gift (transfer of ownership of shares), the ownership period of the previous owner is not taken into account. - Donated shares are not taxed if the donor and the donee are close relatives (clause 18, paragraph 2, clause 18.1, article 217 of the Tax Code of the Russian Federation). According to the Family Code, spouses, parents and children (including adoptive parents and adopted children), grandfathers, grandmothers and grandchildren, full and half (half) brothers and sisters are considered close relatives (Article 14 of the RF IC).

The amount for which the shares were purchased by the donor is exempt from tax. If the shares rise in price, then the tax will have to be paid on the income received from the sale of securities minus the expenses of the donor for their purchase, taking into account commissions.

The amount for which the shares were purchased by the donor is exempt from tax. If the shares rise in price, then the tax will have to be paid on the income received from the sale of securities minus the expenses of the donor for their purchase, taking into account commissions.

Gift certificate for stocks, bonds and portfolio funds

Photo: Shutterstock

bond or a portfolio fund and issue a gift certificate for them. Finam provides such an opportunity.

After paying for the certificate on the site, you will have to visit the broker's office, sign the act of acceptance and transfer of the certificate and receive it in paper form. Certificates can only be obtained at offices in Moscow, St. Petersburg, Yekaterinburg and Chelyabinsk. The buyer of the certificate can present it to any citizen of Russia who has reached the age of 18.

After the donor hands the certificate to the donee, the recipient will have 90 days to open an account and credit the certificate to it. The account can be opened online, but the certificate is credited only offline, since it is necessary to sign the certificate redemption act. Only after the act is signed, the shares are automatically credited to the bearer's account.

The account can be opened online, but the certificate is credited only offline, since it is necessary to sign the certificate redemption act. Only after the act is signed, the shares are automatically credited to the bearer's account.

If for some reason the recipient of the gift certificate does not use it, the donor can return the money paid for the certificate within three years. To return the certificate to the buyer, you need to call the client manager, who initiates the appropriate procedure (it is completely remote).

There will be a surprise

A gift certificate allows you to make a gift with shares as a surprise. When purchasing a certificate, the broker does not require any information about the gifted person.

Online donation of securities

Tinkoff Investments has a service for issuing securities as a gift online - there is no need to visit the office and sign additional papers. Only assets available to unqualified investors can be issued as a gift.

The service is available to those who already have brokerage accounts with Tinkoff, and if the recipient does not have such an account, he will receive an SMS notification with a link to open an account and a debit card. Only after they are opened, the gift can be accepted to the brokerage account.

If the gift is accepted, the donor will be charged a commission according to his tariff. There is also a case in which the recipient can refuse the gift - then the funds spent will be returned to the donor's account, and the commission will not be debited.

The total number of donated shares depends on the change in the value of the securities and the exchange rate from the moment of payment until the moment of donation:

- have to - he will be presented with fewer papers, and the balance of funds will remain in his brokerage account;

- if the rate and value of securities, on the contrary, change for the better for the client, the recipient will be presented with the declared number of securities, and the balance of funds will remain on his account;

- if the amount intended for the gift of a security is not enough even to buy one piece, then the recipient of the gift will be credited the entire amount in the form of cash to the brokerage account.

There will be a surprise

You can make a gift, including on weekends when the exchanges are closed. In such cases, the value of securities will be calculated based on the closing price of the previous trading day.

A gift of a set of shares - a unit investment fund share

Photo: Shutterstock

Instead of giving individual shares, those who wish to make an unusual gift have another option - to give a unit fund unit, which will contain a whole set of shares and other investment products.

For registration of a mutual fund as a gift, the donor and the donee must have opened trust management accounts with the management company. If the recipient of the gift does not have it, then it will be promptly opened when he contacts the management company with a donation agreement.

It is necessary to draw up a donation agreement. As a rule, the management company has a donation agreement template. Otherwise, you can use the standard donation agreement.

