How much food stamps for 1 child

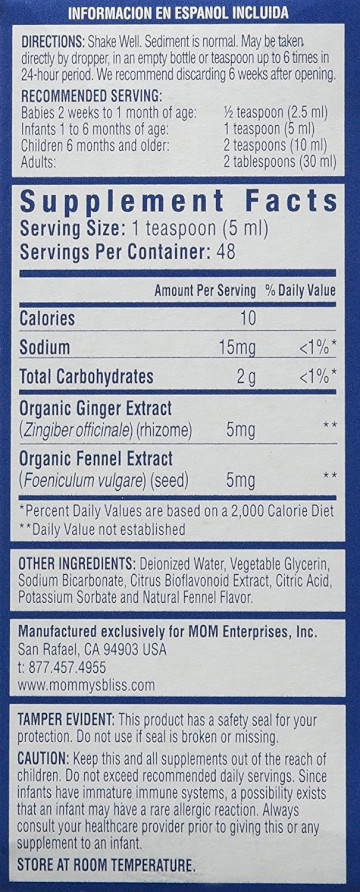

SNAP Food Benefits | Texas Health and Human Services

What it Offers

SNAP helps people buy the food they need for good health. People also can buy garden seeds with SNAP benefits.

SNAP food benefits are put on a Lone Star Card and can be used just like a credit card at any store that accepts SNAP.

SNAP can’t be used to:

- Buy tobacco.

- Buy alcoholic drinks.

- Buy things you can't eat or drink.

- Pay for food bills you owe.

You can also use your SNAP benefits to buy food online. To learn more, click here.

Who is it for?

- People who don’t have a lot of money and meet program rules.

- Most adults ages 18 to 49 with no children in their home can get SNAP for only three months in a three-year period. The benefit period might be longer if the person works at least 20 hours a week or is in a job or training program. Some adults might not have to work to get benefits, such as those who have a disability or are pregnant.

- Households in which all members are either older adults (age 60 and older) or people with disabilities are eligible to participate in the Texas Simplified Application Project (TSAP), which makes the SNAP application process easier and provides three years of benefits at a time instead of six months.

Maximum Monthly Income Limits

| Family size | Maximum monthly income |

|---|---|

| 1 | $ 1,775 |

| 2 | $ 2,396 |

| 3 | $ 3,020 |

| 4 | $ 3,644 |

| 5 | $ 4,268 |

| For each additional person, add: | $ 625 |

Other Rules

Most people ages 16 to 59 must follow work rules to get SNAP benefits. Work rules mean a person must look for a job or be in an approved work program. If the person has a job, they can’t quit without a good reason.

Work rules mean a person must look for a job or be in an approved work program. If the person has a job, they can’t quit without a good reason.

Maximum Monthly SNAP Amount

| Family size | Monthly SNAP amount |

|---|---|

| 1 | $250 |

| 2 | $459 |

| 3 | $658 |

| 4 | $835 |

| 5 | $992 |

| 6 | $1,190 |

| 7 | $1,316 |

| 8 | $1,504 |

| For each additional person, add: | $188 |

Learn More

- Lone Star Card

- Apply for benefits at YourTexasBenefits.

com

com - Texas Simplified Application Project (TSAP)

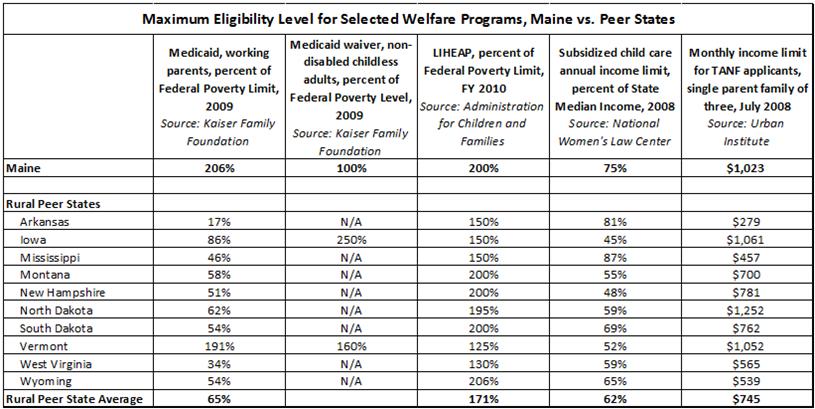

Eligibility Information

The following describes considerations for SNAP eligibility:

