How to set up a trust for minor child

What to Consider When Setting Up Trusts for Children

by ACTEC Fellows Tami Conetta and Natalie M. Perry

| Tami Conetta | Natalie M. Perry |

What’s the best way to leave assets to minor children? Should children receive equal assets? What’s a Pot Trust? What should be considered if my child is married? These and other questions are answered by ACTEC Fellows in this short video with Tami Conetta and Natalie M. Perry.

TRANSCRIPT

Hi, I'm Natalie Perry an ACTEC Fellow from Chicago and I'm here today with Tami Conetta an ACTEC Fellow from Sarasota, Florida. Today we're going to talk about leaving assets to children in Trust. Tammy, I have a few questions that I was hoping you could answer for me on how best to address shares for your children and how the children should actually receive the money. One of the big questions I think people have is should I leave everything equally to my children? Can you touch on that?

Sure. And I think that is the most difficult question for any parent to answer because you love all your children equally but you do recognize that they have different needs and so the default is always yes, that's where you start with — leave them equal shares. But then, I always encourage clients to think about the circumstances of each of their children. Some of them may be wildly successful in business, others may be wildly successful as teachers but not as financially secure as the one who's done well in business, and so being able to balance that out sometimes is a really good objective. But the important thing is that you communicate with your children and explain to them why, if you've done something not perfectly equally, so that they understand and hopefully can buy into that process as well.

Okay, that's helpful. Thanks. What if I have children that are different ages? Perhaps there was a second marriage or some children have already gone through college, they've been educated and then I've got some younger children that I know have more expenses ahead of them?

Yes. So we often see that, and one of the things that we recommend is that they consider using what we call a Pot Trust because you put all the money into one pot and hold it until perhaps the youngest one reaches a certain milestone. For example, it could be graduating from high school or college, and then at that point you can split it up into shares for the children, whether it's equal or unequal. But what you're trying to do is replicate what the parent would actually be doing for the children. So you know, as a parent I'm going to keep all my money in one share and dole it out as I think it's appropriate, but then when they reach a certain age it can be divided and then they have some control over their own share.

So we often see that, and one of the things that we recommend is that they consider using what we call a Pot Trust because you put all the money into one pot and hold it until perhaps the youngest one reaches a certain milestone. For example, it could be graduating from high school or college, and then at that point you can split it up into shares for the children, whether it's equal or unequal. But what you're trying to do is replicate what the parent would actually be doing for the children. So you know, as a parent I'm going to keep all my money in one share and dole it out as I think it's appropriate, but then when they reach a certain age it can be divided and then they have some control over their own share.

Okay. When you said dole it out as I think it's appropriate, so if I'm alive I can decide you know what to give my children and when, but if I'm not around, how do I know when the right time is for children to actually receive assets or can you talk about that a bit?

Sure. Well, and it's different for every child. You know, it's some children mature earlier some children mature later. A lot of times the reason that we hold assets in Trust for our children is to give them an opportunity to gain some skills that maybe they don't have at the time that the Trust is initially created. Whether it's just maturity that's necessary because they're younger or maybe you want them to learn how to manage money better and how to do the investments before the money is actually turned over to them, and so they can sit alongside the trustee and learn those skills along the way.

Well, and it's different for every child. You know, it's some children mature earlier some children mature later. A lot of times the reason that we hold assets in Trust for our children is to give them an opportunity to gain some skills that maybe they don't have at the time that the Trust is initially created. Whether it's just maturity that's necessary because they're younger or maybe you want them to learn how to manage money better and how to do the investments before the money is actually turned over to them, and so they can sit alongside the trustee and learn those skills along the way.

Okay. What if I don't like my son or daughter-in-law? For people who have adult children that are married and maybe even have some kids, if the client has some concerns about the marital situation, what do you do different?

Yeah. It may even be that the marriage is fine right now but we know that more than half of all marriages don't make it, and so it's really important to take that into consideration in the planning process, and for a lot of our clients that's the driver behind putting money into Trust because they feel like as long as the money is held in Trust it's protected. And under most state laws there is a level of protection. It may not be absolute, but it definitely can hold those assets in a way that could protect them in the event that there could be a divorce later. The corollary to that of course is, what if you do love your in-law and you want to make sure that if your child dies that they're taken care of, and they should definitely be included in the Trust document because most often they're not and it's not something that is often seen but on occasion you know you have a really good relationship with your in-laws.

