How long does child tax credit take

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $2,000 for each qualifying child. To get a Child Tax Credit refund, you must earn more than $2,500.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. Eligible parents and caregivers can claim a credit up to $2,000 for each child under 17 on their tax return.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

- Can I still get the 2021 Expanded Child Tax Credit?

Depending on your income and family size, the CTC is worth up to $2,000 per qualifying child. Up to $1,500 is refundable. CTC amounts start to phase-out when you make $200,000 (head of household) or $400,000 (married couples). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

Up to $1,500 is refundable. CTC amounts start to phase-out when you make $200,000 (head of household) or $400,000 (married couples). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you can get up to $1,500 back in your tax refund.

There are three main requirements to claim the CTC:

- Income: You need to have more than $2,500 in earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be under 17 on December 31, 2022.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be continuous. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

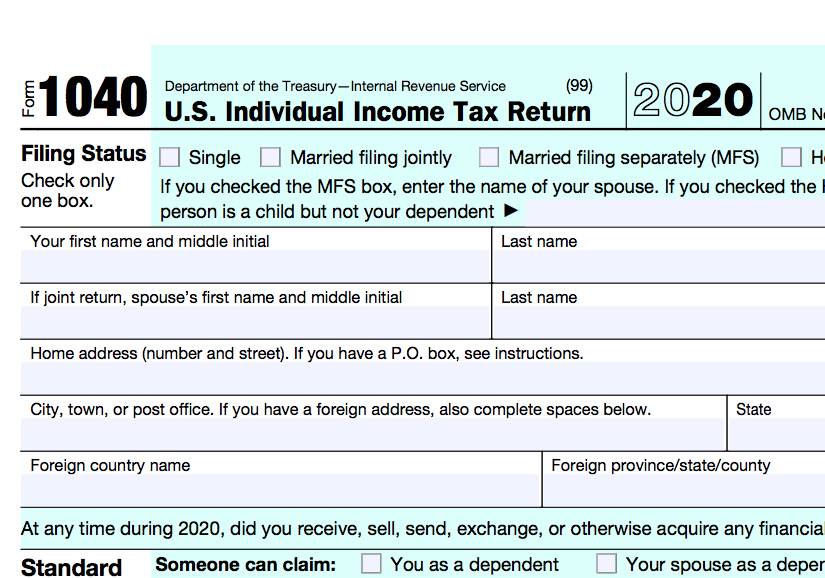

File a 2022 tax return with Schedule 8812 “Additional Child Tax Credit.”

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. These include Volunteer Income Tax Assistance (VITA), GetYourRefund.org and MyFreeTaxes.com.

Yes. It’s not too late to claim your 2021 Expanded Child Tax Credit if you haven’t already. To claim your 2021 Child Tax Credit, you must file a 2021 tax return by April 18, 2025. If you filed a 2021 tax return but didn’t get the Child Tax Credit and were eligible for it, you can amend your tax return.

Contact your local Volunteer Income Tax Assistance (VITA) site to see if they file 2021 tax returns. You can also use GetYourRefund.org.

Learn more about filing prior year tax returns.

The latest

Here’s a list of documents you need to ensure you file taxes accurately. …

…

Congress has passed several economic relief measures to support people through the COVID-19…

By Reagan Van Coutren, 2022 Get It Back Campaign Intern You can file…

What is the deadline for the return of the tax deduction. How long to wait for the payment of money

There is a lot of conflicting information on the Internet about when to apply for a tax refund, how long to wait for a response, and when a tax deduction comes after a desk audit. In the article we will tell you how many days and months money is transferred, how the tax deduction is paid, what documents are needed and about other important nuances.

What is the deadline for payment of the tax deduction

nine0002 The return of overpaid personal income tax is made after the completion of a desk audit of the income declaration of an individual (letter of the Ministry of Finance dated February 21, 2017 No. 03-04-05 / 9949).

03-04-05 / 9949). By law, the IFTS has 4 months to check. During this time, the inspector must check the applicant's documents and make a decision on granting him a tax deduction. The term consists of:

| Verification stage nine0003 | Verification period |

| Desk verification of the declaration | Verification time 3 months (clause 2, article 88 of the Tax Code of the Russian Federation) |

| Making a decision on a desk audit and payment of funds | Term — 10 calendar days nine0003 |

| Transferring money to a bank account | Term - 1 month (clause 6, article 78 of the Tax Code of the Russian Federation) |

Income tax can only be returned by a resident of the Russian Federation who pays personal income tax in the amount of 13% or 15% on a certain type of income. Contact our experts: they will analyze your income and expenses, tell you what deduction and in what amount you can receive, and fill out your declaration in 2 days. nine0003

Contact our experts: they will analyze your income and expenses, tell you what deduction and in what amount you can receive, and fill out your declaration in 2 days. nine0003

Documents for tax deduction

The deadline for submitting documents for the reimbursement of previously paid personal income tax through the inspection is strictly defined - after the end of the tax period (clause 1, article 229 of the Tax Code of the Russian Federation).

