How are child support payments determined

Child Support: How Judges Decide the Amount

How do judges determine how much child support to order? State guidelines are the starting point.

By Emily Doskow, Attorney

Using State Guidelines

Every state has a formula for calculating child support, and judges use those formulas to determine how much child support will be paid in each case. The formulas themselves can be quite complicated, but it's pretty easy to estimate what your child support might be by using free online calculators. (Check for your own state's calculator by entering your state's name and "child support calculator" into a search engine, or use the simplified calculators at Alllaw.com.)

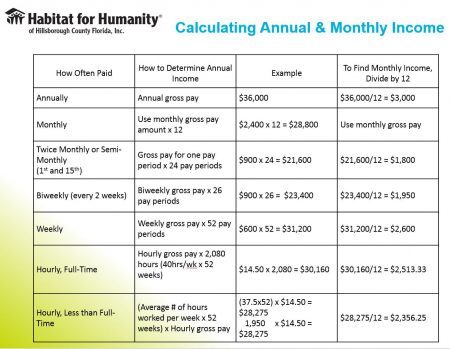

The biggest factor in calculating child support is how much the parents earn. Some states consider both parents' income, but others consider only the income of the noncustodial parent. In most states, the percentage of time that each parent spends with the children is another important factor.

Most states consider at least some of these other factors in calculating child support:

- child support or alimony either parent receives from a previous marriage

- whether either parent is paying child support or alimony from a previous marriage

- whether either parent is responsible for children from a previous (or subsequent) marriage

- which parent is paying for health insurance, and the cost

- which parent is paying day care costs, and the cost

- whether either parent is required to pay union dues or has other amounts deducted from paychecks

- ages of the children

- whether either parent receives irregular income such as bonuses or incentive pay, or expects severance pay or other lump-sum payments, and

- whether either parent lives with a new partner or spouse who contributes to household expenses.

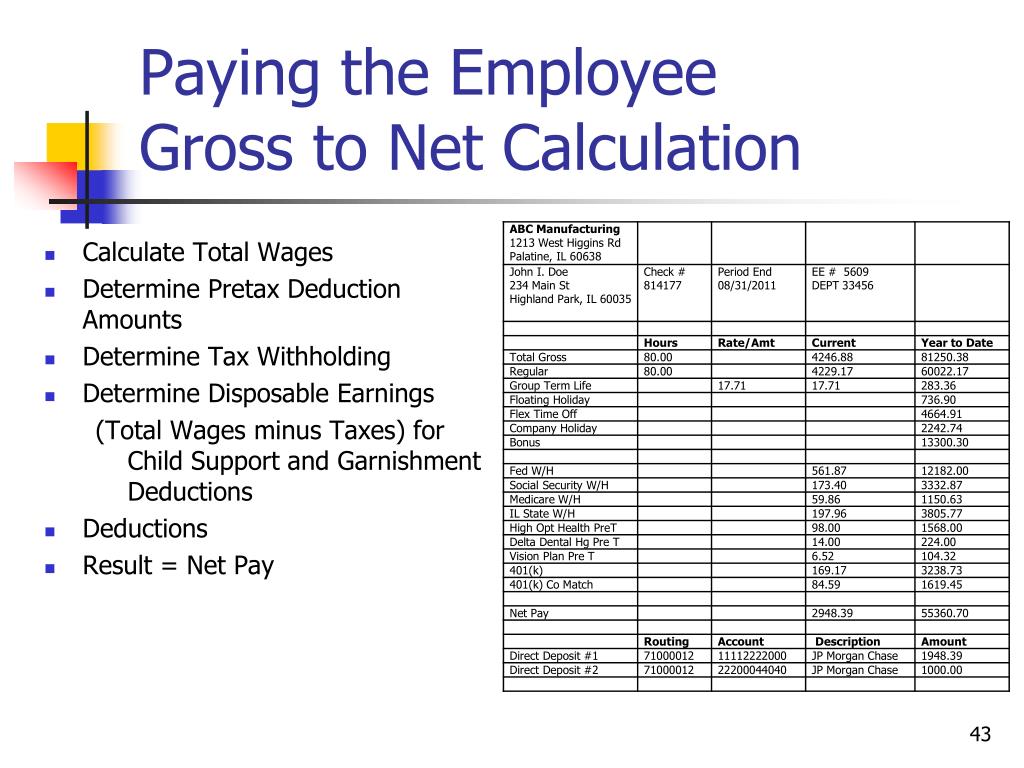

Most courts believe that child support is more important than alimony and calculate child support first, and then evaluate what's left in setting alimony. And states define "income" differently—some use gross income, some use net, and some include gifts, bonuses, and overtime while others do not. If a parent has significant investment income, it may be counted as income for purposes of calculating child support.