And under most state laws there is a level of protection. It may not be absolute, but it definitely can hold those assets in a way that could protect them in the event that there could be a divorce later. The corollary to that of course is, what if you do love your in-law and you want to make sure that if your child dies that they're taken care of, and they should definitely be included in the Trust document because most often they're not and it's not something that is often seen but on occasion you know you have a really good relationship with your in-laws.

Okay. What if my son or daughter might want to buy a house or start a business? Does that get specifically spelled out in the Trust or how does that get addressed?

Well, it definitely should. The whole point of a Trust document is to communicate to the trustee what your wishes are and what you want to happen in case you're not there to be able to do it yourself. And so if you would ordinarily help pay for a wedding or give them seed money to start a business or down payment for a house, then you should definitely include that in the document because then the trustee knows and it makes that decision much easier for the trustee. If it's not clearly spelled out, they may have to go through a lot of hoops to try and get to the same place. Hopefully, they can still get to the same place. Just make sure that the Trust isn't too narrow in its discretionary language.

If it's not clearly spelled out, they may have to go through a lot of hoops to try and get to the same place. Hopefully, they can still get to the same place. Just make sure that the Trust isn't too narrow in its discretionary language.

Okay, great. Well, you've given us a lot to think about. I appreciate your time today. Thanks for being here and for educating us on leaving money to children in Trust.

You're welcome.

How to make your kid a trust fund baby

Updated October 2017

While we all know the stereotypes, it's not as if every trust fund baby is taking a few years off to study minimalist art, hang out in a commune, or complain about the square footage of his free apartment.

In fact, there are millions of Americans with trust funds and millions of parents out there setting one up for their children. And many business owners utilize trusts to keep their companies from falling into the wrong hands and to minimize estate taxes when passing business assets to their heirs.

What is a trust?

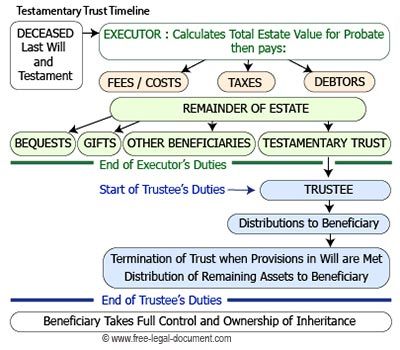

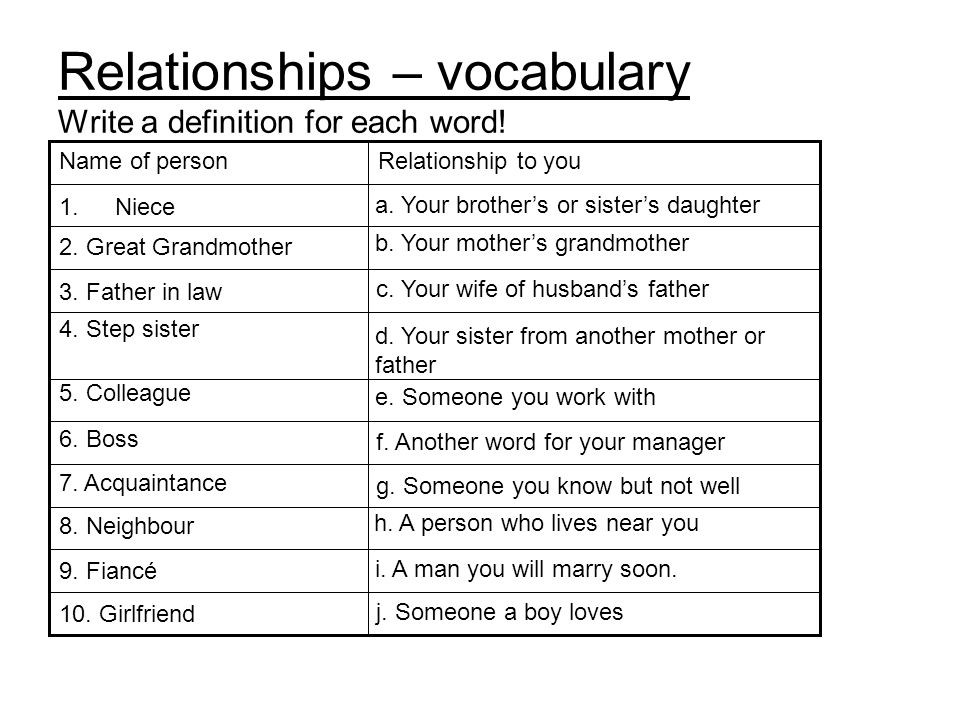

A trust is an arrangement created by one person (the "grantor"�) where assets of the grantor are transferred to another person (the "trustee"�) to be held for the benefit of a third person (the "beneficiary"�). The grantor may also be the trustee and/or the beneficiary of the trust. Trusts can be a smart way to shield certain assets from the costly (and sometimes heavily taxed) probate process, though it's important to note that wills and trusts are different documents with different purposes.