As a rule, the management company has a donation agreement template. Otherwise, you can use the standard donation agreement.

The donation agreement and the order to transfer the shares are submitted to the registrar of the fund.

Shares received as a gift are taxed in the same way as donated shares through brokerage accounts. When the shares are redeemed, the recipient of the gift will be subject to personal income tax from the entire withdrawal amount, unless the giver and recipient are the next of kin. In this case, when providing documents on kinship and a gift agreement, the management company will take into account the costs of the donor, so that you will need to pay personal income tax only from the income received.

Registration of mutual fund shares as a gift for a child also corresponds to the scheme for registration of shares as a gift. If a trust account is opened for a child under the age of 14, then this is done by the parents or guardians. For those over the age of 14, personal presence is required. The application form for opening an account will have to be signed by the young investor and his parent/guardian. It should be borne in mind that all exchange and redemption operations will be carried out with the written permission of the guardianship authorities at the place of registration of the minor until he reaches 18 years of age. Additional purchases can be made without this permission. Therefore, buying units with fixed contributions can be a good long-term plan for the long-term savings of a child until he comes of age, when he can independently decide how to dispose of the accumulated capital.

The application form for opening an account will have to be signed by the young investor and his parent/guardian. It should be borne in mind that all exchange and redemption operations will be carried out with the written permission of the guardianship authorities at the place of registration of the minor until he reaches 18 years of age. Additional purchases can be made without this permission. Therefore, buying units with fixed contributions can be a good long-term plan for the long-term savings of a child until he comes of age, when he can independently decide how to dispose of the accumulated capital.

The editors would like to thank for their help in preparing the material:

- VTB press service;

- Andrey Makarov, head of the sales department of Pervaya Management Company,

- Igor Pimonov, head of the Internet broker "BCS World of Investments" department;

- Head of the Department of Advertising, Promotion and Special Projects of FG "Finam" Vsevolod Polyakov;

- Konstantin Asabin, head of the directorate for tax support of investment activities of Alfa Capital Management Company;

- Tinkoff Investments press service

More investment news can be found on our Instagram account

A financial instrument used to raise capital. The main types of securities: shares (gives the owner the right of ownership), bonds (debt security) and their derivatives. More A debt security whose owner has the right to receive from the person who issued the bond its face value within a specified period. In addition, the bond implies the right of the owner to receive a percentage of its face value or other property rights. Bonds are the equivalent of a loan and are similar in principle to the lending process. Both governments and private companies can issue bonds. A brokerage account allows individuals to buy and sell securities and currencies on the stock markets. Since only brokers and dealers can be bidders on exchanges, ordinary citizens are required to conclude an agreement with such intermediaries, thanks to which the broker will conduct transactions on behalf of the investor. A brokerage account is needed to transfer money through it to buy securities. Read more

The main types of securities: shares (gives the owner the right of ownership), bonds (debt security) and their derivatives. More A debt security whose owner has the right to receive from the person who issued the bond its face value within a specified period. In addition, the bond implies the right of the owner to receive a percentage of its face value or other property rights. Bonds are the equivalent of a loan and are similar in principle to the lending process. Both governments and private companies can issue bonds. A brokerage account allows individuals to buy and sell securities and currencies on the stock markets. Since only brokers and dealers can be bidders on exchanges, ordinary citizens are required to conclude an agreement with such intermediaries, thanks to which the broker will conduct transactions on behalf of the investor. A brokerage account is needed to transfer money through it to buy securities. Read more

Can minors invest? - TOV "FREEDOM FINANCE UKRAINE"

How often can you meet a child who is ready to exchange walks with friends or online rpg games for serious economics and finances? Let's not dissemble, in Ukraine such cases are more isolated cases than mass phenomena.

Now in order. With each new stage of life, a small citizen has more and more rights for investments and investments. Everything is like in the same games: reached a certain level - catch the desired access or bonus. The main rule is that a minor is not solvent, therefore, until the age of 18, his investment portfolio is managed in one way or another by adults: parents, guardian or trustee.