And states define "income" differently—some use gross income, some use net, and some include gifts, bonuses, and overtime while others do not. If a parent has significant investment income, it may be counted as income for purposes of calculating child support.

Setting Support Higher or Lower Than the Guidelines

If you think that the guidelines shouldn't apply for some reason but your spouse doesn't agree with you, you'll have to tell it to the judge. Judges are allowed to deviate from the guidelines if there are good reasons.

For example, if you're the paying parent, you might argue that because you are paying for your kids' private school and all of their uninsured medical expenses, the support payment should be less than the guideline amount. (But even if you're providing some extras, the base amount of support has to be enough for the necessities.) Or if you have custody of a disabled child who requires extra care and has unusual medical expenses, you might think the support paid to you should be higher than the guideline amount.

Be prepared to show the judge documentation of your position. A budget showing all of your expenses relating to the kids will impress the judge with your attention to their needs and the seriousness of your position.

Here are some circumstances that might cause a judge to set support above or below the guideline amount:

- The noncustodial parent can afford more. If the paying parent earns a great deal of money, has other significant assets, or receives in-kind compensation like employer-provided housing, the judge may order a higher-than-guideline payment.

- The guideline amount is more than what's needed. If the noncustodial parent makes so much money that the guideline support amount would be much more than is needed to pay for the children's regular expenses, the judge might reduce the amount.

- The paying parent can't pay. If the noncustodial parent earns very little money, has other expenses that make it impossible to meet the guideline amount, or has recently lost a job, the court may order a lower support amount.

The judge is also likely to order the parents to return to court at a set time so that the judge can review their current circumstances.

The judge is also likely to order the parents to return to court at a set time so that the judge can review their current circumstances. - A child has special needs or interests. A child with unusual medical, psychological, or educational needs may require a higher amount of support. Also, if your child is an avid musician or involved in sports or other activities, you can ask the judge to order the paying parent to pay an additional amount so that the child can continue a favorite activity.

- The paying parent is shirking. A parent's earnings sometimes don't reflect true earning potential—for example, say a parent is trained as a lawyer but works as a bookstore clerk. In that case, especially if the judge believes the parent is purposefully avoiding paying support by taking a low-paying job; a court might calculate support based on what the parent could be earning (that's called imputing income).

State Child Support Guidelines

Select your state from the list below to learn more about local child support guidelines.

Adapted from Nolo's Essential Guide to Divorce, by Emily Doskow.

Talk to a Lawyer

Need a lawyer? Start here.

Calculating Child Support in California

Learn how child support works in California, including how support is calculated, reasons for departing from the guideline, support agreements, and modifying support amounts.

If you're splitting up with your child's (or children's) other parent (or you were never a couple), among your most pressing questions will be whether you'll pay or receive support for your child—and, if so, how much the child support will be. Like all states, California has a uniform guideline for calculating child support. But unlike some other states, California's guideline isn't based just on the parents' incomes. It's a complicated formula that also takes into account how much time each parent spends with the child.

Whether parents agree on support or a judge has to decide for them, the rules in the state's guideline will still apply. So it's important to understand the basics of how child support works in California, including how to get help collecting support and how to change the amount of support you're already paying or receiving.

So it's important to understand the basics of how child support works in California, including how to get help collecting support and how to change the amount of support you're already paying or receiving.

- What Is the California Child Support Calculator?

- Applying California's Child Support Guideline

- Gathering the Information for the Child Support Calculation

- The Guideline Formula

- How California's Guideline Applies to More Than One Child

- When a Parent Who Earns Less Must Pay Child Support

- Child Support Add-Ons Under the California Guideline

- When Child Support May Be Different Than the Guideline Amount

- Allowed Reasons for Deviating from the Child Support Guideline

- Guideline Departures Must Follow California's Child Support Policies

- Requirements for Child Support Agreements

- How Long Does Child Support Last in California?

- How to Apply for or Collect Child Support

- How to Request a Change in Child Support

What Is the California Child Support Calculator?

California provides an online child support calculator that you can use to estimate the amount of support that might apply in your case. But you should know that a judge could very well order a different amount of support in your case, after taking into account various factors allowed under California law.

But you should know that a judge could very well order a different amount of support in your case, after taking into account various factors allowed under California law.