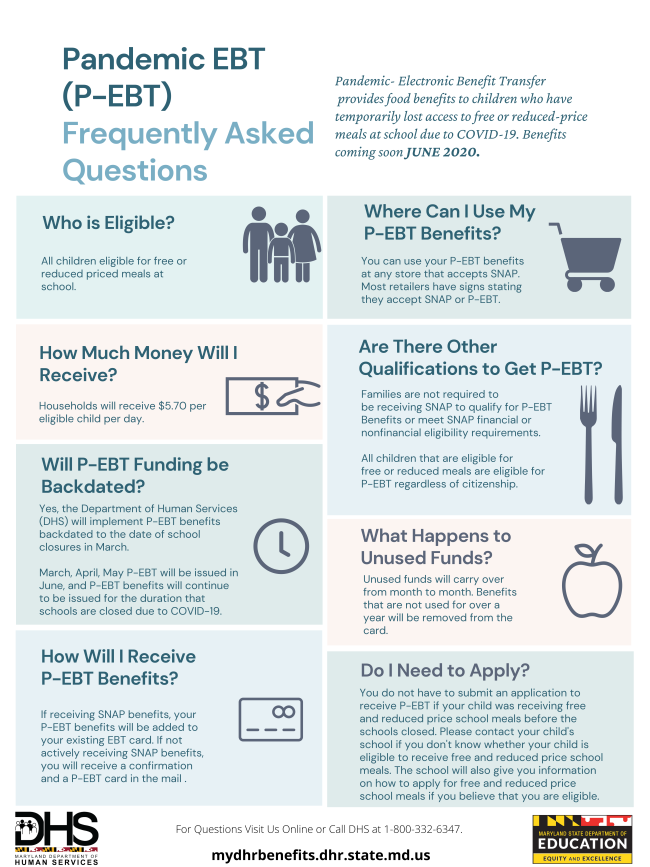

Residency. Applicants must be living in the State of Tennessee to receive SNAP benefits in the state.

Age and Relationship. There are no specific age limits to receive SNAP benefits. Parents and their children 21 years old or younger living together are considered one household. Minors who apply on their own must be living without their parents. Individuals living together and who purchase and prepare food together are treated as one household.

Citizenship and Social Security Numbers. An applicant must be a U.S. citizen, a U.S. National, or a qualified alien to get SNAP benefits. Some legal immigrants are ineligible for SNAP benefits; however, dependents of an ineligible immigrant are often eligible. To be eligible, all SNAP household members must have a social security number or proof of having applied for one.

Work. To receive SNAP benefits, most able-bodied people between 16 and 59 years old must register for work, participate in the Employment & Training Program if offered, accept offers of employment, and cannot quit a job. Able-bodied adults without dependents aged 18 to 49 can receive only a limited number of benefit months in 3 years, unless working 80 hours per month or otherwise determined exempt from the rule.

Other Factors. Strikers must be resource and income eligible before the day of the strike. Most college students must be working an average of 20 hours per week, enrolled in work-study, caring for young dependents, or receiving Families First. Felons convicted of certain drug-related offenses are not eligible for SNAP benefits. Individuals disqualified for fraud are ineligible for one year for the first offense, two years for the second offense, and permanently for the third. Dependents of disqualified or ineligible individuals may be eligible.