How old can you be to invest: shareholders from the cradle

Like any knowledge of life, raising a child's financial literacy also goes through parents. Caring about the future of their child, his further education and quality of life, parents, as a rule, simply open a child's deposit in a bank. It is documented easier, does not require special knowledge and will allow you to increase your savings. However, Ukrainian legislation allows you to purchase securities in the name of a child, even from infancy. In practice, parents begin to think about investing in stocks at a more conscious age for the child. As a rule, such initiatives most often come from them. But sometimes the child himself, at the suggestion of advertising, peers or Internet surfing, asks new questions and begins to understand the open possibilities.

As a rule, such initiatives most often come from them. But sometimes the child himself, at the suggestion of advertising, peers or Internet surfing, asks new questions and begins to understand the open possibilities.

Adolescence is a good time to start getting acquainted with the basic principles of the economy, stocks, deposits, dividends. But at what age can you start trading on the stock exchange and start earning your first money on your own? Under the age of 14, minors cannot make transactions, trade on the stock exchange and dispose of their shares, only parents or guardians with the permission of the guardianship and guardianship authorities can do this for them. Future traders do not yet make independent decisions, but together with adults they can discuss companies, investments, learn to do something new and think strategically.

Investment goals: an inside view

The decision to adopt a pet teaches a child responsibility and compassion. The decision to start investing and trading on the stock exchange with a child also arises due to a number of reasons.

The decision to start investing and trading on the stock exchange with a child also arises due to a number of reasons.

-

First of all, savings and securities will be a good start-up capital by adulthood, when the child enters an independent life.

-

Interest in trading on the exchange develops observation, responsibility, the ability to sensibly assess the situation and control emotions.

-

The child begins to feel like an adult, which, of course, affects his self-esteem.

-

Such initiatives are an additional reason to spend time with the child and teach him useful skills that will be useful in the future.

Young entrepreneurs: at what age can one trade on the stock exchange?

It's simple: children have the opportunity to make independent choices and decisions that require attention. Where to invest, how best to sell and buy shares? Along with economic knowledge comes the ability to see and delve deeper into the activities of companies.

From the age of 14 to 18, teenagers can independently open a brokerage account and make transactions, but only with the mandatory written permission from their parents or guardian. Even having received a passport, minor citizens are not solvent. And any investments are associated with risks, so investors must be fully liable for any of their decisions, including unsuccessful ones.

And here comes another moment, not entirely dependent on the small trader. How do companies and brokers perceive it? Not every agency and company will want to conclude a contract for the provision of services or sell their shares to a schoolchild / student. In addition to the commission, the broker's earnings depend, among other things, on the number of shares in the hands of the trader, and large corporations often do not want to bother with the sale of small shares of shares. Being at the very beginning of the journey, small investors do not yet have a lot of capital, and the volume of their brokerage account will be limited to a little money or a scholarship. Often, following the advice of adult mentors, teenagers can purchase 1 share of different companies, researching and learning from them, which means that they are not of due interest and value to large traders. In other words, there are few benefits for brokers and corporations, and many headaches and approvals.

Often, following the advice of adult mentors, teenagers can purchase 1 share of different companies, researching and learning from them, which means that they are not of due interest and value to large traders. In other words, there are few benefits for brokers and corporations, and many headaches and approvals.

Responsibilities of parents and guardians: limited play.

Summing up the legislative articles, it is important to note that the state, acting as the main regulator, ensures that the assets of minors do not decrease. Especially in that which is associated with risks and can lead to undesirable consequences. In this regard, it acts as the highest authority for the protection of minors, so there are clear restrictions for parents, guardians and trustees when investing for their children.

When opening a brokerage account, one of the mandatory requirements is the written consent of at least one parent or guardian. However, this does not mean a green light and the gas pedal to the floor.