We'll discuss those factors below, as well as explain the numbers that go into the child support calculator. That way, you can be better prepared when gathering all the information you'll need to use the calculator. And if you believe a different amount of support would be more appropriate, you'll have the context to back up your argument.

As a general rule, the greater the difference between the parents' incomes and the less time the higher-earning parent spends with the children, the more child support that parent will owe.

Applying California's Child Support Guideline

As you'll see below, California's formula for calculating child support is very complicated. However, the basic outline is fairly straightforward: As a general rule, the greater the difference between the parents' incomes and the less time the higher-earning parent spends with the children, the more child support that parent will owe.

The formula is used whenever child support needs to be calculated as part of a court case, including:

- divorces (known as "dissolution of marriage" in California)

- support cases involving unmarried parents

- dissolution of domestic partnerships, and

- requests to modify existing support orders.

Gathering the Information for the Child Support Calculation

Before you can calculate the amount of child support, you must gather certain information:

- each parent's gross income and net disposable income

- the percentage of time each child will spend with each parent, and

- other necessary costs for the child (more below on those additional costs).

Gross income includes:

- wages, salaries, self-employment income, commissions, and bonuses

- business income (gross receipts minus operating expenses) and income from rental properties

- pensions

- investment income, such as dividends, interest, and annuities

- certain benefits, including workers' compensation, disability, social security, and unemployment insurance

- spousal support received from a previous marriage to another person (but not child support received for children from a different relationship), and

- if the judge decides it's appropriate, employee benefits that reduce living expenses.

In some cases, California judges may "impute" income to parents who've intentionally lowered their actual income to avoid their duty to support their children, by considering their "earning capacity" along with their actual income. (Cal. Fam. Code § 4058 (2022).)

To figure net disposable income, you'll subtract a number of items from gross income, including:

- actual state and federal income taxes (not necessarily the withholding amount), as well as taxes for Social Security and Medicare

- mandatory payroll deductions for union dues, retirement, or state disability insurance

- health insurance premiums for the parent and children

- child support or spousal support (alimony) payments for someone who's not a part of the current case (such as for children from a previous relationship or an ex from a previous marriage), and

- a deduction for "extreme financial hardship," when a judge finds that it's necessary for reasons like a parent's extraordinary health expenses.

(Cal. Fam. Code §§ 4059, 4060, 4070, 4071 (2022).)

The guideline presumes that parents with primary physical custody will directly contribute a significant part of their resources to supporting their children. (Cal. Fam. Code Cal. Fam. Code § 4053, 4058, 4059, 4070, 4071 (2022).)

The Guideline Formula

The formula California uses to calculate child support is: CS = K (HN - (H%)(TN)).

Here's what the letters mean:

- CS is the child support amount. This is what the formula will calculate once you've plugged in all of your information. The amount will be for one child. (See below for how to multiply that number when you have two or more children.)

- K is the amount of the parents' combined total income that must be devoted to child support. That amount is calculated under another formula that takes into account how much the parents earn and on how much time the higher-earning parent spends with the child, applying stepped-up percentages as income levels go up.

- HN stands for high net—the higher-earning parent's net monthly disposable income.

- H% is the approximate percentage of time that the high earner has or will have primary physical responsibility for the children compared to the other parent. When parents have different time-sharing arrangements for different children, H% equals the average of the approximate percentages of time the high earner parent spends with each child.

- TN is the combined total net monthly disposable income of both parents.

(Cal. Fam. Code § 4055 (2022).)

How California's Guideline Applies to More Than One Child

After calculating the guideline amount for one child, you won't simply multiply the result by the number of children covered by the support order. Instead, the guideline provides specific multipliers, such as:

- for two children: multiply the support amount (CS in the formula) by 1.6

- for three children: multiply by 2

- for four children: multiply by 2.

3, and

3, and - for five children: multiply by 2.5.

The law provides multipliers for up to 10 kids. These multipliers sometimes change, but the state's online calculator should include the current numbers. (Cal. Fam. Code § 4055(b)(4) (2022).)

When a Parent Who Earns Less Must Pay Child Support

Traditionally, mothers had physical custody of their children after divorce, while fathers earned more and paid child support. The gender pay gap persists, but it's much more common in contemporary divorced families for both parents to spend significant time with their kids.

Higher-earning parents are still typically the ones who pay child support. However, the formula in California's guideline sometimes results in a negative amount of child support. When that happens, the lower-earning parent generally pays that amount to the high earner. (Cal. Fam. Code § 4055(b)(5) (2022).)