In order to reimburse personal income tax and receive a refund of 13%, it is necessary to prepare and collect a package of papers and certificates. Below is a list of the most popular deductions. To receive a property tax refund (Article 220 of the Tax Code of the Russian Federation) for the acquisition of real estate, you will need: nine0003

Property deduction

To receive a property tax refund (Article 220 of the Tax Code of the Russian Federation) for the acquisition of real estate, you will need:

- declaration 3-NDFL;

- passport for a personal trip to the inspection;

- certificate 2-NDFL;

- real estate purchase agreement;

- certificate of state registration of ownership, an extract from the USRN or an act of acceptance and transfer of an apartment when buying an apartment under construction under an equity agreement; nine0072

- receipts, cashier's checks, payment orders, etc.

;

; - application for the distribution of the return between the spouses.

When buying a property with a mortgage, it will be possible to additionally return the tax for the interest actually paid on the mortgage. For this you need to prepare:

- mortgage agreement;

- bank certificate on interest paid for the year;

- loan repayment schedule and payment of interest under a mortgage agreement; nine0072

- cashier's checks, receipts, money orders, bank statements, etc.

Tuition

In order to issue a refund of income tax on training (Article 219 of the Tax Code of the Russian Federation), you will need:

- declaration 3-NDFL;

- passport in case of personal contact with the inspection;

- certificate 2-NDFL;

- the contract for training and additional agreements to it, if they have drawn up important changes to the contract, for example, a change in the cost of training; nine0072

- cashier's checks, receipts, payment orders, etc.

;

; - a license of an educational institution, if information about it is not in the contract or other document.

To receive a tax refund for a child's education, you must prepare:

- declaration 3-NDFL;

- passport upon personal submission to the inspection;

- certificate 2-NDFL;

- the contract for training and additional agreements to it, if they have drawn up important changes to the contract, for example, a change in the cost of training; nine0072

- cashier's checks, receipts, payment orders, etc.;

- birth certificate of the child to confirm the relationship and age;

- a certificate stating that the child is studying full-time, if the form of education is not specified in the contract;

- a license of an educational institution, if information about it is not in the contract or other document.

For treatment

Documents for medical services (Article 219Tax Code of the Russian Federation) will be as follows:

- declaration 3-NDFL;

- passport upon personal submission to the inspection;

- certificate 2-NDFL;

- agreement with a medical institution;

- cashier's checks, receipts, payment orders, etc.

;

; - certificate of payment for medical services issued by a medical institution;

- when paying for medicines - a prescription from a doctor, written out in a special form; nine0072

- a document confirming the relationship if the treatment was provided to the husband, wife, parents, children, wards;

- a license of a medical institution to carry out medical activities, if the documents do not contain information about the details of the license.

It is allowed to fill out the declaration and submit documents for the return of personal income tax within three calendar years from the moment the right to deduction arises. So, if payment for tuition or treatment was made in 2020, then the deadline for issuing a refund falls on 2023. An exception is a property refund - it does not have a statute of limitations. nine0003

Read also Property deduction when buying an apartment: statute of limitations

How to get a tax deduction faster

We figured out the timing of the transfer of tax deductions. Now let's talk about whether it is possible to shorten the verification period.

Now let's talk about whether it is possible to shorten the verification period.

It will be possible to reduce the time for consideration of documents if they are submitted not through the IFTS, but through the employer. In this case, the tax authority returns the tax deduction in a different way, so the transfer period, the list of papers and the procedure are different. nine0003

It is necessary to prepare all the documents from the list above, with the exception of the 3-NDFL declaration and the 2-NDFL certificate. The next step is to also submit them to the IFTS.

Cameral check lasts a month. After that, the tax office will independently inform the employer about the employee's due return and send a notice of the right to the benefit.

Pay attention! Personal income tax deduction for previous years can only be obtained through the Federal Tax Service. Through the employer, a refund can only be received year in year out. So, for treatment costs in 2023, deduction documents through the employer must be submitted in the same year. In case of omission, a refund is possible only through the tax. nine0003

In case of omission, a refund is possible only through the tax. nine0003

FAQ

Does how long an application for a tax deduction takes to process depend on the method of filing documents?

+

No, the period of verification does not depend on the method of filing tax returns. Choose the method that is more convenient for you.

When will I receive the money for the tax deduction if I submit my return in December 2022?

+

The review will end in March 2023. It will take another 10 days to make a decision and 30 days to credit the money to the applicant's account.

How is the tax deduction paid?

+

The money is transferred to the bank account that you indicate in the application for a refund of overpaid tax. There is no other transfer method.