Here's what you need to know to make your kid a trust fund baby:

What is a trust fund baby?

A trust fund baby is someone whose parents or grandparents have placed assets in a trust fund for them. They can start accessing the money once they hit a certain age, typically at age 18, or once a certain event occurs, such as the death of the individual who set it up. The trust may be managed by the benefactor, a third party, or the child after time.

What are the benefits of a trust fund?

Trusts funds are pretty flexible. Typically, you can include real estate, the cash in certain bank accounts, insurance policies, jewelry, and even your business assets. While a will covers all property you own, in a trust, you must actively note what property you're including in the trust. If you want your family home or that old Mustang you love included in your trust fund, you have to designate that.

How to set up a trust for a minor

- Select a custodian and a trustee. The custodian will manage the funds in the trust for the child until they are old enough to handle on their own. You will also need a trustee to run your trust and oversee distribution of its assets according to the details in your trust documents.

- Decide when and how you want the child to receive the funds from the trust. You can set this up for the child to receive all of it at once or break it up into increments throughout major milestones in their life.

- Start drafting your trust documents. Outline any provisions you have that restrict the use of the trust funds.

- Consult with a trust fund attorney

There was a time when setting up a trust for a child was mostly for the very wealthy. That's not really the case any longer. More and more Americans are setting up trusts every year and you certainly don't have to think of a trust as something your child will live off for the rest of their life. Instead, think of it as part of your estate plan, a way to give your child something. Since trusts aren't tied up in probate, you can rest assured that your children will receive their trust soon after your passing (or during your life, if you've decided to set up a living trust) without the hassle or public nature of the probate process.

Sometimes we don't realize just how many assets we have. Just because you're not living high on the hog doesn't mean you don't have plenty to pass down. This goes double for small business owners.

This goes double for small business owners.

Your company or your ownership share of a company can often be included in your trust. This is an especially important point for family-owned businesses, as over 70% of them don't make it to the second generation. Since you can maintain control over the business while you're alive and, since trusts don't go through the probate process, you can transfer your ownership share much more smoothly and avoid onerous estate taxes by utilizing a trust.

If you own a share of a company (as opposed to the entire thing), things get a little more complicated. Before setting up a trust, you and your co-owners will want to create a Buy-Sell Agreement so you agree on the ownership transfer rules for your business. After all, you wouldn't want your co-owner to pass his share on to someone you'd hate to work with. Have a frank discussion with your business partners about heirs and make sure everyone's on the same page about the future of your company.

Whether you own your business outright or with partners, setting up a trust for your business assets also helps you avoid family disputes and allows you to appoint a professional who's versed in these matters. They can help navigate the process with your business heirs to keep your company running smoothly during the transfer. It's always a good idea to talk to an attorney to make sure you've covered all of your bases.

When can your child use his or her trust?Generally, a child can access their trust at the age of eighteen. It is sometimes possible to create different age restrictions, but the default is that a child can use their trust once they've become a legal adult.

When should you tell your child about his or her trust?If you set up a living trust (or if your parents set up a trust for your child), you should know there's no legal requirement to tell your child at any certain time. After all, it's not as if your eight-year-old is going to understand the ins and outs of an estate plan. If you choose you could tell your child that he or she has a little something put away in an account that they can access when they're eighteen. Establishing a trust for a child can give you peace of mind if your child is thinking about college and you can start teaching them about managing money early on.

If you choose you could tell your child that he or she has a little something put away in an account that they can access when they're eighteen. Establishing a trust for a child can give you peace of mind if your child is thinking about college and you can start teaching them about managing money early on.

In the end, setting up a trust is a personal choice. Do you want to see you children enjoy their trust while you're alive? Do you have a special item you want to transfer? Do you want to keep part of your estate plan private? Do you want to make sure your small business legacy is preserved for future generations?