For example, say there isn't a big difference between the parents' earnings, and the higher-earning parent has the children more than half of the time. If the formula results in −$200 for the amount of child support, the low earner would have to pay $200 a month to the high earner—unless the low earner can justify a different result based on the legal reasons for departing from the guideline (discussed below).

If the formula results in −$200 for the amount of child support, the low earner would have to pay $200 a month to the high earner—unless the low earner can justify a different result based on the legal reasons for departing from the guideline (discussed below).

In addition to the basic child support guideline amount, parents might be required to contribute to certain expenses for the children's benefit.

Child Support Add-Ons Under the California Guideline

In addition to the basic guideline support amount, parents might be required to contribute to certain expenses for the children's benefit. Some of these add-ons are mandatory, while others are discretionary (meaning they're up to the judge).

As additional child support, judges must order parents to pay:

- any child care costs that are needed because of a parent's job or education (as long as the education or training is reasonably necessary to gain employment skills), and

- reasonable uninsured health care expenses for the child.

When it's appropriate, judges may order parents to pay additional support for:

- expenses related to a child's special needs, including educational needs, and

- travel expenses for visitation.

(Cal. Fam. Code § 4062 (2022).)

When a judge orders child support add-ons, the parents will generally contribute an equal amount for those additional expenses. However, a judge may order the parents to contribute unequal amounts when a parent provides documentation showing that the different apportionment would be more appropriate under the circumstances. For example, if one parent makes far less than the other, a judge may order the high earner to pay more than half of the child care costs that are needed for both of them to work outside the home.

If an unequal allocation is warranted, the judge will first calculate the standard guideline amount and then apportion the add-ons between the parents in proportion to their net disposable incomes—after making allowed adjustments to income, including for spousal support payments. (Cal. Fam. Code § 4061 (2022).

(Cal. Fam. Code § 4061 (2022).

When Child Support May Be Different Than the Guideline Amount

California law presumes that the amount of child support calculated under the guideline formula will be proper in any individual case, but it does allow for departures from the guideline amount in some situations.

Allowed Reasons for Deviating from the Child Support Guideline

If you want to argue for a different amount of support, you'll need to present evidence to convince a judge that application of the guideline would be "unjust or inappropriate" because of the special circumstances in your case, including:

- you and the other parent have agreed on a different amount of support and have met the legal requirements for that agreement (discussed below)

- the parent being ordered to pay child support has an extraordinarily high income and the guideline amount would be more than the children need

- one parent isn't contributing to the children's needs at a level that matches that parent's custodial time

- both parents have roughly equal time with the children, but one parent has to pay a much lower or higher percentage of income for housing than the other parent

- you've deferred the sale of the family home after divorce, and the rental value is more than the mortgage payments, property taxes, and insurance

- you will have different time-sharing arrangements for different children

- your children have special medical or other needs that require more support, or

- your children have more than two legal parents (which is allowed under California law).

(Cal. Fam. Code § 4057 (2022).)

Guideline Departures Must Follow California's Child Support Policies

In addition to proving that applying the guideline would be inappropriate for one of the reasons listed in the law, you'll also need to demonstrate that the departure from the guideline would be consistent with the basic child support principles in California law, including the following:

- The children's interests are the top priority under the guideline, and they should share both of their parents' standard of living. That means it could be appropriate if child support payments improve the living standard in the entire household where the children live most of the time.

- Child support orders must ensure that the amount of support is enough to reflect the high costs of raising a family in California and the state's relatively high standard of living, compared to other states.

- When both parents have a significant amount of time with their children, the amount of support should also reflect the increased costs of raising kids in two homes, and it should minimize any differences between the living standards in those homes.

(Cal. Fam. Code §§ 4053, 4057 (2022).)

Requirements for Child Support Agreements

Parents may—and usually do—agree with each other about the amount of child support, either as part of an overall marital settlement agreement or just on the support issue. To do that in your case, you can start out by using the state's calculator to estimate the guideline amount of support. Then, if you want to negotiate for any adjustments to that amount, you could apply the rules (discussed above) for deviating from the guideline.

Be aware, however, that you will need to submit your agreement (or "stipulation") to the court for approval. If the agreed amount of support is below the guideline amount, the judge won't approve it unless you and the other parent(s) declare that:

- the agreed amount of support will be in the children's best interests and be enough to meet their needs

- you know and understand your rights when it comes to child support

- you weren't forced or coerced into signing the agreement, and

- neither parent is receiving or has applied for public assistance.

(Cal. Fam. Code § 4065 (2022).)