Resource Test. The asset limit is $2,750 for most households and $4,250 for households containing a member who is disabled or 60 years of age. Assets not counted are the home the applicant is presently living in and its lot, household goods, income producing property, real estate that is up for sale, cash value of life insurance, personal property, retirement accounts such as IRA and 401k plans, and vehicles with equity value under $1,500. Other vehicles not counted are those used for family transportation, to go to and from work, to produce income, for subsistence hunting and fishing, as the household’s home, to transport a disabled household member, and to carry the household’s primary source of heating fuel or water. Countable assets include cash on hand, money in checking, savings accounts, certificates of deposit, stocks, bonds, property not up for sale, and lump-sum payments.

Income Tests. The SNAP program does not count scholarships, grants and loans used for tuition and fees, reimbursements, heating assistance, earnings of children age 17 and younger who are in school and most loans. Countable income may include but is not limited to such things as: employment, self-employment, alimony, child support, disability benefits, Social Security/SSI, Worker’s Compensation, Unemployment benefits, pensions, stipends, and interest income. Households which contain an elderly or disabled member do not have to pass the gross income standards but are subject to the net income standards. To see if you might be eligible, click here for the most current income limits to the program.

Countable income may include but is not limited to such things as: employment, self-employment, alimony, child support, disability benefits, Social Security/SSI, Worker’s Compensation, Unemployment benefits, pensions, stipends, and interest income. Households which contain an elderly or disabled member do not have to pass the gross income standards but are subject to the net income standards. To see if you might be eligible, click here for the most current income limits to the program.

Deductions. The SNAP Program rules allow income deductions, including a 20% deduction on earnings, a standard deduction given to all households, dependent care expenses incurred, a shelter/utility deduction for a non-special household not to exceed $624, and medical expenses over $35 for elderly or disabled household members.

Eligibility Information

The United States retained the food stamp system for the poor

The US Department of Agriculture implements 15 federal programs of food assistance to the population. The most widespread of these is the program of preferential purchase of products, formerly known as the issuance of food stamps.

The most widespread of these is the program of preferential purchase of products, formerly known as the issuance of food stamps.

The program is federally funded through the Food and Nutrition Service of the US Department of Agriculture. Food stamps for the poor appeared in 1939 after the massive drop in living standards in the United States during the Great Depression. A claimant's monthly income must be no more than 130 percent of the official poverty line. For example, any family of four with a combined income of $2,500 or less per month is eligible for food stamps. A single American must receive no more than $1,200 per month to become a member of the program.

Therefore, the number of recipients of benefits increases in years of crisis and decreases in years of growth. The program peaked after the 2008 financial crisis. In 2013, a historic record was set: 47.6 million Americans received coupons totaling $76.1 billion. In fiscal 2016, 44 million Americans received $66. 6 billion in food assistance. This is 13.5 percent of the population, which is about one in eight Americans. On average, about 1,500 dollars a year was spent per participant in the program, or a little more than four dollars a day. Approximately 23 percent of the population in the DC metropolitan area is on food benefits, nearly one in four, according to the USDA. This is the highest rate in the country.

6 billion in food assistance. This is 13.5 percent of the population, which is about one in eight Americans. On average, about 1,500 dollars a year was spent per participant in the program, or a little more than four dollars a day. Approximately 23 percent of the population in the DC metropolitan area is on food benefits, nearly one in four, according to the USDA. This is the highest rate in the country.

Statistically, 37 percent of Stamp recipients are White American, 22 percent African American, and 10 percent Hispanic. Not only US citizens can count on benefits, but also legal migrants who have lived in the country for more than 5 years or have adult children.

Funding for this program has proven to be one of the most effective ways for the federal budget to boost the economy after a recession. Each dollar spent from the budget on food benefits ultimately increased the country's GNP by 1.7-1.8 dollars.