Only you can answer these questions. But if the answer to any of the above is "yes," a Trust can help you make that a reality.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

9.2. Trust management of hereditary property

According to paragraph 1 of Art. 1173 of the Civil Code of the Russian Federation, if the inheritance contains property that requires not only protection, but also management (an enterprise, a share in the authorized (share) capital of a corporate legal entity, a share, securities, exclusive rights, etc.), a notary as the founder of the trust management enters into an agreement on the trust management of this property. Trust management agreement is concluded by a notary in accordance with the rules established by Art. 1026 of the Civil Code of the Russian Federation. The institution of inheritance trust management is necessary in order to ensure the rights of heirs when inheriting certain types of property, such as shares or shares

in the authorized capital of the corporation, since in the absence of such management, there is a risk that other right holders will make decisions that do not meet the interests of the heirs, for example, entailing a decrease in the value of these objects. As noted in paragraph 3 of Art. 1173 of the Civil Code of the Russian Federation, trust management of hereditary property is carried out in order to preserve this property and increase

As noted in paragraph 3 of Art. 1173 of the Civil Code of the Russian Federation, trust management of hereditary property is carried out in order to preserve this property and increase

its value.

The trustee under the agreement may be a person who meets the requirements for a trustee in accordance with Art. 1015 of the Civil Code of the Russian Federation. The prospective heir may be appointed trustee with the consent of other heirs identified by the time the trustee was appointed, and if they object, on the basis of a court decision (clause 6 of article 1173 of the Civil Code of the Russian Federation). In the event of the transfer of inheritance property to several trustees, each of them has the authority to manage the inheritance property, unless the trust management agreement or will provides that the trustees exercise these powers jointly. In the event of a disagreement between the trustees regarding the exercise of their rights and obligations, the notary is obliged to terminate the contract of trust management of hereditary property concluded with such managers, require the trustees to submit reports and appoint a new trustee or new trustees (clause 7 of Article 1173 Civil Code of the Russian Federation). If inheritance is carried out under a will in which the executor of the will is appointed, the executor of the will is considered the trustee of the estate

If inheritance is carried out under a will in which the executor of the will is appointed, the executor of the will is considered the trustee of the estate

from the moment he expresses his consent to be the executor of the will (Clause 2, Article 1173 of the Civil Code of the Russian Federation).

Prior to concluding an agreement on trust management of hereditary property, an independent appraiser must appraise that part of the property that is transferred to trust management. Valuation costs relate to the costs of protection and management of the inheritance.

Beneficiary under the contract of trust management of hereditary property is not appointed . An exception to this rule is the making of a testamentary refusal, which involves its execution in favor of a certain person for the period of taking actions to protect and manage hereditary property. In this case, the legatee is appointed as the beneficiary.

In this case, the legatee is appointed as the beneficiary.

If the will of the testator contains his instructions on the management of the estate, then the trustee and the executor are obliged, when taking actions to protect and manage the estate property, to act in accordance with such instructions of the testator, including the obligation to vote in the highest bodies of corporations in such a way that which is specified in the will (Clause 4, Article 1173 of the Civil Code of the Russian Federation). The trustee of the inherited property is not entitled to fulfill the obligations of the testator at the expense of the property transferred to him in trust management before the issuance of a certificate of the right to inheritance to one of the heirs, except in cases where the contract of trust management or the will provides for the obligation of the trustee to reimburse expenses at the expense of the property transferred to trust management property (Clause 3, Article 1173 of the Civil Code of the Russian Federation).

A notary exercising the powers of a founder of a trust management under a trust management agreement is obliged to monitor the performance of his duties by the trustee at least once every two months. In the event that the trustee violates his duties, the notary has the right to unilaterally terminate the trust agreement, require the trustee to submit a report and appoint a new trustee (Clause 5, Article 1173 of the Civil Code of the Russian Federation).

An agreement on trust management of hereditary property may be concluded for a period of not exceeding five years. In any case, at the time issuance of a certificate of inheritance to at least one of the heirs, if such a certificate indicates the property that is the subject of trust management, or if such a certificate is issued in relation to all the property of the testator, no matter what it expressed and wherever it is located, the rights and obligations of the founder of trust management are transferred to such heir (such heirs). The notary who has established trust management is released from the duties of the founder. An heir who has received a certificate of the right to inheritance has the right to terminate trust management and demand that the trustee transfer the property in trust management, the rights to which have passed to this heir, and provide a report on trust management. If the heirs do not demand the transfer of property held in trust management, the trust management agreement is considered extended for a period of five years, and the trust management may be terminated on the grounds provided for by Article 1024 of the Civil Code of the Russian Federation (Clause 8 of Article 1173 of the Civil Code of the Russian Federation)