Thanks to the guideline, it's usually easier to reach an agreement on the amount of child support than other issues in divorce. But negotiations about support often get tangled up with decisions about the exact amount of timeshare—because that will affect the child support calculations. If you and your spouse are having trouble working out agreements on these issues, you may turn to mediation for help.

How Long Does Child Support Last in California?

Generally, the legal obligation to pay child support lasts until the child turns 18. There are exceptions to that cut-off, including:

- If an 18-year-old is still a full-time high school student, the support duty continues until age 19.

- Parents may agree to pay some form of child support beyond age 18 or high school graduation. For instance, some parents agree to contribute to their children's college educations.

- Parents are legally obligated to provide as much support as they can for their adult children who are incapacitated to such an extent that they can't earn a living, and who don't have other sufficient means of support.

(Cal. Fam. Code §§ 3901, 3910 (2022).)

How to Apply for or Collect Child Support

If you're seeking child support when your marriage is ending, you'll simply make the request in the petition and other paperwork when you file for divorce in California. You can also apply for temporary child support while your case is proceeding.

When you aren't married to your child's other parent, you may apply for child support services from the California Child Support Services Agency. If needed, the agency may also help you establish the child's legal parentage. It may also provide assistance with collecting and enforcing child support in California.

How to Request a Change in Child Support

Once a child support order is in place, it's not necessarily set in stone. Judges may order a change (called a "modification") in child support whenever they believe it's necessary. If the existing order was based on both parents' agreement for a below-guideline amount of support, one parent may request an increase in support at any time, without showing that their situation has changed. (Cal. Fam. Code §§ 3651, 4065(d) (2022).)

(Cal. Fam. Code §§ 3651, 4065(d) (2022).)

In all other situations, however, California courts have consistently held that anyone requesting a modification must show that there has been a significant change in circumstances that requires a different amount of support. Usually, judges will grant a modification when the changed circumstances would justify an increase or decrease of 20% or $50 per month, whichever is less.

Some common reasons for modifying support include when:

- a parent has involuntarily lost a job or income

- a parent is making more money than before

- there's been a change in the amount of time each parent is caring for the child or children

- a parent needs to support a new child with a different partner, or

- one parent has been incarcerated.

Keep in mind that when one parent requests a child support modification, the judge must consider both parents' current financial situations and time-share with the child. That could lead to unexpected results—for instance, when the primary custodial parent has also seen an income reduction.

Your local child support agency will provide a review of your case (for free) to see if a modification is justified. Even if the agency denies your request, you may still ask a judge to modify the support order. Your local Family Law Facilitator or a family law attorney can help with your request.

2.2. Child support agreement

A child support agreement is a mutual agreement between parents regarding the payment of child support for minor children. Such an agreement determines the amount of payments, the frequency of transfers, and the method of withholding payments.

In accordance with Art. 103 of the Family Code of the Russian Federation (hereinafter referred to as the RF IC) the amount of alimony paid under an agreement on the payment of alimony is determined by the parties in this agreement. At the same time, the amount of alimony established by an agreement on the payment of alimony for minor children cannot be lower than the amount of alimony that they could receive when collecting alimony in court. The amount of alimony is subject to indexation , which is carried out in accordance with the agreement on the payment of alimony (Article 105 of the RF IC). If the indexation procedure is not provided for in the agreement, indexation is carried out in proportion to the increase in the subsistence minimum for the corresponding socio-demographic group of the population established in the corresponding subject of the Russian Federation at the place of residence of the person receiving alimony, and in the absence of the specified value in the corresponding subject of the Russian Federation, in proportion to the increase in the value the subsistence minimum for the relevant socio-demographic group of the population, established as a whole for the Russian Federation (clause 1 of article 117 of the RF IC).

The amount of alimony is subject to indexation , which is carried out in accordance with the agreement on the payment of alimony (Article 105 of the RF IC). If the indexation procedure is not provided for in the agreement, indexation is carried out in proportion to the increase in the subsistence minimum for the corresponding socio-demographic group of the population established in the corresponding subject of the Russian Federation at the place of residence of the person receiving alimony, and in the absence of the specified value in the corresponding subject of the Russian Federation, in proportion to the increase in the value the subsistence minimum for the relevant socio-demographic group of the population, established as a whole for the Russian Federation (clause 1 of article 117 of the RF IC).

The agreement on the payment of alimony also determines the methods and procedure for paying alimony (Article 104 of the RF IC). So, alimony can be paid:

So, alimony can be paid:

in shares of earnings and (or) other income of a person obliged to pay alimony;

in a fixed sum of money paid periodically;

in a lump sum paid in cash;

· by providing property;

· in other ways as agreed.