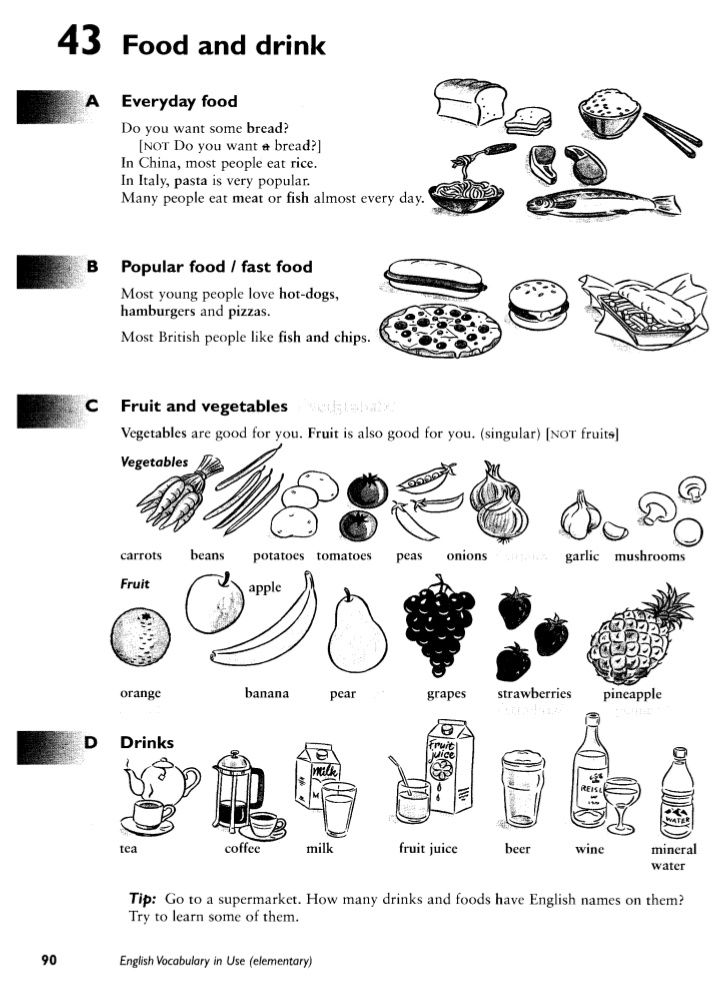

The $1.50 and $10 food stamps were originally printed on paper and were identical in size to banknotes. In recent decades, all states have switched to transferring benefits to special debit electronic cards. Therefore, today food stamps as such in paper form no longer exist, and the mention of them has disappeared from the name of the program. But the essence remains the same. The peculiarity of both coupons and cards from their ordinary cash counterparts is that they can only be spent on the purchase of products. They are not accepted in other outlets, and they are not equivalent to money. Benefits can be used to purchase fruits and vegetables, baked goods, soft drinks, dairy products, meat, poultry and fish, seeds of plants suitable for growing food at home.

In recent decades, all states have switched to transferring benefits to special debit electronic cards. Therefore, today food stamps as such in paper form no longer exist, and the mention of them has disappeared from the name of the program. But the essence remains the same. The peculiarity of both coupons and cards from their ordinary cash counterparts is that they can only be spent on the purchase of products. They are not accepted in other outlets, and they are not equivalent to money. Benefits can be used to purchase fruits and vegetables, baked goods, soft drinks, dairy products, meat, poultry and fish, seeds of plants suitable for growing food at home.

Some food chains accept these vouchers from certain categories of the poor as payment for special affordable meals for the poor. At the same time, it is impossible to buy ready-made hot food, alcohol, wine, beer, tobacco products, vitamins and medicines, household and household goods with preferential cards.

The problem of illegal withdrawal of funds from the program exists, but due to aggressive oversight, its scale is controlled.

Rossiyskaya gazeta - Week - Federal issue: No. 35 (7201)

Share:

USA

how much, what is included, how to calculate

According to the law, 12,654 R per month is enough for an ordinary Russian to provide himself with everything he needs.

Sergey Antonov

loves statistics

Author profile

In this article we will tell you what the living wage is and why it is needed at all.