The notary who has established trust management is released from the duties of the founder. An heir who has received a certificate of the right to inheritance has the right to terminate trust management and demand that the trustee transfer the property in trust management, the rights to which have passed to this heir, and provide a report on trust management. If the heirs do not demand the transfer of property held in trust management, the trust management agreement is considered extended for a period of five years, and the trust management may be terminated on the grounds provided for by Article 1024 of the Civil Code of the Russian Federation (Clause 8 of Article 1173 of the Civil Code of the Russian Federation)

Owner's share of property owned by two or more persons (common property). an official authorized by the state who has the right to perform notarial acts on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities). an agreement of two or more persons on the establishment, change or termination of civil rights and obligations. a person exercising trust management of property transferred to him possession for a certain period and belonging to another person, in the interests of this person or third parties indicated by this person. Property belonging to the testator on the day the inheritance was opened, including property rights and obligations. Intangible benefits, non-property rights and obligations, as well as property rights and obligations that are inextricably linked with the personality of the testator (the right to alimony, the right to compensation for harm caused to the life or health of a citizen, etc.) are not included in the inheritance. property of the deceased by will or by law. An heir is a person who is alive on the day of opening the inheritance, as well as children conceived during the life of the testator and born alive after the opening of the inheritance.

an agreement of two or more persons on the establishment, change or termination of civil rights and obligations. a person exercising trust management of property transferred to him possession for a certain period and belonging to another person, in the interests of this person or third parties indicated by this person. Property belonging to the testator on the day the inheritance was opened, including property rights and obligations. Intangible benefits, non-property rights and obligations, as well as property rights and obligations that are inextricably linked with the personality of the testator (the right to alimony, the right to compensation for harm caused to the life or health of a citizen, etc.) are not included in the inheritance. property of the deceased by will or by law. An heir is a person who is alive on the day of opening the inheritance, as well as children conceived during the life of the testator and born alive after the opening of the inheritance.

Civil Code of the Russian Federation Article 1173.

Trust management of hereditary property \ Consultant Plus

Trust management of hereditary property \ Consultant Plus Consultant Plus: note.

Art. 1173 (as amended by the Federal Law of July 29, 2017 N 259-FZ) apply if the inheritance was opened after September 1, 2018.

of the Civil Code of the Russian Federation Article 1173. Trust management of hereditary property not only protection, but also management (an enterprise, a share in the authorized (share) capital of a corporate legal entity, a share, securities, exclusive rights, etc.), a notary, in accordance with Article 1026 of this Code, as a founder of trust management, concludes a trust management agreement this property.

Before concluding an agreement on trust management of hereditary property, an independent appraiser must evaluate the part of the property that is transferred to trust management. The costs of the evaluation are included in the costs of protection of the inheritance and its management (Article 1174).

2. If the inheritance is carried out under a will in which the executor of the will is appointed, the executor of the will is considered the trustee of the estate from the moment he expresses his consent to be the executor of the will (Article 1134).

3. Trust management of hereditary property is carried out in order to preserve this property and increase its value.

The beneficiary under the contract of trust management of hereditary property is not appointed, except for the case if a testamentary refusal has been made, involving its execution in favor of a certain person for the period of taking actions to protect and manage hereditary property. In such a case, the beneficiary shall be appointed as the beneficiary.

The trustee of the inherited property is not entitled to fulfill the obligations of the testator at the expense of the property transferred to him in trust until the issuance of a certificate of the right to inheritance to one of the heirs, except in cases where the contract of trust management or the will provides for the duty of the trustee to compensate at the expense of the property transferred to the trust property management expenses specified in Article 1174 of this Code.

4. When performing actions for the protection and management of estate property in cases where the will of the testator contains his instructions on the management of the inheritance, the trustee and the executor are obliged to act in accordance with such instructions of the testator, including the obligation to vote in the highest bodies of corporations in the manner specified in the will.

5. A notary exercising the powers of a founder of a trust management under a trust management agreement is obliged to control the performance by the trustee of his duties at least once every two months. In the event that the trustee violates his obligations, the notary has the right to unilaterally terminate the trust management agreement, require the trustee to submit a report and appoint a new trustee.

6. A person who meets the requirements specified in Article 1015 of this Code, including a prospective heir, who may be appointed with the consent of other heirs identified by the time of appointment of the trustee, and if there are their objections - on the basis of a court decision.

7. In the event of the transfer of inheritance property to several trustees, each of them has the authority to manage the inheritance property, unless the trust management agreement or will provides that the trustees exercise these powers jointly. In the event of disagreement between the trustees regarding the exercise of their rights and obligations, the notary is obliged to terminate the contract of trust management of hereditary property concluded with such managers, require the trustees to submit reports and appoint a new trustee or new trustees.