A child support agreement may provide for a combination of different ways of paying child support.

An agreement on the payment of alimony is concluded in writing and is subject to notarization . Failure to comply with this requirement entails the nullity of the agreement (Article 100 of the RF IC). A notarized agreement on the payment of alimony has the force of a writ of execution. This means that if the obligated person evades the payment of alimony, the other party has the right, bypassing the court, to directly apply to the bailiff service for their enforcement.

The provisions of the Civil Code of the Russian Federation governing the conclusion, execution, termination and invalidation of civil law transactions are applied to the conclusion, execution, termination and invalidation of an agreement on the payment of alimony (clause 1 of article 101 of the RF FC).

The maintenance agreement may be amended or terminated at any time by mutual agreement of the parties. The change or termination of the agreement on the payment of alimony must be made in the same form as the agreement on the payment of alimony itself, i.e. notarized (clause 2 of article 101 of the RF IC).

Unilateral refusal to fulfill an agreement on the payment of alimony or a unilateral change in its terms is not allowed (Clause 3, Article 101 of the RF IC).

In the event of a significant change in the financial or marital status of the parties and if an agreement is not reached on changing or terminating the agreement on the payment of alimony, the interested party has the right to apply to the court with a claim for changing or terminating this agreement. When deciding on the issue of changing or terminating an agreement on the payment of alimony, the court has the right to take into account any noteworthy interest of the parties (clause 4 of article 101 of the RF IC).

An agreement on the payment of alimony may be declared invalid by a court order at the request of the legal representative of a minor child or a guardianship and guardianship authority or a prosecutor in the event that the conditions for providing maintenance to a minor child significantly violate his interests, in particular in case of non-compliance with the requirements on the amount of alimony (Article 102 of the RF IC).

material maintenance paid by some family members for the benefit of others. Maintenance obligations are provided for parents and children, spouses and former spouses, as well as other family members. In particular, able-bodied adult children are obliged to support their parents, who have the right to demand alimony in case of disability and need for material assistance. Alimony is payable monthly, unless otherwise provided by law or the maintenance agreement.

How is child support determined? | Juristaitab

From now on, the subsistence minimum is separated from the so-called minimum wage, which has been increasing the subsistence minimum every year until now. HUGO lawyer Vahur Kõlvart explains the nature of the new system below.

HUGO lawyer Vahur Kõlvart explains the nature of the new system below.

In the future, minimum child support will have five different components.

A base amount of at least 200 euros per child, indexed annually to the previous year's consumer price index (which will be officially published by Statistics Estonia on 1 April). After indexation, the base amount resulting from indexation in the previous year is considered the base amount for the next year.

3% of the country's average monthly gross salary for the previous year is added (which is also officially published by Statistics Estonia on 1 April).

Number of children supported in one family - in this case, the amount of maintenance for subsequent children is reduced by 15 percent compared to the amount of maintenance for the first child. The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years.

Family allowances - in comparison with the past, the law clearly states that the parent is not obliged to provide for the maintenance of the child to the extent that the needs of the child can be met from the child allowance and the allowance for a large family. If the benefit claimant receives these benefits, half of the benefit is deducted from the allowance for each child. However, if the recipient of the benefit is a payer, this amount is added to the alimony.

Cohabitation of the child - if the child lives with the parent who pays support, on average at least 7 days per month per year, the amount of support is reduced in proportion to the time spent with the obliging parent. Therefore, if the child lives equally with both parents, maintenance can only be collected if this is due to the greater needs of the child, a significant difference in the income of the parents, or an uneven distribution of expenses related to the child between the parents.

Example:

The child lives with the mother, stays with the father for an average of 10 days per month, and a child allowance of 60 euros is paid into the child's mother's bank account. The minimum allowance per child is 70.43 euros.

Base amount: 200 euros 3% of the average salary for the previous year: the average gross salary in 2020 was 1448 euros per month, of which 3% is 43.44 euros.

Family allowances: half of the child allowance is deducted from the parent's maintenance obligations (60/2=30), then the maintenance amount is 213.44 euros (243.44-30).

Co-habitation: If the child lives with the parent who fulfills the obligation to support between 7 and 15 days per month, the amount of support may be further reduced according to the number of those days. The basis is how many percent of the time the child spends with the parent responsible for child support. 15 days count as half a month. In this example, the child spends 10 days or 66.