What is the subsistence minimum

Legislative basis. The living wage is the minimum amount of income of a citizen necessary to ensure life. From 2021 to 2025, it is set at 44.2% of the median per capita income. If you take all incomes from smallest to largest, then the median will be in the middle.

Law "On the subsistence minimum in the Russian Federation"

The subsistence minimum is calculated for three categories of the population:

- Adults of working age - from 16 years old to the age of receiving an old-age pension.

- Pensioners.

- Children up to and including 15 years of age.

The cost of living for the able-bodied population is set at 109% of the total, for pensioners - 86%, for children - 97%.

Law "On the subsistence minimum in the Russian Federation"

Who establishes. The living wage is set by the government of the Russian Federation based on the median average per capita income for the previous year. The median income is calculated by Rosstat. The cost of living for the next year is determined by July 1 of the current year.

The Government of the Russian Federation has set a living wage for 2022 in the amount of 11,950 R per month. However, in November, at the suggestion of the president, the subsistence minimum for the population was increased to 12,654 R. For the working-age population, it amounted to 13,793 R, for pensioners - 10,882 R, for children - 12,274 R. In fact, in 2022, the subsistence minimum was not determined by a decree government, but by the law on the federal budget.

Differences from the minimum wage. minimum wage is the minimum wage. That is, the amount less than which the full-time salary cannot be. Even if a person performs even very simple and low-skilled work 8 hours 5 days a week, he needs to pay no less than the minimum wage per month. The minimum wage is set for a year.

From 2022, the minimum wage is set at 42% of the median wage. At the same time, it cannot be lower than the subsistence minimum and the minimum wage for the previous year. For 2022, the minimum wage is 13,890 R per month.

Law "On the minimum wage"

The subsistence minimum in the subjects of the federation

The subsistence minimum is set at the federal level and at the level of a particular region. The cost of living is calculated on average per capita and separately for three socio-demographic groups: the working-age population, pensioners and children.

Full table of regional differentiation coefficients

Regional subsistence level is set by local authorities once a year until September 15. Like the federal one, it is determined on average per capita and separately for three groups: able-bodied, pensioners and children. The coefficients for them are the same as for the federal level. The living wage for the working-age population is set at 109% of the regional one, for pensioners - 86%, for children - 97%.

Like the federal one, it is determined on average per capita and separately for three groups: able-bodied, pensioners and children. The coefficients for them are the same as for the federal level. The living wage for the working-age population is set at 109% of the regional one, for pensioners - 86%, for children - 97%.

The cost of living in Moscow in 2022 per capita is 18,714 R, for the working-age population - 21,371 R, for pensioners - 14,009 R, for children - 16,174 R.

Decree of the Government of Moscow dated 12.10. 2022 No. 1597-PP

The cost of living by region is set in the regulations of this region - you can find the standard by the phrase "law on the cost of living" with the name of the region.

Examples of the subsistence minimum in various regions of Russia in 2022

| Region | Per capita | For working-age population | For pensioners | For children |