Expert opinion

nine0002 Regardless of what kind of benefit you are applying for, the return of the tax deduction through the IFTS is made within the same time frame: 3 months for verification, 10 days for making a decision on payment, and another 30 days for execution. The most important thing is to collect all the necessary documents and fill out the reports correctly.

The most important thing is to collect all the necessary documents and fill out the reports correctly. We publish only verified information

nine0163 Article authorLysenko Irina Lead Tax Specialist

Experience: 4 years

Consultations: 2000

Articles: 21

Forms a package of documents and sends 3-personal income tax declarations to tax inspectors provides oral and written advice on taxation of personal income

Let's tell you how you can get a tax deduction for a children's camp

Anastasia Chernova

Last modified:

December 25, 2021

Reading time:

5 minutes

556

- “some on land, some on the sea”, they can already prepare documents for processing compensation for the children's health camp and the one in which they studied.

In this article we will look at how to get compensation for a trip to the camp, how much you can count on, what it depends on and when exactly you need to apply for compensation. nine0003

Contents

- 1 Compensation for a trip to a children's camp. What is it and where does the money come from?

- 2 Who can get camp compensation?

- 3 Compensation for children's camp. What refund amounts can you expect?

- 4 How do I get a tax deduction for the camp and what documents do I need?

Compensation for a ticket to a children's camp. What is it and where does the money come from?

Compensation for the cost of a trip to a children's camp is what, according to the law, is called a social tax deduction ( st. 219 of the Tax Code of the Russian Federation ).

Tax deduction reduces the tax base, that is, the amount from which an individual pays income tax (PIT). First, you pay income tax, then with the help of a deduction you reduce the base and, accordingly, the tax payable, as a result, you have an overpayment that you can return from the budget.

Who can get camp compensation?

A social tax deduction can only be received by a person who:

- Has the status of a tax resident (if you live in Russia for more than six months, then you automatically receive the resident status)

- Pays personal income tax (PIT) at a rate of 13% on his income. Recall that if your children were in the camp in 2021, then you can claim for a refund the tax paid on the following types of income - under employment contracts and GPC agreements, from the provision of various services, from renting out property, from selling or receiving gift of property (excluding securities) and some other income

Please note that You can only receive a refund for the camp if your child was resting in a children's health institution or if he received education in a camp with some kind of educational bias. nine0003

At the same time, if the camp in which your child was an educational one, then you will be able to deduct the expenses that “went” specifically for the education of the child (clause 2 of article 219 of the Tax Code of the Russian Federation). For a health camp, expenses that are spent specifically for treatment are accepted for deduction (clause 3, article 219 of the Tax Code of the Russian Federation).

For a health camp, expenses that are spent specifically for treatment are accepted for deduction (clause 3, article 219 of the Tax Code of the Russian Federation).

Important! For accommodation, transfer of your child, meals, etc. you can't get a tax deduction.

In addition, you will need to obtain a copy of the government-issued license from the camp for the provision of appropriate services - educational or recreational before claiming a tax deduction. nine0003

Compensation for children's camp. What refund amounts can you expect?

Expenses spent on a camp for a child that can be deducted are regulated by the Tax Code (Article 219 of the Tax Code of the Russian Federation).

The limit of the social tax deduction for treatment (improving procedures in the camp) is 120,000 rubles per year. That is, if the cost of treatment in the camp exceeds the limit, compensation for the rest will be 15,600 rubles, and if the costs of treatment were less than 120,000 rubles, then you can return 13% of the actual costs. nine0003

nine0003

The limit of the tax deduction for tuition is less - only 50,000 rubles per year for each child. The refund amount is calculated in the same way. If the cost of the educational camp is more than the limit, then the tax refund is calculated only from 50,000 (that is, you will receive 6,500 rubles to your account). If the expenses amounted to a smaller amount (less than 50,000), then the refund will be equal to 13% of these expenses.

Important! Both parents can receive a tax deduction for the treatment of a child in a camp. But with a tax deduction for the education of a child in a camp, the situation is different - only one of the parents can issue it. nine0003

How do I get a tax deduction for the camp and what documents do I need?

There are two options for issuing a refund:

- through the tax office

- through employer (tax agent)

When making a return through the IFTS, prepare a declaration in the form 3-NDFL and a certificate of annual income (2-NDFL). In addition, you will need:

In addition, you will need:

- An agreement with the camp for the education or treatment of your child (the contract must necessarily allocate the amounts that were spent on education or treatment)

- Certificate of payment for medical services (if the child was treated in the camp)

- Copy of educational or medical institution license

- Documents confirming your expenses for the camp for the child (checks, payments, etc.).

- Child's birth certificate

With all the documents you need to apply to the Federal Tax Service at the place of permanent registration and after you submit the complete “package”, the verification will begin - it takes 3 months. After the end of the check, the inspection will have another 1 month to transfer money to your account. nine0003

Before submitting documents to the IFTS for a deduction, you must wait until the end of the year in which you paid for the camp.