|---|---|---|---|---|

St. Petersburg Petersburg | 13,160.2 R | 14,344.6 R | 11,317.8 R | 12,765.4 R |

| Sevastopol | 12654 Р | 13 793 Р | 10 892 Р | 13 332 Р |

| Voronezh region | 10 756 Р | 11 724 Р | 9796 P | 10 433 Р |

| Murmansk region | 20277 Р | 22047 Р | 17 395 Р | 19620 Р |

| Nizhny Novgorod region | 11 895 Р | 12966 Р | 10 230 Р | 11 538 Р |

| Tyumen region | 12654 Р | 13 793 Р | 10 882 Р | 12475 R |

| Novosibirsk region | 12 775 Р | 13 925 Р | 10 987 Р | 13 238 Р |

St. Petersburg

per capita

13 160.2 R

For the working-age population

14 344. 6 P

6 P

for pensioners

11 317.8 P

for children

2222 12,765.4 R

Sevastopol

Per capita

12 654 R

For the working -age population

13 793 r

for pensioners

10 892 R

for children

13 332 R

Voronezh Region

10 756 R

For the able -bodied population

11 724 r

For pensioners

9796 R

For children

10 433 R

Murmansk Region

per capita

20 277 R

For the working -age population

22 047 2 047

for pensioners

17 395 R

For children

19 620 R

Nizhny Novgorod Region

11 895 R

° TelexFor the working -age population

12 966 r

for pensioners

10 230 °

for children

11 538 R

Tyumen Region

per capita

12 654 r

for the working -age population

13 793 r

for pensioners

10 882 R

for children

12 475 R

Novosibirsk Region

9000 12 775 R

For the working -age population

13 925 rub

For pensioners

10 987 R

For children

1338 R

, a living wage abroad

Analogues of this indicator for economic planning and statistical accounting are used in almost all countries of the world. Most often, the cost of living is tied to the minimum wage. For example, the lower limit of payment is operated by Eurostat, the main statistical body of the EU. There is also an international analogue of the minimum wage — the World Bank considers the minimum income to be $1.25 per day.

Most often, the cost of living is tied to the minimum wage. For example, the lower limit of payment is operated by Eurostat, the main statistical body of the EU. There is also an international analogue of the minimum wage — the World Bank considers the minimum income to be $1.25 per day.

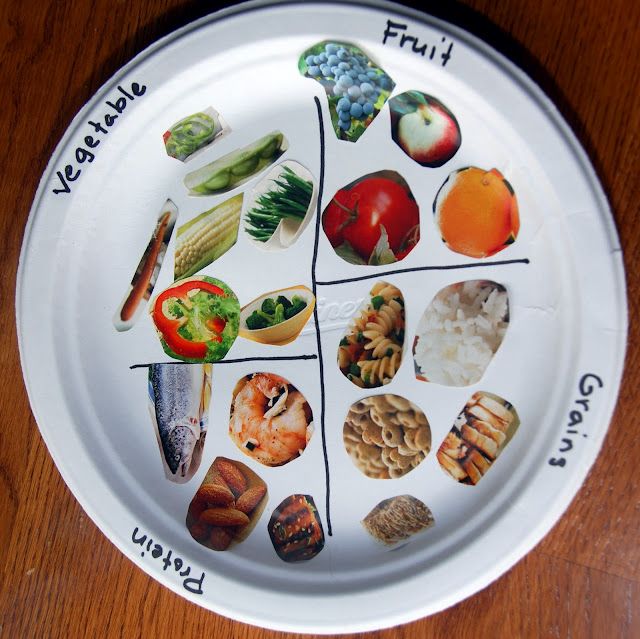

In the USA, in addition to the subsistence level, the so-called food plan is calculated. This is an analogue of our consumer basket, which is compiled by the US Department of Agriculture. It is made in four versions, designed for different levels of spending on products: economical, low, medium and free. The economy plan is used to calculate the cost of food stamps for people in need.

In the United States, in addition to the subsistence level, the Department of Agriculture draws up the so-called food plan - Food Plan. This is an analogue of our consumer basket, which was calculated by Rosstat. Food Plan is made in four versions, designed for different levels of food spending: economical, low, medium and free. The economy plan is used to calculate the cost of food stamps for people in need.

The economy plan is used to calculate the cost of food stamps for people in need.

All calculations are made for three categories of citizens - children under 12 years old, as well as adult men and women. Each of these categories is divided in turn into five age groups.

American 19 to 50 Years Old Economy Plan Pack, kg

| Product | Volumes |

|---|---|

| Dairy products | 258.4 |

| Bread, popcorn, cereals, baked goods, pasta | 251.6 |

| Vegetables | 221.5 |

| Fruit | 182 |

| Soft drinks | 108.6 |

| Meat and meat products | 54.6 |

| Frozen meals and snacks | 18.7 |

| Sauces, sauces and spices | 8.3 |

| Fish | 5.7 |

| Sugar and confectionery | 5. |